MSTR and Bitcoin misconceptions have persisted in the investment community, often fueled by panic during volatile market conditions. Jeff Dorman, the Chief Investment Officer of Arca, highlights the repetitive nature of these misconceptions every time Bitcoin dips, with dire predictions about MSTR’s need to sell its Bitcoin holdings. Contrary to popular belief, MSTR’s management strategy is robust and its debt management practices ensure that the company is not required to liquidate its Bitcoin positions. Furthermore, MSTR’s stock performance remains resilient due to the significant insider ownership by CEO Michael Saylor, which adds stability against activist investor pressures. Investors seeking Bitcoin investment insights would benefit from understanding that MSTR’s financial structure is designed to weather market fluctuations without relying on forced sales of its crypto assets.

Misunderstandings surrounding MSTR’s approach to cryptocurrency investments can often lead to misleading narratives about the company’s financial health. As noted by investment professionals like Jeff Dorman, the financial strategies employed by MSTR are carefully crafted to mitigate risks associated with Bitcoin’s price volatility. The company’s ability to maintain its positions, without succumbing to unnecessary panic selling, reflects strong debt management and a solid core business model. When analyzing MSTR’s fiscal approach, it’s critical to differentiate between speculative investment fears and the realities of structured equity management. This nuanced perspective is essential for stakeholders who wish to navigate the complexities of MSTR’s Bitcoin strategy effectively.

Debunking Common MSTR Misconceptions

One of the most pervasive misconceptions surrounding MicroStrategy (MSTR) and its Bitcoin holdings is the notion that the company will be forced to sell its Bitcoin assets during price downturns. This notion, frequently echoed in financial news whenever Bitcoin experiences a price drop, fails to consider the equity structure and strategic positioning of MSTR. As per Jeff Dorman’s insights, the reality is that MSTR’s stock dynamics are significantly influenced by the majority ownership held by Michael Saylor, who possesses 42% of the shares. Such a majority prevents activist investors from exerting pressure on the company to liquidate its Bitcoin holdings, which reaffirms MSTR’s stability during turbulent market conditions.

Moreover, the fear that MSTR must sell Bitcoin to manage debt is largely unfounded. Dorman highlights that MSTR’s debt terms lack mandatory selling provisions, which means they do not face immediate pressure to liquidate assets to meet debt obligations. This approach contradicts the idea that MSTR operates like a leveraged entity, where falling prices lead to forced sales. Instead, their strategic approach allows them to leverage their Bitcoin investments while maintaining a comfortable debt management strategy and sufficient cash flow from their core technology business.

Understanding MSTR’s Debt Management Strategy

MicroStrategy’s approach to debt management is foundational to its long-term viability. Dorman notes that the company has structured its debt in a manner that balances risk and growth potential. Investors often misunderstand the implications of MSTR holding substantial Bitcoin when evaluating its financial health. The firm has consistently prioritized manageable interest payments, aligning with its cash-generating business model, which continues to perform positively even during market fluctuations. Thus, the narrative that the company is at risk due to its Bitcoin strategy does not reflect its actual financial landscape.

Additionally, it’s crucial to remember that companies, including MSTR, rarely default on debt obligations unless under extreme circumstances. Dorman emphasizes that market behavior typically sees investors favoring the rollover of debts, allowing firms like MSTR to navigate adverse market conditions without resorting to draconian measures, such as liquidating Bitcoin. The business’s resilience in maintaining operational cash flow offers a further buffer against potential market volatility, creating a solid foundation for MSTR’s ambitious Bitcoin investment strategy.

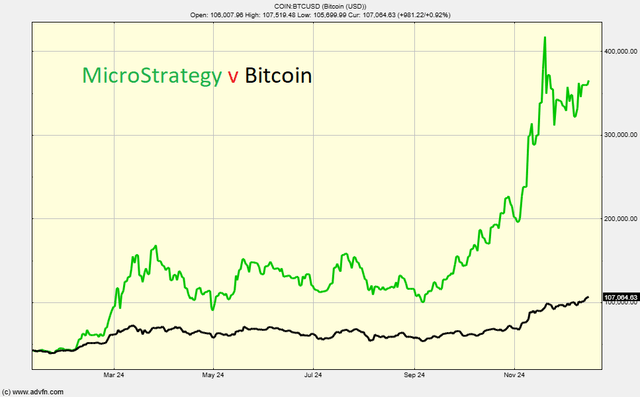

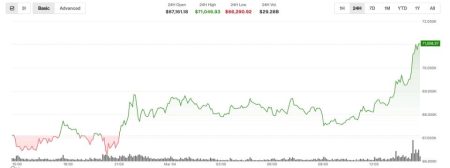

Insights on MSTR’s Stock Performance Amid Bitcoin Volatility

As Bitcoin’s price fluctuates, MicroStrategy’s stock performance often draws intense scrutiny, but this relationship is not as straightforward as many investors believe. Jeff Dorman articulates that the stock’s value is not solely tied to the price of Bitcoin. Instead, the intrinsic value of MSTR originates from its robust technology core, which continues to thrive regardless of Bitcoin market dynamics. MSTR’s dual strategy of integrating Bitcoin with its technology operations positions it uniquely in the market, allowing it to capitalize on both sectors and mitigate risks typically associated with owning volatile assets.

Furthermore, the performance of MSTR shares can also reflect investor sentiment regarding Bitcoin rather than direct price movements. This complex interplay means that while Bitcoin may show volatility, MSTR’s operational efficacy and strategic debt management can bolster stock performance, making it less susceptible to the immediate swings of Bitcoin prices. Understanding these subtle dynamics can provide investors with deeper Bitcoin investment insights, ultimately leading to more informed investment decisions regarding MSTR.

Bitcoin’s Role in MSTR’s Long-Term Strategy

MicroStrategy’s long-term strategy heavily incorporates Bitcoin as a critical asset rather than just a speculative investment. With advances in blockchain technology and increasing institutional interest in cryptocurrency, MSTR positions itself as a leader in the integration of digital assets within enterprise solutions. Dorman suggests that MSTR’s comprehensive approach to Bitcoin reflects a commitment to embracing the asset’s potential rather than acting reactionarily during market downturns.

Incorporating Bitcoin into their financial architecture allows MSTR to leverage emerging trends in digital currency adoption, making it less vulnerable to short-term market fluctuations. As Dorman summarizes, the rationale behind MSTR’s investment access is to build a future-proof foundation that intertwines their business growth with the burgeoning digital asset ecosystem. This dual focus on technology and Bitcoin investment underscores MSTR’s strategy for sustainable growth despite market volatility.

Navigating Market Sentiment for MSTR and Bitcoin

Market sentiment can heavily impact the perception of both MSTR and Bitcoin, but Jeff Dorman argues that one should not conflate stock performance with cryptocurrency price fluctuations. Whenever Bitcoin price dips, speculative narratives often emerge suggesting imminent liquidation by MSTR, which misrepresents the company’s strategic decision-making process. MSTR’s management has been clear about its intentions with Bitcoin, emphasizing that they are invested for long-term appreciation rather than short-term gains.

By understanding the broader implications of market emotions on MSTR stock, investors can better navigate the complexities of cryptocurrency investments. Emphasizing MSTR’s fundamentals is vital, as holding excess Bitcoin should not automatically correlate to an impending crisis or a forced sell-off. Educating investors on this distinction will help demystify the common misconceptions about MSTR and Bitcoin, fostering a more comprehensive understanding of their interconnected roles in the tech and finance landscapes.

MSTR’s Strategic Use of Bitcoin Assets

MicroStrategy’s strategic utilization of Bitcoin assets is not merely a gamble but rather a calculated approach to enhancing corporate treasury management. As articulated by Jeff Dorman, the company views Bitcoin as a substantial part of its financial strategy that goes beyond speculative investment. This dynamic involves introducing Bitcoin not just as an asset to hold, but as a vehicle to potentially increase the value of the business and improve shareholder returns over time.

With Bitcoin gaining recognized value as a digital store of wealth, MSTR effectively integrates cryptocurrency into its treasury practices, showcasing an innovative outlook on asset management. This method reflects a shift in how forward-thinking companies can leverage digital assets, indicating a significant departure from traditional investment paradigms. By adopting Bitcoin into their asset allocation strategy, MSTR is not only managing risk but also positioning itself ahead of peers in a rapidly evolving financial ecosystem, which might influence investor sentiment positively.

Evaluating MSTR’s Financial Stability Relative to Bitcoin

Assessing MSTR in the context of Bitcoin’s price volatility reveals a complex landscape of financial stability. Jeff Dorman emphasizes that MSTR’s financial framework withstands even significant drops in Bitcoin value due in part to its solid debt management practices and the underlying revenue generation from its technology services. This duality provides MSTR with a unique resilience against external market shocks, contrary to the belief that a decline in Bitcoin would jeopardize MSTR’s overall financial health.

The company’s balancing of Bitcoin investment with core business operations underscores why it remains an attractive investment option despite market uncertainties. MSTR’s decisions are informed by a sustainable model that prioritizes consistent cash flow generation while leveraging Bitcoin’s potential appreciation. Investors should consider this balance when evaluating MSTR, recognizing that it presents opportunities distinct from direct Bitcoin investments, thereby offering diversified exposure to cryptocurrency dynamics.

Long-Term Implications of MSTR’s Bitcoin Strategy

The long-term implications of MicroStrategy’s Bitcoin strategy extend into the realms of corporate finance and technological integration. According to Jeff Dorman, the decision to accumulate Bitcoin is not just about capitalizing on the cryptocurrency’s growth but also positioning the company as a pioneer in adopting digital assets in mainstream corporate finance. This forward-thinking approach not only enhances MSTR’s balance sheet but also places it on the map as a tech leader amidst evolving market trends.

By aligning its business strategy with Bitcoin, MSTR not only seeks to harness the potential for asset appreciation but also reinforces its technological ethos, driving innovation in an increasingly digital economy. These long-term benefits create a robust narrative for prospective investors looking beyond short-term volatility, demonstrating how MSTR’s Bitcoin strategy helps in building a resilient and forward-looking enterprise.

Conclusion: The Future of MSTR and Bitcoin Investments

In conclusion, the future of MicroStrategy and its relationship with Bitcoin appears promising, as outlined by the insights from Jeff Dorman. By debunking myths surrounding MSTR and its Bitcoin holdings, it becomes evident that the company’s strategic focus is informed by a long-term vision that prioritizes financial stability alongside asset growth. The groundwork laid by MSTR in integrating Bitcoin with its business operations positions the firm as an innovative player in a landscape rapidly shifting toward digital asset acceptance.

As the cryptocurrency market continues to evolve, understanding MSTR’s adaptive strategies will be crucial for investors looking to navigate this complex environment. The clarity that comes from appreciating the synergies between Bitcoin investment and MSTR’s core operations will help foster a more informed investor base, capable of discerning value beyond the price charts of cryptocurrencies. Ultimately, MSTR represents a case study in how strategic foresight can shape the future of corporate finance in a digital world.

Frequently Asked Questions

What are the misconceptions about MSTR and Bitcoin that investors should know?

Investors often misconceive that MSTR is forced to liquidate its Bitcoin (BTC) holdings whenever BTC prices drop. Jeff Dorman emphasizes that unless BTC prices fall to extremely low levels, MSTR does not need to sell its Bitcoin. Furthermore, MSTR’s debt terms do not mandate selling, and its positive cash flow from core technology operations allows it to manage payments effectively without liquidating assets.

How does MSTR handle its Bitcoin investments according to Jeff Dorman?

Jeff Dorman points out that MSTR has a sound Bitcoin investment strategy, which is well-supported by its manageable debt situation and strong cash flow. With CEO Michael Saylor holding a significant portion of shares, the influence of activist investors is minimal, reducing pressure to sell Bitcoin even in market downturns.

Can MSTR’s debt management strategy affect its Bitcoin strategy?

Yes, MSTR’s debt management strategy directly impacts its Bitcoin strategy. According to Jeff Dorman, the company does not have mandatory provisions to sell Bitcoin to satisfy debt obligations, allowing it to maintain its Bitcoin holdings during market fluctuations. This strategic flexibility is key to MSTR’s ability to weather market volatility.

What insights does Jeff Dorman provide about MSTR and Bitcoin volatility?

Jeff Dorman provides insights that highlight common misconceptions regarding MSTR’s Bitcoin investments during periods of volatility. He asserts that MSTR’s need to sell Bitcoin is overstated and that the company’s strong fundamentals and liquidity position allow it to remain firm even when BTC prices fluctuate negatively.

What drives MSTR’s stock performance in relation to Bitcoin trends?

MSTR’s stock performance is intricately linked to Bitcoin trends; however, as per Jeff Dorman’s analysis, it is important to recognize that the company’s underlying technology business generates positive cash flow, which helps stabilize its stock performance independent of Bitcoin’s price movements. Investors should focus on MSTR’s robust business model rather than solely on Bitcoin market fluctuations.

| Key Points | Details |

|---|---|

| Misconception of MSTR Selling BTC | People wrongly believe that MSTR will be forced to sell its Bitcoin (BTC) during price drops. |

| Jeff Dorman’s Stance | Dorman argues that these claims are unfounded and that MSTR’s position is stable. |

| Key Reason 1 | Saylor controls 42% of MSTR shares, making it hard for activists to exert influence. |

| Key Reason 2 | MSTR’s debt terms do not require mandatory selling of BTC. |

| Key Reason 3 | Interest payments are manageable, bolstered by cash flow from MSTR’s tech business. |

| Key Reason 4 | Most companies successfully rollover their debts, avoiding defaults. |

Summary

MSTR and Bitcoin Misconceptions have been a hot topic due to the persistent rumors surrounding MSTR’s need to liquidate BTC. Jeff Dorman’s insights clarify that MSTR is well-equipped to handle its investments, especially given its management structure and favorable financial conditions. Understanding these dynamics helps dispel unfounded fears regarding MSTR’s stability in the cryptocurrency market.

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend