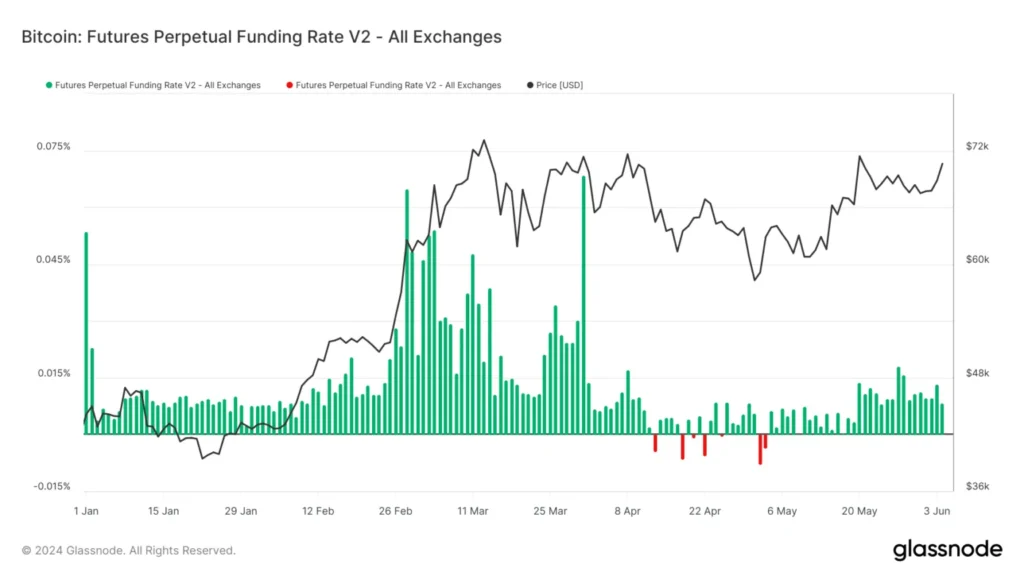

In the ever-evolving landscape of cryptocurrency trading, market sentiment plays a crucial role in guiding investor decisions. Recently, funding rates from both centralized exchanges (CEX) and decentralized exchanges (DEX) have indicated a subtle shift towards a bearish market bias, suggesting a growing inclination among traders toward market neutrality.

Funding rates are a vital component of the crypto trading ecosystem, as they reflect the cost of holding long or short positions in perpetual contracts. When funding rates are positive, it typically indicates that long positions are favored, while negative rates suggest a preference for short positions. The current data reveals that funding rates across various platforms are leaning slightly bearish, hinting that traders are becoming more cautious and possibly anticipating a downturn in the market.

This bearish sentiment could be attributed to several factors, including macroeconomic conditions, regulatory developments, and recent price volatility in major cryptocurrencies. As traders adjust their strategies in response to these influences, the inclination towards market neutrality suggests a desire to mitigate risk rather than chase aggressive gains.

In conclusion, the current funding rate trends signal a noteworthy shift in market sentiment, with traders adopting a more conservative approach. Keeping an eye on these indicators will be essential for investors looking to navigate the complexities of the crypto market effectively.