European Markets Wrap: Stocks and Crypto Fall Amid Weakening Risk Appetite

European stocks and cryptocurrencies faced a downtrend today as investor sentiment weakened, leading to an overall softening in risk appetite. This pivot is largely attributed to mounting concerns over global economic stability, inflation trends, and tightening monetary policies from leading global central banks.

A Closer Look at European Stock Markets

Major indices across Europe ended the day in the red. The Stoxx Europe 600, a key benchmark tracking a broad spectrum of European equities, dropped by 1.2%, reflecting a broad market pullback. National indices also reported losses, with Germany’s DAX, France’s CAC 40, and the UK’s FTSE 100 declining by 1.4%, 1.1%, and 0.9%, respectively.

Sector-specific analysis showed that tech and industrial stocks were among the hardest hit, possibly due to looming concerns over interest rate hikes, which tend to disproportionately affect high-growth companies. Moreover, the automotive sector also suffered due to lingering supply chain issues and fears of decreased consumer spending power in the face of rising inflation.

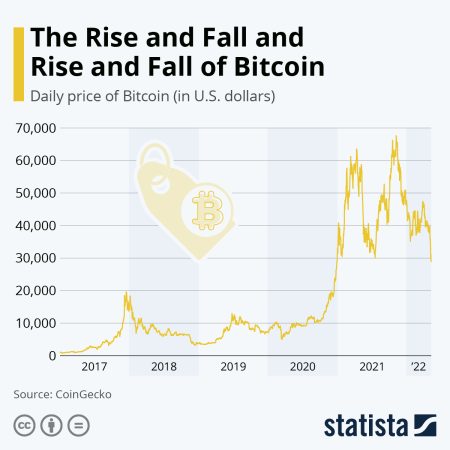

Crypto Market Experiences a Downturn

In the realm of cryptocurrencies, major currencies like Bitcoin and Ethereum saw notable declines, dropping by approximately 5% and 7%, respectively. The crypto market’s downturn can be attributed to the same macroeconomic indicators impacting the stock markets, coupled with recent regulatory news hinting at tighter controls on digital currencies in several countries.

Underlying Economic Concerns

This cautious, risk-off investor mentality has been fueled by a variety of factors. Top of the list is the ongoing inflationary pressure, which has proven to be more than just transitory. With the European Central Bank (ECB) and other central banks hinting at continued interest rate hikes to combat inflation, investors are reevaluating their positions in riskier assets.

Political tensions and geopolitical conflicts also continue to cast a shadow over the market. These situations tend to bring about market volatility and uncertainty, prompting a flight to safer, more stable investments.

The Fed and Monetary Policy Influence

The U.S. Federal Reserve’s recent statements regarding future interest rate adjustments have also played a critical role in shaping market dynamics, not only domestically but globally. European markets, much like their global counterparts, often react to policy changes in the U.S., which still remains a significant bellwether for global financial health.

As the Fed suggested a possible continuation of its rate hikes, markets worldwide are bracing for a potential slowing of economic activities, which inversely affects market performance, including in Europe.

Looking Ahead

Moving forward, analysts recommend that investors adopt a cautious approach. Diversifying investment portfolios and prioritizing sectors that can withstand economic downturns, such as utilities and consumer staples, might prove prudent. Additionally, keeping an eye on monetary policies and their implications will be crucial for making informed investment decisions.

As always, while the markets might be facing a turndown, each phase also opens up new opportunities for keen investors. Positioning for the long-term, considering defensive stocks, or exploring alternative investments might just be the key to navigating through these turbulent times.

In conclusion, today’s market performance is a stark reminder of the interconnectedness of global economies and the cascading effect of macroeconomic policies and global events on local markets. While the immediate outlook might seem bearish, understanding these dynamics and strategizing accordingly could mitigate losses and potentially lead to profitable outcomes.