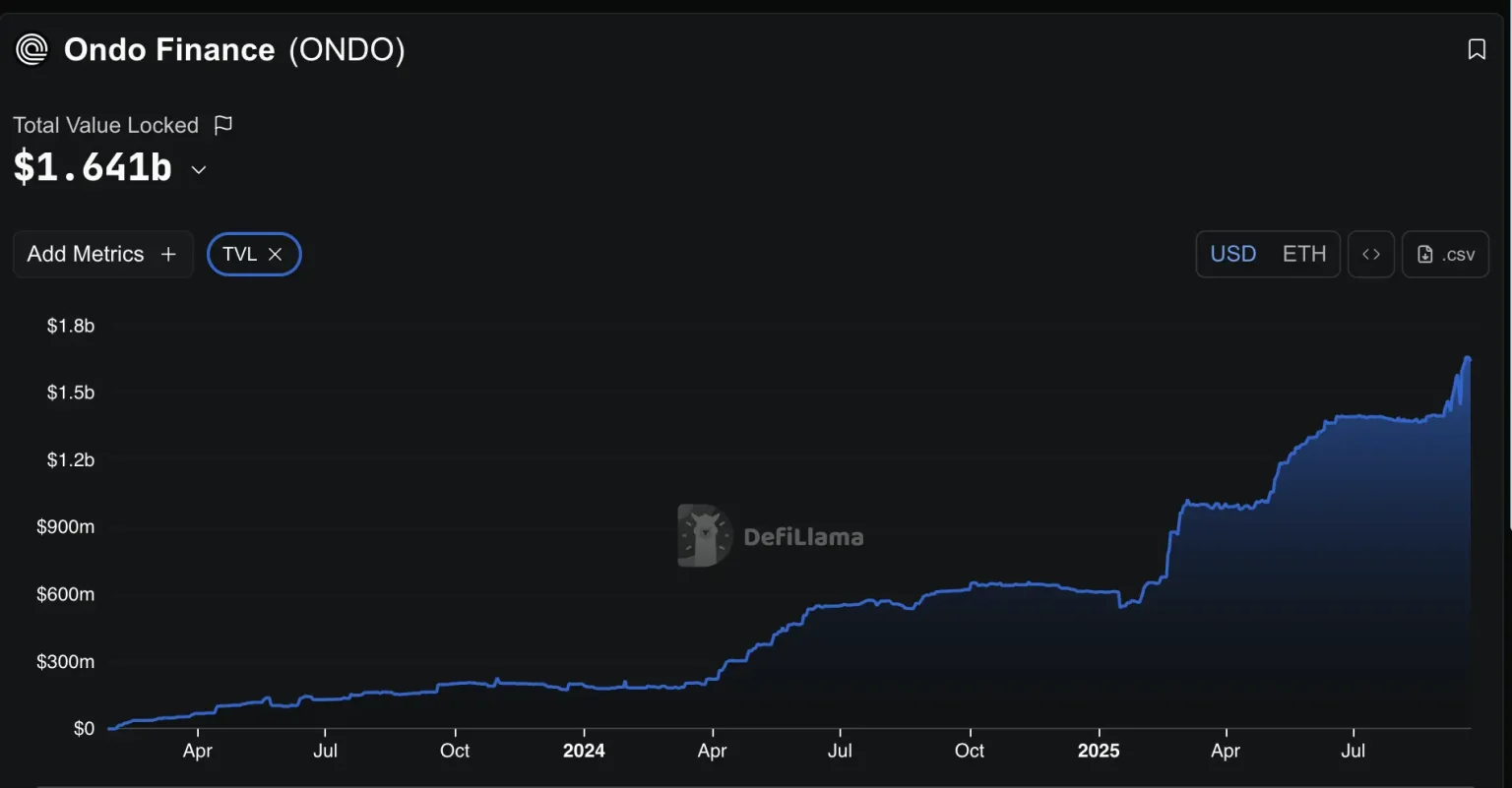

Ondo Finance TVL has recently surpassed an impressive $2.5 billion, positioning the platform as a leader in the realm of tokenized U.S. debt and equities. This milestone highlights Ondo Finance’s significant role in the crypto space, particularly as it supports the growing demand for innovative blockchain investment solutions. With approximately $2 billion of its TVL locked in the tokenized U.S. Treasury market, Ondo’s flagship USDY product alone boasts over $1 billion in total locked value. Furthermore, its institutional fund, OUSG, has attracted investments totaling over $770 million from prestigious firms including Fidelity and BlackRock, showcasing the trust that major institutions place in its offerings. As a crypto platform with a focus on integrating traditional asset classes, Ondo Finance is revolutionizing how investors engage with tokenized equities and contributing to a robust market ecosystem.

The total value locked (TVL) in Ondo Finance highlights its pivotal role in the landscape of digital asset solutions. As a frontrunner in the tokenization of U.S. debt and equity markets, the platform offers groundbreaking financial products, such as the USDY asset, drawing significant attention from both institutional and retail investors. Ondo Finance also facilitates considerable market activity through its establishment of a trusted environment for blockchain investment, with notable traction in the tokenized stocks market. The impressive TVL figures indicate a growing trend towards converting traditional equities into digital representations, thereby enhancing liquidity and accessibility. In essence, Ondo Finance is not just a crypto platform; it is a transformative force in bridging conventional finance with innovative blockchain technology.

| Key Point | Details |

|---|---|

| Total Value Locked (TVL) | Over $2.5 billion, making Ondo Finance a leading global platform for tokenized U.S. debt and equities. |

| Tokenized U.S. Treasury Market TVL | Approximately $2 billion, showcasing substantial investor interest. |

| USDY Product TVL | Exceeds $1 billion, supporting a wide range of global investors across nine blockchains. |

| OUST Fund TVL | Over $770 million, receiving funds from major asset management companies like Fidelity and BlackRock. |

| Tokenized Stocks TVL | Exceeds $500 million, indicating a strong market share of 50%. |

| Cumulative Trading Volume | Surpassed $7 billion since launch in September 2025, covering over 200 stocks. |

| User Engagement | Attracted tens of thousands of users due to its innovative offerings. |

Summary

Ondo Finance TVL has reached remarkable heights, exceeding $2.5 billion and marking it as a forerunner in the tokenized U.S. debt and equity sector. This impressive growth reflects Ondo’s innovative approach to finance, drawing significant investments into its offerings and cementing its position as a leader in the market.

Understanding Ondo Finance’s Impressive TVL Growth

Ondo Finance has recently made headlines with its transformative growth in Total Value Locked (TVL), which has now surged past $2.5 billion. This impressive figure places Ondo as a prominent player in the realm of tokenized U.S. debt and equities. The robust increase in TVL not only reflects the rising demand for blockchain investment options but also signifies the platform’s ability to attract global investors. By providing innovative financial products like tokenized U.S. Treasuries and equities, Ondo Finance is redefining traditional investment opportunities in the digital space.

The substantial TVL growth in the tokenized U.S. Treasury market, estimated at nearly $2 billion, illustrates how investors are increasingly turning toward crypto platforms for safer investment avenues. The performance of Ondo’s USDY product, which has exceeded $1 billion in TVL, further emphasizes investor confidence in its offerings. With an operational framework that spans nine different blockchains, Ondo Finance is positioned not just as an investment platform but as a pioneering force in the tokenized economy.

The Rise of Tokenized U.S. Debt and Equity Investments

The concept of tokenized U.S. debt and equities has gained remarkable traction, largely thanks to platforms like Ondo Finance. By converting traditional assets into tokenized forms, Ondo bridges the gap between conventional finance and the innovative potential of blockchain technology. This transformation allows assets to be more accessible, as investors can engage with fractional ownership, thereby democratizing investment opportunities that were once limited to affluent investors or institutional players.

As traditional financial barriers dissolve, more investors are drawn to the idea of tokenized investments. With Ondo Finance offering tokenized equities, the market share for these products has seen substantial growth, exceeding $500 million in TVL. This growth suggests that many are recognizing the efficiency and transparency offered by blockchain-based investments, leading to greater engagement on trading platforms with a cumulative trading volume surpassing $7 billion.

The Role of USDY in Driving Investment in Tokenized Assets

USDY, Ondo Finance’s flagship product, stands at the forefront of the platform’s vision to revolutionize the investment landscape. With over $1 billion in TVL, USDY not only highlights the demand for tokenized U.S. debt but also exemplifies how digital currencies can reshape traditional forms of investment. Specialized in providing an innovative crypto product that mimics the stability of U.S. dollar-based assets, USDY appeals to a broad base of both retail and institutional investors.

Moreover, USDY represents a pivotal point in crypto platform TVL discussions, illustrating how stablecoin-based investments can offer robust alternatives to conventional asset classes. Investors are becoming increasingly aware of the advantages offered by tokenized assets such as liquidity, transparency, and reduced barriers to entry. The significant uptake of USDY exemplifies a growing trend where blockchain technology meets investor needs for safety and flexibility, enhancing overall trust in crypto investments.

Exploring Blockchain Investment Opportunities with Ondo Finance

Blockchain investment opportunities have expanded exponentially with the advancement of platforms like Ondo Finance. By facilitating easy access to tokenized U.S. debt and equities, Ondo is helping investors leverage the benefits of decentralization, real-time transaction settlements, and enhanced liquidity. This paradigm shift is evident in Ondo’s substantial TVL, which reflects both the maturity of the crypto market and the increasing willingness of traditional investors to explore blockchain opportunities.

With its comprehensive offerings that cater to diverse financial strategies, Ondo Finance is pioneering a unique space where traditional investors can seamlessly integrate digital assets into their portfolios. As the crypto landscape evolves, investors are encouraged to consider blockchain as a viable investment avenue, especially through instruments that ensure a stable, institutional-grade experience in tokenized U.S. debt and equities. This is not just a fleeting trend but a significant evolution in how people understand and interact with their investments.

The Institutional Support Behind Ondo Finance’s Success

The impressive growth of Ondo Finance’s TVL can be attributed in part to the institutional support it receives from renowned asset management companies like Fidelity, BlackRock, and Franklin Templeton. These established firms not only lend credibility to Ondo’s offerings but also attract significant capital inflow, enhancing the platform’s market presence. The institutional fund OUSG, which boasts a TVL of over $770 million, is a testament to the faith that institutional investors have in tokenized assets.

This backing further solidifies Ondo Finance’s position as a trusted provider in the blockchain investing sphere. The collaboration with these prominent financial institutions signifies a paradigm shift, where institutional capital is increasingly investigating tokenized investments as a legitimate alternative. This trend suggests that as more institutions integrate tokenized assets into their portfolios, the overall market for blockchain investments will expand, paving the way for increased adoption and innovation.

Future Trends in Tokenized Assets and Investment Strategies

As the market for tokenized assets continues to grow, it is essential to consider the emerging trends that will shape future investment strategies. Platforms like Ondo Finance, with its advanced blockchain technology and diverse product offerings, are at the helm of this evolution. Investors are beginning to recognize the value in diversifying their portfolios with tokenized versions of traditional assets, such as U.S. debt and equities, which are typically accompanied by stable returns and reduced volatility.

The increasing incorporation of tokenized assets into mainstream investment strategies indicates a shift in investor mentality. As education around crypto products like USDY and tokenized stocks becomes more widespread, the market is likely to see an influx of newcomers eager to capitalize on the benefits of blockchain investment. This evolution will not only enhance the legitimacy of tokenized assets but also pave the way for new financial instruments that could revolutionize how capital is raised and deployed.

Navigating the Competitive Landscape of Crypto Platforms

The rise of Ondo Finance amidst a crowded crypto platform landscape highlights the competitive nature of the blockchain investment space. With various platforms vying for attention and capital, it is essential for investor confidence to be built on transparency and fidelity, features that Ondo has consistently delivered. As platforms innovate and diversify their product offerings, they must also effectively communicate the value-added benefits that tokenized assets bring to the investment table.

In this competitive arena, Ondo Finance’s achievement of surpassing $2.5 billion in TVL serves as a case study in how successfully engaging institutional and retail investors can lead to sustained growth. As the industry continues to mature, the way platforms differentiate themselves will significantly impact their growth trajectories. Ondo’s dedication to providing a comprehensive suite of tokenized investment opportunities gives it a considerable edge in attracting a broader investor base.

The Importance of User Engagement in Crypto Investments

User engagement is a critical component of the success of any investment platform, and Ondo Finance exemplifies this through its strategies aimed at building a robust user community. With tens of thousands of users already participating, Ondo focuses not only on offering superior investment products but also on enhancing the overall user experience. This includes educational resources that empower users to make informed investment decisions regarding tokenized U.S. debt and equities.

The platform’s efforts to engage its users play a crucial role in achieving and maintaining its impressive TVL. By fostering a community of informed investors, Ondo Finance ensures that its users are equipped to navigate the evolving landscape of blockchain investment effectively. This commitment to user engagement reminds potential investors that the platform is not merely a transactional space, but a community dedicated to enhancing the investment journey through education and support.

The Future of Tokenized Investments: Trends to Watch

Looking ahead, the future of tokenized investments appears bright, with increasing trends towards democratization and accessibility in the financial markets. Platforms like Ondo Finance are at the forefront of this change, continually innovating their offerings to incorporate new technologies and investment vehicles. As more investors familiarize themselves with concepts such as tokenized U.S. debt and equities, the appetite for diversified investment products will likely expand.

Additionally, regulatory developments will play a pivotal role in shaping the tokenization landscape. As governments become more aware of the benefits and challenges posed by blockchain technology and tokenized assets, we can expect evolving regulations that could either facilitate or restrict growth in this sector. Investors should stay informed about these changes, as they will undoubtedly impact strategies and the overall direction of tokenized investments in the coming years.

Frequently Asked Questions

What is the current TVL of Ondo Finance and what does it signify?

Ondo Finance’s total locked value (TVL) has recently surpassed $2.5 billion, indicating its emergence as a leading platform for tokenized U.S. debt and equity investments. This substantial TVL reflects strong investor confidence and robust interest in blockchain investment opportunities.

How has Ondo Finance achieved its impressive TVL in tokenized U.S. debt?

Ondo Finance has achieved a TVL of approximately $2 billion in the tokenized U.S. Treasury market by offering innovative financial products, including its popular USDY product, which alone has crossed $1 billion in TVL. This showcases the platform’s ability to attract global investors looking for reliable returns.

What role does the USDY product play in Ondo Finance’s TVL?

The USDY product is a crucial component of Ondo Finance’s TVL, amassing over $1 billion. It enables investors to access tokenized U.S. debt while benefiting from the security of blockchain technology, thereby significantly contributing to the overall growth of Ondo Finance’s total locked value.

How does Ondo Finance’s TVL compare to other crypto platform TVL metrics?

With a TVL of over $2.5 billion, Ondo Finance positions itself among the top crypto platforms, particularly in tokenized U.S. debt and equities. Its strong metrics place it favorably against competitors, showcasing its leading role in the evolving landscape of digital finance.

What is the significance of the tokenized stocks TVL in Ondo Finance’s overall performance?

The TVL for tokenized stocks on Ondo Finance exceeds $500 million, representing a substantial market share of 50%. This performance solidifies Ondo as a significant player in the tokenized equities space, enhancing its overall TVL and appeal to investors interested in diverse asset classes.

Can you explain the institutional involvement in Ondo Finance’s TVL?

Ondo Finance’s institutional flagship fund, OUSG, has amassed a TVL of over $770 million, demonstrating strong institutional confidence from top asset managers like Fidelity, BlackRock, and Franklin Templeton. This institutional backing enhances Ondo’s credibility in the blockchain investment space.

What impact has Ondo Finance’s launch in September 2025 had on its TVL growth?

Since its launch in September 2025, Ondo Finance has seen its cumulative trading volume exceed $7 billion, which has greatly contributed to its impressive TVL. This rapid growth reflects the increasing adoption of tokenized U.S. debt and equities in the financial market.

How do users benefit from engaging with Ondo Finance’s tokenized offerings?

Users engaging with Ondo Finance can access a wide range of tokenized offerings, backed by its substantial TVL, which provides liquidity and stability. This accessibility, combined with the potential for returns from the USDY product and tokenized equities, positions Ondo as a desirable platform for both retail and institutional investors.