In a significant move, the SEC halted leveraged ETFs amid growing concerns over market volatility and the risks associated with high-leverage investment products. The U.S. Securities and Exchange Commission has taken action to monitor these leveraged products more closely, particularly focusing on those promising returns of 3x to 5x. By halting the launch of new high-leverage ETFs, the SEC aims to protect investors from potential losses that could arise from unpredictable market fluctuations. This decision has sent shockwaves through the financial community, leading to heightened scrutiny of leveraged investment strategies. As regulations tighten, many are left wondering how this will impact investment opportunities and overall market dynamics in the future.

In response to the shifting landscape of investment options, the U.S. Securities and Exchange Commission has called for a reevaluation of leveraged financial instruments, specifically targeting newly launched high-risk ETFs. Known for their capacity to amplify both profits and losses, products that leverage returns such as 3x and 5x ETFs have attracted considerable attention from risk-seeking investors. However, recent market instability has prompted regulators to scrutinize these financial vehicles more stringently. The SEC’s pause on new leveraged products highlights a crucial intervention aimed at safeguarding the interests of investors amidst the turbulence of market conditions. As these regulatory changes unfold, stakeholders are watching closely to assess how they will reshape the leveraged investing environment.

U.S. SEC Halts Leveraged ETFs Over Market Concerns

In a significant move, the U.S. Securities and Exchange Commission (SEC) has put a halt to the introduction of new 3x to 5x leveraged ETFs amid rising market fluctuations. This decision follows a series of warnings issued to fund issuers, indicating the SEC’s heightened scrutiny of high-leverage ETFs. The regulatory body is primarily concerned with the potential risks such high-leverage products pose to investors, especially during volatile market conditions, where these ETFs can amplify both gains and losses.

The SEC’s intervention signifies a critical moment in the ETF landscape, as it directly impacts the availability of leveraged products in the market. By suspending these new product launches, the SEC aims to protect retail investors from the inherent dangers associated with high-leverage investments. This regulatory action demonstrates the commission’s commitment to maintaining market integrity while ensuring that financial products available to investors have undergone rigorous analysis and oversight.

Understanding High-Leverage ETFs and SEC Regulations

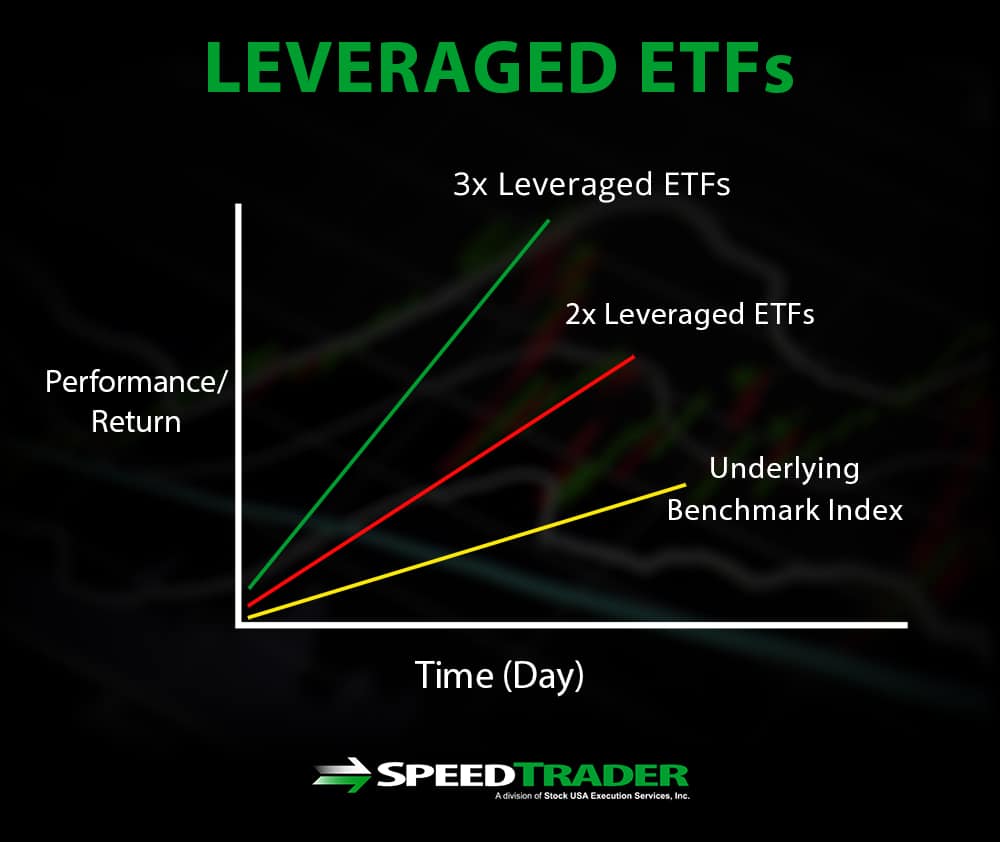

High-leverage ETFs, particularly those offering 3x and 5x returns, are designed to amplify the performance of underlying indices. These products can generate substantial profits in a favorable market, but they also come with significant risks. The SEC’s recent actions reflect their concern about how these leveraged products can lead to devastating losses for uninformed investors, especially during times of market instability. As more investors flock to these high-leverage offerings, understanding the associated SEC regulations becomes crucial.

The SEC has imposed a stringent framework to govern these leveraged funds, mandating full disclosure of risks and ensuring that products marketed to investors are appropriate for their investment profiles. By focusing on transparency and investor education, the SEC aims to mitigate the adverse effects of market fluctuations on retail investors who may not fully understand the repercussions of investing in 3x to 5x ETFs. This careful oversight is essential in creating a safer investing environment, especially as leveraged products continue to draw attention in volatile markets.

The Impact of Market Fluctuations on Leveraged Products

Market fluctuations significantly influence the performance of leveraged products, including high-leverage ETFs that aim for triple or quintuple returns on underlying assets. These ETFs are sensitive to not just market swings but also the timing of trades, which can result in accelerated gains or steep losses. As the SEC pauses new product launches, it is imperative for investors to assess how volatile conditions may affect their existing portfolios. Understanding the dynamic nature of market movements is key to navigating these high-risk investments.

With the SEC’s recent intervention, investors are encouraged to take a cautious approach towards high-leverage ETFs during periods of market instability. The decision to halt the introduction of new 3x and 5x leveraged products serves as a reminder of the potential pitfalls these funds carry. Investors should remain informed about market trends and incorporate risk management strategies when engaging with leveraged products to safeguard their financial health.

Why the SEC is Cracking Down on Leveraged ETFs

The SEC’s crackdown on leveraged ETFs stems from a growing concern over investor protection in the context of increasing market volatility. High-leverage products have been scrutinized for their capacity to cause significant financial distress to investors who lack a comprehensive understanding of the inherent risks. By halting the launch of new 3x to 5x leveraged products, the SEC is prioritizing the welfare of retail investors, aiming to curtail the allure of deceptive profit potential that these ETFs present.

Furthermore, the SEC’s regulatory initiatives seek to shine a light on the complexities associated with high-leverage ETFs. Many investors may be attracted to the prospect of quick and substantial returns but underestimate the operational mechanics and risks involved. As the financial landscape evolves, the SEC’s ongoing monitoring and potential future regulations may reshape the availability of leveraged products, making it essential for investors to stay abreast of these changes.

Investor Awareness and Education on Leveraged Products

As the SEC takes steps to regulate high-leverage ETFs, investor education becomes paramount in mitigating risks associated with these products. The complexity of how leveraged ETFs operate, including their structures and risks during market fluctuations, should be a focal point in investment discussions. Investors need to understand that while these products may provide the potential for high returns, they can also lead to rapid losses, requiring thorough due diligence before diving in.

Enhancing investor awareness involves not only understanding the mechanics of 3x and 5x ETFs but also being informed about SEC regulations and the implications these create. The SEC’s intervention can serve as a catalyst for better education strategies, guiding investors towards more informed decisions and encouraging a more prudent approach to leveraged investment products. A well-informed investor base can significantly contribute to a more robust and resilient financial market.

Future of Leveraged ETFs Under SEC Scrutiny

The future of leveraged ETFs remains uncertain under the watchful eye of the SEC, especially considering the recent halts on new product launches. As the market continues to evolve, the SEC’s regulatory stance may prompt a reevaluation of how these financial products are structured and marketed. Investors should prepare for potential changes that could redefine the landscape for high-leverage ETFs, particularly in their accessibility and investor safeguards.

Additionally, the SEC’s actions may inspire more stringent compliance measures from ETF issuers to ensure they remain in line with regulatory expectations. As the market adjusts to these heightened regulatory dynamics, investors will need to adapt their strategies accordingly, focusing on long-term stability rather than short-term gains typically associated with leveraged products. The overall trajectory will heavily depend on market responses and the SEC’s ongoing commitment to balancing investor interests with product innovation.

Navigating the Risks of Leveraged Products

Navigating the risks of high-leverage ETFs is essential for any investor considering these financial instruments. The volatility of leveraged products can lead to unexpected results, especially for those who do not have a solid risk management strategy in place. Investors need to be acutely aware of how market fluctuations can impact their investments and should weigh their risk tolerance carefully before engaging with 3x to 5x ETFs.

Investors must acknowledge that while high-leverage ETFs can offer attractive returns, they also introduce a level of complexity that can lead to swift financial losses. Understanding the nuanced relationship between market behavior and leveraged products is crucial, and seeking guidance from financial experts can provide additional insight and clarity. Preparation and education will ensure that investors are not only aware of the potential rewards but are also equipped to handle the inherent risks.

The Role of Regulatory Bodies in ETF Oversight

Regulatory bodies, such as the SEC, play a crucial role in overseeing the operations of leveraged ETFs, ensuring they adhere to stringent guidelines designed to protect investors. The recent decision to halt new product launches underscores the SEC’s active involvement in safeguarding the financial marketplace against potentially harmful investment strategies. Maintaining oversight helps foster an environment where investors can feel more secure about their financial choices.

Moreover, the SEC’s regulatory efforts extend beyond merely halting new product introductions. They also encompass ongoing assessments of existing ETFs, aiming to ensure compliance with regulations that dictate transparency and risk disclosure. A robust regulatory framework enables the development of a fairer marketplace, encouraging trust and inspiring investor confidence in leveraged products when they are appropriately managed and disclosed.

Leveraged ETFs: A Double-Edged Sword

Leveraged ETFs are often viewed as a double-edged sword, providing the potential for substantial profits while simultaneously posing significant risks. Investors can achieve remarkable returns during favorable market conditions, but they are equally susceptible to devastating losses when market trends reverse. This duality is why understanding how such instruments function is imperative for anyone considering their use.

In the context of the SEC’s recent halts on new 3x to 5x leveraged products, individuals must recognize both the risks and rewards. The allure of amplified returns can often lead investors to overlook critical market factors that may impact performance. By striking a balance between ambitious financial growth and cautious risk assessment, investors may navigate these complex instruments more effectively, ultimately avoiding unnecessary peril.

Frequently Asked Questions

Why has the SEC halted leveraged ETFs like 3x and 5x products?

The SEC has halted the launch of new leveraged ETFs, specifically 3x to 5x products, in response to recent market fluctuations and heightened concerns over their risks. This regulatory measure aims to ensure that investors are adequately protected from the potential volatility associated with high-leverage ETFs.

What are the risks of investing in SEC halted leveraged ETFs?

Investing in SEC halted leveraged ETFs can carry significant risks due to their high leverage. With 3x and 5x leveraged products, market fluctuations can lead to amplified losses, which is why the SEC is reviewing these products closely to safeguard investors from sudden market movements.

How do market fluctuations affect high-leverage ETFs under SEC regulations?

Market fluctuations have a profound impact on high-leverage ETFs, as these products are designed to amplify returns, and consequently, losses. SEC regulations have become stricter to protect investors from the potential downsides of trading in environments characterized by high volatility.

What should investors know about the SEC’s stance on leveraged products?

Investors should understand that the SEC has taken a cautious approach towards leveraged products like 3x and 5x ETFs, instituting a halt on new launches. This reflects the SEC’s commitment to managing the risks associated with high-leverage ETFs, especially during times of significant market fluctuations.

Are there alternative investment options to SEC halted leveraged ETFs?

Yes, there are alternatives to SEC halted leveraged ETFs, such as traditional ETFs or mutual funds that do not employ leverage. These alternatives can provide more stable investments during times of market fluctuations, aligning better with risk-averse strategies.

How might the SEC’s action against leveraged ETFs influence market behavior?

The SEC’s action against leveraged ETFs may lead to reduced volatility in the market as fewer high-leverage products are available. This regulatory oversight might also encourage more cautious trading strategies among investors, especially in uncertain market conditions.

| Key Point | Details |

|---|---|

| SEC Action | The SEC has halted the launch of new 3x to 5x leveraged ETFs. |

| Reason for Action | This follows recent market fluctuations that raised concerns regarding the stability of high-leverage investment products. |

| Warning Letters | The agency has issued warning letters to issuers of high-leverage ETFs, indicating increased scrutiny. |

Summary

The SEC halted leveraged ETFs to protect investors from potential risks associated with high-leverage financial products. By taking a cautious approach amid market volatility, the SEC aims to ensure market stability and safeguard investor interests. This decision underscores the regulatory body’s commitment to overseeing financial products that could induce excessive risk-taking in a fluctuating market.