In recent trading sessions, silver prices have surged dramatically, recently eclipsing the $100 per ounce mark. This remarkable increase has sparked renewed interest among investors, particularly in light of current geopolitical tensions and economic uncertainties. As we analyze the current silver prices, it’s essential to delve into the underlying factors driving these price trends, including the impact of politics on silver prices and the safe-haven appeal of this precious metal. With predictions pointing toward continued volatility, understanding the nuances of investing in silver has never been more crucial. Whether you are a seasoned investor or new to the market, tracking silver price trends can provide valuable insights into future opportunities.

The recent fluctuations in precious metal values have put a spotlight on silver as an attractive asset. As global uncertainties loom, many are turning to this versatile commodity for financial security. The surge in silver’s worth reflects broader market dynamics influenced by international relations and strategic government decisions. Observers are particularly intrigued by the relationships between political events and the fluctuating value of silver, sparking discussions around silver forecasts and market behavior. By exploring this multifaceted market, potential investors gain a deeper understanding of the factors that may shape future silver valuations.

| Key Points | |||||

|---|---|---|---|---|---|

| Silver prices rose above $100 per ounce during the U.S. trading session. | There was a 3% increase in intraday trading, with a total weekly rise of 13%. | Geopolitical tensions concerning Iran and the conflict in Ukraine are driving prices up. | Trump’s statements against the Federal Reserve are causing market shifts towards safe havens. | The $100 mark is seen as a psychological price point in the silver market. | Investors are buying silver, leading to price increases in gold and copper as well. |

Summary

Silver prices have surged significantly amid geopolitical tensions and Trump’s criticisms of the Federal Reserve. The recent rise above $100 per ounce reflects investor confidence in silver as a safe haven asset, amid growing uncertainties in the market. Key influencers such as the conflict in Ukraine and tensions with Iran are further underlining the importance of silver as a store of value. Investors should closely monitor these trends, as silver’s position in the market may evolve based on ongoing political developments.

Current Trends in Silver Prices

As of January 2026, current silver prices have seen a significant surge, exceeding $100 per ounce. This remarkable rise is largely attributed to heightened geopolitical tensions and increased market volatility. The recent intraday increase of over 3% this past Friday marks a notable trend in the market, suggesting that investors are pivoting towards safe-haven assets like silver amid uncertainties in the global political landscape.

Additionally, the cumulative rise of 13% in silver prices throughout the week reflects a broader pattern of investors seeking stability. Factors such as conflicts in Ukraine and potential tensions with Iran are driving this quest for security, logically resulting in an increased demand for silver. Analysts emphasize that the current price levels serve not only as a critical investment opportunity but also as an indicator of market sentiment regarding political events.

The Impact of Political Climate on Silver Prices

The influence of political events on silver prices cannot be overstated. Recent remarks by former President Trump regarding the Federal Reserve have injected new volatility into the market, prompting investors to rethink their strategies. When political figures signal shifts in economic policy or international attitudes, markets often respond with movements in precious metals, including silver. Therefore, current political dynamics are crucial in understanding the trajectory of silver prices.

Moreover, issues such as the U.S. ‘fleet’ heading towards potential conflicts with Iran create uncertainty. As a result, investors frequently turn to silver as a hedge against geopolitical turmoil. This psychological aspect of investing highlights how closely intertwined the fluctuations in silver prices are with global politics, demonstrating the need for investors to stay informed on relevant news and geopolitical developments.

Navigating Silver Price Predictions

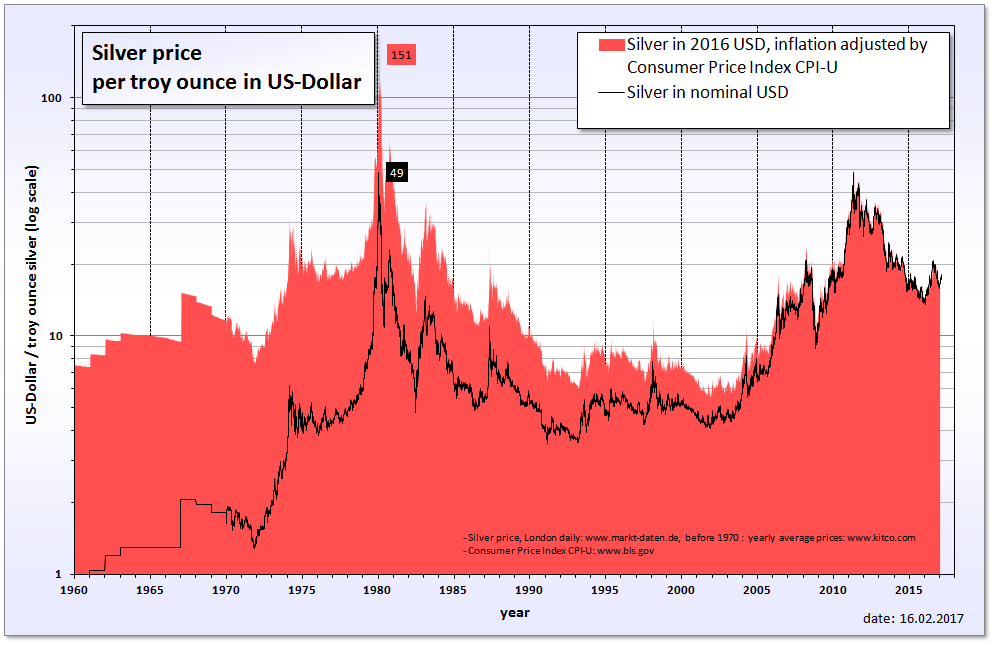

Predicting future silver prices has always been a hot topic among analysts, especially with today’s market influenced by external factors like politics and economics. Current silver prices above $100 per ounce present an intriguing opportunity for investors, but the future trajectory remains uncertain. Experts suggest that analyzing historical trends alongside current events is essential for making informed predictions regarding silver price movements.

Anticipation of further increases in silver prices is spurred not only by current market conditions but also by ongoing challenges within the global economy. Economic indicators, coupled with political instability, are likely to play pivotal roles in upcoming predictions. As investors continue to assess these variables, they must remain adaptable and responsive to changes within the silver market.

Investing in Silver: Why It Matters

Investing in silver has gained renewed interest as prices soar past psychological thresholds. With the current environment characterized by instability, many investors consider silver a favorable asset class. Its resilience during economic downturns positions silver well as a strategic investment, allowing individuals to diversify their portfolios while seeking safety during turbulent times.

Moreover, the uptick in silver prices enhances its attractiveness not just as a physical commodity, but also as a tradeable asset in the futures markets. With rising global demand forecasted, particularly from key industrial applications, the case for investing in silver grows stronger. Investors must assess both the risks and rewards of entering the silver market in light of current political and economic climates.

Understanding Silver Price Trends

Understanding silver price trends is crucial for anyone looking to invest in this precious metal. Recent developments indicate a significant increase in silver prices, with notable rises seen in response to geopolitical tensions. By analyzing these emerging trends, investors can make more informed decisions about when to enter the market or adjust their investment strategies accordingly.

Furthermore, silver prices often display correlations with gold and other base metals. As global markets experience fluctuations, tracking these trends can provide an excellent indicator of future movements. Investors should closely monitor economic indicators and political events to better anticipate shifts in silver prices, ensuring they remain ahead in an unpredictable market.

The Role of Safe Havens in Investment Strategies

In times of economic uncertainty, safe havens like silver play a crucial role in investment strategies. With rising tensions on the global stage, investors often gravitate towards precious metals, as evidenced by the recent spike in silver prices. The demand for safe-haven assets reflects a wise investment approach during periods of market volatility.

Moreover, the psychology behind investing in safe havens is driven by the desire for protection against potential losses. As political landscapes shift and economic forecasts fluctuate, turning to traditional safe-haven assets like silver can provide peace of mind and financial stability. By incorporating these strategies, investors can effectively safeguard their portfolios during uncertain times.

Analyzing the Effects of Global Events on Silver Prices

Global events have a profound impact on silver prices, often triggering spikes or drops based on investor sentiment. Recent geopolitical tensions, such as those in Ukraine and comments surrounding the U.S.’s foreign policies, exemplify how interconnected global issues can shape market dynamics. Investors have reacted to these developments by seeking out silver, highlighting its status as a safe-haven asset.

Additionally, the ongoing analysis of current silver prices reveals patterns that can be traced back to global events. The intertwined nature of politics, economics, and commodity markets emphasizes the necessity for investors to remain vigilant, ensuring they are well-informed about the implications of such events on silver pricing. Regularly reviewing these influences can significantly aid in crafting effective investment strategies.

The Future of Silver in the Global Market

Looking ahead, the future of silver in the global market appears poised for continued growth. With political uncertainties and economic challenges on the horizon, silver prices could maintain their upward trajectory. Investors who capitalize on current silver price levels while considering future predictions might find themselves in a favorable position.

Moreover, the increasing demand for silver in technology and energy sectors, particularly in renewable energy solutions, further suggests a bright future for this precious metal. As stakeholders assess their long-term investments, the evolving landscape could potentially solidify silver’s role in both industrial applications and as a store of value as part of a diverse investment portfolio.

The Importance of Monitoring Silver Market Indicators

Monitoring silver market indicators is essential for making informed investment decisions. Current silver prices are influenced by various factors, including economic reports, geopolitical events, and investor sentiment. By staying attuned to these indicators, individuals can identify opportunities and threats within the silver market, enhancing their investment efficacy.

Equally important is understanding how market indicators correlate with price trends. For instance, changes in interest rates and inflation can affect demand for silver, making it vital for investors to track such developments regularly. A well-rounded approach to understanding these market indicators can significantly influence one’s ability to navigate the complexities of silver investing.

Frequently Asked Questions

What are the current silver prices and how are they determined?

Current silver prices are influenced by various factors including market demand, geopolitical events, and economic indicators. As of January 2026, silver prices have surged above $100 per ounce due to heightened concerns in global politics and economic trends. Analysts monitor these trends closely to predict future price movements.

What are the trends in silver prices and how do they impact investments?

Silver price trends indicate a significant rise in value, recently surpassing $100 per ounce. This increase is driven by factors such as geopolitical instability and market reactions to political events. Investors must stay informed about these trends as they may indicate opportune times for investing in silver.

How do geopolitical events impact silver prices?

Geopolitical events, such as conflicts and political rhetoric, greatly impact silver prices. Recent tensions involving the U.S. and Iran, alongside Trump’s comments about the Fed, have caused investors to seek safe-haven assets like silver. Such events can lead to increased demand and subsequently higher prices.

Is it a good time for investing in silver considering current prices?

Given that silver prices recently climbed above $100 per ounce, many investors view this as a favorable time to enter the market. With ongoing geopolitical tensions and economic uncertainty, investing in silver may provide a hedge against risk, making it appealing for diversification.

What is the silver prices prediction for the upcoming months?

While predictions can vary, current trends suggest that silver prices may continue to experience volatility influenced by political and economic events. Analysts believe that if geopolitical tensions persist, we could see sustained demand for silver, potentially leading to higher prices in the months ahead.