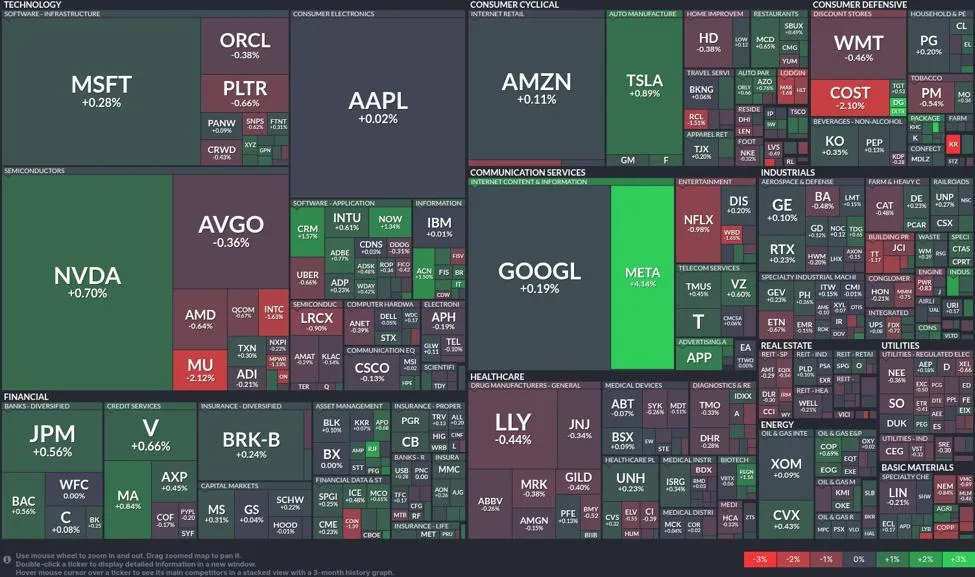

Meta’s Rally Cushions Chip Selloff as Wall Street Rotates; Risk Tone Mixed Across Tech and Financials

US stocks were mixed as a powerful rebound in communication services—led by Meta—offset weakness in semiconductors, keeping risk appetite uneven and rates-sensitive trades cautious.

Market overview

Traders leaned into mega-cap platforms while paring exposure to parts of the chip complex. Meta jumped more than 4%, outpacing broader tech as investors favored advertising-driven cash flows. Semiconductor sentiment was softer, with Micron sliding over 2% even as Nvidia edged up about 0.7%. Financials offered a mild cushion, while consumer cyclicals were largely flat.

Key Points

- Tech bifurcation: Meta’s >4% gain steadied the tape as chip stocks lagged; Nvidia rose ~0.7% while Micron fell ~2.1%.

- Communication services leadership: Alphabet advanced modestly (~0.2%), reinforcing the rotation into ad-driven megacaps.

- Financials firm: JPMorgan and Visa added ~0.6–0.7%, aiding broader indices amid tech dispersion.

- Consumer cyclicals muted: Amazon rose ~0.1%, reflecting cautious discretionary demand signals.

- Macro lens: Split tech performance keeps risk appetite measured; FX and rates traders watch yields and dollar direction for the next impulse.

Sector moves and market texture

Technology: The market’s favorite AI bellwether, Nvidia, ticked higher, but broader semis lagged as investors reassessed cyclical exposure tied to memory pricing, inventory normalization, and capex timing. A softer read on chips typically tempers high-beta equity and FX risk, even when a handful of AI leaders hold up.

Communication services: Meta’s outsized advance underpinned mega-cap concentration, with Alphabet also firmer. Strong engagement, cost discipline, and ad pricing resilience remain core pillars behind the bid for these cash generators.

Financials: Banks and payments were constructive—JPMorgan and Visa climbed roughly 0.6–0.7%—consistent with a calmer rates backdrop and stable credit conditions.

Consumer cyclicals: Amazon was little changed, suggesting ongoing caution toward discretionary demand as markets weigh holiday spending quality against margin discipline.

FX, yields and cross-asset implications

For currency markets, a split tape in US equities tends to keep G10 ranges contained: a chip-led wobble can support the dollar via safe-haven channels, while a mega-cap communications rally can bolster broader risk sentiment. If semiconductors underperform persistently, high-beta FX (AUD, NOK) could lag, while relative resilience in US growth assets would cap downside in the dollar on dips. Rates traders will look to front-end yield moves and Fed path pricing for the next catalyst; tighter equity leadership breadth often coincides with choppy USD and equities-volatility correlations.

What to watch next

- Semiconductor guidance and any updates on memory pricing or AI server demand, which could swing the sector’s risk premium.

- Ad spend trends from big platforms—key for communication services’ leadership durability.

- Rates and the dollar: Shifts in rate-cut expectations can reshape sector leadership and FX risk bias quickly.

- Liquidity into year-end: Thinner conditions can amplify moves across equities, FX and credit.

Strategy takeaways

Positioning appears to favor quality growth with robust balance sheets and clear earnings visibility—an environment where communication services megacaps can outperform. For semis, selectivity remains crucial until visibility improves across inventory and end-market demand. In FX, a cautiously risk-on posture—influent by yields—argues for nimble exposure and discipline around event risk. As always, execution detail and hedging matter more when leadership narrows.

FAQ

Why are semiconductor stocks lagging while some tech names rally?

Semiconductors are navigating a classic cycle reset—balancing AI-driven demand with memory pricing, inventory normalization and capex cadence. That can create drawdowns even as select AI leaders or ad-platform mega caps advance on resilient earnings and cash flow.

What does this split in tech leadership mean for the US dollar?

A softer chip tape can support the dollar via a mild safety bid, while strength in mega-cap platforms supports risk sentiment and can cap USD upside. The net effect often keeps G10 ranges tight until yields or data deliver a clearer macro impulse.

How should equity investors navigate this environment?

Favor quality balance sheets and earnings visibility in communication services and select large-cap tech. In semis, be selective and watch guidance. Financials can provide ballast if credit stays benign and yields remain orderly.

Which FX pairs are most sensitive if chip weakness persists?

High-beta currencies like AUD and NOK typically underperform when cyclicals or semis weaken, while USD and JPY can catch support. The magnitude depends on rates moves and broader risk conditions.

What are the next catalysts to watch?

Company updates from chipmakers, ad spend signals from platform megacaps, US labor and inflation data shaping Fed expectations, and any shifts in Treasury yields. Liquidity into year-end, as BPayNews notes, can also magnify moves across equities and FX.