Introduction to the Current Market Landscape

The cryptocurrency market has experienced considerable fluctuations in recent times, particularly concerning the two leading assets: Bitcoin and Ethereum. As of the latest analysis, Bitcoin’s price has seen a resurgence, rising above the $30,000 mark amidst a backdrop of increasing institutional interest. This upswing has been propelled by a series of positive developments, including regulatory clarity in various jurisdictions and renewed adoption by major corporations. Similarly, Ethereum has maintained a robust presence in the market, driven in part by the ongoing expansion of decentralized finance (DeFi) and non-fungible tokens (NFTs).

In terms of pricing, recent weeks have showcased a notable volatility as both Bitcoin and Ethereum encountered support and resistance levels. Bitcoin faced a resistance zone around $32,500 but demonstrated strong support near $28,000 during a brief corrective phase. In contrast, Ethereum has shown resilience, recently oscillating between $1,800 and $2,200, with positive sentiment bolstered by the anticipation surrounding Ethereum 2.0 upgrades. These trends indicate a dynamic market where investors remain cautious yet optimistic about potential long-term gains.

The overall sentiment among investors has been characterized by a balance of fear and greed, reflecting the broader market dynamics. The Fear and Greed Index, a popular tool for gauging investor emotions, has shown signs of near-greed territory, suggesting that a significant portion of the market believes in a continued upward trajectory for both Bitcoin and Ethereum. However, external factors such as regulatory changes, market corrections, and macroeconomic conditions suggest that volatility is likely to persist. This current market landscape provides a critical foundation for understanding the trends and movements that will be analyzed in the subsequent sections.

Recent Developments Impacting Bitcoin and Ethereum

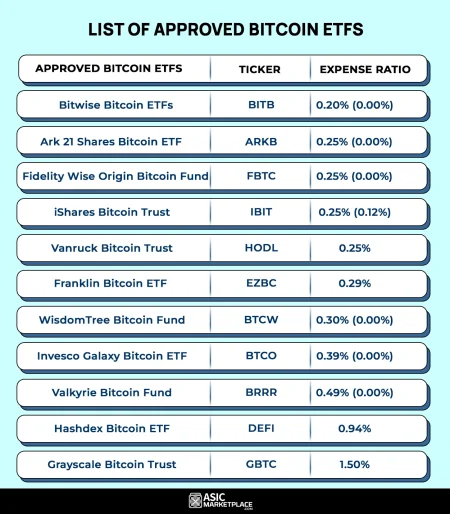

Recent developments in the cryptocurrency landscape have significantly influenced the market dynamics for Bitcoin and Ethereum. Regulatory announcements have emerged as pivotal factors, as governments across the globe continue to refine their stance on digital assets. For instance, the increased regulatory scrutiny in the United States, particularly within the realms of compliance and taxation, has led to a more cautious investor sentiment. On the other hand, positive legislative moves, such as the approval of Bitcoin ETFs by certain regulatory bodies, have sparked optimism and contributed to price increases.

In addition to regulation, technological advancements play a crucial role in shaping the market direction of Bitcoin and Ethereum. The Ethereum network, for example, has recently undergone significant upgrades aimed at improving scalability and transaction speeds. These upgrades not only enhance user experience but also attract developers to build decentralized applications (dApps) on the platform, bolstering its utility in the digital economy. Bitcoin, too, has benefited from improvements focused on transaction efficiency and security, which enhance its positioning as a formidable digital asset in the marketplace.

Macroeconomic factors cannot be overlooked when assessing the trajectory of Bitcoin and Ethereum. Influences such as inflation rates, interest rates, and overall market sentiment heavily weigh on investor behavior. Recent developments in global economic trends, including shifts in monetary policy by major central banks, have created an environment that either fosters or hinders digital asset investment. For example, in scenarios where there is heightened inflationary pressure, Bitcoin is frequently regarded as a hedge, leading to increased demand and subsequently higher price levels.

Taking these elements together—regulatory shifts, technological enhancements, and macroeconomic climates—provides insights into the ongoing evolution of both Bitcoin and Ethereum. Understanding these influences is essential for investors seeking to navigate the complex cryptocurrency market effectively.

Technical Analysis of Bitcoin

The technical analysis of Bitcoin involves evaluating price movements through various indicators, including support and resistance levels, moving averages, and trading volumes. These elements are essential for predicting potential price movements and establishing a clear understanding of Bitcoin’s market direction in the upcoming week.

Support and resistance levels play a vital role in technical analysis. A support level is where buying interest is strong enough to prevent the price from falling further, while a resistance level is where selling interest typically emerges to prevent prices from climbing higher. Currently, Bitcoin has established a support level around $25,000, with resistance observed at the $30,000 mark. Monitoring these levels can provide insights into investor sentiment and market dynamics.

Moving averages are another crucial component of technical analysis. The 50-day and 200-day moving averages are commonly used to determine the trend’s direction. If the 50-day moving average crosses above the 200-day moving average, known as a “golden cross,” it often signals bullish momentum. Conversely, if the 50-day moving average crosses below the 200-day moving average, referred to as a “death cross,” it might indicate bearish sentiment. Currently, Bitcoin is hovering close to the 50-day moving average, which can serve as a critical indicator for the short-term trend.

Trading volume is another factor worth considering. High trading volumes during price increases indicate strong bullish trends, whereas high volumes during price declines suggest bearish trends. Recently, Bitcoin has seen fluctuating trading volumes, which may indicate indecision among traders. Understanding these patterns can assist in forming predictions about potential price movements in the weeks to come.

In conclusion, analyzing these technical indicators provides an essential perspective on Bitcoin’s possible future movements. Maintaining a close watch on support and resistance levels, moving averages, and trading volumes will be critical for investors aiming to navigate the complexities of the cryptocurrency market.

Technical Analysis of Ethereum

The technical analysis of Ethereum provides a multifaceted view of its market direction and potential movements in the coming week. Recent trends indicate that Ethereum has displayed bullish patterns supported by rising trading volumes. This resurgence is particularly noteworthy as it indicates growing investor interest and confidence in Ethereum’s performance, often contrasting with broader market sentiments.

Historically, Ethereum has demonstrated a correlation with key moving averages, specifically the 50-day and 200-day moving averages. Currently, Ethereum’s price is trading above these significant indicators, suggesting a potential continuation of an upward trajectory. Traders often use these moving averages to identify support and resistance levels, and the current position indicates a probable support around the $1,800 mark. Conversely, resistance could be anticipated near the $2,200 level, where price has previously struggled to maintain consistent upward movement.

Additionally, the Relative Strength Index (RSI) offers insights into market conditions for Ethereum. A current RSI above 70 suggests that Ethereum may be approaching overbought territory, signaling caution among traders. Should the RSI dip below 70, this might indicate a consolidation phase or even a pullback, allowing for an opportunity to re-enter positions at favorable prices. Volume analysis further affirms this perspective, revealing increased buying activity which often precedes significant price movements.

Moreover, it is essential to consider the trends in broader macroeconomic factors influencing the cryptocurrency market, including regulatory developments, technological advancements, and market sentiment balances encapsulated by the Fear and Greed Index. By evaluating these elements alongside established technical indicators, traders can make more informed predictions about Ethereum’s price behavior in the upcoming week.

Fear and Greed Index: Understanding Market Sentiment

The Fear and Greed Index is a crucial tool used to evaluate the emotional state of the market, particularly in the highly volatile cryptocurrency sector. This index combines various indicators to assess whether investors are feeling more fearful or greedy at any given moment, which can provide insights into potential market movements. It operates on a scale from 0 to 100, where a lower score indicates market fear, while a higher score suggests a state of greed. Such emotional indicators are significant as they influence trading behavior, and thus, impact the prices of digital assets like Bitcoin and Ethereum.

Understanding the current reading of the Fear and Greed Index is essential for gauging market sentiment. For instance, a reading above 70 could imply that the market is in a state of extreme greed, often leading to overvaluation and a potential market correction. Conversely, a reading below 30 reflects extreme fear, where investors might sell off assets hastily, potentially presenting buying opportunities. This dynamic is particularly relevant for cryptocurrencies, given their notorious susceptibility to market sentiment shifts.

As of the latest update, the Fear and Greed Index is registering a score of 50, indicating a neutral sentiment among investors towards Bitcoin and Ethereum. This score suggests that the market is currently balanced between fear and greed, implying a period of uncertainty. With significant events influencing the crypto ecosystem, investors are likely adopting a wait-and-see approach. Monitoring the Fear and Greed Index can provide valuable context for understanding market trends, and help strategize investment decisions in Bitcoin and Ethereum, greatly influencing future market trajectories.

Implications of Fear and Greed Analysis for Investors

The Fear and Greed Index serves as a crucial indicator for cryptocurrency markets, particularly for prominent assets like Bitcoin and Ethereum. Investors often exhibit psychological tendencies that are influenced by the current market sentiment, which is reflected in the Fear and Greed Index readings. When investors experience fear, they may rush to sell off their holdings, fearing that prices will continue to decline. Conversely, when the index points towards greed, investors might eagerly buy in, expecting further price increases. Understanding these psychological dynamics is essential for making informed decisions in the volatile crypto landscape.

A high Fear reading on the index often corresponds to significant market downturns, which can present strategic buying opportunities for long-term investors. Conversely, a high Greed reading typically precedes price corrections, serving as a signal for investors to reassess their positions and consider profit-taking. Thus, being attuned to the implications of the Fear and Greed Index can help investors avoid making impulsive decisions driven by emotion. The concept of “buy low, sell high” becomes particularly pertinent in this context, as investors need to identify the optimal moments for entering and exiting positions based on market sentiment.

Furthermore, it is important to recognize potential risks associated with trading strategies that heavily rely on fear or greed. Market sentiment can shift rapidly, and reactions based on these feelings may lead to substantial losses when the market reverses unexpectedly. Successful investors tend to adopt a more balanced approach, integrating technical analysis and market fundamentals alongside sentiment indicators. By doing so, they can mitigate risks while capitalizing on market opportunities driven by emotional fluctuations. As such, a prudent investor should strive to maintain a level-headed perspective, leveraging the Fear and Greed Index merely as one of many tools in their trading arsenal.

Market Predictions for Bitcoin This Week

As we assess the market direction for Bitcoin this week, it is essential to integrate both technical analysis and market sentiment in order to formulate predictions accurately. Recent price movements suggest that Bitcoin is currently experiencing a consolidation phase, fluctuating between critical support and resistance levels. The support level is established around $25,000, while the first resistance is observed at approximately $28,500. Investors should monitor these levels closely as they may indicate potential entry or exit points in the market.

Technical indicators such as the Relative Strength Index (RSI) and Moving Averages provide further insights into the probable direction of Bitcoin’s price. Currently, the RSI is positioned near the neutral zone, suggesting neither overbought nor oversold conditions. This neutrality can imply further indecisiveness among traders, possibly extending the consolidation phase. However, should Bitcoin manage to break above the resistance level of $28,500 with significant trading volume, it could signal a potential rally, encouraging bullish sentiment.

Conversely, if Bitcoin’s price declines below the established support level of $25,000, this may prompt a bearish outlook and catalyze selling pressure. If such a scenario unfolds, investors might consider carefully re-evaluating their positions to mitigate risks. Moreover, it is vital for investors to remain vigilant concerning macroeconomic indicators, such as inflation rates and regulatory updates, which can significantly impact market sentiment and potentially alter Bitcoin’s trajectory within the week.

In conclusion, while current indicators suggest a neutral outlook for Bitcoin, its movement near key levels of support and resistance highlights the necessity for investors to remain alert to changes in market sentiment. Keeping track of technical signals will be crucial for making informed decisions regarding entry and exit points during this week.

Market Predictions for Ethereum This Week

This week, Ethereum stands at a pivotal point as market sentiment evolves amidst broader trends influencing cryptocurrency valuations. With Bitcoin’s fluctuating price dynamics often impacting Ethereum’s performance, it is essential to analyze the market predictions specific to Ethereum to provide investors with a clearer perspective. Currently, Ethereum is anticipated to exhibit a trading range between $1,600 and $1,800, dependent largely on external factors such as regulatory news, technological advancements, and investor sentiment.

One major influence on Ethereum’s market direction this week may be linked to developments surrounding Ethereum 2.0 and its transition to a proof-of-stake consensus mechanism. Positive advancements in this area could enhance investor confidence and drive prices higher. Conversely, any setbacks or delays could lead to increased volatility and potential price dips. Additionally, macroeconomic factors, such as interest rate fluctuations and inflation data, continue to play a crucial role in shaping the market landscape for Ethereum.

For investors looking to navigate the potential price movements, maintaining a balanced strategy is advisable. Consider dollar-cost averaging to accumulate Ethereum during price dips rather than trying to time the market, as this can reduce the impact of volatility on overall investment. Moreover, monitoring on-chain data, including changes in active addresses and transaction volumes, can provide deeper insights into Ethereum’s market health and investor sentiment.

In light of these factors, investors should stay informed about global events and market news that could impact Ethereum’s price trajectory. This approach can lead to more informed decisions and potentially profitable outcomes in the weeks to come. Consequently, Ethereum offers both risks and opportunities as it progresses through this uncertain market landscape.

Conclusion: Key Takeaways and Final Thoughts

As we assess the current market condition for Bitcoin and Ethereum, it is essential to synthesize the key insights that emerge from analyzing both cryptocurrencies’ movements within the context of fear and greed. The cryptocurrency market, known for its volatility, often responds sharply to sentiment indicators. Understanding these emotions is vital for investors aiming to navigate this unpredictable landscape effectively.

One of the most significant takeaways is the influence of market sentiment on price fluctuations. When fear predominates, typically seen during market sell-offs or negative news cycles, investors often face heightened anxiety regarding their holdings. Conversely, periods of greed may lead to rapid price appreciation, reflecting a bullish outlook on these cryptocurrencies. Recognizing the emotional undercurrents of the market can empower investors to make informed decisions, either by acting preemptively in fear-driven environments or capitalizing on opportunities during greed-driven rallies.

Additionally, the analysis suggests a need for diversification in investment strategies. Both Bitcoin and Ethereum have shown resilience but also possess unique attributes that can appeal to different investor appetites. While Bitcoin is often viewed as a ‘digital gold,’ Ethereum offers scalability and innovations through its smart contract capabilities. Investors should weigh these characteristics against their risk tolerance and market forecasting skills.

Ultimately, aligning investment strategies with a clear understanding of the fear and greed index may facilitate improved decision-making. A careful analysis of trends, consistently monitoring market conditions, and staying informed of broader economic indicators will aid investors in adjusting their portfolios proactively. In this period of uncertainty, remaining adaptable is paramount to navigating the evolving cryptocurrency landscape successfully.