Public Keys: Coinbase Cashes In, IBIT Slips, and REX Spins Volatility Into Gold – Decrypt

In the dynamic world of cryptocurrency, the market’s pendulum swings often bring both tumult and opportunity. Recently, three major players—Coinbase, IBIT, and REX—have demonstrated how to navigate the volatile waves of digital currency in very different ways. Here’s a detailed look at how these companies are making headlines in the crypto industry.

Coinbase Cashes In

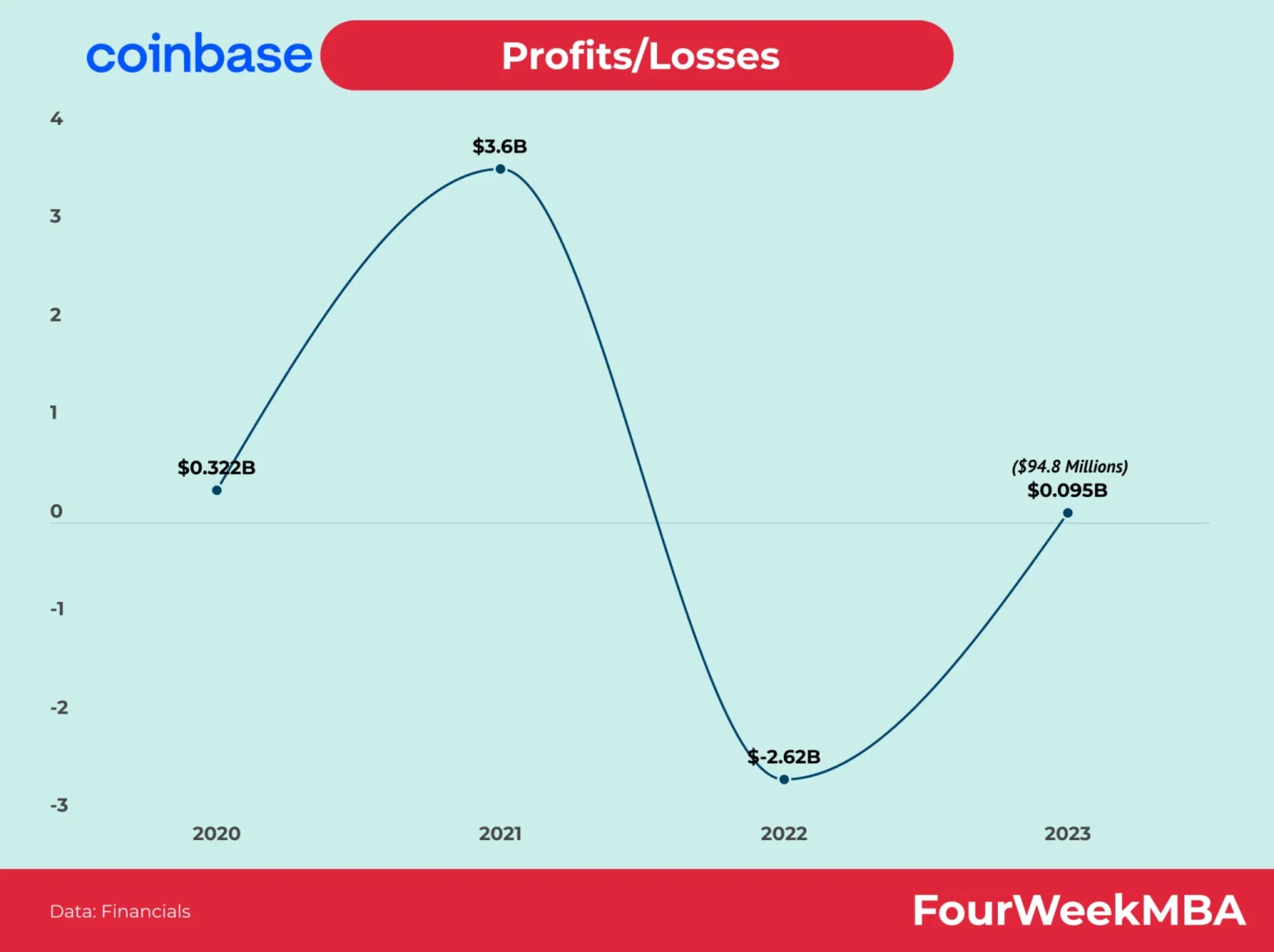

San Francisco-based Coinbase, one of the largest and most well-known cryptocurrency exchanges globally, has been cashing in significantly amidst the market’s recent stability. As Bitcoin has demonstrated a relatively stable price, increasing institutional interest has boosted transaction volumes across the board. This scenario has been particularly beneficial for Coinbase, which thrives on the fees generated from high trading volumes.

What sets Coinbase apart in recent months is its aggressive expansion strategy. The company has rolled out new products tailored for institutional investors, such as Coinbase Custody and Coinbase Prime, addressing the needs for high security and diversified crypto trading options. These moves have not only fortified its customer base but have also increased its revenue streams, demonstrating a solid grasp on the evolving crypto landscape where institutional investors become increasingly pivotal.

IBIT Slips

On the other end of the spectrum is IBIT, a relatively newer exchange that made waves last year with its revolutionary low-fee structure and user-friendly platform. However, the firm has seen a noticeable slip in both its market share and reputation. Analysts point to IBIT’s slow response to adopting enhanced vetting and security features, which has been critical in an era where cybersecurity threats loom large in the digital asset space.

Moreover, user feedback has highlighted issues regarding customer service and technical disruptions during high traffic times. Such challenges have led to a shift in user loyalty, with traders moving towards platforms that offer more reliability and better security measures.

REX Spins Volatility Into Gold

Meanwhile, REX, a lesser-known but strategically savvy trading platform, has managed to turn market volatility into a lucrative opportunity. With a focus on derivative products like futures and options, REX has catered to a niche but growing segment of crypto traders who look to hedge or speculate on price movements rather than holding actual cryptocurrencies.

This approach has proven particularly effective during periods of high volatility, as it enables traders to make gains irrespective of market direction. REX’s robust risk management tools and user-centric design provide traders the confidence to engage with these complex products, thereby diversifying its revenue sources even in uncertain times.

Future Outlook

As the cryptocurrency market continues to mature, the pathways chosen by entities like Coinbase, IBIT, and REX highlight the diverse strategies firms can adopt in reaction to market conditions. Coinbase’s focus on institutional players, IBIT’s lessons in operational resilience, and REX’s innovative product offerings showcase the varying dynamics and expansive possibilities within the crypto industry.

Looking ahead, the trajectory for these companies will hinge on several factors including technological advancements, regulatory shifts, and market sentiment. However, one thing remains clear: adaptability and customer focus appear to be central themes that will dictate success in the volatile yet potent cryptocurrency marketplace.

In the grand scheme of things, understanding these movements and shifts is essential for anyone engaged in or considering entering the crypto market, whether as a trader, investor, or observer. As the public keys to blockchain and cryptocurrencies evolve, keeping a close eye on these cryptographic “cash machines” will offer invaluable insights.