In recent cryptocurrency news, the SOL price drop has captured the attention of investors as it tumbles below 130 USDT. With a current trading value of 129.95 USDT, this notable decline reflects a 24-hour decrease of 2.09%, according to the latest SOL market data from OKX. This downturn in SOL reflects broader trends affecting the cryptocurrency market, leading many traders to seek in-depth SOL analysis to understand potential recovery paths. Market participants now closely monitor SOL USDT fluctuations to gauge sentiment and future movements. The ongoing decline has raised concerns among stakeholders about the price stability of this prominent altcoin.

The recent dip in SOL’s value, commonly referred to as the SOL decline, has prompted discussions among cryptocurrency enthusiasts and analysts alike. As SOL continues to exhibit volatile behavior, many are looking to cryptocurrency market data to anticipate its next moves. Analysts are sifting through the latest performance statistics to provide a comprehensive overview, which is essential for those invested in the SOL ecosystem. As this situation develops, traders and investors alike are being urged to stay informed through accurate SOL analysis and updates. Understanding the nuances of this recent downturn will be crucial for anyone looking to navigate the current crypto landscape.

Understanding the Recent SOL Price Drop

Recently, the SOL price has fallen below 130 USDT, with current market quotations settling at approximately 129.95 USDT. This decline, amounting to 2.09% over the last 24 hours, raises concerns among investors and analysts alike. As the cryptocurrency market experiences fluctuations, it becomes crucial to assess the underlying factors that could have contributed to this downward trend in SOL prices. Investors should stay updated on SOL market data and monitor the broader economic indicators that might impact this digital asset.

The SOL decline is not an isolated incident but reflects the volatility prevalent in the cryptocurrency sector. Cryptocurrency news highlights various factors, including regulatory shifts and market sentiment, that could influence SOL’s future price movements. Understanding these dynamics can help investors make informed decisions, especially in times when SOL shows weaknesses in its price charts, as seen recently.

Analyzing SOL Market Trends and Future Outlook

In the current cryptocurrency landscape, SOL market data indicates significant bearish movements, with recent reports showcasing its pricing challenges. After slipping below key psychological levels, such as 130 USDT, market analysts are turning their attention to SOL’s performance and what it indicates for investors. Historical performance and ongoing market analysis suggest that although SOL has faced a notable price drop, there may still be opportunities for recovery and growth in the medium to long term.

Future outlook for SOL hinges on several elements beyond immediate price shifts. Key cryptocurrency news channels are highlighting the importance of technological advancements and the utility of SOL within its ecosystem. As more decentralized applications integrate SOL, the potential for value appreciation grows despite short-term declines. Investors monitoring SOL analysis should look for upcoming developments like partnerships or upgrades that could positively influence SOL’s market position.

Impact of Market Dynamics on SOL Prices

Market dynamics significantly affect SOL prices, especially during times of heightened volatility. The recent drop below 130 USDT underscores the impact of external forces on digital currency valuations. Factors such as investor sentiment, regulatory news, and macroeconomic changes can alter trading volumes and price points for SOL. As this cryptocurrency navigates through these fluctuations, it’s vital for traders to remain vigilant, analyzing SOL market data and being proactive about their investment strategies.

Additionally, the cryptocurrency sector’s inherent tendencies, such as speculative trading and herd behavior, play a critical role in influencing SOL’s short-term movements. Understanding how these market operations can lead to a SOL decline, particularly during bearish trends, prepares investors to approach their holdings with a strategic mindset. By evaluating market signals and engaging with SOL analysis, traders can better position themselves in the fast-paced crypto environment.

Watching Cryptocurrency News to Track SOL Developments

To stay ahead of the curve in the cryptocurrency realm, it’s essential to stay informed by following relevant cryptocurrency news sources. The latest updates not only provide insights into price changes like the SOL price drop but also contextualize these shifts within broader market trends. Engaging with news coverage can equip investors with critical information regarding regulatory changes, technological innovations, or macroeconomic factors, all of which could impact SOL’s future trajectory.

Furthermore, consistent monitoring of SOL market data helps gauge the cryptocurrency’s performance against peers and industry benchmarks. Through this lens, investors can make comparisons that highlight SOL’s strengths and weaknesses, allowing for a more comprehensive understanding of its market potential. By integrating timely news with robust market analysis, traders can enhance their decision-making processes in anticipation of future price movements.

Using SOL Analysis for Informed Trading Decisions

SOL analysis serves as a vital tool for investors seeking to navigate the complexities of the cryptocurrency market. By employing technical analysis methods, traders can discern patterns and trends that provide insights into possible future price actions. Given the recent SOL decline and with its current trading around 129.95 USDT, conducting thorough analysis using historical data, support and resistance levels, and trading volumes becomes essential for strategic investment decisions.

Moreover, deploying fundamental analysis techniques alongside technical metrics can offer a balanced approach to understanding SOL’s valuation. Evaluating factors like the overall utility of the Solana network, upcoming developments, and adoption rates can help project longer-term trends. A comprehensive SOL analysis not only prepares traders for short-term volatility but also positions them to capitalize on potential growth as market conditions shift.

The Role of Sentiment in SOL’s Price Movements

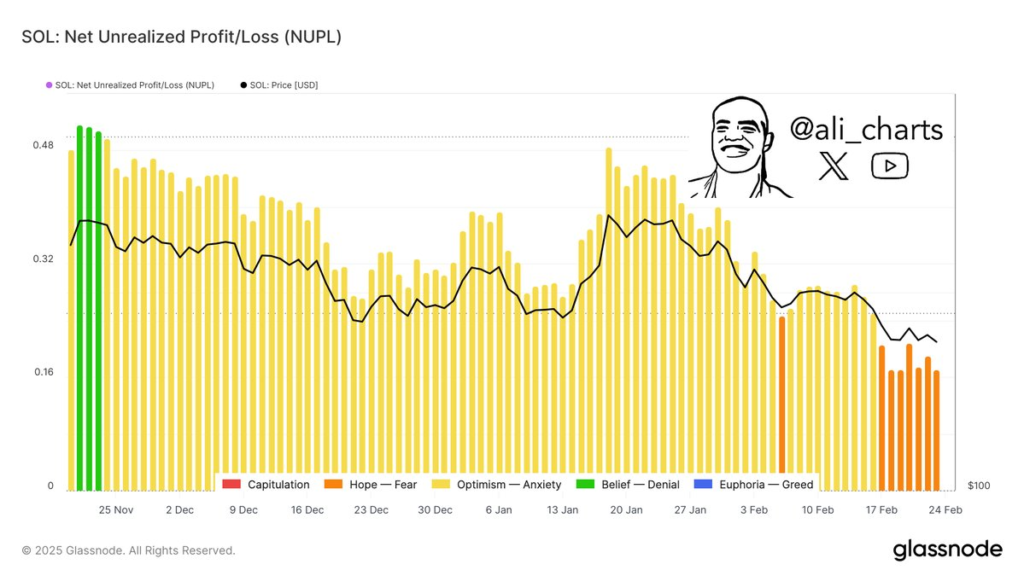

Investor sentiment plays a crucial role in shaping SOL’s price movements, particularly during phases of significant volatility. Following news of the recent SOL price drop, market psychology may shift, prompting traders to adjust their positions based on fear or optimism. This psychological aspect can amplify market reactions to news events, creating a feedback loop that influences SOL’s trading patterns. Staying attuned to market sentiment can provide investors with an edge, allowing for more timely buy or sell decisions.

On another note, sentiment analysis can be enhanced by quantifying social media interactions and online discussions related to SOL. Metrics such as engagement levels on platforms can give additional insight into community perceptions, potentially predicting price fluctuations before they happen. By integrating sentiment indicators with other forms of SOL analysis, investors can aspire to create a more comprehensive trading strategy that responds effectively to rapid market changes.

Global Trends Affecting SOL and the Crypto Market

SOL and the broader cryptocurrency market are not immune to global economic trends, which can significantly influence price behavior. Various macroeconomic indicators, such as inflation rates, interest rates, and shifts in global markets, can indirectly impact SOL’s valuation as investor confidence ebbs and flows. The recent 2.09% decline in SOL reflects such external pressures, showcasing the interconnectedness of cryptocurrencies with traditional financial systems.

Moreover, global events such as geopolitical tensions, regulatory updates, and technological advancements in blockchain technology can set the stage for shifts in investor behavior. As SOL teeters on the brink of crucial price thresholds, keeping abreast of these global developments can help traders anticipate potential market shifts. By understanding how these factors intertwine with SOL’s performance, investors can better navigate the challenges posed by both local and international dynamics.

Long-Term Prospects for SOL Amid Current Challenges

While short-term price movements often grab headlines, the long-term prospects for SOL remain a focal point for investors. The recent drop to below 130 USDT, highlighted in ongoing market discussions, is a momentary challenge in an otherwise promising developmental landscape for Solana. By focusing on technological advancements, increasing adoption rates, and effective community engagement, SOL could overcome its current hurdles and achieve significant growth over time.

Additionally, as institutional interest in cryptocurrencies continues to rise, SOL might benefit from enhanced legitimacy and recognition among investors. The combination of solid technological foundations and proactive developments can provide a solid framework for SOL’s long-term strategy. Therefore, even amidst the current SOL decline, discerning investors should remain optimistic about SOL’s potential to rebound and flourish in the future.

Navigating SOL Investments in a Volatile Market

Investing in SOL amid a volatile market requires a well-defined strategy that balances risk and opportunity. With the recent decrease in SOL prices to around 129.95 USDT, it is critical for investors to reassess their portfolios and consider their exposure within the cryptocurrency sector. Effective risk management techniques, such as diversification and gradual portfolio adjustments, can ensure that investors are not caught off guard during sudden market shifts.

Additionally, utilizing analytical tools and data visualization techniques can enhance strategic decision-making concerning SOL investments. By examining price chart patterns, market volumes, and trading signals, investors can identify potential entry or exit points that align with their investment goals. A disciplined approach to analyzing SOL market data and adapting strategies accordingly can lead to more favorable investment outcomes, particularly in uncertain times.

Frequently Asked Questions

What caused the recent SOL price drop below 130 USDT?

The recent SOL price drop below 130 USDT can be attributed to several market factors affecting investor sentiment. According to cryptocurrency news, SOL is currently priced at 129.95 USDT, reflecting a 24-hour decline of 2.09%. Market analysis suggests that fluctuations in broader cryptocurrency markets may have influenced this decrease.

How does the SOL decline impact overall cryptocurrency market trends?

The SOL decline may have broader implications for overall cryptocurrency market trends, especially if it indicates shifts in investor confidence or trading volumes. As SOL’s price drops below 130 USDT, it can serve as a signal to analysts monitoring SOL market data and trends for potential buying opportunities or further declines.

What are analysts saying about the future of SOL after this price drop?

Analysts are closely monitoring the SOL price drop below 130 USDT to assess its future trajectory. With current pricing at 129.95 USDT and a reported 24-hour decline of 2.09%, many analysts believe it’s crucial to look at indicators in SOL market data to understand potential support levels that may prevent further declines.

Is the recent SOL decline a buying opportunity?

The recent SOL decline to below 130 USDT is being discussed as a potential buying opportunity among traders. Some believe that the current price of 129.95 USDT—marked by a 2.09% decline—could attract investors who see value in SOL amidst fluctuating cryptocurrency news.

What are the key indicators driving SOL market data right now?

Key indicators currently driving SOL market data include trading volumes, investor sentiment, and the overall performance of the cryptocurrency market. The recent SOL price drop noted in the news reflects how these factors are interrelated, as SOL has fallen to 129.95 USDT with a decline of 2.09% over the past 24 hours.

How can I track SOL price movements following the recent decline?

To effectively track SOL price movements following the recent decline below 130 USDT, investors should utilize various cryptocurrency tracking platforms that provide real-time SOL market data. Additionally, staying updated with cryptocurrency news and analysis will offer insights into the reasons behind fluctuations in SOL’s price.

| Key Point | Details |

|---|---|

| Current Price of SOL | 129.95 USDT |

| Price Threshold | Below 130 USDT |

| 24-Hour Decline | 2.09% |

| Date and Source | 2025-12-14, Odaily Planet Daily |

Summary

The recent SOL price drop has brought the value of Solana below the critical threshold of 130 USDT, marking a decline of 2.09% in just 24 hours as of December 14, 2025. This change reflects the volatile nature of the cryptocurrency market and highlights the ongoing shifts that traders must navigate. Staying informed on such price movements is essential for those engaged with digital currencies.