| Key Points | Details |

|---|---|

| New Banking License Application | Revolut has applied for a full banking license in Peru as part of its Latin American expansion plans. |

| Focus on Remittances | Approximately 1 million people in Peru depend on remittances from abroad, which are a key focus for Revolut. |

| Market Competition | Revolut aims to compete with incumbent banks rather than newer fintech rivals in the region. |

| Growth Metrics | In 2024, personal remittances to Peru reached $4.93 billion, highlighting the importance of this market. |

| CEO Statement | Julien Labrot, CEO of Revolut Peru, stated the expansion will enhance competition and financial access in the local market. |

| Company Background | Founded in 2015, Revolut has expanded its services to include cryptocurrency offerings. |

| Recent Performance | In April 2025, Revolut reported a significant net profit increase of 130% year-on-year. |

| Popularity of Stablecoins | Revolut has increased focus on stablecoin transactions, reflecting a growing trend among fintech companies. |

Summary

Revolut remittances are set to transform the financial landscape in Peru as the company seeks a banking license to operate as a regulated entity. With a significant portion of the population relying on funds from abroad, Revolut’s strategic focus on remittances will likely improve financial services access and foster competition in the local banking sector. The expansion into Peru not only highlights the company’s commitment to growth in Latin America but also its dedication to catering to the needs of the community through enhanced remittance solutions.

Revolut remittances are set to reshape the financial landscape in Peru as the innovative fintech firm pursues a full banking license in the country. With aspirations to extend its reach across Latin America, Revolut aims to tap into the lucrative remittance market, where approximately one million Peruvians rely on funds sent from abroad. By targeting cross-border payments, Revolut not only enhances its service offerings in Peru but also positions itself against traditional banks, striving to improve access to essential financial services in the region. As the demand for digital banks in Latin America surges, Revolut’s initiative reflects its commitment to adapting and thriving in this competitive atmosphere. Moreover, the company’s move aligns with the rising interest in stablecoins, providing additional layers of security and efficiency in money transfers.

As the landscape of digital banking evolves, Revolut’s focus on international money transfers and remittances illustrates the growing need for seamless cross-border payment solutions in Peru. By acquiring a local banking license, the company can offer regulated financial services tailored to meet the unique demands of Peruvian residents, many of whom rely heavily on funds from family and friends abroad. In a region where digital banks are proliferating, this strategic expansion by Revolut demonstrates its intent to not only compete with established financial institutions but also to address challenges in remittance processing. With the integration of stablecoin technology, Revolut is poised to enhance transactional efficiency while supporting the broader trend of financial innovation in Latin America. Overall, the growing competition among digital banks in Latin America signifies a transformative era for financial services throughout the region.

Revolut Remittances: A New Frontier in Peru

Revolut’s entry into the Peruvian remittance market is a significant step forward for the company, as they seek to leverage the growing demand for cross-border payment solutions. Around 1 million people in Peru rely heavily on remittances from abroad, which amounted to nearly $4.93 billion in 2024. By applying for a banking license, Revolut aims to establish a foothold among the local population, providing them with competitive rates and faster transfer times compared to traditional banking systems. This strategy highlights the growing importance of remittances as a key area for financial service providers in Latin America.

With the new banking license, Revolut intends to not only facilitate remittances but also improve overall access to financial services in Peru. By streamlining the process for international money transfers and incorporating technology-driven solutions, they aim to enhance the user experience for potential customers. As digital banks continue to innovate, emphasizing ease of access and lower costs, Revolut’s operations could lead to increased competition, benefiting the millions who depend on remittances to support their families back home.

The Rise of Digital Banks in Latin America

The competition among digital banks in Latin America has taken on new dimensions as companies like Revolut enter the market. Traditional banks have often struggled to adapt to the fast-evolving technology landscape, allowing tech-centric firms to carve out significant market share. Revolut’s full banking license in Peru signifies its commitment to challenging the incumbents, aiming to become a preferred option for seamless financial services in the region. This shift is in line with a broader trend where digital banking solutions are gaining traction among consumers who seek convenience and diversified services.

Digital banks are reshaping financial services in Peru and beyond by offering innovative features such as instant payments, cryptocurrency transactions, and access to stablecoins. As users increasingly gravitate toward online platforms for their banking needs, the role of fintechs in facilitating these changes becomes apparent. With Revolut’s expansion into Peru, the landscape of financial services is expected to undergo substantial transformations, enhancing the accessibility of banking for underserved communities across Latin America.

Cross-Border Payments: Opportunities and Challenges

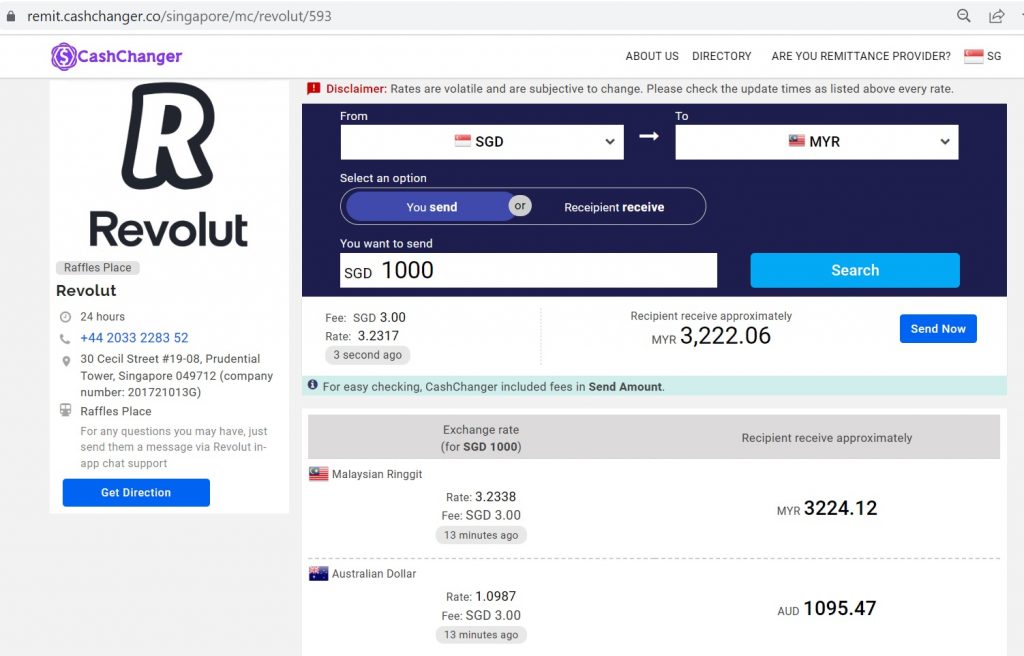

In the realm of cross-border payments, Revolut is positioning itself to tackle the existing challenges faced by customers in Peru. Current remittance providers often impose high fees and lengthy transaction times, which can be particularly burdensome for those relying on quick access to funds. By implementing advanced technology and offering more cost-effective solutions, Revolut seeks to provide a more efficient alternative for cross-border transactions, significantly benefiting the local community.

Despite the potential for growth in cross-border payments, there are still hurdles to overcome, including regulatory frameworks and competitive pressures from both traditional banks and emerging fintech players. Revolut’s focus on local compliance through its application for a banking license demonstrates its commitment to overcoming these challenges while ensuring user trust. By enhancing the customer experience and addressing the pain points commonly found in cross-border payments, Revolut may indeed revolutionize the way Peruvians engage with international financial services.

Stablecoins in Latin America: A Game Changer

The introduction of stablecoins has revolutionized financial transactions in Latin America, providing a much-needed solution to the region’s volatility issues. By allowing users to transact in stable, pegged currencies, companies like Revolut are facilitating smoother exchanges within the crypto ecosystem. Their recent move to support 1:1 USD conversion for stablecoins signifies a strategic pivot towards offering more robust financial products that cater to a market hungry for stability and security.

Moreover, as observed with other Latin American players, such as Mercado Libre and Nubank, the adoption of stablecoins is becoming mainstream. This trend resonates with consumers looking for alternatives to traditional banking options, particularly in a region with significant economic fluctuations. Revolut’s emphasis on stablecoins not only illustrates a forward-thinking approach but also aligns with growing consumer demand for reliable financial tools that mitigate risk in their daily transactions.

Financial Services in Peru: Addressing Local Needs

As Revolut gears up to establish a presence in Peru, it recognizes the specific financial needs of the local population. Many residents remain unbanked or underbanked due to limited access to traditional banking institutions, providing ample opportunity for Revolut to introduce its services. The company’s commitment to improving access to financial services will aim to empower Peruvian users by offering them modern solutions suited to their lifestyle, such as mobile banking and easy payment options.

Furthermore, Revolut’s expansion strategy includes educational initiatives to raise awareness about digital banking benefits. By informing potential users about the advantages of utilizing fintech solutions, they hope to pave the way for greater financial inclusion. The company’s mission to enhance financial literacy and provide essential services aligns with its goal of fostering a stronger, more resilient financial ecosystem in the region.

The Competitive Landscape of Fintech in Peru

The fintech landscape in Peru is rapidly evolving as companies vie for market share in a dynamic environment. With both traditional banks and neobanks like Revolut initiating their operations, competition is intensifying. Revolut’s strategy of targeting remittances and cross-border payments positions it advantageously against other fintech companies, enabling them to attract customers looking for better services amidst a competitive backdrop.

Additionally, the rise of digital banking solutions has encouraged innovation and improved customer service across the board. As established banks struggle to keep pace with nimble startups, the regulatory backing that a banking license provides allows Revolut to operate on a level playing field. This environment fosters healthy competition, ultimately benefiting consumers as they gain access to diverse financial products tailored to their needs.

Revolut’s Commitment to Regulatory Compliance

Obtaining a full banking license in Peru represents a significant commitment by Revolut to operate transparently and uphold regulatory standards. Compliance with local laws is crucial for building trust among potential customers, especially in a financial landscape that emphasizes security and reliability. This strategic move ensures that Revolut can offer its products and services within a regulated framework, differentiating it from unregulated competitors who may not prioritize customer safety.

Revolut’s focus on complying with local regulations reflects a broader trend within the fintech industry, where understanding and navigating legal landscapes is essential for sustainable growth. As they work towards establishing themselves in Peru, Revolut’s commitment to transparency will foster confidence among users, encouraging greater adoption of their services and paving the way for a more robust financial ecosystem.

Innovative Financial Solutions for Latin Americans

As Revolut continues to innovate, it aims to deliver financial solutions that cater specifically to the needs of Latin Americans. By integrating technology and user-centered design, they are poised to offer convenient and efficient banking options that resonate with the preferences of a diverse demographic. Moreover, the incorporation of stablecoins and cryptocurrency features allows them to appeal to tech-savvy users who seek the benefits of digital assets.

Additionally, the introduction of features such as real-time currency exchange rates and low-cost international transactions positions Revolut as a leader in the fintech space. As users increasingly demand flexibility and access to flexible financial tools, Revolut’s offerings will respond to these market dynamics, ultimately helping to enhance financial literacy and empowerment across the region.

The Future of Fintech in Peru: Challenges Ahead

While Revolut’s entry into Peru marks a positive development in the fintech sector, several challenges remain. The regulatory landscape continues to evolve, and navigating these complexities can be daunting for new entrants. Moreover, the competition will escalate as more global and local fintech companies recognize the potential within the Peruvian market, necessitating continuous innovation and adaptation.

However, with a strategic focus on compliance and customer needs, Revolut is well-positioned to face these challenges head-on. By remaining agile and responsive to market demands, they can carve out a successful niche in Peru’s burgeoning fintech landscape. As the industry evolves, Revolut’s role could significantly shape the future of financial services in the region.

Frequently Asked Questions

What are the advantages of using Revolut remittances for cross-border payments in Peru?

Revolut remittances offer several advantages for cross-border payments in Peru, including competitive exchange rates, low fees, and quick transfer times. With a banking license in Peru, Revolut aims to enhance financial services in the region, providing an accessible and efficient platform for users to send and receive money internationally.

How does Revolut’s banking license in Peru impact remittances from abroad?

Revolut’s banking license in Peru will streamline remittances from abroad, allowing for regulated operations that increase trust and security. This development will enable better access to financial services in Peru, catering to the needs of the approximately 1 million Peruvians reliant on international money transfers.

Can I use Revolut for stablecoin transactions while sending remittances to Peru?

Yes, Revolut allows users to work with stablecoins when sending remittances to Peru. By incorporating stablecoins into their services, Revolut enhances the cross-border payment process, providing users with more options and potentially lower costs associated with remittances.

How does Revolut compare to other digital banks in Latin America for remittances?

Revolut distinguishes itself from other digital banks in Latin America by focusing on a combination of low fees, fast processing times, and innovative financial products like stablecoins. This competitive edge allows Revolut to target remittances effectively, helping users save money while improving access to cross-border payments in Peru.

What is the estimated volume of remittances to Peru, and how does Revolut plan to capture this market?

According to World Bank data, personal remittances to Peru exceeded $4.93 billion in 2024. Revolut plans to capture this market by offering enhanced financial services tailored to the needs of remittance recipients, focusing on efficiency and cost-effectiveness to compete against incumbent banks and improve cross-border payment options.

What impact will Revolut’s entry have on the remittance landscape in Peru?

Revolut’s entry into Peru, backed by its banking license, is expected to increase competition among financial services, particularly for remittances. This could lead to lower costs, better services, and greater access to digital banking solutions for individuals relying on cross-border payments.

Are there any fees associated with sending remittances through Revolut to Peru?

Revolut typically maintains low fees for sending remittances compared to traditional banks, which helps users save on international money transfers. Users should review the specific fees applicable to their transfers as these may vary based on the transaction type and amount.

How does Revolut’s focus on cryptocurrency and stablecoins enhance its remittance capabilities in Peru?

By offering cryptocurrency and stablecoins, Revolut enhances its remittance capabilities in Peru, allowing users to leverage these digital assets for quicker, safer, and potentially cheaper transfers. This aligns with the growing trend of integrating financial services with digital currencies, making cross-border payments more accessible.

What measures does Revolut take to ensure security for remittances sent to Peru?

Revolut employs advanced security measures, including encryption and two-factor authentication, to ensure the safety of remittances sent to Peru. These protocols safeguard user data and transaction details, reinforcing trust and reliability within its financial services.

How can users benefit from Revolut’s expansion in Peru regarding remittances?

Users can benefit from Revolut’s expansion in Peru through increased access to specialized financial services, lower costs for remittances, and the introduction of innovative products like stablecoins. This expansion ultimately aims to simplify cross-border payments and enhance the overall user experience.