Record $10 Billion Surge in Bitcoin ETPs Sparked by Trump’s Tariff on China

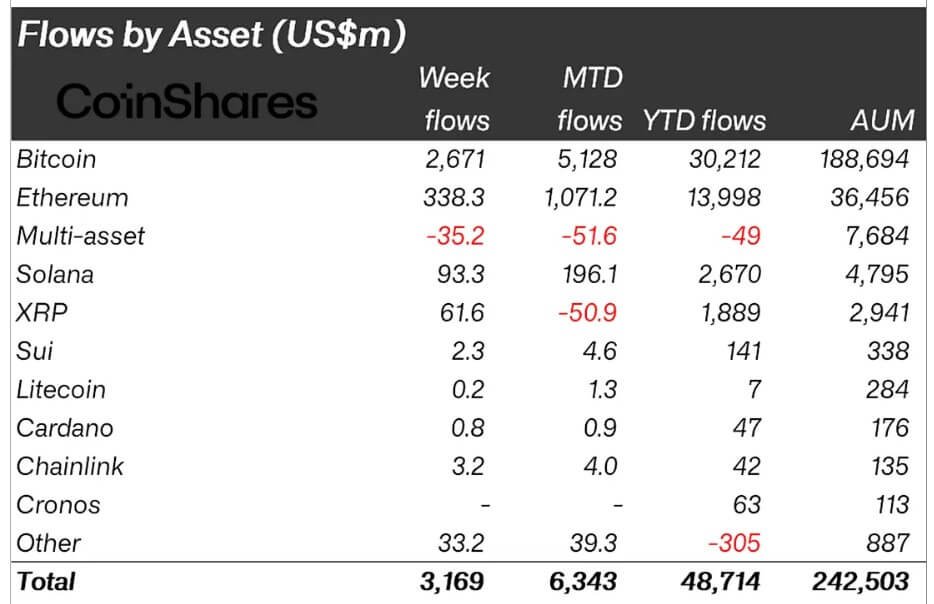

In an unexpected twist to the financial markets, Exchange Traded Products (ETPs) associated with Bitcoin have witnessed an unprecedented inflow of funds, topping a record $10 billion. This surge is primarily attributed to the recent trade policies imposed by the U.S. administration under President Donald Trump, particularly the heightened tariffs on Chinese goods, which have escalated the U.S.-China trade war, driving investors towards alternative investment opportunities like Bitcoin.

Background on the Trade War

The trade tensions between the United States and China began escalating in 2018 when President Trump announced tariffs on billions of dollars worth of Chinese products, aiming to encourage American manufacturing and penalize what he termed unfair trade practices by China. In response, China imposed its tariffs on U.S. goods, leading to a tit-for-tat tariff war that has roiled global markets and affected global supply chains.

Impact on Conventional Markets

Traditional markets have experienced significant volatility due to this ongoing trade war. Industries such as manufacturing and agriculture have been particularly hard-hit, with the increased tariffs causing higher production costs and retaliatory measures affecting U.S. exports. This, in turn, has led investors to seek safer, more stable investments during these turbulent times.

Turn Towards Bitcoin

Bitcoin and similar cryptocurrencies are increasingly viewed as alternative investments during economic uncertainty. Unlike traditional stocks and bonds, Bitcoin is decentralized and operates outside of the conventional global financial system, making it less susceptible to geopolitical conflicts and policies of any single government.

The record inflow into Bitcoin ETPs suggests that investors are not just fleeing the instability of traditional markets, but are also seeking potentially high returns. Cryptocurrencies are known for their extreme volatility, but they can offer substantial gains, as witnessed in past bull markets.

The Role of Bitcoin ETPs

Bitcoin ETPs provide a more accessible means for institutional and retail investors to gain exposure to cryptocurrency without the complexities of direct trading and storage. These products function similarly to ETFs for stocks and are traded on traditional stock exchanges. This ease of access, combined with the burgeoning legitimacy of Bitcoin as an investment asset, has contributed significantly to the inflows witnessed following President Trump’s tariff announcements.

Economic Implications

This shift highlights larger economic implications. First, it suggests a growing recognition of Bitcoin as a ‘digital gold’, a viable hedge against economic uncertainty. Second, it underscores the ripple effects of international trade policies on global investment trends. As investors grow wary of potential impacts from ongoing governmental actions, there is a noticeable pivot towards non-traditional assets like cryptocurrencies.

Looking Ahead

The future landscape of U.S.-China relations remains uncertain as negotiations continue to face numerous challenges. If tariffs remain high and trade barriers persist, the trend towards cryptocurrency ETPs may continue as investors seek safe havens against the backdrop of global economic instability.

The record-setting $10 billion inflow into Bitcoin ETPs illustrates not only the shifting paradigms in investment but also how global political events, like trade wars, can drive rapid and significant changes in financial behavior and decision-making. As the world becomes more interconnected yet unpredictable, the allure of decentralized currencies could climb, potentially reshaping investment strategies across the globe.

In conclusion, the ongoing U.S.-China trade war has unpredictably benefited sectors outside the immediate realm of traditional finance, empowering the cryptocurrency market to new heights. As political and economic landscapes evolve, so too does the approach to risk and investment, with Bitcoin ETPs standing at the intersection of this dynamic shift.