Microsoft Holds 200-Day Line as Sellers Pause; Traders Eye $492 and $512 Caps

Microsoft shares stabilized after a sharp multiweek slide, with buyers defending the 200-day moving average and stemming downside momentum. The stock was last up 0.36% at $473.81 after intraday lows near $468, keeping the longer-term trend gauge intact and refocusing attention on nearby resistance layers.

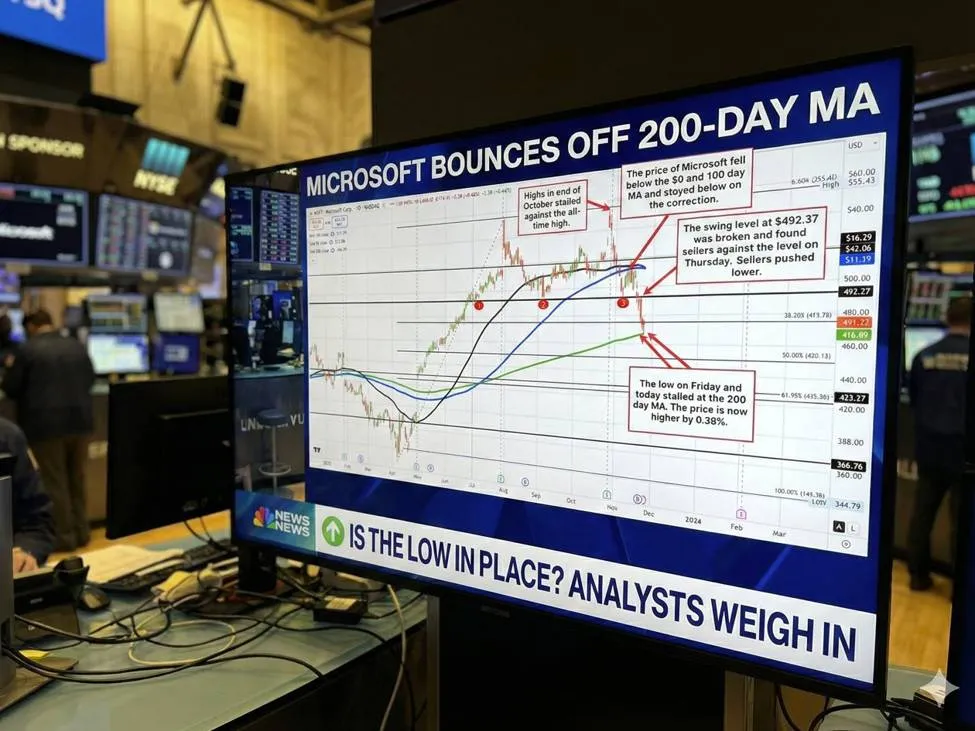

Technical Picture The stock failed to clear its July record high at $555.45 in late October, stalling at $553.72 and triggering a momentum rollover. The subsequent breakdown through the 50-day and 100-day moving averages in early November shifted the near-term bias lower and invited systematic selling. The decline accelerated into last week, printing a low at $468.27 on Friday and $468.02 today—both holding just above the rising 200-day moving average near $466.89.

Despite a brief rebound from the November 7 trough at $492.37, bulls were checked precisely at the confluence of the 50- and 100-day moving averages, with price rotating lower again from November 13. From the late-October peak, Microsoft’s drawdown has reached roughly -15.4%, a typical retracement magnitude for a large-cap leader when trend dynamics cool and risk appetite moderates.

Key Levels to Watch – Support: The 200-day moving average at $466.89 remains the pivotal downside line. Holding above it keeps the bullish long-term structure intact and offers a defined risk anchor for dip buyers. – First resistance: A reclaim of the prior floor at $492.37 would bolster buyer conviction and signal repair of market structure. – Next hurdle: The now-converged 50- and 100-day moving averages near $512 are the next upside objective; a sustained break above would force short covering and could restore upward momentum. – Break risk: A decisive close below the 200-day would undermine the bullish bias and open scope toward $450.12, the 50% retracement of the advance from the April 2025 low.

Market Context The recent setback underscores how quickly leadership momentum can fade when technical levels give way. With positioning more cautious after the failed breakout, liquidity flows are gravitating around well-defined moving averages as investors recalibrate exposure. For broader U.S. equities, stabilization in megacap technology could temper index volatility, while a breach of the 200-day may re-ignite de-risking in growth-heavy benchmarks.

Market Highlights – MSFT up 0.36% at $473.81 after bouncing off intraday lows near $468. – The 200-day moving average at $466.89 has held twice, preserving the primary uptrend. – Pullback from late-October high sits near -15.4%. – Resistance at $492.37, with a secondary cap at the 50/100-day moving averages clustered around $512. – A break below $466.89 would expose $450.12, the 50% retracement of the rally from the April 2025 low.

Q&A Q: What would confirm a near-term bottom for Microsoft? A: A sustained reclaim of $492.37 with higher lows above the 200-day, followed by a break and hold above the $512 moving average cluster, would strengthen the case for a durable bottom.

Q: Why is the 200-day moving average so important here? A: It’s a widely followed trend proxy that influences discretionary and systematic flows. Holding above it supports positive trend signals and cushions drawdowns; a break often accelerates selling.

Q: Where does the risk skew if $466.89 fails? A: The next tactical downside target is $450.12, aligning with the 50% retracement of the rally from the April 2025 low, where dip demand may re-emerge.

Q: How could this move affect the broader indices? A: As a heavyweight in the S&P 500 and Nasdaq 100, Microsoft’s ability to base above its 200-day could dampen equity volatility; a breakdown would likely add pressure to growth benchmarks.

For more real-time market coverage and technical analysis, follow BPayNews.