As the cryptocurrency market continues to evolve, many investors are keenly interested in the Monero price forecast. Currently, XMR is making headlines, having recently achieved an impressive all-time high of $596, reflecting its robust performance compared to other leading cryptocurrencies. With a remarkable 15% surge in just 24 hours, Monero stands out as the 12th-largest cryptocurrency by market capitalization, attracting attention from both retail and institutional investors. Analysts are closely examining the current XMR price prediction, considering that a breakthrough above the $600 threshold could pave the way for a climb toward $700. In light of the latest Monero news, the increasing demand for privacy coins suggests that XMR could maintain its upward trajectory amid shifting cryptocurrency trends.

In the realm of digital assets, the future valuation of Monero, commonly referred to as XMR, is generating considerable buzz among crypto enthusiasts. With its recent record-setting price points, market analysts are assessing the potential price action of Monero to determine whether it can sustain its current momentum. As privacy-focused cryptocurrencies gain traction, the Monero analysis indicates that the demand could further influence XMR’s price dynamics. Investors are also turning to market updates to get insights into how factors affecting overall cryptocurrency trends might impact Monero’s performance. The discussion around XMR has become increasingly relevant as its market movements could signify broader implications for privacy coins in the digital currency landscape.

Understanding Monero’s Price Trends and Market Dynamics

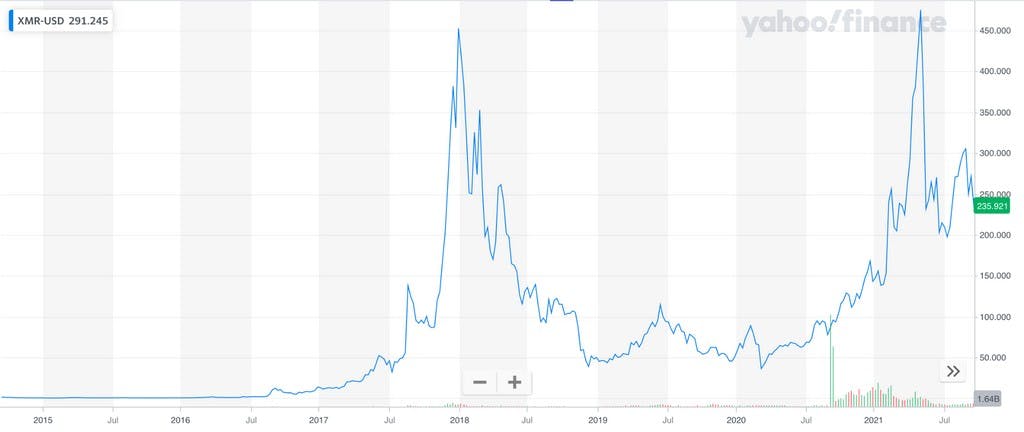

In the ever-evolving cryptocurrency landscape, Monero (XMR) continues to demonstrate significant resilience and volatility. Recently, it achieved a new all-time high of $596, which has sparked optimism among investors and traders alike. Understanding the dynamics that contribute to these price movements is essential for anyone involved in cryptocurrency investments. Factors such as supply and demand, market sentiment, and technological developments heavily influence XMR pricing. As Monero maintains its position as the leading privacy coin, its unique features present an attractive investment opportunity against the backdrop of broader market trends.

While the price action of Monero is exhilarating, it’s crucial to dig deeper into the signals indicating future price movements. Technical analysis reveals patterns that may forecast the next stages for XMR. For example, the recent surge and subsequent correction can be associated with the overall trends in cryptocurrencies and shifting investor behavior. Continuous updates in the broader cryptocurrency news, particularly about privacy coins, can help predict XMR’s future trajectory and potential price fluctuations. Investors must keep an eye on such trends to better understand the strategic positioning of Monero in the market.

Monero Price Forecast: Could XMR Hit $700?

As Monero’s recent performance has attracted attention, many are now pondering whether XMR can reach the psychological level of $700. With the XMR/USD pair exhibiting bullish tendencies, the analysis points toward a possible continuation of this growing momentum. Factors influencing this prediction include the relative strength index (RSI) and bullish indicators like MACD. If XMR successfully breaches the resistance at $640, it could pave the way for a breakthrough towards $700, making it a pivotal watch point for traders considering both short-term and long-term positions.

However, it is essential to acknowledge the risks involved. The market’s behavior can be unpredictable, and current overbought conditions, as indicated by the RSI nearing 80, suggest caution. If bearish forces reclaim control, this could lower Monero’s price, potentially retesting lower support levels around $569. Thus, while the community remains optimistic about a potential surge, careful consideration of market updates and ongoing analysis will be paramount in navigating this highly volatile environment.

The Role of Privacy Coins in Current Cryptocurrency Trends

Privacy coins like Monero are gaining traction in today’s cryptocurrency trends, appealing to a growing base of privacy-conscious investors. In a financial world where data privacy has become more critical, Monero’s robust features allow users to transact discreetly without compromising their identity. The increasing demand for secure transactions has positioned XMR as a leading choice among investors who prioritize privacy, edging past fluctuations seen in more traditional assets. This trend signals a burgeoning niche within the cryptocurrency market that is likely to influence broader market dynamics.

As market sentiments shift, Monero’s performance often reflects the demand for privacy coins amid regulatory scrutiny of cryptocurrencies. The recent rise in market value, driven by investor interest, shows that the narrative surrounding privacy is becoming a fundamental aspect of cryptocurrency discussions. With major updates from relevant projects and analysis of Monero’s fundamentals, investors can better gauge its positioning against other cryptocurrencies. Keeping abreast of these trends is essential for anyone looking to invest in Monero or related assets.

Recent Market Updates: What’s Next for Monero?

Recent market updates have shown Monero’s impressive ascent amid fluctuating market conditions. At present, XMR stands as the 12th-largest cryptocurrency by market cap, a position that underscores its resilience even as it experiences price corrections. News surrounding Monero, including its performance relative to competitors and its technical indicators, plays a significant role in shaping investor sentiment. Consequently, ongoing market updates serve as critical touchpoints that can influence trading strategies and decisions concerning XMR.

Looking forward, investors are keenly interested in what lies ahead for Monero, especially as it approaches significant resistance levels. Market analysts are closely monitoring the interplay between bullish momentum and potential bearish trends. As the landscape for cryptocurrencies evolves, Monero’s distinct position in the market may offer lucrative opportunities or pose risks that traders must navigate carefully. Timely updates and comprehensive analysis can effectively inform decisions as traders anticipate the next movements for Monero.

Technical Analysis of Monero: Indicators to Watch

Conducting technical analysis on Monero involves scrutinizing key indicators that help predict future price movements. Understanding patterns such as support and resistance levels is crucial for traders looking to maximize their gains. The current bullish trend indicates continuation possibilities towards notable price points, but it also calls for a cautious approach given the overbought conditions highlighted by the Relative Strength Index (RSI). For successful trading, monitoring these indicators can help navigate the complexities of Monero’s price actions.

Moreover, indicators like the Moving Average Convergence Divergence (MACD) continue to suggest bullish momentum, reinforcing the expectation of a potential rally. Traders should also be aware of external factors influencing market movements, such as shifts in Bitcoin‘s performance, which commonly affects altcoins like Monero. By maintaining a thorough analysis of these technical indicators and market trends, investors stand a better chance of making informed decisions as they navigate the ever-changing cryptocurrency landscape.

Why Monero Stands Out Among Privacy Coins

Monero sets itself apart from other privacy coins through its unwavering commitment to anonymity and privacy, offering features that attract both individual users and institutional investors. As decentralized finance (DeFi) and blockchain technology continue to evolve, Monero’s robust security measures make it a preferred choice for users seeking confidentiality in their transactions. Unlike many alternatives, Monero employs standard default privacy protocols, which instill confidence among its growing user base.

In a time when privacy concerns are escalating globally, Monero’s trajectory presents an opportunity for investors who prioritize security and anonymity. As more individuals become aware of the importance of privacy, the demand for Monero is likely to increase. This added layer of scrutiny on privacy coins positions Monero uniquely, as ongoing developments and community discussions continue to sculpt its future in the cryptocurrency arena.

The Future of Monero: A Long-term Investment Perspective

Taking a long-term investment perspective on Monero can yield substantial benefits as the cryptocurrency ecosystem matures. Investors who focus on the fundamentals and the inherent value of Monero’s privacy features are likelier to see favorable outcomes despite market volatility. The steady growth of XMR underscores a promising promise for long-term holders, especially as institutional interest starts to grow around privacy-centric solutions amid increasing regulatory debates.

Examining the future potential of Monero also involves considering its adaptability in an ever-evolving market. As more developments in blockchain technology unfold, Monero’s engineering excellence could cement its place as a leading privacy coin in the years to come. Sound investing requires keeping an eye on both current trends and future implications, ensuring that investors are well-informed and prepared for any shifts in the market landscape.

Impact of Market Events on Monero’s Price Movements

Market events can significantly influence Monero’s price trajectories, often leading to rapid fluctuations based on news cycles or shifts in investor sentiment. For instance, announcements of regulatory updates or major technological advancements can sway the interest in Monero, triggering surges or declines in pricing. Understanding the relationship between market events and price movements is crucial for traders looking to capitalize on these dynamics.

As the cryptocurrency landscape reacts to global events, keeping abreast of developments through reliable Monero news channels can bolster investment strategies. Analyzing how similar events have affected XMR in the past can also provide valuable insights, shaping predictions for future scenarios. By examining past market behaviors alongside current events, traders can enhance their decision-making processes when navigating the complexities of Monero and its position within the broader crypto market.

Investor Sentiment: Analyzing Trends in Monero

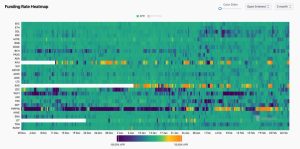

Investor sentiment plays a critical role in shaping the future of Monero, influencing buying patterns and market behaviors. Analyzing sentiment data can provide valuable insights into how the Monero community reacts to price changes and market events. High levels of positive sentiment usually correlate with price increases, whereas bearish sentiment can lead to declines or corrections. Being attuned to these emotional undercurrents can aid investors in making timely decisions regarding their holdings.

Trends in Monero’s investor sentiment can also be linked to broader environmental factors, including market trends, regulatory news, and technological advancements. Monitoring social media platforms, forums, and crypto news outlets can help gauge community sentiment effectively. As a result, an understanding of these sentiments allows traders to anticipate future price movements, thereby enhancing their investment strategies and risk management approaches in navigating the Monero landscape.

Frequently Asked Questions

What is the Monero price forecast for XMR in the upcoming weeks?

The Monero price forecast suggests that XMR could be heading towards a new all-time high of $700 if the current bullish trend continues. Analysts predict a critical resistance at the $640 mark which XMR needs to surpass to gain momentum.

How does the recent Monero news impact the XMR price prediction?

Recent Monero news indicates a rally fueled by increased retail demand for privacy coins. This has led to a 35% rise in XMR since the beginning of the month, positively affecting the XMR price prediction.

What are the current cryptocurrency trends affecting Monero analysis?

Current cryptocurrency trends show a shift of investor interest towards privacy coins, particularly Monero. This shift is enhancing the XMR price forecast and driving the recent upward movement in Monero’s valuation.

Could XMR reach $700 based on recent market updates?

Yes, based on recent market updates, XMR has the potential to reach $700 if it manages to break above the $600 resistance level. Technical indicators suggest continued bullish momentum for Monero.

What factors could influence the Monero price forecast this year?

Several factors could influence the Monero price forecast, including overall market performance, Bitcoin trends, regulatory news, and advancements in privacy technology, all of which contribute to XMR’s market dynamics.

What is currently supporting the bullish trend in XMR market updates?

The bullish trend in XMR market updates is supported by a strong retail interest in privacy coins, Monero’s recent performance surpassing other cryptocurrencies, and technical indicators pointing towards a possible price increase.

How do technical indicators affect the XMR price prediction?

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) play crucial roles in the XMR price prediction, showing both overbought conditions and a continuation of upward trends.

| Key Points |

|---|

| Monero’s Current Price and Performance |

| New All-Time High of $596 |

| Currently 12th in Market Capitalization |

| Last 24 Hours Performance: Up 15% |

| Recent Price trading around $573 |

| Potential Rally towards $640 and $700 |

| Technical Indicators: Bullish RSI at 80 |

| Support Level to Watch: $569 |

| Possible Retracement towards $489 in Bearish Scenario |

Summary

The Monero price forecast indicates that XMR is on a promising trajectory, potentially heading towards $700. With a recent surge in its value, Monero has displayed strong upward movement, recording an all-time high of $596. As the cryptocurrency continues to attract retail interest, its prospects appear bright, especially if it can maintain momentum and break through key resistance levels. Investors should watch for any retracements but remain optimistic about the coin’s ability to reach new heights in the near future.

Related: More from Market Analysis | PayPal USD Powers New PYUSDx App | Pantera and Franklin Test Sentient AI Agent