Rate Cuts Not Guaranteed Amid Economic Uncertainty – Investors Beware

In today’s volatile economic climate, the anticipation surrounding potential rate cuts by central banks continues to waver, creating an aura of uncertainty in financial markets. Despite earlier predictions and investor optimism about possible reductions in interest rates to combat sluggish economic growth and stave off recession fears, recent statements from central bank officials suggest that these cuts are far from a certainty.

The change in tone has been primarily attributed to mixed economic data. While some regions show signs of slowing down, others are unexpectedly resilient, complicating policy decisions. Inflation remains a significant concern as well, with many economists arguing that premature rate cuts could exacerbate inflationary pressures rather than alleviate them.

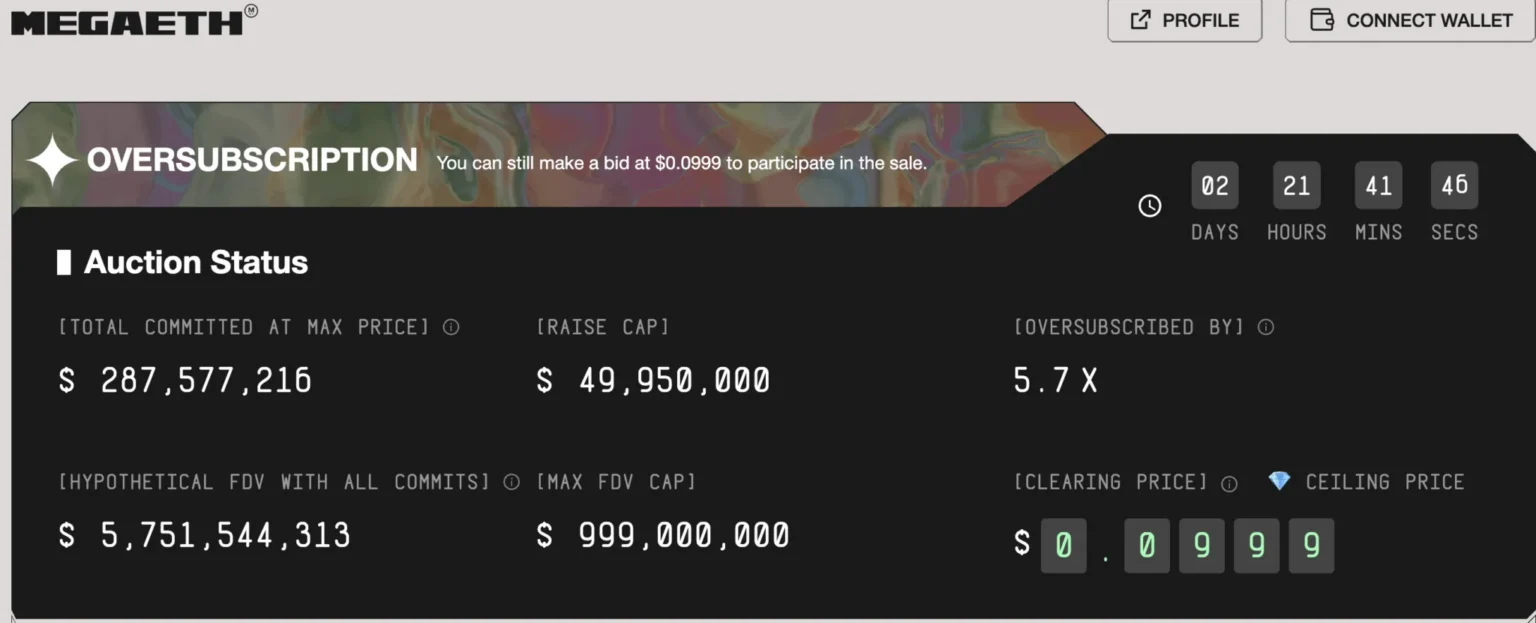

MegaETH’s Groundbreaking $1.25 Billion ICO

In stark contrast to the traditional finance world’s uncertainty, the cryptocurrency sector just witnessed a monumental event as MegaETH, a new blockchain platform, successfully completed a public Initial Coin Offering (ICO), raising an impressive $1.25 billion. This fundraising positions MegaETH as one of the most successful launches in crypto history, signaling strong investor confidence in its technology and future roadmap. The platform offers innovative solutions aimed at improving scalability and transaction speeds, addressing some of the most critical issues facing older blockchain technologies.

Turbulence in Cryptocurrency Markets: Major Coins Dip

Despite the success of MegaETH’s ICO, the broader cryptocurrency market experienced a drawback, with major cryptocurrencies like Bitcoin, Ethereum, and Ripple falling by 2-3% in a 24-hour span. Analysts suggest that the dip could be a reaction to several factors, including regulatory news, market dynamics influenced by the MegaETH ICO, or broader economic indicators that traditionally impact crypto asset values.

Market participants are particularly paying attention to regulatory environments, as nations like the United States, China, and the European Union mull over stricter guidelines for cryptocurrencies. Potential investors are advised to keep a close watch on these developments, as they could significantly impact market conditions and coin valuations.

Analysis and Investor Advice

The juxtaposition of uncertain rate cuts in the traditional financial sphere and groundbreaking developments in the crypto world highlights the diverse and dynamic nature of global financial markets today. Investors are urged to maintain a balanced and well-informed portfolio, considering both the risks and opportunities present in various asset classes.

Moreover, with rate cuts no longer a guaranteed policy response, investors might need to recalibrate their strategies, potentially shifting towards more conservative investments or sectors that traditionally perform well in higher interest rate environments.

On the cryptocurrency front, while opportunities abound, especially with promising new entrants like MegaETH, the inherent volatility and regulatory uncertainties call for a cautious approach. Diversification and a keen eye on geopolitical and economic news remain as crucial as ever.

In conclusion, as financial landscapes evolve, both seasoned and novice investors alike must stay agile, informed, and ready to adapt to ensure that their investment decisions align with the changing times. Keeping abreast of developments in both traditional and alternative financial sectors is key to navigating these uncertain waters successfully.