| Key Point | Details |

|---|---|

| Incident Date | 2026-01-20 04:34 |

| Attack Target | Makinafi |

| ETH Lost | 1,299 ETH |

| Monetary Value of Loss | Approx. 4.13 million USD |

| Detection | Detected by PeckShieldAlert |

| MEV Builder | 0xa6c2… |

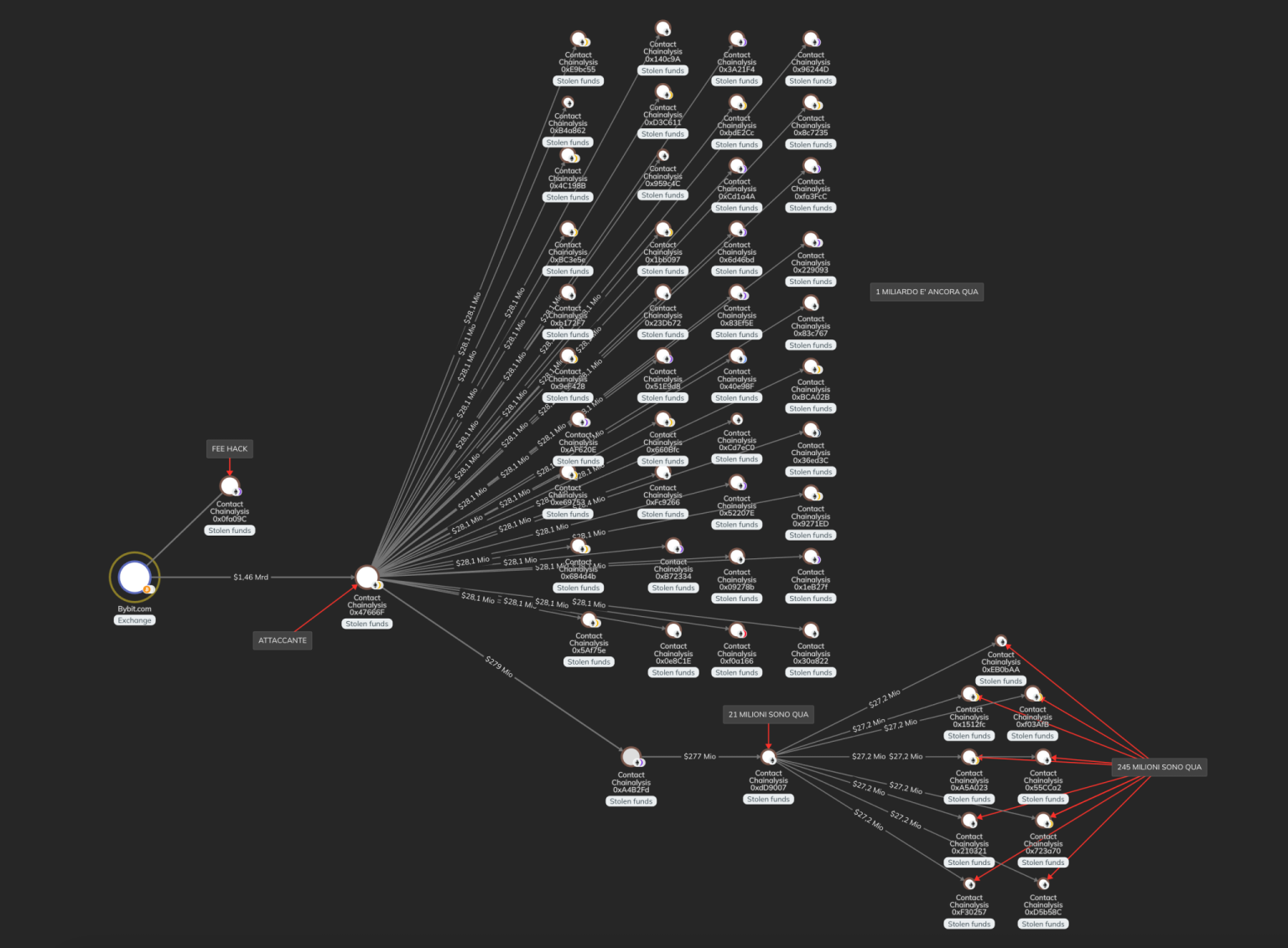

| Stolen Fund Addresses | 0xbed2…dE25 (3.3 million USD), 0x573d…910e (880,000 USD) |

Summary

The Makinafi ETH attack highlights significant vulnerabilities within the cryptocurrency space, resulting in a staggering loss of approximately 1,299 ETH, or 4.13 million USD. This incident underlines the ongoing challenges that platforms face in safeguarding their assets against sophisticated hacking techniques.

The recent Makinafi ETH attack has sent shockwaves through the cryptocurrency community as it highlights the vulnerabilities within decentralized finance platforms. On January 20, 2026, the project suffered a staggering loss of approximately 1,299 ETH, equivalent to around 4.13 million USD, following a calculated assault linked to MEV Builder hacking tactics. This incident has reignited discussions about Ethereum theft and the importance of security measures in crypto assets. As detailed in the latest crypto news, these types of hacks are becoming alarmingly common and pose significant threats to investors and platforms alike. The Makinafi hack serves as a cautionary tale, illustrating the ongoing battle against digital threats and the critical need for robust safeguards in the world of decentralized finance.

In the realm of cryptocurrency, incidents like the Makinafi ETH breach are increasingly prevalent, revealing the harsh realities of digital asset security. This particular hacking event resulted in the theft of a substantial amount of Ethereum, drawing attention to the vulnerabilities that exist for various online finance platforms. Often, attacks like these are executed by sophisticated actors leveraging complex methodologies, such as MEV strategies, to exploit flaws and siphon off valuable assets. The loss of ETH in such attacks underscores the necessity for stronger protective measures and vigilant monitoring systems within the crypto ecosystem. As the landscape evolves, staying informed about these threats is vital for both developers and investors navigating the turbulent waters of cryptocurrency.

The Makinafi ETH Attack: Unveiling the Impact

On January 20, 2026, Makinafi fell victim to a significant security breach, resulting in a staggering loss of approximately 1,299 ETH, equivalent to roughly 4.13 million USD. This incident highlights the persistent vulnerabilities within the cryptocurrency space and the importance of robust security measures. As the crypto industry continues to evolve, such attacks raise critical concerns regarding the safety of Ethereum and other digital assets, making it imperative for users and developers to remain vigilant.

The Ethereum landscape is marred with incidents of theft and hacking, as seen in this latest Makinafi hack. The stolen funds are reportedly being held across two distinct addresses, indicating that the perpetrators have a clear strategy to obfuscate their tracks. News surrounding this incident has been heavily featured in crypto news from January 2026, shedding light on the evolving tactics used by hackers and the financial implications of such breaches on the blockchain ecosystem.

Frequently Asked Questions

What happened in the Makinafi ETH attack in January 2026?

In January 2026, the Makinafi ETH attack resulted in a theft of approximately 1,299 ETH, worth around 4.13 million USD. This attack was orchestrated by exploiting vulnerabilities linked to the MEV Builder.

How much ETH was stolen in the Makinafi hack attack?

The Makinafi hack resulted in the loss of about 1,299 ETH, translating to a financial impact of around 4.13 million USD.

What were the repercussions of the Makinafi ETH theft?

The repercussions of the Makinafi ETH theft include financial losses of 1,299 ETH and significant damage to the platform’s reputation, along with increased scrutiny of security measures in Ethereum-based applications.

What does ‘MEV Builder hacking’ refer to in the context of the Makinafi attack?

In the context of the Makinafi attack, ‘MEV Builder hacking’ refers to the manipulation and exploitation of the Maximum Extractable Value (MEV) strategy during the transaction process, which led to the successful theft of ETH.

What are the addresses associated with the stolen funds from the Makinafi ETH attack?

Following the Makinafi ETH attack, the stolen funds are reported to be stored in two addresses, with one holding 3.3 million USD and the other holding 880,000 USD.

Is there ongoing coverage of the Makinafi ETH attack in crypto news?

Yes, the Makinafi ETH attack has been widely covered in crypto news, particularly in January 2026, as it highlighted security issues in the Ethereum network and the hacking risks associated with MEV tactics.

What measures can be taken to prevent incidents similar to the Makinafi hack?

To prevent incidents like the Makinafi hack, it is essential to enhance security protocols, conduct regular audits, and implement better monitoring mechanisms to detect and mitigate potential vulnerabilities in Ethereum applications.

What can users learn from the Makinafi ETH attack?

Users can learn about the importance of security in crypto platforms, the risks of Ethereum thefts, and the need to stay informed about potential vulnerabilities and news related to technological exploits like the Makinafi hack.