As the financial landscape evolves, analysts are closely examining the implications of a potential rate cut cycle initiated by central banks. Recent insights from Bitunix Analysts suggest that such a shift could inadvertently fuel an asset bubble, raising concerns among investors and analysts alike. But what does this mean for the market, especially amidst the backdrop of increasing Congressional shutdown risks?

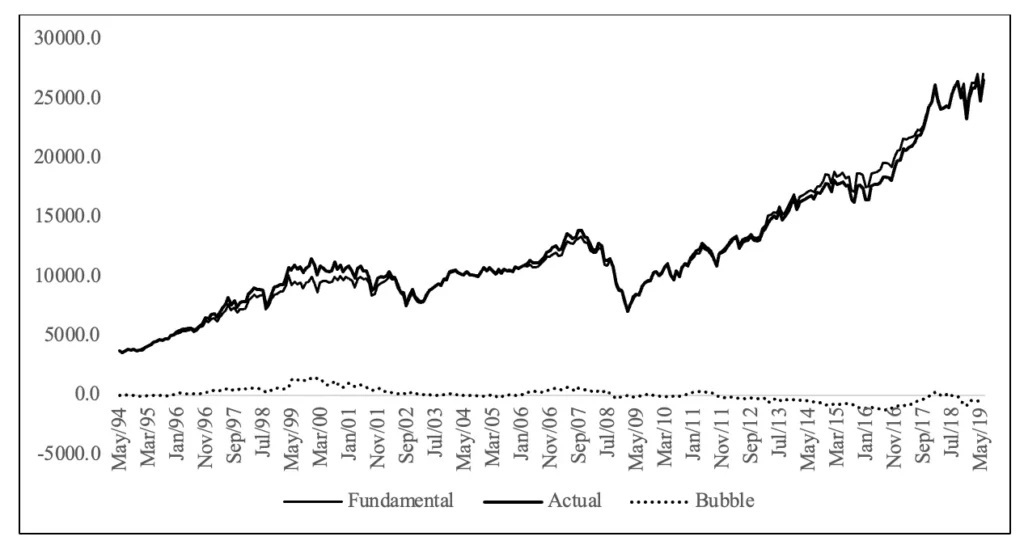

When central banks lower interest rates, the aim is often to stimulate economic growth by making borrowing cheaper. While this can bolster consumer spending and business investments, it also creates an environment ripe for speculation. Lower borrowing costs can push investors towards riskier assets, inflating their prices beyond sustainable levels. As a result, we could be on the precipice of a significant asset bubble that could burst, leading to severe market corrections.

Meanwhile, the potential for a Congressional shutdown is amplifying market volatility. Political gridlock can disrupt financial stability, creating uncertainty for businesses and investors. If lawmakers fail to reach agreements, it could lead to spending cuts and a halt in government services, impacting economic growth. The interplay between rate cuts and Congressional actions could create a volatile market landscape, where investors must navigate unpredictable waters.

As we witness these developments, it becomes essential for investors to remain vigilant and informed. Monitoring the interplay of monetary policies and political climates will be crucial in making strategic financial decisions that can weather potential storms ahead.