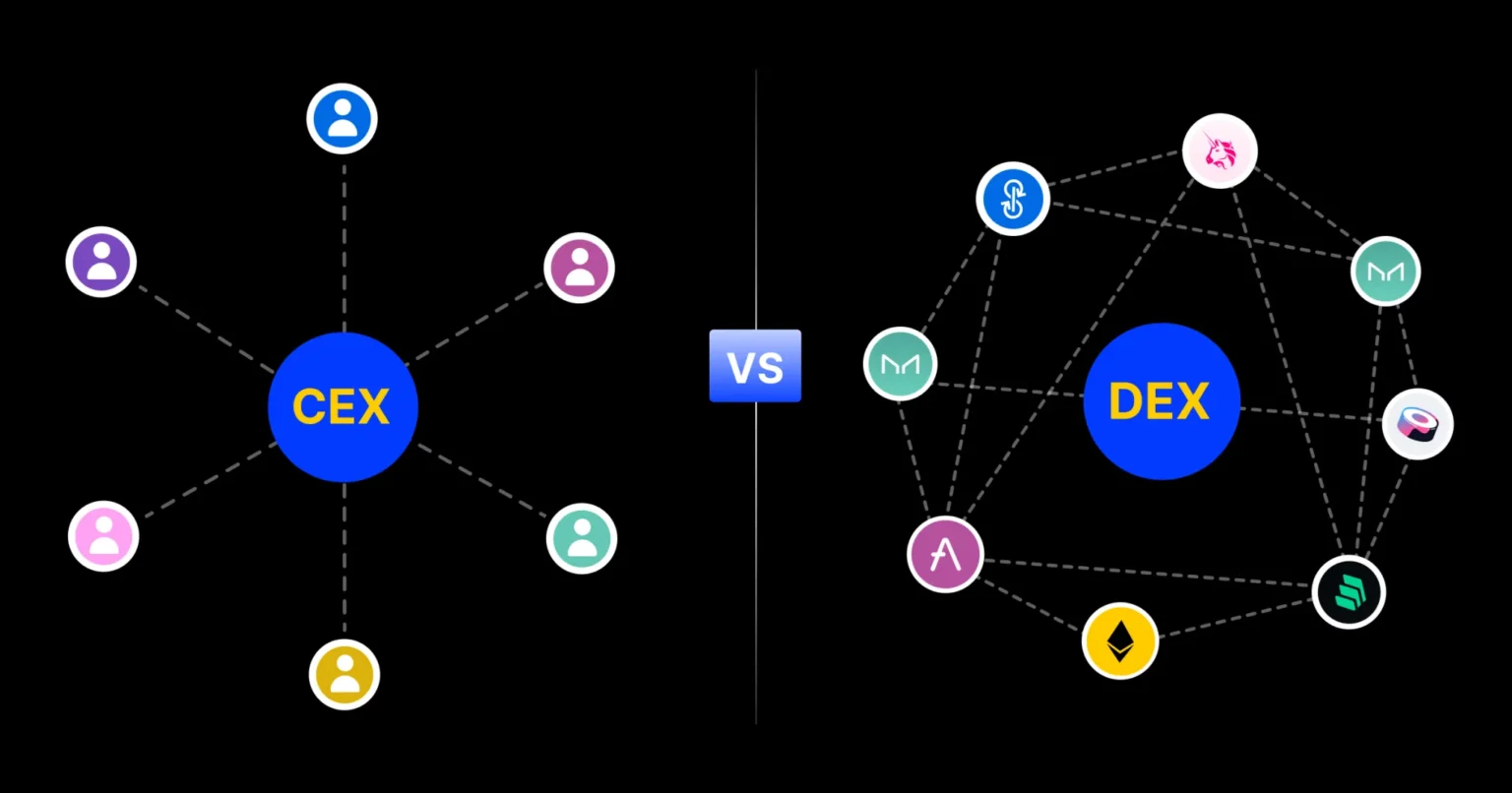

The current funding rates for both centralized exchanges (CEX) and decentralized exchanges (DEX) suggest that the market is shifting closer to neutrality following a recent recovery. This change indicates a stabilization trend in the market dynamics, reflecting a potential balance between bullish and bearish sentiments. The funding rates serve as a key indicator of traders’ expectations regarding future price movements, and the recent rebound may signal a gradual return to equilibrium. Market participants often watch CEX and DEX funding rates closely, as they can provide insights into prevailing market conditions and sentiment. As trading activity resumes, the observed funding rate patterns could influence decision-making among investors and traders alike.

#post_seo_title #image_title

Market Moves Towards Neutrality as CEX and DEX Funding Rates Rebound

Previous ArticleAI Crypto Trading Competition: QWEN Leads with Over 60% ROI

Next Article WLFI Adds 300 Million USD Minted Early Today

Related Posts

Add A Comment