In the realm of cryptocurrency, the recent Polycule hack has sent shockwaves through the trading community. This hack, which targeted the Polycule trading bot associated with Polymarket, has reportedly compromised approximately $230,000 in user funds. As traders and investors scramble to understand the implications of these security breaches, the vulnerability of crypto project hacking has come into sharp focus. The Polycule team has suspended operations of the bot to address the situation, implementing necessary patch repairs and conducting thorough security audits. This incident serves as a critical reminder of the importance of cybersecurity within the cryptocurrency trading landscape.

The incident involving the Polycule trading bot underscores the growing challenges in the crypto market, where online platforms face increasing threats from malicious actors. Commonly referred to as trading bot hacks, this specific breach highlights the risks users encounter when engaging with digital asset exchange services. As platforms like Polymarket innovate, the security of user investments remains paramount. While the hacking of the Polycule project has raised alarms, it also opens discussions about the measures necessary to safeguard user funds in an ever-evolving digital landscape. Understanding these alternative terms and safeguarding efforts is crucial for individuals looking to secure their investments in blockchain technology.

Understanding the Polycule Trading Bot and Its Vulnerabilities

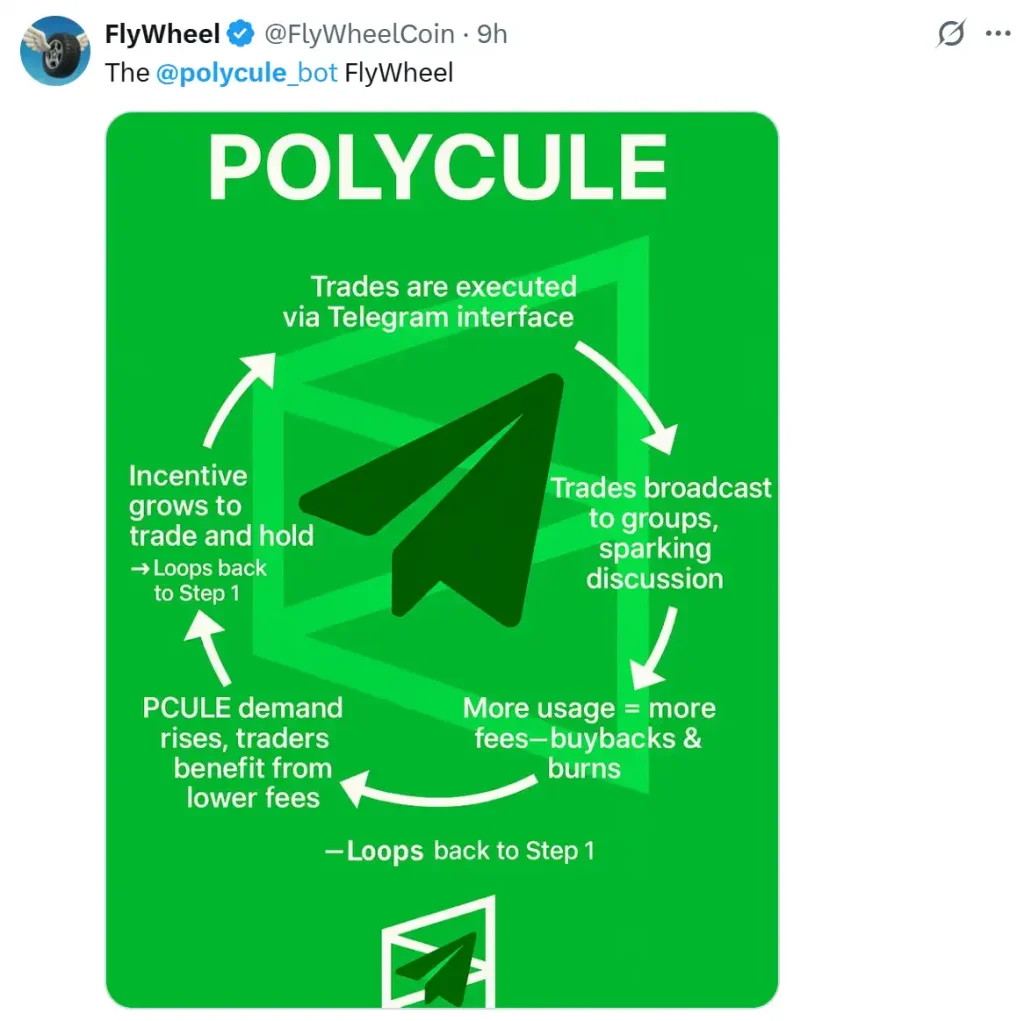

The Polycule trading bot, designed to automate trading strategies on Polymarket, has gained popularity among crypto enthusiasts due to its user-friendly interface and innovative features. However, like all trading bots, Polycule is susceptible to vulnerabilities that can expose user funds to risks. The recent hacking incident that resulted in a significant loss of approximately $230,000 has raised critical questions about the security measures implemented by the Polycule team. As more users turn to automated trading solutions, it’s essential to understand these vulnerabilities and the importance of maintaining adequate security protocols.

In the rapidly evolving landscape of cryptocurrency trading, projects like Polycule must prioritize robust security practices to protect user investments. This incident not only highlights the potential risks associated with trading bots but also the consequences of inadequate security measures in crypto projects. Following the Polycule hack, the team has announced a series of patch repairs and security audits in an attempt to restore user confidence. However, users must remain vigilant and informed about how to safeguard their wallets against potential threats that plague the industry.

Impact of the Polycule Hack on User Funds

The Polycule hack has undeniably had a substantial impact on its users, with approximately $230,000 of their funds compromised in the attack. This incident serves as a stark reminder of the importance of security in the cryptocurrency trading landscape. Users rely on trading bots to manage their assets effectively, but when a security breach occurs, the repercussions can be devastating. Many Polycule users may find themselves facing the harsh reality of losses, prompting a need for heightened awareness and proactive measures to protect their funds.

In light of this security breach, affected users may be left wondering about the future of their investments and the chances of recovering lost funds. Historically, hacked projects have struggled to reimburse affected users, but this incident puts additional pressure on the Polycule team to act transparently and diligently. For users, it becomes crucial to stay informed on how the team plans to address this breach and what measures are being implemented to prevent future incidents. As the industry grapples with the fallout of the Polycule hack, the importance of security in trading bots is more critical than ever.

Polycule Hack: Lessons Learned for Crypto Projects

The hacking of the Polycule trading bot serves as a pivotal lesson for other crypto projects regarding the necessity of implementing stringent security protocols. As cyber threats continue to evolve, the crypto space must adapt by conducting regular security audits and prioritizing the safeguarding of user data and funds. Projects that neglect to address potential vulnerabilities often find themselves facing serious repercussions, as seen in the Polycule incident. In addition, transparency within a project’s operations and their approach to security can greatly influence user trust and long-term success.

Moreover, learning from the Polycule hack means that upcoming projects must invest in top-notch encryption methods, user education on potential scams, and rapid response strategies for security breaches. The lessons derived from this incident should encourage developers to not only focus on creating innovative products but also to be vigilant partners in user security. By doing so, they can foster a safer trading ecosystem in the ever-expanding realm of cryptocurrency.

How Trading Bot Hacks Affect the Crypto Ecosystem

Trading bot hacks like the one experienced by Polycule create rippling effects throughout the cryptocurrency ecosystem, impacting not just individual projects but also user confidence in digital assets as a whole. As hacks become more frequent, they threaten the integrity of the crypto market, leading users to reconsider their investments and trust in automated trading solutions. This hesitance can diminish the overall growth potential of the industry, as fewer individuals are willing to participate in crypto trading due to fears of security threats.

Moreover, the aftermath of trading bot hacks often leads to increased regulatory scrutiny on the cryptocurrency market. Governments and regulatory bodies may step in to enforce stricter security compliance measures for trading platforms and bots. Such developments may lead to a temporary setback in innovation as projects scramble to meet new regulations. In the long run, however, enhanced security measures could contribute to a more resilient trading environment, benefiting users and projects alike.

Crypto Project Hacking: A Growing Concern

The rise of crypto project hacking poses an escalating issue that the digital currency world must confront, as demonstrated by the recent Polycule hack. Cybercriminals are increasingly targeting blockchain projects, exploiting vulnerabilities for financial gain. The Polycule incident emphasizes how susceptible even well-known trading bots can be to malicious attacks, which can lead to considerable financial losses for users. It is essential for the community to acknowledge this trend and advocate for robust security enhancements across all projects.

In response to such growing concerns, many crypto organizations are revisiting their security strategies, investing in safer infrastructure, and employing expert teams to monitor for potential threats. Users themselves hold a responsibility to educate and remain vigilant regarding the platforms they use. With heightened awareness around crypto project hacking, users can make better-informed choices about which trading bots and services they trust their funds with.

What are the Implications of the Polymarket Security Breach?

The recent security breach concerning Polymarket and its associated Polycule trading bot has led to numerous implications for users and stakeholders within the cryptocurrency ecosystem. Primarily, this incident raises concerns about the overall security measures in place at Polymarket itself. Users are likely questioning whether their funds are safe, leading to potential withdrawals and decreased trust in the platform’s ability to manage and protect assets effectively. This incident serves as a crucial case study for others in the industry, urging them to bolster their security protocols.

Moreover, the implications extend beyond just trust and user confidence; they highlight the need for regulatory developments surrounding data protection and asset security in the crypto arena. Authorities may begin to impose stricter guidelines on how trading platforms must handle user funds to prevent such breaches. This shift could alter the way crypto projects operate, potentially leading to increased compliance costs but providing enhanced protection for users. Ultimately, this security breach may catalyze a significant change in the landscape of cryptocurrency trading.

Mitigating Risks in Automated Trading

To mitigate risks in automated trading, users must stay informed about the tools they employ, such as trading bots like Polycule. Conducting extensive research on the security measures implemented by these platforms is essential for safeguarding user funds. Moreover, understanding how trading bots function and the vulnerabilities they may have can assist users in making better-informed decisions about which bots to use. As witnessed with the Polycule hack, knowledge can be a powerful tool in preventing future losses.

Additionally, users should consider implementing risk management strategies, including diversifying their investments across different platforms and avoiding putting down large sums into any single project. Utilizing tools that allow for withdrawal limits or alerts can provide an extra layer of protection. Ultimately, combining user diligence with proactive security practices can help to safeguard funds against the inherent risks associated with automated trading.

The Future of Trading Bots Post-Polycule Incident

In light of the Polycule incident, the future of trading bots in the crypto market may witness substantial changes. Many investors will likely approach automated trading with heightened caution, prompting developers to place an even greater emphasis on security in their projects. As the market evolves, we may see the emergence of advanced security technologies, as well as new trends prioritizing user privacy and fund protection. The demand for reliable trading solutions is still present, but security concerns will dominate discussions moving forward.

Additionally, the Polycule hack could result in a consolidation of outstanding trading bot projects that prioritize security over the marginal gains in functionality that less secure bots may offer. As transparency and user trust become increasingly paramount, projects that fail to adapt to these new expectations may find it challenging to gain traction in the market. Thus, the future of trading bots will likely require a commitment to robust security measures to ensure long-term success in a competitive landscape.

The Role of Security Audits in Protecting User Funds

Security audits play a crucial role in protecting user funds in the cryptocurrency space, especially for automated trading platforms like Polycule. Regular audits can identify vulnerabilities and weaknesses within the platform, helping to reinforce security measures before any incidents occur. The recent hack has highlighted the necessity for platforms to prioritize these audits to shield against potential breaches. The Polycule team has recognized this need and is expected to conduct security reviews following the incident.

By enforcing rigorous security audits, projects can not only build user trust but also enhance their reputation within the crypto community. Users are more likely to invest in platforms that demonstrate a consistent commitment to safety. As automated trading continues to grow in popularity, prioritizing security audits will be essential in maintaining the integrity of the trading experience and ensuring users’ funds remain secure.

Frequently Asked Questions

What is the Polycule hack and how did it impact users?

The Polycule hack refers to a recent security breach involving the Polycule trading bot, which is built on the Polymarket platform. This incident resulted in the loss of approximately $230,000 in user funds. The Polycule team has since taken the trading bot offline to address vulnerabilities and is conducting security audits to prevent future breaches.

How did the Polycule trading bot get hacked?

The exact methods used in the Polycule trading bot hack are still under investigation. However, it involved a security vulnerability that allowed unauthorized access to user funds. Following the hacking incident, the Polycule team is implementing patch repairs to enhance security and safeguard against future attacks.

What measures are being taken to fix the Polycule user funds issue after the hack?

To address the impacts of the Polycule hacking incident, the project team is conducting thorough security audits and implementing patch repairs to ensure the safety of user funds. They aim to reinforce the trading bot’s security before re-launching it on the Polymarket platform.

What security precautions are necessary to prevent trading bot hacks like the Polycule incident?

To prevent trading bot hacks similar to the Polycule incident, it is important for projects to implement robust encryption, regular security audits, and real-time monitoring systems. User education about secure wallet management and two-factor authentication can also help protect user funds from potential breaches.

Are Polycule user funds recoverable after the hack?

The recoverability of Polycule user funds after the hack remains uncertain. The Polycule team is actively working to assess the situation and determine the best course of action. Users are encouraged to stay updated with official communications about potential recovery plans.

What should users do if they were affected by the Polycule hack?

Users affected by the Polycule hack should monitor the official updates from the Polycule team regarding the situation and any recovery efforts. It is also advisable for them to enhance their personal security measures, such as changing passwords and reviewing account settings.

Is the Polycule trading bot safe to use after the security breach?

Currently, the Polycule trading bot is offline as the team works on repairs and enhancing its security following the hack. It is advisable for users to wait for confirmation from the Polycule team regarding the safety and trustworthiness of the trading bot before using it again.

What lessons can be learned from the Polycule security breach?

The Polycule security breach highlights the importance of maintaining high security standards in crypto projects. Continuous monitoring, regular security audits, and clear communication with users are essential strategies to enhance trust and protect user funds from being compromised.

What role does Polymarket play in the Polycule hack incident?

Polymarket is the platform on which the Polycule trading bot operates. The hack incident underscores the need for robust security measures not only for trading bots but also for the underlying platforms like Polymarket that facilitate cryptocurrency trading.

How does the Polycule hack impact the perception of trading bots in crypto?

The Polycule hack may lead to increased scrutiny of trading bots in the crypto space, highlighting the necessity for enhanced security and trust. Users may become more cautious and demand transparency regarding the safety protocols implemented by trading bot projects.

| Date | Event | Impacted Amount | Current Status | Future Actions |

|---|---|---|---|---|

| January 8, 2026 | Hacking of Polycule Trading Bot | $230,000 | Bot taken offline | Security audits and repairs expected to be completed soon |

Summary

Polycule hack has highlighted significant vulnerabilities in trading bots. On January 8, 2026, this platform experienced a severe breach, leading to a loss of approximately $230,000 in user funds. The Polycule team is actively working to resolve the issue by conducting security audits and repair work. This incident serves as a crucial reminder of the need for enhanced security measures in trading technologies.