This morning, the crypto community was abuzz with news of the Ma Ji Da Ge liquidation, as major positions were wiped out. Reports from Odaily Planet Daily, citing data from Hyperbot, reveal that both BTC and PUMP long positions held by Huang Li Cheng faced full liquidation. The ripple effects extend beyond Bitcoin, with partial liquidations impacting his HYPE and Ethereum (ETH) positions as well. With a staggering weekly trading win rate of only 27%, the performance of his investments has left many wondering about the implications for future trading strategies. In the world of crypto liquidation details and performance metrics, understanding incidents like the Ma Ji Da Ge liquidation is crucial for traders aiming to navigate this volatile landscape.

In recent trading activities, the unexpected liquidation affecting Ma Ji Da Ge has captured the attention of crypto enthusiasts and investors alike. This incident highlights the challenges associated with high-leverage trading in the cryptocurrency market, particularly regarding digital assets like BTC and PUMP. Meanwhile, HYPE token performance and Ethereum long positions have also shown vulnerability amid these market fluctuations. As the trading week winds down, investors look to assess their weekly trading win rate while remaining informed on the latest BTC liquidation news. Such events underscore the importance of analyzing liquidation details, as they can significantly impact the overall trading environment.

| Key Points |

|---|

| Ma Ji Da Ge’s BTC and PUMP positions liquidated |

| Liquidation occurred early this morning |

| Partial liquidation of HYPE and ETH long positions |

| Current ETH position: 600 ETH at 25x leverage |

| ETH liquidation price: $1788.9 |

| Current HYPE position: 26,500 HYPE at 10x leverage |

| HYPE liquidation price: approximately $32.47 |

| Weekly performance: 3 wins and 8 losses |

| Win rate: 27.27% |

| Weekly net loss of approximately $286,000 |

Summary

Ma Ji Da Ge liquidation highlights the volatility and risks associated with leveraged trading. This incident showcases how quickly market conditions can change, leading to significant losses. With a weekly win rate of just 27% and considerable financial losses, it serves as a cautionary tale for traders engaging in similar strategies.

Understanding Ma Ji Da Ge’s Liquidation Impact

The recent liquidation of Ma Ji Da Ge’s BTC and PUMP long positions significantly highlights the risks involved in crypto trading. With a leveraged trading approach, particularly seen in his handling of Ethereum long positions, traders expose themselves to high volatility, which can lead to substantial financial losses. The early morning liquidation serves as a stark reminder of the market’s unpredictable nature, as even experienced traders can find their positions compromised during sudden price movements.

Liquidation events in the cryptocurrency domain can have far-reaching impacts on the overall market sentiment and performance. For instance, when high-profile traders like Ma Ji Da Ge experience liquidations, it often triggers a wave of sell-offs or adjustments in positions by other traders, potentially resulting in a market dip. Moreover, understanding these liquidation details can enhance risk management strategies for other cryptocurrency investors. They serve as cautionary tales that reinforce the importance of well-informed trading practices.

Analyzing the Performance of HYPE Token Amid Liquidations

Despite the recent challenges faced by Ma Ji Da Ge, the performance of HYPE tokens continues to be a focal point for traders. The recent partial liquidation of Ma Ji Da Ge’s HYPE long position indicates that while he remains optimistic about the token, the volatility in the market can quickly turn advantageous positions into liabilities. Traders often monitor such performance data closely to gauge market movements and make informed decisions on their investments.

The fluctuations in HYPE’s valuation are influenced by various factors, including market trends and trading volume. Keeping an eye on HYPE token performance is crucial for those engaging in speculative trading. Data analytics can reveal trends that may suggest potential rebounds or downturns, offering insights into timing and strategy for both new and seasoned traders in the crypto landscape.

Weekly Trading Win Rate Insights

Ma Ji Da Ge’s weekly trading win rate of just 27% underscores the unpredictable nature of cryptocurrency trading. This statistic sheds light on the challenges traders face, particularly when leveraging their positions. A win rate below 30% indicates that a trader has to manage their positions carefully, ensuring that the profitable trades outweigh the losses to maintain a sustainable trading routine.

Additionally, a low weekly win rate may provoke traders to reassess their strategies. In cryptocurrencies, optimal timing and market analysis become paramount, especially in unpredictable climates. For Ma Ji Da Ge, with this week resulting in significant losses totaling approximately $286,000, it prompts a deeper evaluation of trading techniques and the potential adjustments needed to enhance future performance.

The Role of Liquidity in Ethereum Trading

Liquidity plays a fundamental role in the trading of Ethereum and other cryptocurrencies, influencing price stability and investor confidence. In the case of Ma Ji Da Ge, the current liquidation of his Ethereum long position emphasizes the importance of sufficient liquidity and understanding market demand. Ethereum’s capacity to handle significant volume swings showcases its robust trading ecosystem, facilitating transactions even during turbulent conditions.

For traders, recognizing how liquidity affects Ethereum’s price action can be crucial for making educated trading decisions. Adequate liquidity ensures more stable price movements and potentially mitigates the risk of sudden liquidations. Monitoring liquidity levels could provide insights into entry and exit points, ultimately enhancing the trader’s success rates in the market.

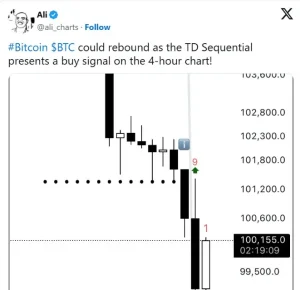

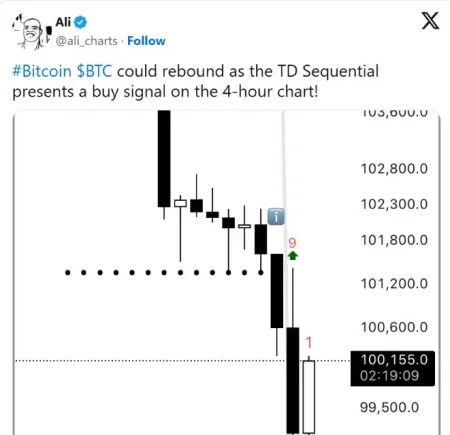

Exploring BTC Liquidation News and Market Trends

BTC liquidation news is a critical aspect for traders who stay updated in the rapidly changing crypto market. The recent events surrounding Ma Ji Da Ge’s liquidation highlight the inclinations of Bitcoin’s price and wider market trends. Keeping abreast of such liquidation scenarios not only influences investor sentiment but also provides a clearer picture of market dynamics that can impact future trading strategies.

Understanding how BTC liquidations tie into market movements is essential for traders. When large positions are liquidated, it often leads to price corrections that can create opportunities for those capable of reading the market accurately. Monitoring BTC liquidation details is thus vital for those looking to capitalize on potential dips and re-establish stable trading practices.

Learning from Liquidation Outcomes in Crypto Trading

Learning from past liquidation outcomes is key for any trader looking to succeed in the cryptocurrency landscape. The recent liquidation experienced by Ma Ji Da Ge provides valuable lessons regarding risk management and strategic positioning. Each trading experience offers insights that can inform future decisions, particularly about how leverage can dramatically amplify both gains and risks in the crypto environment.

Incorporating lessons from liquidations into trading strategies enables investors to build resilience in their approaches. Be it through stricter stop-loss measures or more comprehensive risk assessments, adjusting for what was learned can help traders navigate the unpredictability of markets like cryptocurrencies. This ensures a more disciplined method in handling further trades and potentially improving the overall win rate.

Market Volatile Behavior Affecting Long Positions

Market volatility is an inescapable reality for traders managing long positions in cryptocurrencies. The fluctuations can arise from a myriad of factors, including fluctuating investor sentiment, macroeconomic changes, and specific events impacting particular cryptocurrencies. For example, Ma Ji Da Ge’s experience with liquidating both BTC and Ethereum positions emphasizes how agile traders must be to adapt to rapid market shifts.

Moreover, traders often develop strategies specifically designed to cushion against the adverse effects of such volatility. Adopting diverse positions including shorter durations, setting realistic profit targets, and employing risk-calibrated leveraging tactics can drastically improve a trader’s resilience against sudden shifts. An awareness of volatility not only supports better decision-making but also aids in setting acceptable limits to long positions.

Future of Crypto Trading and Implications of Leverage

The future of crypto trading is poised to be dynamic, particularly with the continued discussion surrounding leveraged trading. Traders like Ma Ji Da Ge, who operate with significant leverage, need to navigate carefully as the market becomes increasingly competitive and unpredictable. Understanding the implications of leverage is crucial for maintaining a viable trading operation.

As more traders enter the crypto space, leveraging practices will likely evolve, incorporating sophisticated risk management tools to protect against similar liquidation scenarios. Enhanced knowledge sharing and improved technological tools can enhance strategic planning, ultimately fostering a more sustainable trading environment where leverage is used thoughtfully and effectively.

Tracking Trends in Ethereum and HYPE Token Markets

Understanding the market trends associated with Ethereum and HYPE tokens is crucial for traders looking to capitalize on nascent opportunities. The landscape is constantly shifting, influenced by regulatory news, technological advancements, and shifts in institutional investment. Traders must remain vigilant to track these trends effectively, enabling them to make informed decisions that align with market forecasts.

Market analysis tools can provide traders with the necessary data to evaluate ongoing trends deeply. Utilizing analytics and monitoring of both Ethereum and HYPE token performance allows traders the ability to foresee shifts, thus improving their chances of success. This diligent approach toward market tracking is vital as cryptocurrencies continue to garner attention from a broader audience on a global scale.

Frequently Asked Questions

What happened to Ma Ji Da Ge’s BTC long positions during liquidation?

This morning, Ma Ji Da Ge’s BTC long positions were fully liquidated, highlighting the volatility in the crypto market. Reports indicate that this liquidation was part of a broader trend affecting various cryptocurrencies, including Ethereum.

How did the liquidation impact Ma Ji Da Ge’s weekly trading win rate?

The liquidation event contributed to Ma Ji Da Ge’s weekly trading win rate, which now stands at only 27.27%. This indicates a challenging trading environment, with 3 profitable trades out of 11 positions closed.

What can we learn from Ma Ji Da Ge’s ETH long positions and their liquidation details?

Ma Ji Da Ge’s ETH long positions faced partial liquidations, which underscore the risks associated with leveraged trading. Currently, their 25x leverage position holds 600 ETH, with a critical liquidation price set at around $1788.9.

What are the implications of the HYPE token’s performance following the liquidation?

Following the liquidation, the performance of the HYPE token has come into focus, especially with a 10x leveraged position of 26,500 HYPE that carries a liquidation price near $32.47. Investors should monitor its movement closely.

Why did Ma Ji Da Ge experience a net loss of $286,000 this week?

Ma Ji Da Ge’s net loss of approximately $286,000 this week can be attributed to multiple liquidations across BTC and Ethereum positions. The high leverage used in trading has amplified the impact of market fluctuations.

What strategies could Ma Ji Da Ge employ to improve their weekly trading win rate?

To improve the weekly trading win rate, Ma Ji Da Ge could consider reducing leverage on positions, diversifying trades, or employing risk management strategies to mitigate potential losses during volatile market conditions.