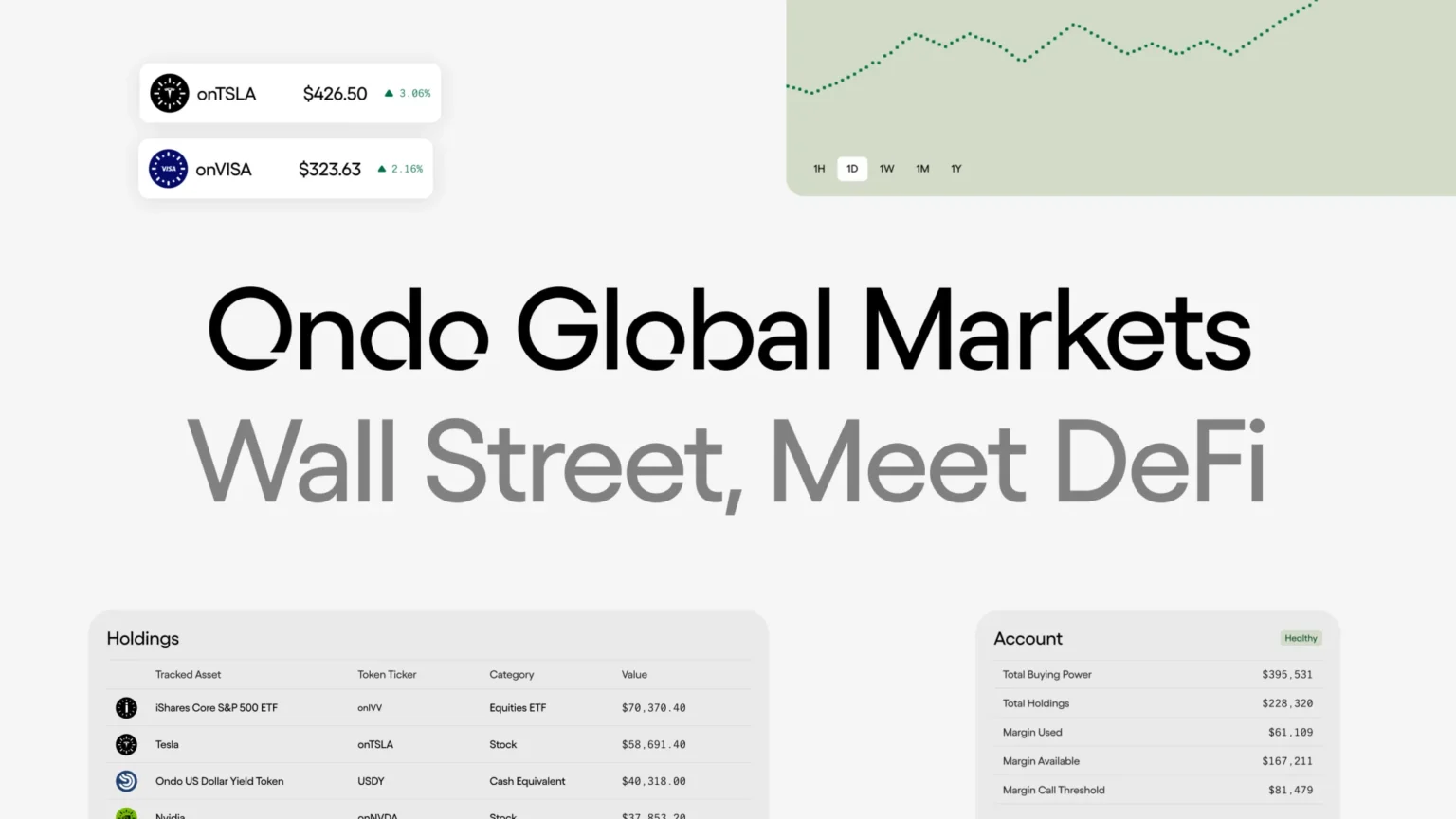

In a significant development within the financial technology sector, Ondo Global Markets has announced that its stock tokenization scale has surpassed an impressive $300 million. This milestone underscores the growing acceptance and integration of blockchain technology in traditional finance, particularly in the realm of asset management and investment.

Stock tokenization refers to the process of creating digital tokens on a blockchain that represent shares of a company. This innovative approach allows for fractional ownership, making it easier for investors to buy and sell shares with lower barriers to entry. Ondo Global Markets has been at the forefront of this movement, providing a platform that enables companies to tokenize their equity and offer it to a broader audience.

The $300 million figure is not just a number; it reflects a shift in how investors view asset ownership and liquidity. By leveraging blockchain technology, Ondo is facilitating a more transparent and efficient marketplace, where transactions can occur in real-time and with reduced costs. This is particularly appealing to younger investors who are increasingly seeking digital solutions for their investment needs.

Furthermore, the success of Ondo Global Markets highlights the potential for further growth in the tokenization space. As regulatory frameworks evolve and more companies recognize the benefits of tokenizing their assets, we can expect to see an even greater influx of capital into this innovative sector. Ondo’s achievement is a testament to the future of finance, where traditional and digital assets converge to create new opportunities for investors worldwide.