The recent dismissal of the Mark Cuban cryptocurrency lawsuit has brought significant attention to the legal issues surrounding the NBA billionaire and his involvement in the now-defunct Voyager Digital. Investors claimed that Cuban, along with the Dallas Mavericks, misled them through promotional statements about the cryptocurrency lending platform, which ultimately faced bankruptcy. This case has highlighted the vulnerabilities in the cryptocurrency market and the dangers posed to investors in an already volatile landscape. With Voyager’s bankruptcy, which occurred amidst a broader market downturn, many are left questioning the responsibilities of influential figures like Cuban in the crypto ecosystem. As the dust settles on this lawsuit, the implications for both cryptocurrency investors and legal frameworks in the industry remain a focal point for continued discourse and scrutiny.

The recently overturned legal proceedings against Mark Cuban regarding his endorsement of a collapsing crypto lending platform have sparked a discourse on accountability in the digital currency space. This case, involving claims against both Cuban and the NBA’s Dallas Mavericks, emerged in the wake of Voyager Digital’s filing for bankruptcy protection. The fallout from the lawsuit sheds light on the challenges faced by cryptocurrency backers and raises critical questions about what safeguards exist for investors. As more high-profile personalities engage in the crypto arena, the ramifications of such legal challenges could reshape how endorsements are viewed in the context of financial stability. As the cryptocurrency landscape evolves, these developments will likely influence investor confidence and the regulation of digital assets.

Overview of the Mark Cuban Cryptocurrency Lawsuit

The lawsuit filed against Mark Cuban and the NBA’s Dallas Mavericks was a collective effort from investors who believed they were misled regarding the viability of Voyager Digital, a cryptocurrency lending platform that recently declared bankruptcy. The allegations highlighted that Cuban made a series of misleading statements about Voyager, which was prominent in the crypto landscape prior to its downfall. As the lawsuit aimed to draw attention to the responsibilities of high-profile endorsers in the cryptocurrency sector, it raised important questions about investor protection and the role of celebrity endorsements in volatile markets.

The dismissal of the lawsuit not only marked a significant moment for Mark Cuban but also reflected the broader challenges that investors face in holding influential figures accountable in the rapidly evolving cryptocurrency landscape. With the recent bankruptcy of Voyager Digital, valued at approximately $1.3 billion at its peak, this case underscores the importance of conducting thorough research before investing in cryptocurrencies. The dismissal could also set a precedent for future cases involving celebrity endorsements in crypto, leaving many stakeholders questioning the implications for investor claims and the responsibilities of public figures.

Impact of Voyager Digital Bankruptcy on Investors

The bankruptcy of Voyager Digital had a profound effect on its users and the broader cryptocurrency community. As one of the well-known crypto lending platforms, Voyager allowed users to earn interest on their digital assets and promised attractive returns. However, the collapse not only led to significant financial losses for investors but also raised concerns about the stability and reliability of crypto lending platforms overall. Many users found themselves amidst confusion and uncertainty over the fate of their assets, prompting a wave of investor claims in attempts to reclaim lost capital.

In this context, the repercussions of Voyager’s failure went beyond individual losses, as the incident was emblematic of the risks within the wider cryptocurrency market. The failure of key players in the industry often triggers a domino effect, leading to a heightened sense of insecurity among cryptocurrency investors. The case against Cuban highlighted the need for clear communication and transparency, particularly in the marketing of cryptocurrency services, as the fallout from Voyager’s bankruptcy continues to reverberate throughout the community.

Legal Challenges Facing Crypto Promoters

Legal issues surrounding cryptocurrency promotion have become increasingly prominent as regulatory bodies and stakeholders seek to navigate the complexities of this unregulated market. The case against Mark Cuban illustrates just how vulnerable those who promote crypto-related products can be to legal ramifications. As more investors report losses and pursue legal action against high-profile names in the industry, the landscape for endorsements and sponsorships is increasingly fraught with potential challenges. This case serves as a stark reminder that celebrity status does not shield one from the consequences of misleading investors.

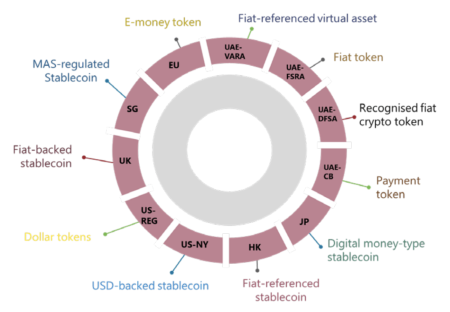

The implications of these legal challenges extend beyond individual lawsuits. They also signal the need for stricter regulations concerning how cryptocurrency projects are marketed and the responsibilities of endorsers in communicating risks to investors clearly. As the market continues to mature, it will be crucial for promoters and influencers to understand their legal obligations, particularly as lawsuits related to misleading or false statements become more common in the wake of high-profile bankruptcies.

Analysis of the Broader Cryptocurrency Market Trends

The dismissal of the lawsuit against Mark Cuban coincides with a turbulent period in the cryptocurrency market, characterized by heightened volatility and scrutiny. Recent events, including the drastic market downturn associated with the Terra blockchain collapse, which wiped out approximately $40 billion in value, highlight the fragility of the current ecosystem. This has forced investors to reevaluate their strategies, placing a premium on due diligence when engaging with emerging technologies and platforms.

Moreover, the ongoing challenges faced by crypto lending platforms like Voyager Digital point to an urgent need for transformative changes in the market. Investors are calling for more robust protections and clearer regulations to prevent fraudulent practices and misleading promotions. As the market evolves, staying informed about such trends and developments is critical for participants, both new and seasoned, in navigating the complex landscape of cryptocurrency investments.

The Future of Cryptocurrency Investments After the Lawsuit

In the wake of the dismissed collective lawsuit, the future of cryptocurrency investments remains uncertain. The case against Mark Cuban illustrated the potential for high-profile investors to be called into question, but it also highlights the challenges that investors face in seeking recourse. As the market finds its footing following significant turmoil, investors must remain vigilant and informed about both the opportunities and risks associated with engaging in cryptocurrency.

Continued investor claims and legal actions could also lead to more stringent regulations, which may ultimately foster a healthier environment for cryptocurrency investments. Industry stakeholders and regulatory bodies are now more aware of the importance of accountability and transparency, which could lead to initiatives aimed at protecting investors from misleading practices. As the industry matures, the combination of legal oversight and informed investing may help to stabilize the cryptocurrency market moving forward.

Mark Cuban’s Response to Legal Allegations

In response to the legal allegations, Mark Cuban has consistently defended his involvement with Voyager Digital, asserting that he provided no false information intentionally. Cuban’s legal team argued that the accusations stem from an understanding of the volatility inherent in cryptocurrency investments. His stance emphasizes the need for investors to conduct their own research rather than relying solely on endorsements from influential figures in the industry.

Cuban’s case showcases a broader conflict between celebrity endorsements and investor accountability. As the legal landscape continues to evolve, it is essential for public figures like Cuban to navigate these waters carefully, ensuring that they communicate the potential risks associated with cryptocurrency investments effectively. The continuing dialogue surrounding these issues will undoubtedly shape the future of promotions in the cryptocurrency space.

Understanding the Dallas Mavericks’ Role in the Lawsuit

The Dallas Mavericks, owned by Mark Cuban, were also implicated in the lawsuit surrounding Voyager Digital, raising questions about the responsibilities of sports franchises in promoting cryptocurrency ventures. By partnering with a crypto lending platform, the Mavericks became part of the larger conversation about the role of professional teams in the increasingly blurred lines between sports, marketing, and cryptocurrency investment. As such, the involvement of high-profile franchises could set significant precedents for future partnerships.

The lawsuit brought attention to the potential risks associated with sports teams endorsing financial products, especially in an industry as volatile as cryptocurrencies. This incident may lead to more stringent guidelines for professional teams in their marketing efforts, as they must consider the implications of exposing fans and investors to investments that can carry significant risks. Ongoing scrutiny around such collaborations may ultimately drive more responsible marketing practices within sports and cryptocurrency.

The Role of Celebrity Endorsements in Cryptocurrency

Celebrity endorsements are a double-edged sword in the cryptocurrency space, as they can effectively draw attention and lend credibility to new projects while simultaneously posing risks for investors. The Mark Cuban lawsuit exemplifies the complexities of accountability when high-profile figures promote financial products that may prove unreliable or fail outright. As the cryptocurrency landscape evolves, so too must the understanding that endorsements do not equate to safety in investment.

Investors must remain cautious and prioritize their research above celebrity endorsements, recognizing the inherent risks associated with investing in cryptocurrencies. The insights from the legal implications of Cuban’s case might encourage industry stakeholders and regulators to refine their approaches to endorsements, promoting more transparency and consumer protection, in order to foster a healthier investment environment.

Approaching Investor Claims in Cryptocurrency

The dismissal of the Mark Cuban lawsuit raises important considerations regarding how investors approach their claims in the cryptocurrency space. Many individuals seeking restitution for lost investments face challenges in navigating the legal terrains associated with cryptocurrency. The case serves as a reminder of the complexities involved when attempting to hold high-profile individuals accountable, especially in an industry that frequently experiences dramatic fluctuations in asset values.

As interest in cryptocurrency continues to grow, the landscape for pursuing investor claims may also need to evolve. Stakeholders could benefit from a clearer framework that outlines how to seek recourse when a financial investment goes awry. Furthermore, fostering dialogue around investor protection rights can empower individuals to make informed decisions and better advocate for themselves in a rapidly changing market.

Frequently Asked Questions

What was the outcome of the Mark Cuban cryptocurrency lawsuit involving Voyager Digital?

The Mark Cuban cryptocurrency lawsuit, which accused him and the Dallas Mavericks of misleading investors regarding Voyager Digital, has been dismissed. The court found no sufficient evidence to support the claims made against Cuban.

Why was the Dallas Mavericks involved in the cryptocurrency lawsuit against Mark Cuban?

The Dallas Mavericks were involved in the lawsuit as they promoted Voyager Digital, a cryptocurrency lending platform that later declared bankruptcy. The lawsuit alleged that both Cuban and the team misled investors about the platform’s stability.

What were the claims made by cryptocurrency investors against Mark Cuban related to Voyager Digital?

Cryptocurrency investors claimed that Mark Cuban made false statements about Voyager Digital prior to its bankruptcy in 2022. These claims centered around allegations of deception regarding the viability of the platform.

How did Voyager Digital’s bankruptcy affect the lawsuit against Mark Cuban?

Voyager Digital’s bankruptcy was a focal point in the lawsuit against Mark Cuban, as the collapse of the platform, which resulted in significant financial losses for investors, led to the allegations of misrepresentation made against him.

What legal issues has Mark Cuban faced regarding cryptocurrency investments?

Mark Cuban has faced legal issues related to cryptocurrency investments, notably the lawsuit connected to Voyager Digital. This case discusses investor claims about his promotion of the now-defunct lending platform.

What impact did the collapse of Voyager Digital have on the cryptocurrency market?

The collapse of Voyager Digital contributed to a larger cryptocurrency market downturn, which was triggered by failures in other projects, such as the Terra blockchain, leading to substantial financial losses for investors.

Are there any ongoing legal disputes related to Mark Cuban’s cryptocurrency endorsements?

As of now, the prominent lawsuit against Mark Cuban regarding Voyager Digital has been dismissed, but any future legal disputes could arise depending on his continued involvement in the cryptocurrency sector.

What lessons can be learned from the Mark Cuban cryptocurrency lawsuit?

The Mark Cuban cryptocurrency lawsuit highlights the importance of due diligence for investors and the need for transparency from promoters of cryptocurrency platforms, especially in light of the risks associated with the volatile market.

| Key Points |

|---|

| Lawsuit Dismissal |

| Accusations against Mark Cuban and the Dallas Mavericks for deceiving investors via Voyager Digital promotion. |

| False statements were allegedly made by Cuban prior to Voyager’s bankruptcy filing in 2022. |

| Voyager Digital filed for Chapter 11 bankruptcy protection in 2022, with $1.3 billion in cryptocurrency assets involved. |

| The collapse of Voyager occurred during a broader market downturn affecting the cryptocurrency industry. |

| The downturn was linked to the failure of the Terra blockchain, leading to a significant loss in market value. |

| Do Kwon, founder of Terra, was sentenced to 15 years in prison amidst this market turmoil. |

Summary

The conclusion of the Mark Cuban cryptocurrency lawsuit marks a significant moment in the ongoing scrutiny of high-profile figures in the cryptocurrency space. This case, which centered around allegations of misleading investors regarding the now-defunct Voyager Digital, highlights the challenges and risks associated with digital asset investments. Despite the dismissal of the lawsuit, the events surrounding Voyager’s bankruptcy and the broader market downturn reflect the volatility and unpredictability of cryptocurrencies. Insights into such legal battles serve to emphasize the importance of due diligence when engaging with crypto-related investments.