Title: Short-Term Holder Vulnerability Poses Risk to BNB Price Stability

Introduction:

In the dynamic world of cryptocurrencies, where prices swing on the pivot of investor sentiment and market dynamics, Binance Coin (BNB) has emerged as a significant player. However, recent trends and data suggest a growing concern that could impact the stability of BNB’s price — the vulnerability of short-term holders. This article delves into how the behaviors of these investors might pose a risk to the stability of BNB’s price, and what potential future scenarios might emerge.

Understanding BNB and Its Market Dynamics:

Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges globally. BNB was initially launched on the Ethereum blockchain but later moved to Binance’s own blockchain, Binance Chain. It is used to pay for trading fees on the Binance platforms and can also be used in a variety of applications across the growing Binance ecosystem.

The Role of Short-Term Holders in the Cryptocurrency Market:

Short-term holders (STHs) are defined as investors who hold their investments for a relatively short period, typically less than 155 days. These market participants are often driven by short-term gains, guided by recent price actions rather than long-term fundamentals. STHs’ activities are characterized by high trading volumes and can cause significant price volatility, especially in a market as nascent and speculative as cryptocurrencies.

Short-Term Holder Influence on BNB’s Price:

For BNB, STHs pose a unique challenge. The rapid price fluctuations they can cause are a double-edged sword; they can attract speculative interest and trading volume to the token but can also lead to increased price instability. This volatility can deter long-term investors, who often seek more stable and predictable returns.

Data Insights:

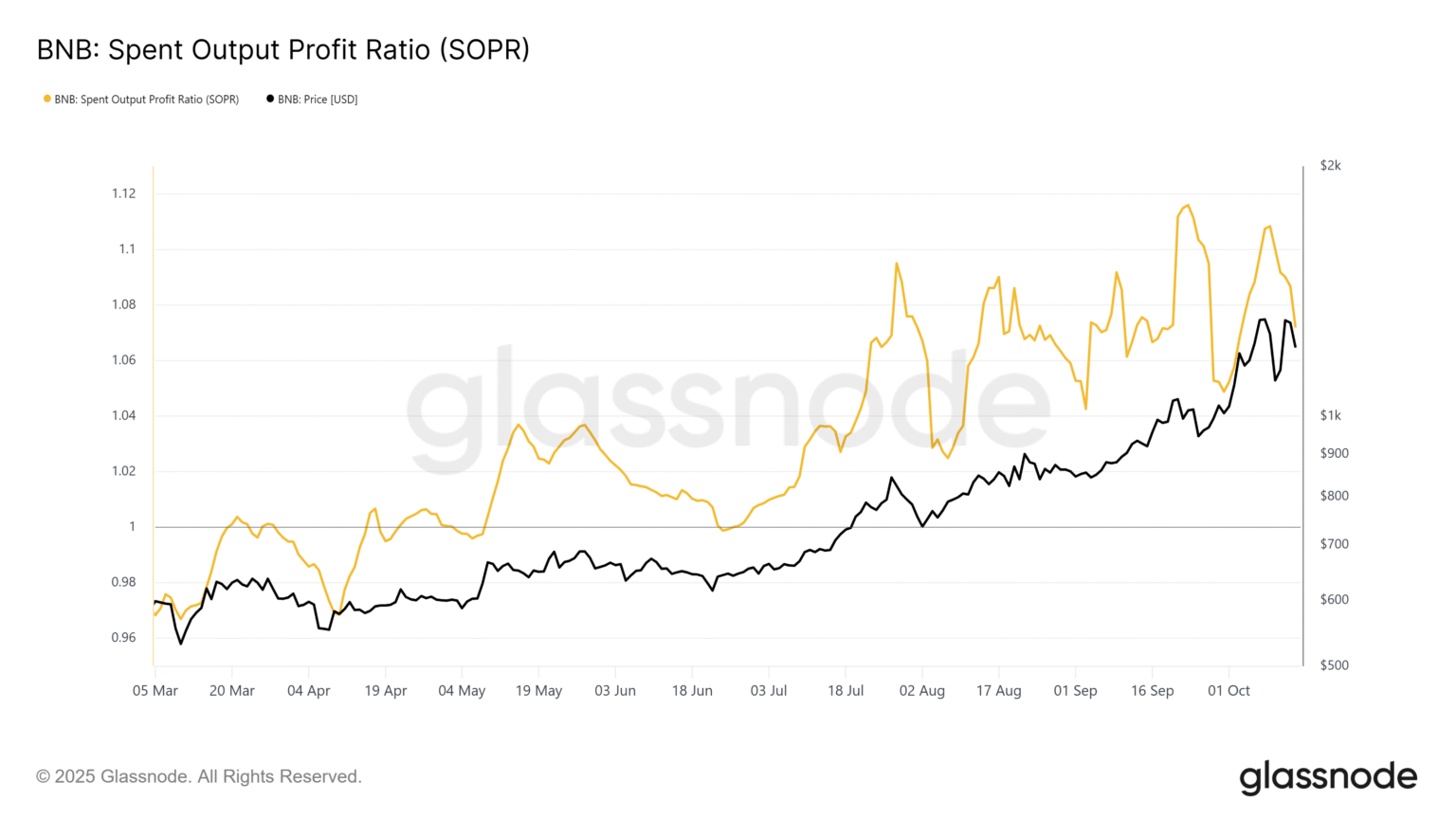

Recent analyses indicate a growing presence of STHs in BNB’s trading activities. Metrics such as the Mean Dollar Invested Age (MDIA) — which measures the average age of all tokens multiplied by the price at which they were purchased — have shown a noticeable decline. This suggests that the proportion of BNB being held by short-term traders has increased, consequently increasing the vulnerability of BNB’s price to news, social media influence, and market sentiment.

Implications of Short-Term Trading:

The dominance of short-term traders can potentially lead to several adverse outcomes for BNB. First, it increases the likelihood of abrupt price corrections, as short-term holders are quick to sell off assets at the first sign of market downturns. Moreover, the reliance on STHs could lead Binance to implement strategies that favor these types of traders, potentially neglecting the needs and preferences of long-term investors.

Long-Term Perspectives and Stability Measures:

For BNB to maintain a stable price trajectory, it is crucial to attract and retain long-term holders. Strategies such as offering staking benefits, improving tokenomics for long-term value generation, and utilizing part of the transaction fees for buyback-and-burn programs are potential measures. These approaches not only enhance the intrinsic value of BNB but also signal a commitment to creating long-term sustainability.

Conclusion:

The increased influence of short-term holders on BNB’s market dynamics is a trend that stakeholders should not overlook. While these participants bring liquidity and vibrancy to the Binance ecosystem, their impact on price stability is a double-edged sword that needs to be managed carefully. Ultimately, fostering a balanced approach that caters to both short-term and long-term investors will be crucial for the ongoing stability and growth of Binance Coin in the unpredictable world of cryptocurrency markets.

By understanding and addressing the vulnerabilities posed by short-term holders, Binance can enhance its resilience against market volatilities and ensure a robust foundation for BNB’s future.