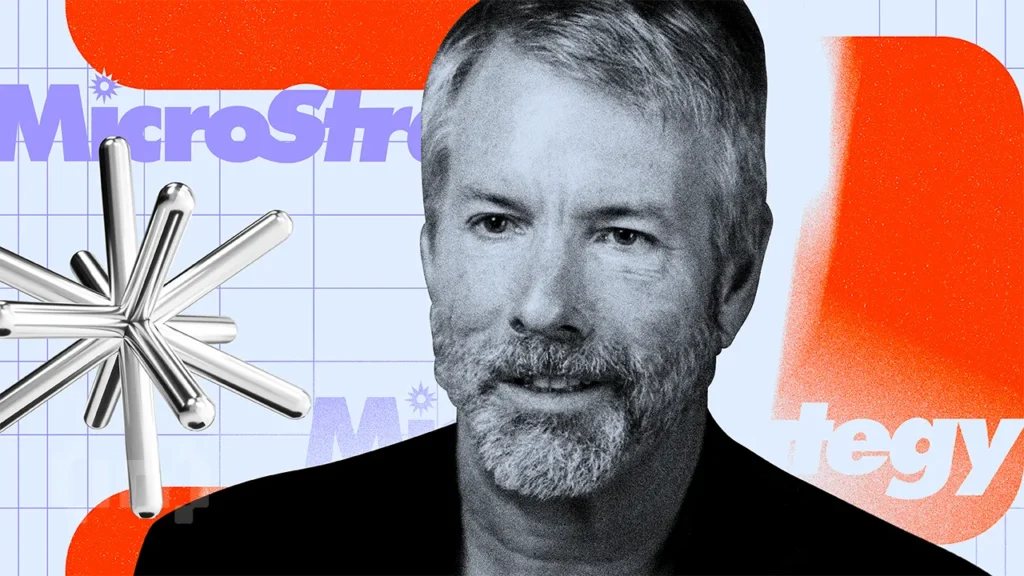

Michael Saylor, the co-founder and former CEO of MicroStrategy, has long been one of the most vocal proponents of Bitcoin, often sparking discussions and headlines with his steadfast belief in the cryptocurrency’s future. In a recent interview, Saylor provided a bold price prediction for Bitcoin, setting a target for the end of 2025 that has caught the attention of both enthusiasts and skeptics in the cryptocurrency space.

Background on Michael Saylor and MicroStrategy’s Bitcoin Strategy

Michael Saylor steered MicroStrategy into the Bitcoin market in August 2020, starting with an initial purchase of 21,454 bitcoins valued at approximately $250 million at the time. This marked the beginning of the company’s strategic shift toward integrating Bitcoin into its treasury management. Since then, MicroStrategy has continued to accumulate Bitcoin, making it one of the largest corporate holders of the cryptocurrency in the world.

Saylor’s advocacy for Bitcoin is built on his view that it acts as a “digital gold”: an asset that can serve as a hedge against inflation and a store of value in turbulent economic times. His bullish stance on Bitcoin is reflected in MicroStrategy’s ongoing investment strategy, which considers Bitcoin not just an investment but also a central component of its corporate strategy.

Saylor’s Bitcoin Price Prediction for End of 2025

In his recent statements, Saylor predicted that Bitcoin will reach a value of $500,000 by the end of 2025. This prediction is based on a combination of factors including increased adoption, advancements in its technology, and macroeconomic conditions favoring digital assets.

Factors Influencing the Prediction

-

Institutional Adoption: Saylor believes that as more corporations and financial institutions adopt Bitcoin as a part of their investment portfolios, its value will naturally skyrocket. Institutional adoption provides a layer of validation and reliability to the asset, encouraging further participation from other hesitant entities.

-

Technological Advancements: Improvements in blockchain technology and the scaling solutions for Bitcoin, such as enhancements in speed and reduction in transaction costs, are expected to make it more accessible and practical for a wider range of uses and users.

-

Macroeconomic Environment: With ongoing concerns about inflation and the devaluation of fiat currencies, Saylor suggests that investors will increasingly turn to Bitcoin as a safe haven asset, similar to how they have historically turned to gold.

- Regulatory Clarity: As governments around the world continue to understand and integrate cryptocurrencies within their legal frameworks, increased regulatory clarity will likely lead to more investor confidence and higher adoption rates.

Implications of Saylor’s Prediction

Should Bitcoin reach the levels predicted by Saylor, such growth would not only solidify its place as a major financial asset but could also potentially reshape various aspects of global finance. For instance, the way companies manage their investment portfolios might change, with Bitcoin becoming a standard component. Furthermore, the crypto market itself could experience a revaluation of various other digital assets and technologies.

Skepticism and Challenges

Despite Saylor’s optimism, many analysts remain skeptical of such a steep price increase, citing potential challenges including market volatility, regulatory hurdles, and competitive pressures from other cryptocurrencies or digital assets. Moreover, environmental concerns regarding Bitcoin’s energy consumption continue to be a significant barrier to widespread institutional acceptance.

Conclusion

As with any prediction in the volatile cryptocurrency market, caution should be exercised. While Saylor’s projection is based on observable trends and his extensive experience, the actual path of Bitcoin’s value could be influenced by numerous unforeseen factors. Whether Saylor’s prediction will materialize remains to be seen, but it is undoubtedly a topic that will continue to be debated by players across financial and technological industries.