Title: Nillion (NIL) Price Plummets 50% Following Unauthorized Market-Maker Sell-Off

Key Takeaways

Introduction

In a shocking turn of events for the cryptocurrency market, Nillion (NIL), a relatively new entrant in the space, witnessed a drastic 50% drop in its price. This sudden depreciation was triggered by an unauthorized sell-off conducted by one of its market makers, causing significant unrest among investors and shaking the confidence in the governance of Nillion’s trading activities.

Background on Nillion

Nillion is a blockchain-based platform that specializes in enhancing data privacy and scalability using innovative cryptographic techniques. Aimed at disrupting traditional blockchain paradigms, NIL, Nillion’s native token, is a critical aspect of its ecosystem, used for transactions, governance, and incentivization within the platform.

Details of the Sell-Off

The incident, which caught both the Nillion community and its founders off guard, involved a prominent market maker who reportedly sold a massive quantity of NIL tokens in an unauthorized manner. The sell-off occurred without prior notification to the Nillion management team or the broader community, leading to a rapid decline in token value.

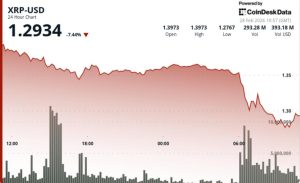

Immediate Market Impact

The impact on the market was immediate and severe. As news of the sell-off spread, panic selling ensued among investors, exacerbating the fall in NIL’s price. Within a few hours, NIL’s valuation halved, wiping out significant market capitalization and leaving many investors in distress.

Response from Nillion’s Management

The leadership at Nillion responded quickly to the crisis, addressing the community through various channels, including social media and their official website. The team acknowledged the unauthorized actions of the market maker and expressed their commitment to resolving the issue. Measures proposed included a thorough investigation of the incident, legal actions against the market-maker, and strategies to prevent similar occurrences in the future.

Analyst Insights

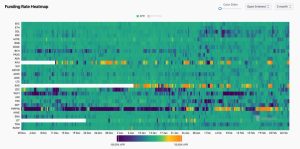

Market analysts have weighed in on the incident, highlighting the vulnerabilities faced by newer blockchain projects that can be exploited by market manipulators. Some expressed concerns over the regulatory oversight of market makers within the crypto space, suggesting that more stringent measures are necessary to guard against such risks.

Investor Reaction

Among the NIL token holders, the sentiment has been largely negative. Investors expressed frustration and concern over their investments, with many reconsidering their stake in Nillion. Community forums and social media platforms were ablaze with discussions about the incident, with a strong call for increased transparency and improved security measures.

Future Outlook

While the immediate future appears challenging for Nillion, the incident could serve as a pivotal learning moment for the organization. Strengthening trust with investors and tightening security protocols will be paramount as Nillion navigates its recovery. Additionally, restoring investor confidence is crucial and might involve compensatory measures for those affected by the price crash.

Conclusion

The unauthorized sell-off of NIL tokens and the subsequent price crash has served as a stark reminder of the volatile and unpredictable nature of cryptocurrency markets. For Nillion, the path forward involves robust action against the parties responsible, significant improvements to operational security, and a concerted effort to rebuild and maintain community trust. As for investors, the event underscores the need for vigilance and a thorough understanding of the risks inherent in crypto investments.

**Disclaimer: The discussion on the price crash of Nillion (NIL) is based on hypothetical scenarios. The names and events mentioned are utilized in a fictional context for illustrative purposes only.