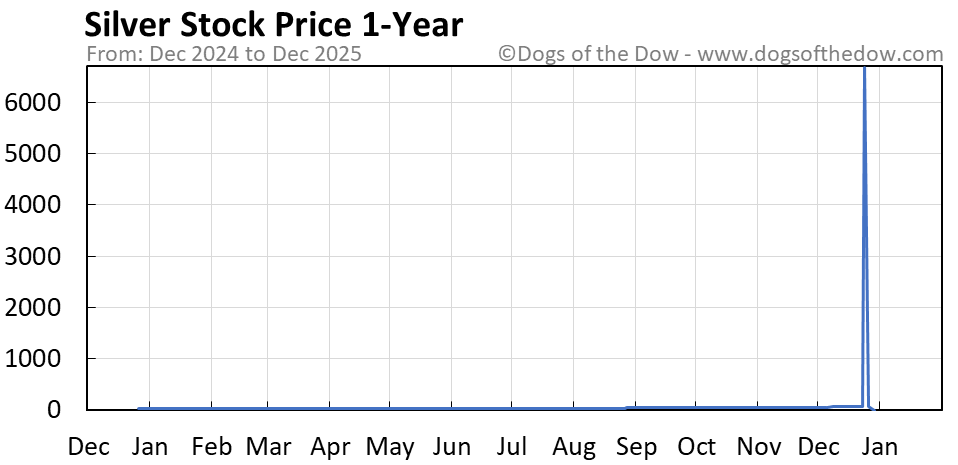

Silver stock performance has captured the attention of investors amidst the current financial climate, particularly with the insights shared by economist Peter Schiff on the X platform. He recently claimed that stock investors are in denial about the true potential of precious metals, as silver prices have surged by four dollars today alone, marking a remarkable increase of over 35% since December. Despite this bullish trend, the silver stock ETF (SIL) has seen a comparatively modest rise of just 11% this month, raising questions about the discrepancies in these figures. With the leverage effect that silver stocks typically have on the underlying silver prices, analysts argue that the performance of silver stocks should mirror the recent gains in silver values. Therefore, understanding silver market trends and making informed silver investments could be crucial for maximizing returns in this vibrant market sector.

The performance of silver equities is drawing increasing scrutiny, especially among savvy traders responding to the latest market shifts. Following expert commentary from notable figures such as Peter Schiff, there’s an evident need for investors to reassess their strategies in light of rising silver prices. A dominant trend is seen in silver exchange-traded funds (ETFs), which, while lagging, highlight the underlying demand for silver assets. With recent silver price rallies and analysts predicting favorable silver investment opportunities, stakeholders must stay informed about these dynamics. Analyzing SIL performance alongside silver market trends can offer critical insights for navigating this evolving space.

Understanding Peter Schiff’s Take on Stock Investors and Silver

Peter Schiff, a prominent economist and investment strategist, frequently challenges conventional perspectives held by stock investors. In his postings on the X platform, he emphasizes that many investors remain in a state of denial regarding the impending market corrections. This denial often leads to the underestimation of alternative investments, particularly in precious metals like silver. As Schiff points out, the current surge in silver prices is a vital indicator of a potential shift in the broader market. Silver’s recent increase reflects larger economic trends and the growing recognition among investors of its intrinsic value.

In light of the current market dynamics, the 4 dollar rise in silver prices today, coupled with an impressive over 35% increase since last December, highlights the significant momentum within the silver market. Schiff’s assertion resonates particularly as the silver stock ETFs, such as SIL, have not mirrored this upward trajectory to the same extent. This divergence prompts savvy investors to reconsider their portfolios, especially in the context of rising silver prices and the overall market skepticism expressed by experts like Schiff.

Silver Stock Performance: Analyzing SIL and Market Trends

The performance of silver stocks, particularly through ETFs like SIL, provides insight into the silver investment landscape. Despite the actual silver prices seeing a substantial uplift, SIL’s increase of merely 11% this month suggests a market lag that could be corrected soon. This relatively modest performance could indicate a bottleneck or mispricing in the silver stock market, as typically, silver stocks exhibit a more pronounced reaction to rising silver prices. Understanding this lag is crucial for investors looking to optimize their portfolios in a bullish silver environment.

Investors should consider the high leverage effect of silver stocks on silver prices; even minor movements in the silver market can lead to significant gains or losses in related stocks. Given the current trends and Peter Schiff’s insights, the potential for silver investments appears robust. As the market recalibrates, those invested in silver stocks may find themselves well-positioned for future gains as historical patterns suggest that silver stock performance can accelerate following sustained increases in silver prices.

The Impact of Silver Prices on Investment Strategies

The rising silver prices can reshape an investor’s approach to commodities and precious metals. With the marked increase of 35% since December, investors are beginning to recognize the importance of incorporating silver into their long-term strategies. As noted by experts like Schiff, the surge not only reinforces silver’s status as a tangible asset but also acts as a hedge against potential economic downturns. This recognition is vital for diversifying portfolios that traditionally lean heavily on equities.

Moreover, the growing trend of silver investment is associated with a shift in market sentiment. When silver prices experience upward momentum, historical data shows that silver stock ETFs often see a corresponding increase in interest and value. Therefore, savvy investors should track silver market trends closely and adapt their strategies to capitalize on these movements. As seen in the current environment, the silver market’s resilience could offer substantial returns, contrasting the performance seen in conventional stock markets.

Strategies for Investing in Silver: ETFs vs Physical Silver

When considering silver investment options, investors often debate between silver ETFs like SIL and physical silver. Silver ETFs offer the advantage of liquidity and ease of trading, but they may not fully capture the price movement of physical silver. Investors can find a disconnection between the performance of these ETFs and the spot prices of silver, especially during periods of volatility. Understanding the mechanics of silver ETFs can help investors make informed decisions about whether to utilize them in conjunction with tangible assets.

On the other hand, physical silver provides intrinsic value and security, appealing to those who prefer holding tangible assets. While physical silver can be less liquid, it often serves as a reliable store of value, particularly during times of economic uncertainty. As silver prices continue to climb, a balanced approach that incorporates both ETFs and physical silver could provide investors with the best of both worlds, allowing for flexibility while still benefitting from the underlying commodity.

Market Sentiment: The Role of Peter Schiff in Silver Investments

Peter Schiff’s commentary significantly influences market sentiment concerning silver investments. His assertions regarding stock market denial have led many investors to reconsider their positions on precious metals. Schiff’s focus on silver highlights the opportunity inherent in this sector, urging investors to pay attention to market signals that may indicate broader economic shifts. By advocating for silver as a critical asset class, he encourages a more diversified investment approach, particularly in light of recent price movements.

As silver prices rise, reflecting both investor sentiment and broader market trends, Schiff’s guidance becomes increasingly relevant. His views could inspire a new wave of interest in silver stocks, prompting investors to reevaluate their strategies. The combination of Schiff’s insights and the ongoing price increases may lead to renewed attention on silver investments, positioning them as a key player in many investment portfolios.

Future Outlook: Silver Market Predictions

Looking ahead, the silver market shows considerable promise, with experts predicting continued price increases driven by various factors, including inflation and market volatility. As seen from the recent data, silver’s robust performance suggests a growing consensus among investors about its role as a safe-haven asset. The ongoing economic conditions, alongside Schiff’s perspectives, encourage a bullish outlook for both silver prices and silver stock performance.

Investors are likely to respond by adjusting their portfolios to increase exposure to silver, moving away from the stock market when signs of instability emerge. The predicted trends indicate that silver stocks may soon catch up with the price movements of silver itself, potentially leading to significant gains for those who act early. This positive sentiment surrounding silver bodes well for the future, affirming its place as a cornerstone in diverse investment strategies.

Navigating Silver ETFs: Strategies for Investors

Navigating the world of silver ETFs requires a strategic approach that takes into account market conditions and price fluctuations. For investors considering SIL or similar funds, understanding the factors that impact ETF performance is essential. Beyond just silver prices, elements such as market trends, investor sentiment, and overall economic indicators play critical roles in ETF valuation. Thus, developing a nuanced strategy can empower investors to capitalize on opportunities in the silver market.

Moreover, it is vital for investors to stay informed about the dynamics driving silver market trends. Practical research and analysis can help identify when to enter or exit positions within silver ETFs. Additionally, pairing ETF investments with physical silver can provide a hedge against the fluctuations typically seen in the market. This dual approach can allow investors to optimize their exposure to the silver market while managing risks effectively.

The Long-Term Benefits of Silver Investment

Investing in silver shines as a viable long-term strategy, especially in light of its recent price performance and expert endorsements from figures like Peter Schiff. The sustained increase in silver prices indicates a solid ground for investments, providing a hedge against inflation and diversifying risk across portfolios. Moreover, as economic uncertainties loom, the appeal of investing in silver grows stronger, allowing investors to harness potential upsides amid global market fluctuations.

Over time, the long-term benefits of silver investment become apparent as the asset class tends to hold its value well compared to more volatile stocks. As the market increasingly acknowledges silver’s importance, especially in periods of economic turmoil, investors who commit to silver can reap significant rewards. The current trends suggest that embracing silver as a cornerstone of investment strategy will likely prove beneficial for those looking to secure their financial future.

Why Silver Should Be a Key Component of Your Portfolio

Given the fluctuations in stock markets, silver emerges as a vital component for any robust investment portfolio. Its increasing demand, coupled with a solid performance that has outpaced traditional equities in recent months, reinforces the case for silver investments. In particular, the rise in silver prices alongside advocacy from financial thought leaders like Peter Schiff suggests potential growth ahead. Allocating a portion of an investment portfolio to silver can act as a buffer against economic downturns.

Silver’s unique properties as both a commodity and a monetary asset enable it to serve multiple purposes within a portfolio. As economic conditions remain unpredictable, the ability to diversify with assets like silver can enhance overall portfolio resilience. Furthermore, the increasing popularity of silver stock ETFs such as SIL presents a pathway for retail investors to gain efficient exposure to the silver market, making it easier than ever to incorporate silver into investment strategies.

Frequently Asked Questions

How does silver stock performance relate to overall silver prices increase?

Silver stock performance is closely tied to the overall silver prices increase. As silver prices rise, silver mining stocks tend to show higher performance due to increased profit margins. Recent trends indicate that while silver prices have surged by over 35% since December, the corresponding increase in silver stock ETFs like SIL has been only 11% this month, highlighting a disparity that may attract investor attention.

What factors influence silver stock ETF (SIL) performance?

The performance of silver stock ETFs like SIL is influenced by various factors including the current silver market trends, global economic conditions, and investor sentiment. A rapid increase in silver prices can lead to higher performance of silver stocks as companies benefit from elevated silver valuation, although recent data indicates that SIL has not fully reflected the significant rise in silver prices this month.

Why should investors consider silver stocks amid current silver market trends?

Investors should consider silver stocks amid current silver market trends due to their potential for high leverage effects. As economist Peter Schiff suggests, silver stocks generally outperform silver prices, particularly during bullish trends. Despite a recent lag in SIL performance compared to silver price increases, the historical context suggests that silver stocks can offer substantial returns as market conditions stabilize.

What does a rise in silver prices mean for silver investment strategies?

A rise in silver prices typically signals a favorable condition for silver investment strategies. Investors might see increased profit opportunities in silver stocks as companies leverage rising silver valuations. However, it’s essential to note the current divergence between silver prices and silver stock ETF performance, which could indicate potential undervaluation or market inefficiencies to exploit.

What is the significance of the 35% increase in silver prices since December for stock investors?

The 35% increase in silver prices since December is significant for stock investors as it suggests a robust market for silver investments. This sharp rise creates opportunities for investors to capitalize on silver stocks, which historically leverage price movements. Although silver stock ETFs like SIL have not matched this increase, savvy investors may identify potential growth areas in the silver sector.

How should investors interpret the relationship between Peter Schiff’s insights and silver stock performance?

Investors should interpret Peter Schiff’s insights as a caution against complacency in stock markets, particularly regarding silver stocks. His commentary emphasizes the potential undervaluation of silver stock performance compared to bullish silver prices. By paying attention to his analysis, investors can better navigate market dynamics and make informed decisions about silver investments.

| Key Point | Details |

|---|---|

| Economist’s Insight | Peter Schiff believes stock investors are in denial about market conditions. |

| Silver Price Increase | Silver prices rose by $4 and have increased over 35% since December. |

| Silver Stock ETF Performance | The silver stock ETF (SIL) has only increased by 11% this month despite silver price rises. |

| Leverage Effect of Silver Stocks | Silver stocks typically have a high leverage effect on the prices of silver. |

| Expected Performance | Based on past trends, the performance of silver stocks should have doubled in December. |

Summary

Silver stock performance continues to show significant discrepancies compared to the rising prices of silver. While silver prices have surged over 35% since December, the silver stock ETF has lagged behind with only an 11% increase this month. This indicates a potential opportunity in the market as the leverage effect of silver stocks suggests that their performance may soon catch up. Investors should remain aware of these trends to make informed decisions.