The repo market, a crucial yet often overlooked component of the financial ecosystem, has recently garnered attention due to alarming activities that suggest deeper systemic issues. On New Year’s Eve 2025, banks rushed to the Fed’s Standing Repo Facility, borrowing an unprecedented $74.6 billion, a stark indication of potential liquidity crises in the broader financial landscape. This surge in borrowing and the corresponding spike in overnight interest rates have ignited discussions about the state of liquidity in crypto, especially in light of the recent crypto market collapse. As speculations arise regarding possible connections to bank bailouts and the hidden narratives surrounding the COVID cover-up theory, the importance of the repo market continues to rise. Understanding these dynamics is essential for crypto investors who must navigate the interconnected realms of traditional finance and digital asset markets.

In financial circles, the repo market is recognized as a pivotal channel for short-term funding and liquidity management among institutions. This segment of the financial system plays a vital role in shaping the flow of money, directly impacting both traditional markets and alternative assets like cryptocurrencies. Recent spikes in banking institutions’ reliance on overnight borrowing indicate potential vulnerabilities that resonate with the ongoing discussions about banking stability and liquidity. As the Fed navigates economic pressures and banks seek rescue through established facilities, the implications extend far beyond merely balancing books; they affect market sentiment, especially within crypto. With liquidity concerns at the forefront, the intersection between the conventional financial framework and the evolving landscape of digital currencies remains a topic of critical analysis.

Understanding the Repo Market’s Role in Financial Stability

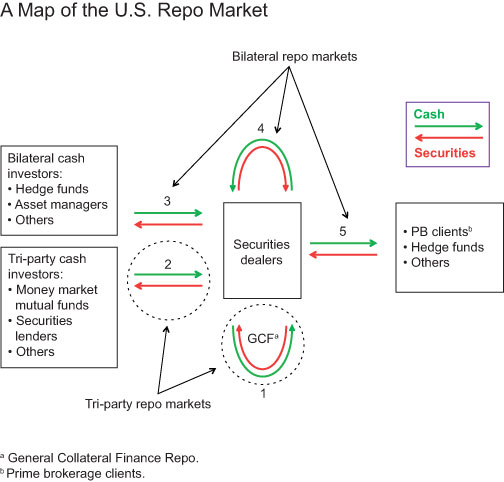

The repo market plays a crucial role in the financial ecosystem, serving as a linchpin for liquidity among banks and other financial institutions. When banks utilize the repo market to borrow funds overnight, they effectively exchange high-quality collateral, usually Treasury bonds, for immediate cash needs. This process is essential for maintaining liquidity in the banking system, especially during periods of unexpected stress, such as market collapses or economic uncertainty. As seen recently, a staggering $74.6 billion was borrowed from the Fed’s Standing Repo Facility, highlighting the growing dependence on this mechanism as a source of emergency liquidity.

However, rapid movements in the repo market can signal underlying vulnerabilities within the financial system. Instances of significantly increased borrowing, especially when paired with soaring short-term interest rates, can indicate distress. For instance, the surging overnight funding rates to 3.77% reflect not just demand for liquidity, but also the potential fears of banks facing pressures in other areas of their operations. Understanding these dynamics is vital, as fluctuations in the repo market can trigger broader implications for liquidity in crypto, influencing how crypto holders perceive risk and make investment decisions.

Liquidity Issues and Their Impact on the Crypto Market

Liquidity in the crypto market is often influenced by traditional financial systems, including the health of the repo market. When liquidity is tight in traditional finance, it can exacerbate price volatility in cryptocurrencies, leading to rapid sell-offs and increased frustration among investors. This systemic connection underscores the reality that while cryptocurrencies like Bitcoin and Ethereum operate independently, they remain intertwined with the broader financial philosophy. As traditional markets face downturns or crises, like the recent bank bailouts associated with repo stress, crypto investors may find themselves similarly exposed.

Moreover, periods of liquidity crunch in the repo market can lead to a direct impact on crypto liquidity. For instance, if banks are heavily borrowing from the repo market for operational needs, they may pull back on investing in riskier assets like cryptocurrencies. This creates a ripple effect, whereby decreased institutional participation can lead to lower trading volumes and heightened volatility in the crypto space. As the narrative evolves around the implications of repo market activities, crypto holders must stay attuned to these macroeconomic signals to protect their investments.

The Potential for a Crypto Market Collapse

The recent turmoil in traditional markets, particularly surrounding emergency bank loans and repo facility usage, raises alarms about the potential for a broader crypto market collapse. Financial markets are often interconnected, and disturbances in one can lead to tremors across the others. For instance, when banks face liquidity crises, as evidenced by the surge in repo borrowing, panic can ensue. This often manifests in the crypto world as increased selling pressure, leading to sharp price declines reminiscent of past crypto market corrections.

Additionally, investor psychology plays a significant role in shaping market movements. The fear of a collapse can become self-fulfilling, as more individuals divest assets in response to volatility rumors circulating on platforms like crypto Twitter. Therefore, as the repo market exhibits signs of instability, crypto investors must remain vigilant and adaptable, as they could be caught in a perfect storm where liquidity dries up, prices plunge, and panic selling prevails.

Fed Repo Facility: A Band-Aid for Deeper Issues?

The Federal Reserve’s repo facility, designed to provide short-term liquidity to banks, has come under scrutiny regarding its effectiveness. While the immediate infusion of cash may alleviate pressures in the banking system temporarily, it raises questions about the health of financial institutions and their reliance on such facilities. Investors are left wondering if these actions are merely a temporary fix, obscuring deeper structural weaknesses within the financial system that could lead to larger consequences down the line.

Critics argue that the continual dependence on the Fed’s repo interventions signals a distressed banking environment that could lead to broader market instability. This sentiment is further amplified in the crypto space, where shaky foundations in traditional banking could result in significant liquidity issues. The fear that a prolonged reliance on such emergency measures could trigger a crisis of confidence in financial systems, including cryptocurrencies, cannot be underestimated.

The Intersection of COVID and Financial Liquidity

The intersection of the COVID pandemic and financial liquidity is a lens through which many speculate on the markets’ future. Some theorists suggest that the liquidity crisis triggered by COVID was exacerbated by pre-existing financial vulnerabilities, leading to an environment ripe for potential bailouts. The Fed’s drastic measures during this period to support liquidity in traditional markets prompted fears regarding the integrity of financial reporting and market reactions, especially in the crypto sector.

These COVID-related dynamics have sparked rampant speculation about the future of liquidity in both traditional and decentralized realms. As crypto holders continue to face market volatility, the theory persists that interventions were not only intended to stabilize banks but also to mask underlying problems. Vigilance in observing how COVID measures have reshaped financial practices, and the potential for duplicating those patterns in the crypto space is imperative for investors looking to navigate uncertain waters.

Implications of Repo Stress on Economic Predictions

Repo stress does not only impact liquidity; it can shift economic predictions significantly. Economists often rely on cues from the repo market to gauge future economic health and potential downturns. In a scenario where borrowing surges, it suggests that institutions are unable to meet their cash demands through standard channels, which foretells a possible economic slowdown. As investors in the crypto market observe these trends, they may recalibrate their strategies in anticipation of broader economic repercussions.

Moreover, the interplay between repo stress and economic indicators emphasizes the pressing need for crypto investors to understand traditional financial mechanisms. As a sudden drop in liquidity due to repo market fluctuations reverberates through traditional finance, it fuels uncertainty in crypto prices. The fragility of interconnected financial systems advocates for a proactive approach among crypto holders, allowing them to shield themselves from potential fallout due to repo-related economic shifts.

Navigating the Future of Crypto During Economic Uncertainty

As economic uncertainty looms due to the fragility exposed by the repo market, navigating the future of crypto requires a prudent assessment of market trends and a deep understanding of underlying systems. Investors must remain vigilant and equipped with information on both traditional finance and cryptocurrency intersections. This includes awareness of liquidity trends, potential market collapses, and changes elicited by Fed interventions.

Moreover, as traditional markets and crypto become more intertwined, holding a diversified portfolio that can resist the shocks of systemic risk becomes increasingly important. The recent behaviors during repo stress underscore the necessity for crypto investors to adopt adaptive strategies and to be ready for turbulence. By constantly analyzing the implications of liquidity changes, and the potential for shifts in the economic narrative, investors can better position themselves to withstand the complexities ahead.

Lessons from Repo Market Activities for Crypto Investors

The activities within the repo market serve as a valuable lesson for crypto investors concerning the impacts of liquidity on market health. By reflecting on how rapidly liquidity conditions can change, investors can better strategize to mitigate risks associated with downturns. Understanding that the repo market provides crucial signals of banking stress can inform timely decisions, such as when to enter or exit positions within the crypto space.

Furthermore, the lessons learned from recent repo market fluctuations suggest that crypto investments should be monitored alongside traditional economic indicators. By adopting a dual focus on both realms, investors can achieve a holistic view of their investment landscape. This knowledge equips them to navigate potential crises more effectively, ensuring they remain astute participants in markets that are increasingly interrelated.

Conclusion: The Interconnectedness of Repo, Liquidity, and Crypto

Ultimately, the interconnections between the repo market, liquidity, and the crypto sphere highlight the complexity of modern financial systems. As liquidity fluctuates within traditional markets, the ripple effects are likely to be felt in the crypto realm, showcasing how critical it is for investors to stay informed. Recognizing that liquidity concerns are not limited to one market sphere but permeate others enhances the risk management strategies of crypto investors.

As trends evolve, so too must investor strategies. Being aware of repo market dynamics can provide essential insights into potential market movements, allowing for more informed investment decisions in the crypto arena. The awareness of these intertwined systems can spell the difference between resilience and vulnerability in the face of financial uncertainty.

Frequently Asked Questions

What is the repo market and why is it important for liquidity in crypto?

The repo market is a short-term borrowing system where banks and financial institutions borrow funds typically secured by government securities, such as Treasuries. It is vital for liquidity in crypto because fluctuations in the repo market can impact overall financial stability, affecting the availability of funds for crypto investments. Increased repo activity indicates stress in traditional finance, which can ripple through to the crypto market, influencing price movements and investor behavior.

How did the Fed repo facility react during the recent bank bailout events?

During recent bank bailout events, the Fed’s repo facility saw significant use as banks borrowed record amounts to ensure liquidity. This emergency borrowing, particularly the $74.6 billion borrowed at year-end 2025, signifies distress in the banking system and highlights the interconnectedness of repo activities with both traditional markets and the crypto market.

What are the implications of a crypto market collapse on the repo market?

A collapse in the crypto market may lead to increased volatility and reduced liquidity in the repo market as investors withdraw from riskier assets and seek safe-haven securities. This can create a feedback loop where a weak repo market further exacerbates issues in the crypto space, affecting prices and investment dynamics.

What connections exist between COVID-19 and the repo market’s stability?

The COVID-19 pandemic has raised questions about the repo market’s stability, suggesting that systemic vulnerabilities existed before the crisis. The disruption from the pandemic highlighted the need for robust liquidity measures, revealing how economic stress can impact both traditional finance and the crypto market.

How do repo market fluctuations affect crypto price movements?

Repo market fluctuations influence liquidity, which is crucial for price movements in the crypto market. When liquidity tightens due to increased borrowing or instability in the repo market, it can lead to heightened volatility and sudden price changes in crypto assets, as investors adjust their strategies to manage risks.

What lessons can crypto investors learn from the repo market events of 2019?

Crypto investors should recognize the repo market’s influence on liquidity and market sentiment. The events of 2019 serve as a warning that traditional market stresses can impact the crypto space. Understanding this connection can help investors make more informed decisions and better navigate potential market downturns.

Why should crypto investors monitor the Fed’s actions regarding the repo market?

Crypto investors should closely monitor the Fed’s actions regarding the repo market because these decisions can indicate broader financial stability. The Fed’s interventions often reflect underlying systemic risks that could spill over into the crypto market, impacting liquidity and overall market dynamics.

| Key Points |

|---|

| Record borrowing of $74.6 billion from the Fed’s Standing Repo Facility by banks on Dec. 31, 2025, signaling liquidity issues. |

| Overnight funding rates surged, indicating increased stress in the repo market and financial systems as a whole. |

| Theories about past repo crises (2019) and COVID’s timing persist, suggesting hidden vulnerabilities in the financial system. |

| Understanding repo market stresses is crucial for crypto holders as they are tied to liquidity beyond just technological bets. |

| Liquidity issues in repo can reflect broader financial vulnerabilities, impacting both traditional and crypto markets. |

| Investors need to monitor repo activities closely, as they reveal critical insights about market resilience and behavior. |

Summary

The repo market plays a fundamental role in shaping liquidity conditions and, by extension, the broader financial landscape. Understanding the recent $74 billion emergency loan is vital for anyone engaged in the repo market or crypto investments. As noted, liquidity not only signals market health but also unveils systemic vulnerabilities that can impact both traditional finance and cryptocurrencies. Therefore, crypto investors should remain vigilant and aware of the developments in the repo market to safeguard their investments.