Nasdaq Bitcoin ETF options are set to undergo a significant transformation with a proposal that seeks to quadruple the trading limits for BlackRock’s iShares Bitcoin Trust (IBIT). This move not only emphasizes the growing interest in Bitcoin derivatives among institutional investors but also aligns these options with major equities like Apple and NVIDIA. By raising the position limits from 250,000 to 1,000,000 contracts, Nasdaq aims to enhance market liquidity and depth, providing a more robust platform for institutional trading. Analysts believe that these changes could stabilize volatility and allow larger allocation strategies, ultimately enriching the overall market dynamics. As the demand for Bitcoin ETFs continues to escalate, the adjustment in options limits appears to be a strategic response to support the needs of serious market players.

The recent developments surrounding Nasdaq Bitcoin ETF options highlight the regulatory shifts intended to bolster the trading infrastructure for Bitcoin. Specifically, the proposal to increase limits on BlackRock’s iShares Bitcoin Trust reflects an overarching trend toward legitimizing cryptocurrency in traditional finance. By expanding the IBIT options, the Nasdaq International Securities Exchange is aiming to place Bitcoin on a comparable footing with established equity markets, thus fostering greater participation from institutional investors. This initiative could streamline trading processes and enhance transparency in cryptocurrency markets, aligning closely with the needs of market makers and sophisticated traders who seek to navigate Bitcoin derivatives effectively. The implications of this proposal signify a potential evolution in how Bitcoin is integrated into institutional asset management strategies.

Understanding Nasdaq Bitcoin ETF Options

Nasdaq’s approach to Bitcoin ETF options is indicative of a broader trend in institutional trading. By increasing the IBIT option limits from 250,000 to 1,000,000 contracts, Nasdaq aims to align Bitcoin derivatives with the trading volumes of major equities. This change not only enhances liquidity but also draws in more institutional investors who see these options as part of a larger strategy to manage risk and diversify portfolios. The implications of such a move could significantly stabilize the market dynamics around Bitcoin and its derivatives.

Moreover, this proposed increase in trading limits reflects a growing acceptance of Bitcoin as an integral asset class within the financial markets. As institutions become more familiar with Bitcoin derivatives, their participation can lead to more mature market behaviors, reducing volatility and enabling better pricing mechanisms. This is crucial for any investment vehicle, particularly for those like Bitcoin, which have been historically subject to extreme price fluctuations.

The Role of BlackRock’s Bitcoin ETF in Institutional Trading

BlackRock’s iShares Bitcoin Trust (IBIT) plays a pivotal role in legitimizing Bitcoin as an asset within institutional portfolios. The ETF allows professional market participants to gain exposure to Bitcoin without directly purchasing the cryptocurrency, thus easing the entry barrier. With the proposed increase in IBIT option limits, institutions can implement more complex trading strategies, ensuring that they can hedge their Bitcoin exposure effectively and potentially enhance their returns.

Furthermore, the move by Nasdaq to increase option limits is not just a reaction to current market conditions but a proactive step towards embracing the future of institutional trading in digital assets. As larger financial entities adopt Bitcoin ETFs as a core part of their trading strategies, they contribute to the development of a standardized trading framework, similar to that of traditional assets. This ultimately benefits both institutional and retail investors by creating a more stable and regulated trading environment.

Impact of Nasdaq ISE’s Proposal on Market Liquidity

The Nasdaq ISE’s proposal to increase the trading limits on BlackRock’s Bitcoin ETF options is likely to have a profound impact on market liquidity. With a potential increase in options available, institutional players can engage in larger transactions without the constraints that currently impede efforts to build significant positions in Bitcoin. This increased liquidity is essential for fostering a more vibrant trading environment where institutional strategies can thrive.

In turn, elevated liquidity can lead to a reduction in spreads and improved price discovery within the Bitcoin market. As institutions place larger trades, the resulting fluctuations can be managed more effectively, reducing the likelihood of extreme volatility spikes that have marred Bitcoin’s performance in the past. As the market matures, such developments could facilitate a fundamental shift in how Bitcoin is viewed by financial professionals, increasingly aligning it with traditional investment vehicles.

Analyzing the Risks and Benefits of Higher Trading Limits

The proposal to raise the trading limits for BlackRock’s Bitcoin ETF options can introduce both risks and benefits. One of the primary advantages is that it enables institutional investors to execute more robust trading strategies, potentially leading to a more stable market environment. However, increased leverage might also result in higher volatility during sudden market shifts, particularly if market psychology takes a downturn.

Additionally, with larger trading limits, there is a risk of market manipulation or excessive speculation. Regulators and exchanges will need to monitor this closely to ensure that the integrity of the market is maintained. The balance between facilitating greater access for institutions and protecting the marketplace from potential abuses will be critical in the effective implementation of the proposed changes to IBIT trading limits.

BlackRock’s Strategy for Bitcoin Derivatives

BlackRock’s strategy for integrating Bitcoin derivatives into its offerings revolves around meeting the needs of institutional investors seeking exposure to the cryptocurrency. By leading the charge with its Bitcoin ETF, the firm not only positions itself at the forefront of the evolving digital asset landscape but also instills confidence among cautious investors. The ability to utilize options for hedging and risk management makes IBIT particularly appealing for institutions looking to diversify their asset allocations.

As analytical assessments suggest that the demand for Bitcoin derivatives is only set to increase, BlackRock’s initiatives can serve as a benchmark for other asset managers considering similar products. This may kickstart a chain reaction where major financial institutions feel compelled to include Bitcoin and its derivatives in their offerings, further legitimizing the cryptocurrency space while fostering innovative trading strategies.

Navigating Regulatory Landscapes with Bitcoin ETFs

Navigating the regulatory landscape is a crucial aspect for Bitcoin ETFs like BlackRock’s IBIT. The approval and acceptance of these financial products by regulatory bodies often dictate how institutional investors perceive the viability of investing in Bitcoin. The increased option limits proposed by Nasdaq ISE highlight both the growing interest from regulators and the need for updated guidelines that reflect the maturation of the digital asset market.

Furthermore, the focus on establishing clear regulatory frameworks enables institutional investors to engage with Bitcoin ETFs and derivatives with greater confidence. As the market evolves, proactive measures taken by exchanges and firms like BlackRock may encourage further regulatory clarity, paving the way for enhanced participation from institutional players who have been cautious in the past.

Institutional Demand for Bitcoin: A Growing Trend

The demand for Bitcoin among institutional investors has been on an upward trajectory, driven by the search for inflation hedges and alternative investment options. With BlackRock leading the charge through the launch of Bitcoin ETFs and derivatives, more institutions are beginning to recognize Bitcoin as a credible asset. This trend points toward a broader acceptance of digital currencies as part of diversified financial strategies.

Additionally, as institutions embrace Bitcoin derivatives as a part of their investment strategies, the market will likely see new financial products and investment vehicles emerge. This can create a snowball effect where increased participation leads to greater price stability, less speculation, and a more mature market overall, compelling traditional financial institutions to reconsider their stance on Bitcoin and digital assets.

The Future of Bitcoin Trading After Nasdaq’s Proposal

Looking forward, Nasdaq’s proposal to raise trading limits on Bitcoin ETF options could significantly alter the future of Bitcoin trading. By creating an environment where larger trades can be executed more seamlessly, this move could contribute to a reduction in volatility and an increase in Bitcoin’s attractiveness as a macro asset. As institutional traders adapt to the new limits, capital inflow into Bitcoin ETFs is expected to rise, promising exciting prospects for price movement.

Moreover, an increase in participation from institutional players may lead to the development of more sophisticated trading strategies, akin to those seen in traditional equity markets. This could manifest in innovations within structured financial products related to Bitcoin, fundamentally changing how the asset is perceived and traded. In the long run, this transition may surround Bitcoin with a level of legitimacy that could rival that of other established investment assets.

Volatility Trends in Bitcoin and Its Impact on Trading Strategies

Bitcoin has been notorious for its price volatility, affecting how both retail and institutional investors approach the asset. Nasdaq’s proposed increase in trading limits for IBIT options may help mitigate some of this volatility through enhanced liquidity and larger institutional positions. This implies that as market dynamics shift, Bitcoin trading could transition from pure speculation to more strategic asset allocation.

Reducing volatility is beneficial not just for traders but for the entire cryptocurrency ecosystem. Stable prices allow for more predictable trading experiences, facilitating better planning and execution of investment strategies. Therefore, as Nasdaq’s proposal takes effect and market participants adapt, we could witness a fundamental transformation in the way Bitcoin interacts with traditional financial markets.

Frequently Asked Questions

What are Nasdaq Bitcoin ETF options?

Nasdaq Bitcoin ETF options refer to the trading options available for exchange-traded funds (ETFs) that are based on Bitcoin, such as BlackRock’s iShares Bitcoin Trust (IBIT). These options give investors the right, but not the obligation, to buy or sell shares of the Bitcoin ETF at a predetermined price before a specified expiration date.

How does the Nasdaq ISE proposal affect BlackRock Bitcoin ETF options?

The Nasdaq International Securities Exchange (ISE) proposal seeks to increase the position limits for BlackRock Bitcoin ETF options (IBIT) from 250,000 to 1,000,000 contracts. This change aims to enhance market depth and liquidity, aligning IBIT options with major equities and facilitating larger institutional trading.

What are the benefits of increasing IBIT option limits?

Increasing IBIT option limits enhances liquidity and allows institutional traders to engage in larger positions, which can improve trading strategies and reduce volatility. This shift supports the growing interest in Bitcoin derivatives among institutional investors looking for lower-risk allocation strategies.

How will the Nasdaq’s proposed changes impact institutional trading of Bitcoin?

The proposed changes by Nasdaq can significantly impact institutional trading by enabling larger, structured products based on the Bitcoin ETF options. This increased capacity for trading can help move transactions away from less transparent markets, improving overall market integrity.

What are FLEX options in the context of Bitcoin ETF trading?

FLEX options are customizable options contracts that allow traders to specify the terms differently from standard options. The Nasdaq proposal includes an exemption to remove limits on physically delivered FLEX options for BlackRock Bitcoin ETF options, potentially increasing the trading flexibility for institutions.

What is the current status of Bitcoin derivatives in institutional trading?

Currently, demand for Bitcoin derivatives, including options linked to the BlackRock Bitcoin ETF, is rising among institutional traders. As larger players seek to allocate Bitcoin in a more stable manner, the changes proposed by Nasdaq’s ISE are seen as a crucial step towards accommodating this growing interest.

Will the increase in IBIT option limits affect Bitcoin’s volatility?

Yes, analysts believe that the increase in IBIT option limits could potentially compress Bitcoin’s volatility over time. By allowing institutions to engage in larger positions, the market may experience less drastic price swings, which could lead to a more stable trading environment.

How do Nasdaq Bitcoin ETF options compare to traditional equities?

Nasdaq Bitcoin ETF options, especially the proposed IBIT options, are proposed to be elevated to position limits comparable to major equities like Apple and NVIDIA. This aligns Bitcoin derivatives trading with more established financial products, fostering institutional confidence and participation in the market.

What market changes are anticipated if Nasdaq’s proposal is approved?

If Nasdaq’s proposal is approved, it is expected to enhance liquidity, attract more institutional trading, and promote the establishment of larger capital allocations to Bitcoin ETFs. This could lead to a fundamental shift in how Bitcoin is traded, moving it towards being treated like a macro asset rather than a speculative one.

| Key Point | Details |

|---|---|

| Increase in Options Limits | Nasdaq aims to raise IBIT options limit from 250,000 to 1,000,000 contracts. |

| FLEX Options Exemption | Proposal includes eliminating limits for physically delivered FLEX options, enhancing market activity. |

| Institutional Access | This change signifies a deeper institutional involvement in Bitcoin via IBIT options. |

| Market Impact | Expected to support larger, lower-risk Bitcoin positions and reduce market volatility. |

| Historical Context | This is Nasdaq’s second attempt to increase limits, highlighting growing demand for Bitcoin derivatives. |

Summary

Nasdaq Bitcoin ETF options are seeing significant proposed changes that aim to quadruple trading limits for BlackRock’s iShares Bitcoin Trust (IBIT). This adjustment attempts to align Bitcoin derivatives with other major equities and deepen the market’s institutional engagement. The proposal not only plans to increase the limits significantly but also includes an exemption for FLEX options, allowing for more strategic investment approaches. If approved, these changes could enhance market depth, liquidity, and encourage larger allocations from institutional investors, signaling a shift in Bitcoin trading practices towards more managed investment behaviors.

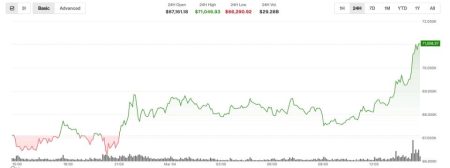

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend