In a significant move within the cryptocurrency space, Metalpha withdraws ETH from Kraken, making headlines across the crypto community. Just three hours ago, reports from Odaily Planet Daily revealed that Metalpha executed a transaction withdrawing an impressive 6,000 ETH, which is valued at approximately $18.67 million. This transaction highlights the ongoing activity in the crypto market, particularly concerning Ethereum, and provides vital ETH transaction details for investors keeping an eye on market trends. As the landscape of digital assets evolves, such significant withdrawals underscore the importance of staying updated with the latest Metalpha news and Ethereum updates. With the volatility of the crypto market, movements like these can often signal shifts in investor confidence and asset management strategies.

In a noteworthy development, the cryptocurrency firm Metalpha has made a substantial withdrawal of Ethereum from the Kraken exchange, further stirring interest in the digital asset realm. This action aligns with broader narratives in the crypto market, especially as traders and investors scrutinize the movements of major players. The recent movement of 6,000 ETH not only reflects Metalpha’s strategic interests but also invites attention to pertinent Ethereum updates that could impact market dynamics. As users dive into crypto market news, understanding each withdrawal’s context becomes crucial for informed trading decisions. The transaction serves as a reminder of the fluid nature of digital finance, compelling stakeholders to remain vigilant and engaged.

Recent Developments in the Crypto Market: Metalpha Withdraws ETH

In a significant move that has caught the attention of crypto enthusiasts, Metalpha recently withdrew a substantial sum of 6,000 ETH from the Kraken exchange, translating to a notable value of $18.67 million. This transaction, occurring on January 9, 2026, is more than just a transfer of digital assets; it reflects the ongoing volatility and dynamism of the cryptocurrency market. Such withdrawals can often signal a strategic shift in a company’s operation or investment strategy, especially in a space known for its rapid changes.

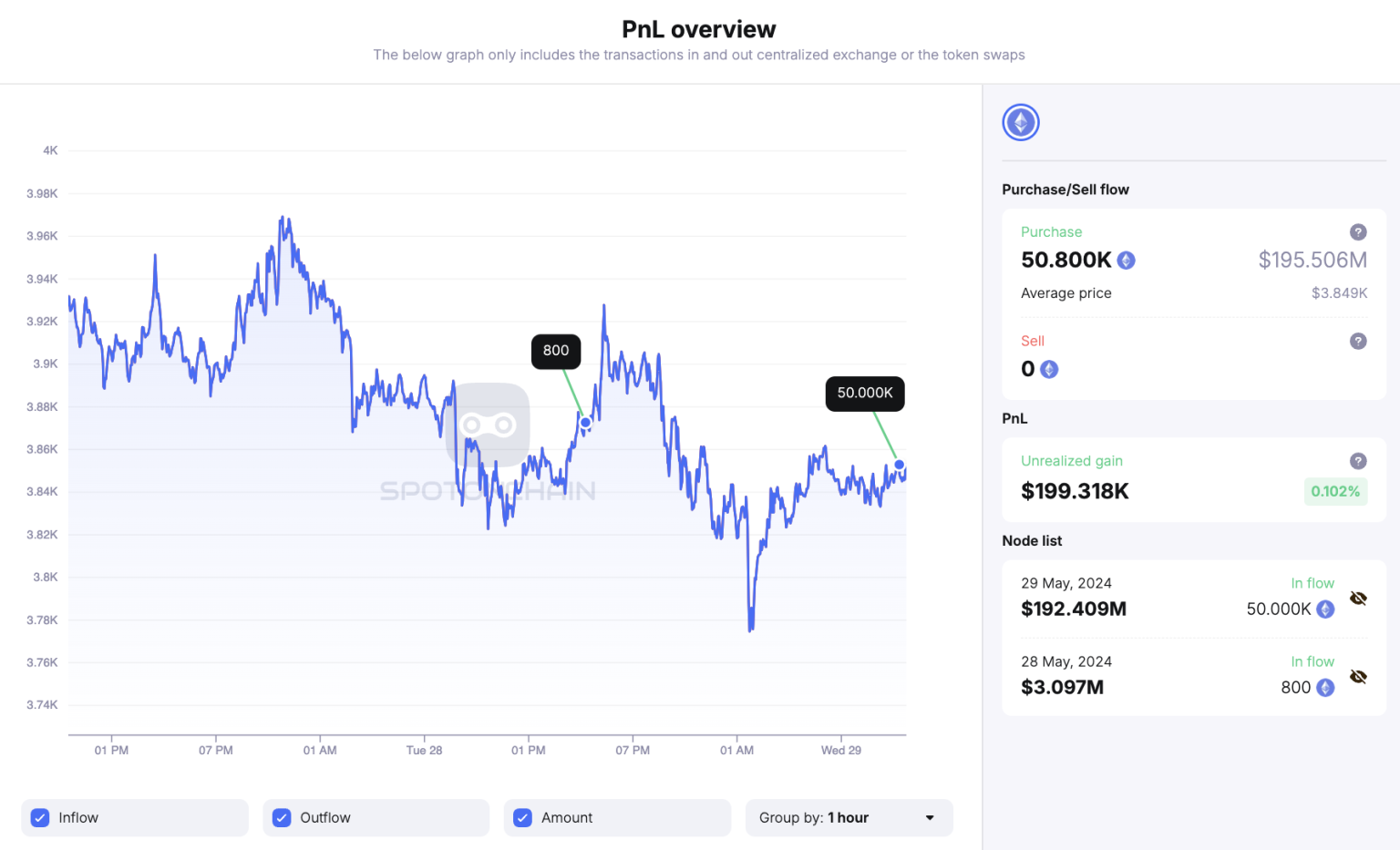

The withdrawal by Metalpha comes amid a backdrop of fluctuating Ethereum values and broader market trends. Keeping up with the latest arm crypto news reveals how such large transactions can impact trading sentiments and, consequently, price movements within the Ethereum ecosystem. As market participants analyze these developments, tools like Lookonchain monitoring provide insight into on-chain activities, helping traders stay informed about potential shifts in market dynamics.

Understanding ETH Transaction Details: What They Mean for Investors

Transaction details like those of Metalpha’s recent ETH withdrawal are crucial for understanding how large assets are moved within the crypto ecosystem. When Metalpha transferred 6,000 ETH from Kraken, it didn’t just represent a significant quantity of Ethereum; the transaction itself highlights the intricate operational decisions within the crypto space. Investors should always analyze such transactions to gauge confidence levels in Ethereum and the overall stability of the market.

Moreover, these transaction details are critical in evaluating the motivations behind withdrawals. If crypto companies or institutional investors are rapidly liquidating their assets, it could hint at upcoming market corrections. Conversely, large stakes being moved for long-term holding might project confidence in Ethereum’s future performance. Staying updated with Ethereum updates, and analyzing transactions like Metalpha’s can empower investors with the knowledge to make informed decisions in an ever-evolving market.

The nuances of Ethereum transactions also provide insight into liquidity positions and can affect ETH prices. Therefore, keeping a watchful eye on both news related to companies like Metalpha and regular updates on Ethereum technology will aid in better understanding future market trends.

Kraken Exchange and Its Role in the Cryptocurrency Ecosystem

Kraken, as one of the leading cryptocurrency exchanges, plays a pivotal role in enabling transactions, trading, and liquidity for various cryptocurrencies, including Ethereum. The recent withdrawal of 6,000 ETH by Metalpha from Kraken draws attention to the exchange’s significance in facilitating large trades and withdrawals within the digital asset landscape. Kraken’s reliability and robust trading platform make it a preferred choice for many institutional players looking to manage their cryptocurrency investments.

For investors and traders alike, knowing more about how to use Kraken efficiently can enhance their trading strategies. With features like staking, futures, and various trading pairs, Kraken is not only a platform for transactions but a comprehensive crypto management tool. Users should regularly keep abreast of the latest Kraken withdrawal news and exchange updates to maximize their trading potential and understand market movements influenced by such substantial withdrawals.

Market Reactions to Metalpha’s Crypto Transactions

The reaction from the crypto community and investors regarding Metalpha’s withdrawal can be indicative of broader market sentiment. Large withdrawals like the recent 6,000 ETH from Kraken can sometimes lead to price fluctuations, as market participants assess the implications of such transfers. It raises questions about potential market strategies Metalpha might pursue with those funds, especially in relation to ongoing Ethereum developments.

Moreover, reactions to such news stories often highlight the importance of liquidity and market depth, which are essential components for cryptocurrency traders. Studying how the market responds to Metalpha’s ETH transactions can provide insights into trader psychology, potential buying opportunities, and an understanding of whether similar withdrawals may lead to negative or positive price adjustments for Ethereum and other altcoins.

Ethereum Updates: Tracking the Trends and Future Projections

Staying informed on the latest Ethereum updates is vital for any cryptocurrency investor, especially following significant events like Metalpha’s withdrawal. Ethereum continues to evolve with updates aimed at scaling and improving the network’s functionality, which can have subsequent impacts on its market value. Understanding these developments helps investors visualize how the ETH ecosystem adapts to challenges and opportunities.

Furthermore, market analysts often correlate ETH fundamentals with large transactions, allowing them to predict short-term price movements or long-term trends based on the transaction patterns of major players like Metalpha. Regularly following crypto market news and updates related to Ethereum can aid in making timely investment decisions and maximizing potential returns.

Impact of Metalpha’s ETH Withdrawal on Investor Strategies

When a significant player like Metalpha withdraws 6,000 ETH from Kraken, it prompts a reevaluation of investment strategies among market participants. Investors often scrutinize such movements to deduce potential shifts in the market landscape. Understanding how this withdrawal could alter supply dynamics plays a crucial role in shaping trading strategies for both short-term traders and long-term holders alike.

Additionally, large withdrawals may lead to speculations about future investments, further impacting ETH’s position in the market. Investors who recognize these patterns can position themselves strategically in anticipation of price swings, contributing to informed decision-making. Thus, keeping tabs on sudden transactions and understanding their implications can empower traders in navigating volatility in the cryptocurrency world.

The Importance of Monitoring Large Transactions in Crypto

Monitoring large transactions, such as Metalpha’s withdrawal of 6,000 ETH, is essential for understanding the broader market behavior in cryptocurrencies. Transactions of this magnitude can significantly alter the liquidity of assets and influence market movements. By staying vigilant regarding these major transactions, investors can glean insights into potential market shifts or the sentiments surrounding certain cryptocurrencies.

For cryptocurrency traders, knowledge gained from tracking large withdrawals and deposits becomes part of their trading toolkit. Establishing protocols for observing these activities can improve overall market awareness and responsiveness, allowing traders to navigate fluctuations with greater agility. Therefore, meticulous monitoring of large crypto transactions becomes a fundamental practice for anyone serious about investing in the space.

Evaluating Institutional Interest in Ethereum through Metalpha’s Actions

The actions of firms like Metalpha serve as a lens through which investors can evaluate institutional interest in Ethereum. The recent withdrawal of 6,000 ETH from Kraken should prompt conversations about how institutional actors influence market perceptions and stability. High levels of engagement such as this signal confidence in Ethereum, perhaps foreshadowing upcoming trends in institutional adoption.

Analyzing institutional movements provides retail investors with the opportunity to align their strategies with broader market sentiments. Observing how firms such as Metalpha leverage their crypto holdings can be informative for capitalizing on market opportunities. Understanding institutional behaviors in relation to Ethereum can help individual investors better strategize amidst the evolving crypto landscape.

Future Implications of Metalpha’s ETH Withdrawal for Cryptocurrency Valuations

The implications of large withdrawals on cryptocurrency valuations cannot be understated. Metalpha’s recent action of withdrawing 6,000 ETH from Kraken raises critical discussions about the future price trajectories of Ethereum. Market analysts and investors alike watch for possible sell-off patterns following such withdrawals, as they can set a precedent for future trading behaviors across the cryptocurrency market.

Moreover, understanding the long-term consequences of such institutional actions requires a keen analysis of market trends and the overall sentiment surrounding Ethereum. As investors continue to monitor the market dynamics influenced by Metalpha and similar entities, it is paramount to recognize that every transaction may carry weight in forecasting Ethereum’s valuation and market posture.

Frequently Asked Questions

What is the significance of Metalpha’s recent withdrawal of 6,000 ETH from Kraken?

Metalpha’s withdrawal of 6,000 ETH from Kraken represents a significant amount of cryptocurrency, valued at approximately $18.67 million. This move is noteworthy in the crypto market news as it highlights Metalpha’s strategies in managing its Ethereum holdings.

How does the Metalpha withdrawal impact the Ethereum market?

The withdrawal of 6,000 ETH by Metalpha may influence the Ethereum market by affecting liquidity on exchanges like Kraken. Such large transactions can signal changes in market sentiment, attracting attention from traders and analysts following recent Ethereum updates.

Are there any specific details about the ETH transaction related to Metalpha and Kraken?

Yes, Metalpha withdrew 6,000 ETH from Kraken. This transaction, monitored by Lookonchain, occurred recently and is reported to be worth $18.67 million, which underscores the scale of crypto transactions being executed in the current market.

What should investors know about Metalpha’s latest move with ETH?

Investors should note that Metalpha’s decision to withdraw 6,000 ETH from Kraken could indicate a shift in their investment strategy or market positioning, as seen in various crypto market news analyses, potentially providing insight into future Ethereum performance.

How frequently does Metalpha engage in significant ETH transactions like this?

While the specific frequency of Metalpha’s large ETH transactions isn’t publicly documented, this recent withdrawal of 6,000 ETH from Kraken adds to the narrative of their active participation in the Ethereum market, making it a point of interest in investor discussions.

What are the implications of Metalpha withdrawing ETH for general crypto investors?

For general crypto investors, Metalpha’s substantial withdrawal from Kraken may be interpreted as a confidence signal in Ethereum’s future, leading to potential interest in ETH investments. Staying updated with Metalpha news can provide insights into market trends and investment strategies.

| Key Point | Details | Value |

|---|---|---|

| Withdrawal Source | Kraken | N/A |

| Amount Withdrawn | 6,000 ETH | $18.67 million |

| Time of Withdrawal | 3 hours prior to the report | N/A |

| Monitoring Source | Lookonchain | N/A |

| Transaction Address | 0x4a2…b82 | N/A |

Summary

Metalpha withdraws ETH in a significant transaction, pulling out 6,000 ETH from the Kraken exchange, which is valued at approximately $18.67 million. This withdrawal was reported by Lookonchain just hours after it was executed, highlighting Metalpha’s active management of its assets in the volatile cryptocurrency market.

Related: More from Ethereum News | Stock Drops on Mixed Q4 Results | Google Cloud, MoneyGram Join New Privacy Network Bank Initiative