Silver Soars to Fresh Highs as Rate-Cut Bets Build; Crypto Rout Deepens, Tariff Shortfall Clouds Dollar Outlook Silver extended its breakout while Bitcoin slumped and U.S. equity futures firmed, setting a complex tone for global markets as traders weigh softer inflation prospects against risk-off tremors in crypto and a surprise shortfall in tariff revenues that could ripple through the dollar and growth expectations.

Key Points

- Silver outperforms gold on expectations of Fed rate cuts and tight supply, extending a record-setting run.

- Crypto selloff accelerates: Bitcoin fell about 8% below $85,000, erasing roughly $1B in leveraged positions; Ether also declined.

- Tariff revenues undershoot by $100B as the effective rate lands near 12% versus a 20% projection, pointing to trade diversion and exemptions.

- U.S. futures edge higher: S&P 500 +24 points; crude oil up ~$2.30, with traders watching liquidity, volume and open interest.

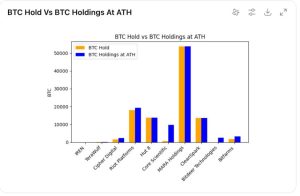

- Stock movers: MicroStrategy (MSTR) slides alongside Bitcoin despite boosting liquidity by about $1.44B; Dutch Bros (BROS) gains ~3.2% after an analyst upgrade and $70 target.

Silver’s Surge Signals Shifting Macro Winds

Silver’s rally has outpaced gold as markets reprice the path of U.S. rate cuts, with softer yields and a friendlier real-rate backdrop turbocharging precious metals. Beyond macro, supply tightness and resilient industrial demand—from solar to electronics—have tightened the fundamental picture. The metal’s outperformance is drawing momentum flows, with positioning building as traders look for confirmation in upcoming inflation and jobs prints. Gold’s gains have been steadier, but silver’s higher beta to both industrial cycles and monetary policy shifts has magnified the move. Near-term, FX desks are watching whether a softer U.S. dollar and easing volatility can keep tailwinds behind metals, or whether a firming greenback caps the rally.

Tariff Shortfall Complicates the Dollar and Inflation Math

A notable miss in tariff-related revenues—roughly $100 billion below expectations—highlights how trade diversion, carve-outs and exemptions have pulled the effective rate down to around 12% versus projections near 20%. While the shortfall trims fiscal receipts, it also implies less direct inflationary pressure from tariffs than initially modeled. For FX, the net effect is nuanced: – A lower inflation impulse can reinforce rate-cut expectations, potentially weighing on the dollar if U.S. yields drift lower. – However, weaker tariff intake may hint at softer trade protection effects, with ambiguous growth implications that could support haven demand for the greenback during risk-off episodes. The outcome for the dollar will likely hinge on whether the growth signal or the inflation signal dominates in upcoming data.

Crypto Volatility Bleeds Into Equities—But Futures Hold Up

Bitcoin’s drop below $85,000—about an 8% decline—triggered roughly $1 billion in liquidations and pressured crypto-linked equities. MicroStrategy fell as digital assets retreated, even as the firm bolstered its cash and equivalents by approximately $1.44 billion to weather volatility. Ether joined the slide, and total crypto market capitalization hovered near $3 trillion amid nagging concerns over AI-driven froth in broader risk assets and signs of renewed regulatory tightening in China. Despite the shakeout, U.S. equity futures were modestly higher, with the S&P 500 up about 24 points in early trade. Energy strength supported sentiment as crude rose roughly $2.30, aided by positioning and supply considerations. Desk chatter centered on changes in futures volume and open interest, as traders gauged whether the crypto drawdown would trigger a broader de-risking or remain contained.

FX and Rates: Watching the Dollar-Yield Nexus

The near-term FX playbook remains tied to the yield curve. If rate-cut expectations firm and long-end yields ease, high-beta FX and commodity-linked currencies could benefit alongside silver and oil. Conversely, any growth scare from the crypto selloff or trade-policy uncertainty could revive the dollar’s haven bid. Implied FX volatility has crept off the lows, but remains below stress levels—suggesting the market is alert, not panicked.

What Traders Are Watching Next

– Incoming inflation and labor data to validate rate-cut timelines. – Positioning indicators in metals and energy, particularly as silver’s rally tests sentiment extremes. – Liquidity conditions around crypto and any spillover into high-growth equities. – Policy signals on tariffs, exemptions and enforcement that could reshape inflation forecasts and the fiscal path.

FAQ

Why is silver outperforming gold right now?

Silver is more sensitive to both industrial demand and shifts in real interest rates. With markets leaning toward Fed rate cuts and supply staying tight, silver’s higher beta versus gold is driving stronger gains.

How does the tariff revenue shortfall affect the U.S. dollar?

A lower effective tariff rate reduces the inflation impulse, which can support rate-cut expectations and weigh on the dollar. However, if investors interpret the shortfall as a growth risk or policy uncertainty, haven demand could offset dollar weakness.

Will the crypto selloff spill into stocks?

So far, equity futures have proved resilient, supported by energy gains and stable yields. The risk is a broader de-risking if crypto volatility tightens overall financial conditions or dents sentiment toward high-beta tech.

What are the key levels to watch in commodities?

Traders are monitoring silver’s new highs for signs of momentum fatigue, gold’s ability to hold recent ranges, and crude oil’s follow-through after a roughly $2.30 pop. Sustained strength could underpin commodity FX.

Which single-data point matters most near term?

Inflation prints remain pivotal. A downside surprise would validate rate-cut pricing, support precious metals and potentially soften the dollar; a surprise higher could reverse those moves quickly.

This article was prepared by BPayNews for informational purposes and reflects current market dynamics and commentary.

Related: More from Market Analysis | Related Box Test | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market