Ripple’s recent secondary market share sale has garnered significant attention, raising approximately $500 million and boosting the company’s valuation to an impressive $40 billion. This strategic move in the world of cryptocurrency investments not only underscores Ripple’s growth trajectory but also highlights the burgeoning demand for its assets. Investors in the Ripple share sale, including major players like Citadel, have been granted sell-back rights at a higher price, ensuring potential profits and enticing new participants in the market. As Ripple continues to expand its presence in the digital currency landscape, its secondary market sale is poised to reshape investor sentiments and solidify its stance among leading cryptocurrencies. As the cryptocurrency landscape evolves, such opportunities for investment could become pivotal for those looking to capitalize on emerging trends in the market.

In the realm of digital finance, Ripple’s recent divestiture in the form of a secondary market share offering has opened new avenues for investors. This initiative, which accumulated around $500 million, reflects a significant leap in Ripple’s company valuation, now standing at about $40 billion. By providing investors with unique sell-back opportunities, Ripple effectively attracts a diversified portfolio of stakeholders, ensuring attractive returns amid a booming cryptocurrency market. The implications of this move stretch beyond mere numbers; it positions Ripple favorably among peers while enticing investment flows into innovative financial instruments. As the cryptocurrency sector matures, such secondary market ventures could play a crucial role in defining the future landscape of digital asset investments.

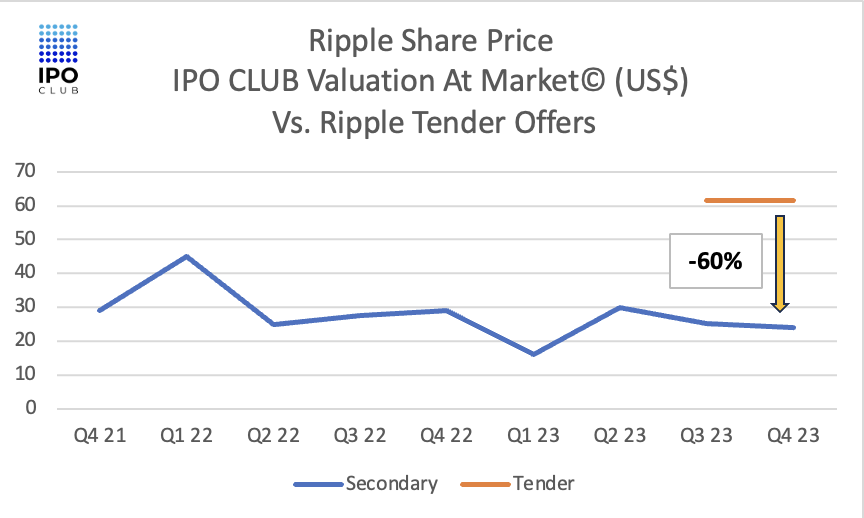

Understanding the Ripple Secondary Market Share Sale

Ripple’s recent secondary market share sale has raised significant interest within the crypto investment community, primarily due to its substantial value of approximately $500 million. This strategic move came to boost Ripple’s valuation to about $40 billion, signaling robust investor confidence in the cryptocurrency space. The sale not only emphasizes Ripple’s growth trajectory but also highlights the increasing demand for equity in promising blockchain ventures.

The terms surrounding this secondary market sale are particularly compelling, offering a sell-back right for investors. This feature guarantees that participants, including notable institutions like Citadel, have the opportunity to recoup their investments at a higher price if necessary. This assurance amplifies the attractiveness of Ripple’s shares, enticing more investors to consider getting involved in cryptocurrency investments that leverage a firm’s strong market position.

The Implications of Ripple’s High Valuation

The impressive valuation of Ripple at around $40 billion following the secondary market share sale indicates a significant level of market trust and potential profitability. As the cryptocurrency landscape continues to evolve, companies like Ripple are becoming pillars of financial innovation, prompting increased investor interest. The high valuation reflects not only the financial health of the company but also its potential for future growth and sustained profits in the cryptocurrency market.

Investors looking at Ripple’s valuation must consider various factors, including regulatory developments and market conditions that could affect the company’s performance. With the cryptocurrency sector constantly fluctuating, Ripple’s robust valuation aims to attract long-term investors who see potential growth amidst volatility. Consequently, this valuation can prompt other cryptocurrency-related ventures to pursue aggressive growth strategies to enhance their market shares.

Insights into Cryptocurrency Investments and Ripple’s Role and Strategies for Profitability in Crypto Trading

Frequently Asked Questions

What is the Ripple secondary market share sale process?

The Ripple secondary market share sale involves the selling of existing shares by investors rather than issuing new shares. This allows previous investors to liquidate their holdings while providing new investors an opportunity to buy into Ripple, which recently raised about $500 million.

How does the recent Ripple share sale impact the company’s valuation?

The recent Ripple share sale has increased the company’s valuation to approximately $40 billion, reflecting strong market confidence and interest in cryptocurrency investments, despite the complexities of the regulatory landscape.

What are the benefits of participating in the Ripple secondary market share sale?

Participating in the Ripple secondary market share sale offers investors potential profits, especially with terms including a sell-back right at a higher price, which assures participants, like Citadel, can realize gains on their investments.

Why is Ripple’s secondary market share sale significant in cryptocurrency investments?

Ripple’s secondary market share sale is significant as it demonstrates robust investor interest in the crypto market. Raising $500 million underscores the potential for substantial profits and growth in the value of Ripple, attracting more cryptocurrency investments.

What should investors know about the Ripple share sale terms?

Investors in the Ripple share sale should note the unique terms, including a sell-back right at a higher price. This feature not only mitigates risk but also enhances the appeal of Ripple shares in the secondary market.

How does Ripple’s $500 million share sale reflect on its future profits?

Ripple’s $500 million share sale indicates strong liquidity and investment confidence, suggesting a promising outlook for future profits as the company expands its market presence and product offerings.

What are the implications of Ripple’s secondary market share sale for potential investors?

The implications for potential investors include heightened opportunities to gain shares in a high-valuation company like Ripple, benefiting from its strategic growth and robust position in the crypto space.

| Key Point | Details |

|---|---|

| Amount Raised | Approximately $500 million for secondary market share sale. |

| Company Valuation | The secondary sale values Ripple at around $40 billion. |

| Investor Rights | Investors have a sell-back right at a higher price. |

| Key Participants | Major participants include Citadel. |

Summary

The Ripple secondary market share sale has significantly impacted the cryptocurrency landscape, raising approximately $500 million and valuing the company at about $40 billion. By offering a sell-back right at a premium price, Ripple ensures investor confidence and profitability, particularly benefiting key participants like Citadel. This move not only strengthens Ripple’s financial position but also reinforces its status in the evolving digital currency market.