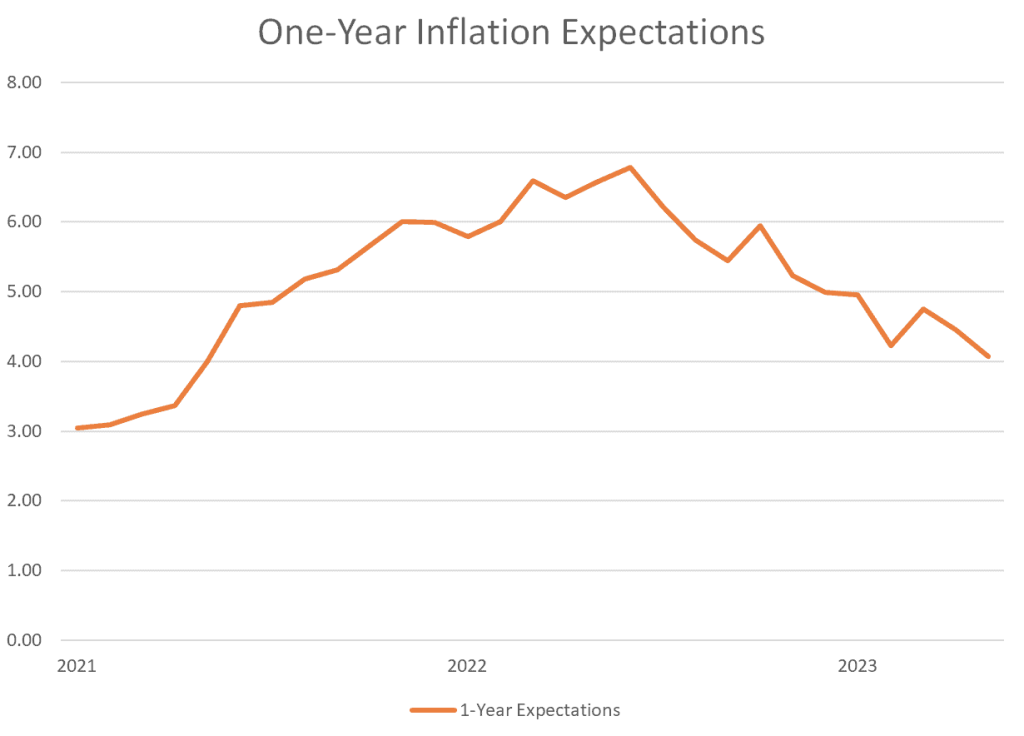

The one-year inflation expectation has recently caught the attention of economists as it climbed to 3.4% in December, according to the New York Federal Reserve. This increase from the previous rate of 3.20% reflects ongoing economic trends in 2023, prompting analysts to reassess future inflation rates. Understanding these inflation statistics becomes crucial for consumers and businesses alike, as they navigate financial decisions amid fluctuating costs. Meanwhile, the five-year inflation expectation held steady at 3%, suggesting a varied outlook for long-term inflation. As we delve deeper into these figures, it’s evident that tracking inflation expectations is vital for grasping the larger economic landscape.

The anticipation of inflation over the coming year, often referred to as short-term price stability projections, plays a significant role in shaping fiscal policy. Current reports indicate that expectations for price increases surged to 3.4% as of December, a notable shift compared to earlier assessments. Such data from the New York Federal Reserve highlights crucial elements of economic trends for 2023, suggesting consumers and investors should remain vigilant. Moreover, while the long-term inflation outlook remains stable at 3%, discerning these metrics can provide invaluable insights into economic health. Therefore, keeping abreast of these inflation projections is essential for making informed monetary choices.

Understanding the One-Year Inflation Expectation

The recent report from the New York Federal Reserve indicates a increase in the one-year inflation expectation, which has moved up to 3.4% in December. This is a notable rise from the previous figure of 3.20%, suggesting that consumers and analysts expect prices to rise over the next year. Inflation expectations are critical indicators as they can influence spending, investment decisions, and overall economic trends; hence understanding this movement is essential for both policymakers and the market.

The higher one-year inflation expectation reflects underlying concerns about inflationary pressures that could impact consumers significantly. Factors contributing to this increase might include supply chain disruptions, rising commodity prices, or increased demand as the economy rebounds. Moreover, monitoring these expectations helps central banks, like the New York Federal Reserve, gauge the effectiveness of their monetary policies against inflation statistics.

Insights into the Five-Year Inflation Expectation

In contrast to the one-year expectation, the five-year inflation expectation remained stable at 3% this December. This consistency suggests that while short-term views perceive a rise in inflation, long-term expectations remain grounded. For businesses and investors, this stability can provide reassurance, indicating that while immediate pressures exist, a return to stability or economic balance is anticipated over a longer horizon.

Keeping an eye on both the one-year and five-year inflation expectations offers a fuller picture of economic trends in 2023. The stagnant five-year expectation juxtaposed with increasing short-term forecasts may mean that businesses will plan conservatively in the coming months while still being aware of potential price increases. Analysts may further interpret this data alongside the broader context of inflation rates in December to understand the future landscape of the economy.

Analyzing Economic Trends in 2023 and Inflation Statistics

As we venture into 2023, understanding the evolving economic trends is critical, particularly as they relate to inflation. The data released by the New York Federal Reserve regarding inflation rates in December serves as a significant barometer for what may lie ahead. With rising one-year inflation expectations, economists are closely monitoring how inflation statistics will evolve throughout the year, considering factors such as labor market changes and energy prices.

Emerging economic trends indicate that while inflationary pressures remain a challenge, several markets are adjusting. For instance, sectors that are particularly sensitive to prices, such as consumer goods and housing, may start to see shifts in demand as inflation expectations influence buyer behavior. The correlation between rising inflation expectations and consumer sentiment will likely inform strategies for businesses looking to navigate 2023’s complicated economic landscape.

The Role of the New York Federal Reserve in Inflation Management

The New York Federal Reserve plays a pivotal role in managing inflation expectations within the United States. By reporting on metrics such as the one-year and five-year inflation expectations, the Fed provides valuable insights that help shape fiscal policy and economic strategies for various sectors. Their data allows businesses and consumers alike to make more informed decisions based on anticipated price movements.

In recent assessments, the New York Federal Reserve has particularly focused on balancing inflation control with fostering economic growth. The challenge lies in ensuring that measures taken do not stifle recovery but rather support a sustainable economic environment. As inflation statistics become more concerning, the Fed’s deliberations over interest rates and monetary policy will be crucial in guiding the economy as we progress into 2023.

Analyzing Inflation Rates in Detail

As we look into the specifics of inflation rates for December, the figures released by the New York Federal Reserve reveal crucial details about the current economic environment. With a one-year inflation expectation rising to 3.4%, it highlights the perceptions that consumers and businesses have regarding price stability in the near future. This immediate concern can significantly influence purchasing decisions and market dynamics.

The analysis does not stop at the one-year marks, as inflation rates must be seen in a broader context. With the five-year inflation expectation holding steady at 3%, it indicates a possible confidence in long-term economic stability. This disparity between short-term expectations and long-term averages offers a complex landscape for analysts and policymakers tasked with forecasting economic activity and setting strategic goals.

Impact of Inflation on Consumer Behavior

Understanding how inflation affects consumer behavior is vital in navigating market conditions. The recent rise in the one-year inflation expectation to 3.4% can lead to changes in how consumers make purchasing decisions, shifting preferences towards essential goods and services. This shift can have ripple effects across various sectors, impacting everything from retail to real estate.

Moreover, as inflation expectations define spending behavior, companies might adjust pricing strategies to meet the evolving demands of consumers. Inflation statistics from credible sources like the New York Federal Reserve will be instrumental in guiding businesses to anticipate market responses to price changes throughout 2023. Awareness of consumer sentiment is key to sustaining growth in a fluctuating economic environment.

Strategic Financial Planning Amid Rising Inflation

With the one-year inflation expectation witnessing an increase, strategic financial planning becomes essential for individuals and businesses alike. Understanding the implications of rising inflation rates is crucial to making informed investment decisions and budgeting effectively. This situation encourages entities to evaluate their expenditure, seeking ways to cope with potential increases in costs over time.

Furthermore, financial institutions and advisors will need to incorporate insights from the New York Federal Reserve and relevant inflation statistics into their strategic outlooks. By evaluating how inflation may impact interest rates and investment returns, they can help clients navigate this shifting economic landscape while planning for long-term financial health in 2023.

Long-Term Economic Projections Based on Inflation Expectations

Long-term economic projections hinge significantly on understanding both short and long-term inflation expectations, as marked by the data from the New York Federal Reserve. The persistent five-year inflation expectation at 3% against a backdrop of rising one-year expectations provides a unique perspective on the economy’s trajectory. Analysts are tasked with interpreting these figures to project economic growth, assessing potential risks and opportunities.

These economic projections can influence monetary policy decisions and market sentiment as businesses prepare for what lies ahead. By comprehensively examining inflation statistics, stakeholders can create more robust frameworks to predict consumer trends and pricing strategies over the next few years. Therefore, a keen understanding of how inflation affects the economy is essential for fostering long-term growth.

Consumer Confidence and Its Link to Inflation

The connection between consumer confidence and inflation levels cannot be understated. Increasing inflation expectations, like the reported rise to 3.4% for 2023, may dampen consumer sentiment, leading to cautious spending habits. As consumers anticipate higher prices, they may prioritize savings over expenditures, affecting overall economic activity.

As such, central banks, including the New York Federal Reserve, must monitor these variables closely. Ensuring that consumer confidence remains steady in the face of rising one-year inflation expectations is critical for sustaining demand in the economy. Therefore, understanding this relationship will be paramount for businesses and policymakers alike as they navigate the complexities of the economic landscape.

The Future of Inflation in Economic Discourse

Looking ahead, the discourse around inflation will undoubtedly shape the economic landscape in 2023 and beyond. The rising one-year inflation expectation and the stable five-year metrics will lead to various debates among economists regarding sustainable growth strategies. Assessing how these inflation rates will evolve will help determine appropriate monetary policies and fiscal measures to manage potential threats to the economy.

Additionally, inflation will remain a central focus in economic discussions, influencing not just monetary policy but also consumer behavior and business strategies. Stakeholders must stay vigilant in analyzing trends and statistics while remaining adaptable to the unpredictable nature of the economy influenced by domestic and global factors.

Frequently Asked Questions

What is the one-year inflation expectation according to the New York Federal Reserve for December 2023?

The one-year inflation expectation reported by the New York Federal Reserve for December 2023 rose to 3.4%, increasing from the previous rate of 3.20%.

How does the one-year inflation expectation in December compare to the five-year inflation expectation?

In December 2023, the one-year inflation expectation was 3.4%, while the five-year inflation expectation remained stable at 3%. This indicates a slight increase in short-term inflation expectations compared to a longer-term outlook.

What economic trends are influencing the one-year inflation expectation in late 2023?

Economic trends in 2023, including shifts in consumer demand and supply chain dynamics, are partly driving the rise in the one-year inflation expectation to 3.4% as noted by the New York Federal Reserve.

What are the latest inflation statistics for December 2023?

The latest inflation statistics show that the one-year inflation expectation reached 3.4% in December 2023, highlighting a rise, while the five-year inflation expectation held at 3%.

Why is the one-year inflation expectation important for economic planning?

The one-year inflation expectation is crucial for economic planning as it helps policymakers and businesses gauge short-term price changes, influencing decisions on investments, wages, and pricing strategies.

| Key Point | Details |

|---|---|

| One-Year Inflation Expectation | Rose to 3.4% in December, up from 3.20% in the previous month. |

| Five-Year Inflation Expectation | Remained unchanged at 3% in December. |

Summary

The one-year inflation expectation has shown a significant increase, rising to 3.4% in December from 3.20% the month before, signaling growing concerns about future inflation levels among consumers and investors. Meanwhile, the five-year inflation expectation has held steady at 3%. This data highlights the necessity for policymakers and economic analysts to monitor these expectations closely as they can influence monetary policy, financial markets, and overall economic stability in the upcoming year.