Risk Appetite Splinters as China Chip Stocks Slide on Nvidia Sales Talk; Crypto ETFs See $1.2B Outflows, Futures Rebound

Key Takeaways

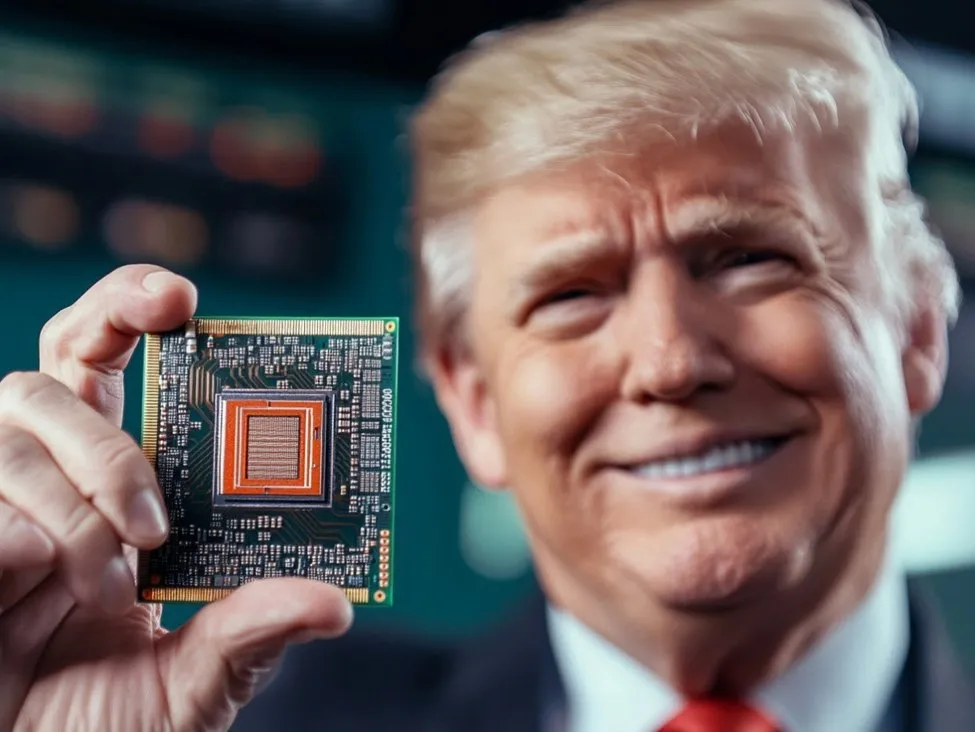

Chinese semiconductor shares fell to multi-month lows after a Reuters report said Washington is considering allowing Nvidia to sell H200 artificial-intelligence chips to China, stirring fresh uncertainty around the competitive landscape and export controls. The risk-off impulse bled into digital assets where Bitcoin and Ether ETFs saw more than $1.2 billion in net outflows, even as US equity futures bounced on hopes the holiday shopping season can offset November’s drawdown.

AI chips: Chinese makers hit as Washington weighs Nvidia H200 sales Chinese chipmakers slumped as traders recalibrated the policy path and market positioning for mainland AI hardware providers. The prospect of a limited resumption of Nvidia shipments to China—if confirmed—could temper demand for local alternatives and reshape liquidity flows into the sector. Investors also weighed remarks from South Korea’s trade minister that Seoul may coordinate with Taiwan in talks on US chip tariffs, with US officials signaling potential implementation delays. Korea’s new arrangement aims to ensure it does not face harsher terms than Taipei, an attempt to reduce policy asymmetry across regional supply chains.

Crypto flows reverse as retail retreats Bitcoin- and Ether-linked ETFs suffered more than $1.2 billion in combined outflows, with about $523 million exiting BlackRock’s product, indicating a decisive swing in near-term risk appetite and positioning. The bleed underscores elevated FX and cross-asset volatility sensitivity to liquidity conditions; systematic and retail-driven de-risking often accelerates when price momentum turns. Spot crypto prices steadied in thin liquidity, but the flows suggest a fragile near-term demand backdrop.

Rates, gold and equities: mixed signals for Q4 risk Gold held steady as rate markets priced roughly 60% odds of a near-term Federal Reserve cut, keeping real-yield dynamics supportive but indecisive. Dow futures rose about 200 points as traders looked for resilient holiday consumption to cushion November’s losses. Still, a survey suggesting US workers desire roughly $70,000 more annual income for financial stability—and that 44% cannot cover a $1,000 medical expense—highlights potential headwinds to discretionary spending as excess savings fade and credit conditions tighten.

Policy watch: committee constraints temper Fed pivot hopes The Wall Street Journal’s Nick Timiraos cautioned that even a change in Fed leadership would not guarantee rapid rate cuts, citing the Federal Open Market Committee’s internal dynamics and historical instances where chairs lost key votes. Markets remain sensitive to headline risk: a policy pivot requires committee consensus, not just leadership intent, a nuance that continues to anchor front-end yield expectations and cap aggressive easing bets.

Market Highlights – China chipmakers drop to multi-month lows on talk the US may allow Nvidia to sell H200 chips to China. – Bitcoin and Ether ETFs post $1.2B+ in outflows; $523M exits BlackRock’s fund, signaling retail de-risking. – Dow futures up about 200 points as traders eye holiday spending to offset November weakness. – Gold steady with ~60% probability of a near-term Fed cut priced into rates; real yields remain pivotal. – Seoul signals cooperation with Taipei on US chip tariff negotiations; US may delay implementation.

What does potential H200 approval mean for markets? A limited allowance for Nvidia to ship H200 chips to China could reprice competitive expectations for Chinese AI chipmakers and ease some supply frictions for Chinese buyers. Equities may react asymmetrically: global AI leaders could see sentiment support, while domestic Chinese substitutes face pressure.

Are crypto ETF outflows a capitulation signal? Not necessarily. The $1.2B+ outflows reflect a sharp swing in short-term positioning and weaker retail participation. Confirmation would require stabilization in price, narrowing discounts to NAV, and a turn in net flows across multiple issuers.

How do Fed cut odds affect gold and equities? A roughly 60% probability of a near-term cut supports gold via lower real yields and weaker opportunity costs. For equities, easing expectations can bolster multiples, but earnings resilience and consumer demand remain the gating factors.

What’s the latest on US chip tariffs and Asia supply chains? South Korea is negotiating terms in tandem with Taiwan and has secured an assurance that it won’t face worse conditions than Taipei. US officials have signaled potential delays, reducing near-term execution risk for regional exporters.

This article was produced for global investors by BPayNews’ markets desk.