Metaplanet to Offer Dividend-Paying Preferred Shares to Buy More Bitcoin, Echoing Strategy

In a bold move that underscores the growing intersection of traditional finance and cryptocurrency, Metaplanet has announced its plans to issue dividend-paying preferred shares to fund the acquisition of more Bitcoin. This decision, reflective of an emerging trend in corporate strategies aimed at integrating digital assets, signals a significant pivot not only for Metaplanet but for the market at large.

Key Takeaways

Strategic Shift Towards Cryptocurrency

Metaplanet, a company renowned for its forward-thinking approach to technology and investment, is venturing further into the cryptocurrency space. By offering preferred shares that pay dividends, Metaplanet aims to attract investors looking for stable returns while leveraging the capital raised to increase its Bitcoin holdings. This strategic move is designed to balance investor appeal with aggressive growth in the rapidly evolving crypto sector.

The Mechanics of the Offering

Preferred shares are a type of stock that generally provides no voting rights but has a higher claim on assets and earnings than common shares. The dividends offered on these preferred shares typically make them attractive to risk-averse investors seeking predictable income. Metaplanet’s announcement detailed that the dividends would be competitive with current market rates, making it an enticing option for those who are also bullish on Bitcoin’s long-term value.

The funds raised from this issuance will be used directly to purchase Bitcoin, a decision driven by the company’s belief in Bitcoin’s future as a store of value and a hedge against inflation. This aligns with the thoughts of many analysts who see cryptocurrencies, particularly Bitcoin, as becoming a more mainstream asset class over the coming years.

Implications and Potential Risks

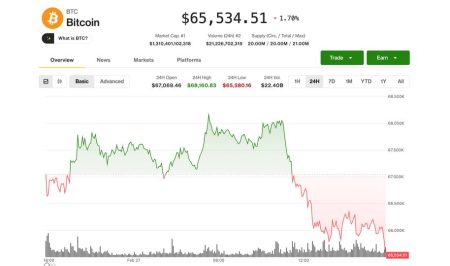

While the strategy of leveraging dividend-paying shares to invest in a volatile asset like Bitcoin is innovative, it does not come without risks. Bitcoin’s price volatility is legendary, with dramatic shifts that can occur in short periods. This volatility can lead to substantial fluctuations in the value of Metaplanet’s Bitcoin holdings, potentially impacting its ability to pay dividends or redeem shares in the future.

Investors in these preferred shares will need to weigh the potential for high returns against the volatility inherent in Bitcoin investments. Furthermore, regulatory considerations could also play a role, as governments and financial authorities worldwide are still in the process of determining how to deal with cryptocurrencies from a legal and fiscal standpoint.

Market Reaction and Future Outlook

The initial market reaction to Metaplanet’s announcement has been cautiously optimistic. Investment analysts have praised the innovative use of traditional financial instruments to facilitate growth in the realm of digital assets. However, they also caution that the success of this strategy is heavily dependent on the future market behavior of Bitcoin.

If successful, Metaplanet’s strategy could open the doors for other companies to follow suit, creating a new funding pathway that bridges the gap between traditional corporate finance and cryptocurrency investments. It might also prompt more businesses to consider direct integration of digital assets into their financial strategies, expanding the legitimacy and stability of cryptocurrencies like Bitcoin.

Conclusion

By issuing dividend-paying preferred shares to fund Bitcoin purchases, Metaplanet is not only diversifying its investment approach but also pioneering a model that may well become a norm if the digital currency continues to mature into an established asset class. As with any innovative strategy, there are significant risks involved, but the potential for high rewards may well justify this audacious venture into the nexus of traditional finance and cryptocurrency. This bold move will be closely watched by investors and companies alike, potentially setting the stage for how businesses might engage with cryptocurrency in the future.