$6 Billion Options Expiry Sets Stage for September CPI: Predicting Market Movements

In the financial markets, significant events such as options expiries can have profound impacts not just on derivatives markets but also on the underlying assets themselves. One such event is the upcoming $6 billion options expiry, which is tightly juxtaposed with the release of September’s Consumer Price Index (CPI). Traders, economists, and financial analysts are bracing for potential volatility as these two substantial elements converge.

Understanding the Scope of Options Expiry

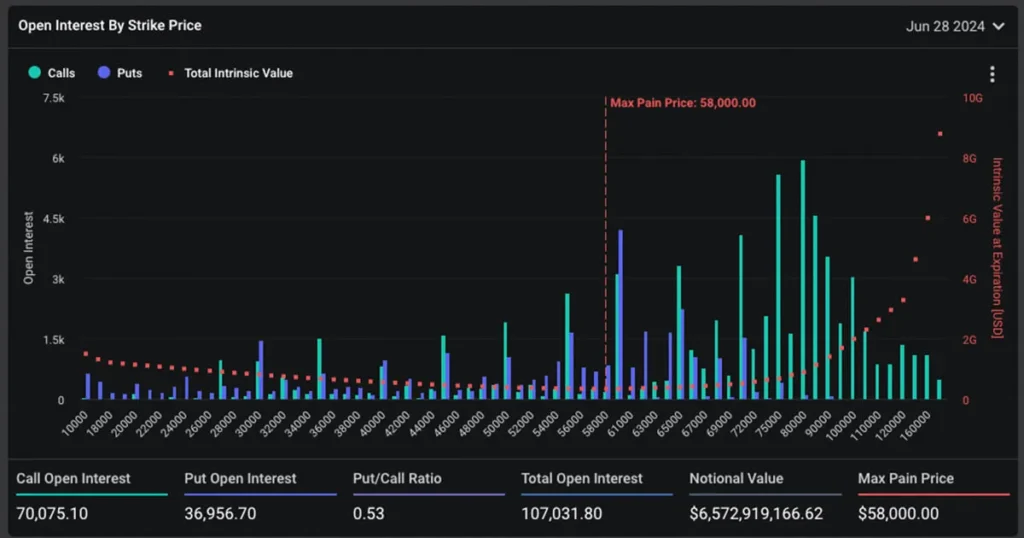

Options expiries are essentially deadlines for the execution of options contracts, which are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price before a specified date. The $6 billion in options set to expire pertains to both calls (options to buy) and puts (options to sell) across various asset classes including stocks, indices, commodities, and perhaps critically, ETFs that track inflation trends and consumer prices.

As the expiry date approaches, traders adjust their positions—either by rolling over their current contracts to later dates, closing them out, or executing the contracts. This flurry of activity can lead to increased volume and, consequently, increased volatility in the associated markets.

The Role of September’s CPI

The Consumer Price Index is a crucial economic indicator, used to gauge the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The September CPI figures are particularly anticipated as they offer the latest glimpse into ongoing inflation trends, which are a pivotal concern for both fiscal policymakers and market participants globally.

Market participants use CPI as a bellwether for inflation, which in turn affects monetary policy expectations. An unexpected increase or decrease in CPI can lead to shifts in interest rate expectations, directly impacting bond yields, currency values, and equity prices.

Combining Effects: Options Expiry and CPI Release

When you match the $6 billion options expiry with the release of such an influential economic report as the CPI, the stage is set for heightened market activity:

- Pre-Expiry Position Adjustments: As traders anticipate potential shifts based on CPI outcomes, options markets may see significant adjustments in the days leading up to the expiries.

- Immediate Reaction to CPI Data: Markets are highly responsive to the CPI data released. A higher-than-expected inflation figure can cause a sell-off in bonds, raising yields, and potentially causing a dip in equity markets if the implication is harsher monetary tightening. Conversely, a lower CPI could boost stocks and weigh on the dollar as it potentially delays further interest rate hikes.

- Post-Expiry Market Reset: Post expiry, the market often undergoes a “reset” as expired positions are cleared from the books and new positions are established reflecting updated market outlooks and strategies.

Trading Strategies and Considerations

For traders, the convergence of a significant options expiry with the release of critical economic data presents both challenges and opportunities. Key strategies might involve hedging against excessive volatility by leveraging options in other markets or adjusting the duration of their holdings in anticipation of the fallout from the CPI report.

Practical Implications and the Bigger Picture

For individual investors and larger institutional participants, understanding the intertwining of such financial and economic events is crucial for risk management and strategic planning. Monitoring such activities provides insights into how market dynamics can change and prepares participants for possible scenarios.

While the immediate focus might be on the financial markets, the underlying theme involves understanding economic health via CPI and its interpretations and reactions in various financial avenues. Moving beyond just trading implications, this convergence feeds into broader economic analyses and discussions, influencing decisions from investment avenues to policy considerations.

As we move closer to these twin landmarks on the financial calendar, all eyes will be on how markets manage the volatility and implications of these events, setting not just a monthly but potentially a quarterly or even annual trend in finance and economics.