Headline: Markets Split as AI-Fueled Stocks Climb, 401(k) Millionaires Hit Record, and Crypto Stumbles

Key Takeaways

Introduction: Global markets are sending mixed signals as AI-led equity strength coexists with rate and currency volatility and a sharp pullback in digital assets. Retirement savers are seeing record milestones, while institutional investors reposition across risk assets amid shifting policy and valuation concerns.

The S&P 500’s momentum—driven by big-cap technology and the ongoing AI boom—has lifted retirement balances, with a record 654,000 401(k) accounts now above $1 million. Millennials are increasingly represented in this cohort, underscoring the long-term benefit of steady contributions and compounding during bull markets. Strategists remain constructive on equities, with one major forecast calling for an additional 11% gain in the S&P 500 by 2026 and up to a 16% advance across risk assets, even as investors keep a close eye on valuations.

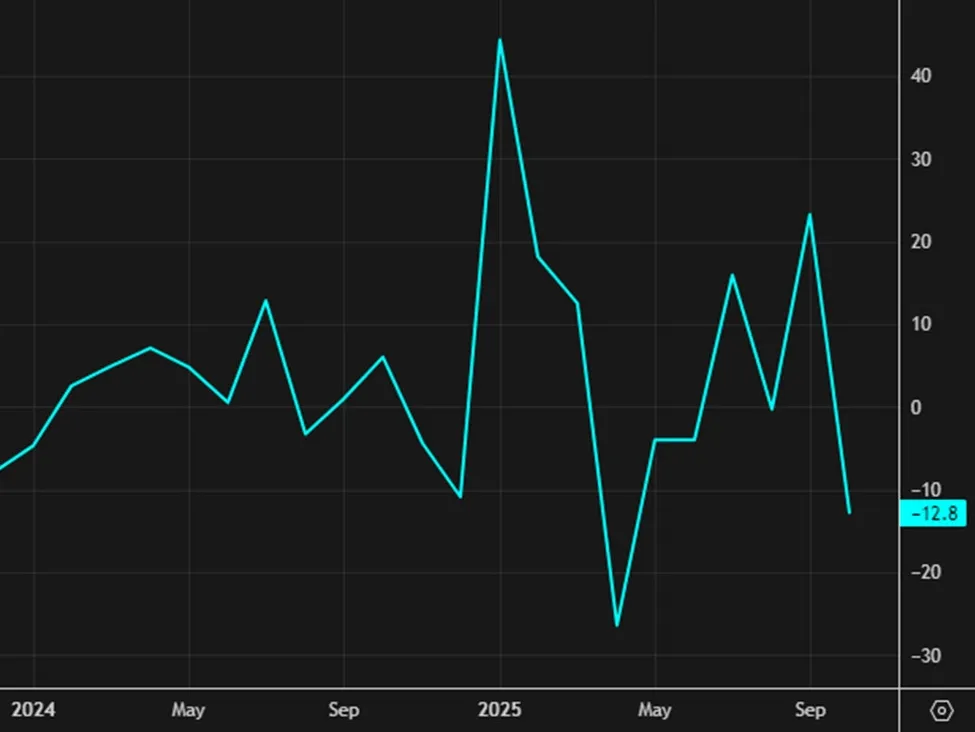

Beneath the surface, divergences are growing. Palantir was downgraded to Hold with a price target of $188, and the stock slipped below its 50-day moving average as traders reassess AI-linked valuations and the risk of overheated momentum. In macro, the yen and Japanese Government Bonds saw heightened volatility amid concerns over stimulus and policy shifts, with markets closely watching the Bank of Japan’s next move as yields rise and the currency weakens. Family offices have been selectively buying beaten-down names despite equity benchmarks sitting near record highs, a strategy that could prove opportunistic—or a late-cycle bull trap—depending on how earnings and rates evolve.

Crypto added a risk-off wrinkle. Bitcoin’s latest sell-off dragged the broader digital asset market lower, but spot Bitcoin ETFs posted $75 million in net inflows, snapping a five-day outflow streak. IBIT led with approximately $60 million in inflows, though several funds continued to see redemptions. Traders are watching the $90,000 zone as near-term support as liquidity and sentiment remain fragile.

Key Points: – Record 654,000 401(k) millionaires, boosted by the S&P 500’s AI-driven rally; more millennials join the ranks. – Strategists see potential for an 11% S&P 500 gain by 2026 and a 16% rise in risk assets, with valuation risks in focus. – Palantir downgraded to Hold with a $188 target; shares dipped below the 50-day moving average. – Yen and JGB volatility intensifies as markets anticipate possible Bank of Japan policy shifts. – Family offices accumulate beaten-down stocks even as indexes hover near record highs. – Bitcoin slides, but spot Bitcoin ETFs record $75M in inflows; IBIT leads while some funds still face outflows, with $90K eyed as support.