LIT pre-market contracts are making headlines as they have recently surged past the significant threshold of 3 USDT, reflecting a noteworthy trend in the cryptocurrency market. This rise is a strong indicator of increasing investor confidence and aligns with the broader USDT cryptocurrency news landscape. With changing dynamics in OKX market trends, traders are closely observing how LIT’s price analysis could impact the performance of crypto assets. Analysts suggest that these movements might be tied to a renewed adherence to Web3 financial logic, making it imperative for investors to stay informed. As the market evolves, understanding LIT pre-market contracts could offer valuable insights into future trading strategies.

In the realm of cryptocurrency, early trading agreements known as LIT pre-market contracts have recently garnered attention due to their price exceeding 3 USDT. This uptick signals a potential shift in market sentiment, coinciding with key developments in the USDT and overall crypto market performance. As discussions around digital assets and their behaviors intensify, the analysis of LIT’s trajectory becomes essential for investors keen on navigating the latest trends. The convergence of market trends from platforms like OKX and the emerging framework of Web3 adds layers of complexity and opportunity in the trading landscape. Recognizing these elements can empower traders to better interpret price movements and assess the viability of their investment choices.

Analysis of LIT Pre-Market Contracts Surpassing 3 USDT

The recent rise of LIT pre-market contracts above 3 USDT represents a significant milestone in the current cryptocurrency landscape. According to OKX market data, this increase reflects not only a rebound in LIT’s price but also hints at shifting market sentiments among traders and investors. With this surge, analysts are turning their attention to the drivers behind this price movement, investigating whether it is influenced by broader trends in the crypto market or specific events affecting LIT and its stakeholders.

Furthermore, the rise to this price level is intriguing as it coincides with various factors in the cryptocurrency ecosystem, including the recent activity of prominent whales and market influencers. As traders seek to capitalize on the upswing, understanding these dynamics is crucial for predicting future movements. This scenario necessitates regular updates and thorough LIT price analysis to keep potential investors informed.

Understanding LIT’s Position Amidst Crypto Asset Performance Trends

LIT’s recent performance within the market reinforces the notion that crypto assets are increasingly returning to a more stable financial logic as noted by Arkstream Capital. The assertion suggests that the upswing in LIT could be indicative of broader trends affecting the crypto sector, where projects with strong fundamentals are gaining traction. This trend highlights the importance of assessing not just price movements but underlying project values and community sentiment.

In the context of USDT cryptocurrency news and global market conditions, LIT stands out as a case study. The competition in the market demands that investments are carefully analyzed, especially with the acceptance of decentralized finance (DeFi) solutions and Web3 technologies gaining momentum. Investors need to focus on understanding crypto asset performance beyond mere speculation, aligning their strategies with the core values and long-term visions driving these innovations.

Impact of OKX Market Trends on LIT’s Performance

The OKX exchange continues to play a pivotal role in shaping market trends for many cryptocurrencies, including LIT. With the rise of LIT pre-market contracts above 3 USDT, liquidity on platforms like OKX has become more apparent, allowing traders to interact more freely and efficiently within the market. Increased trading volumes on OKX may contribute to enhanced price stability for LIT, attracting both speculators and long-term investors.

Moreover, staying updated with OKX market trends is vital for investors looking to make informed decisions. As the exchange introduces new product offerings and trading options, these changes can also influence the broader perception of LIT and its market viability. Understanding these trends will help traders capitalize on price movements while managing potential risks associated with volatility.

The Role of Market Influencers in LIT’s Rise Above 3 USDT

Recent activities by market influencers, including notable figures like Sun Yuchen, highlight the significant impact individuals can have on the price movements of cryptocurrencies such as LIT. Reports indicate Yuchen’s recent transaction, where he withdrew 5.2 million USDC to accumulate approximately 1.66 million LIT. Such high-profile purchases can lead to increased confidence in LIT and spark interest among other investors.

These influencer-driven dynamics emphasize the importance of social sentiment analysis in crypto trading. As trends shift, traders must not only rely on traditional analysis methods but also consider the influence of social media activities and endorsements. The interconnectedness of crypto communities on platforms can accelerate price movements, demonstrating the crucial role market influencers play in shaping the future of cryptocurrencies.

Exploring the Future of Web3 Financial Logic in Relation to LIT

As observed by analysts, the resurgence of crypto assets, including LIT, hints at a broader alignment with ’financial logic’ that underpins Web3. This transformation signifies a shift from speculative trading to a focus on creating tangible value and utility within decentralized applications. LIT’s growth reflects how projects are adapting to meet this emerging set of expectations.

Critically, the adoption of Web3 financial logic could lead to enhanced opportunities for assets like LIT, blending traditional financial principles with innovative blockchain technologies. Embracing this shift could position LIT favorably as it resonates with investors looking for projects that align with the evolving financial landscape, thus driving further interest and investment as the crypto ecosystem matures.

Key Market Developments Affecting LIT Pre-Market Contracts

Market developments play a crucial role in shaping the direction of LIT pre-market contracts, which recently crossed the 3 USDT threshold. The fluctuations observed are a microcosm of a larger trend within the crypto industry that has experienced significant volatility in recent months. Keeping abreast of market shifts and external catalysts is essential for traders looking to capitalize on these movements.

In addition to institutional investments and notable transactions, regulatory news and technological advancements can significantly impact contract performance. The interplay between these factors can create new trading opportunities, requiring a responsive and informed investor approach, particularly for those interested in LIT and similar assets.

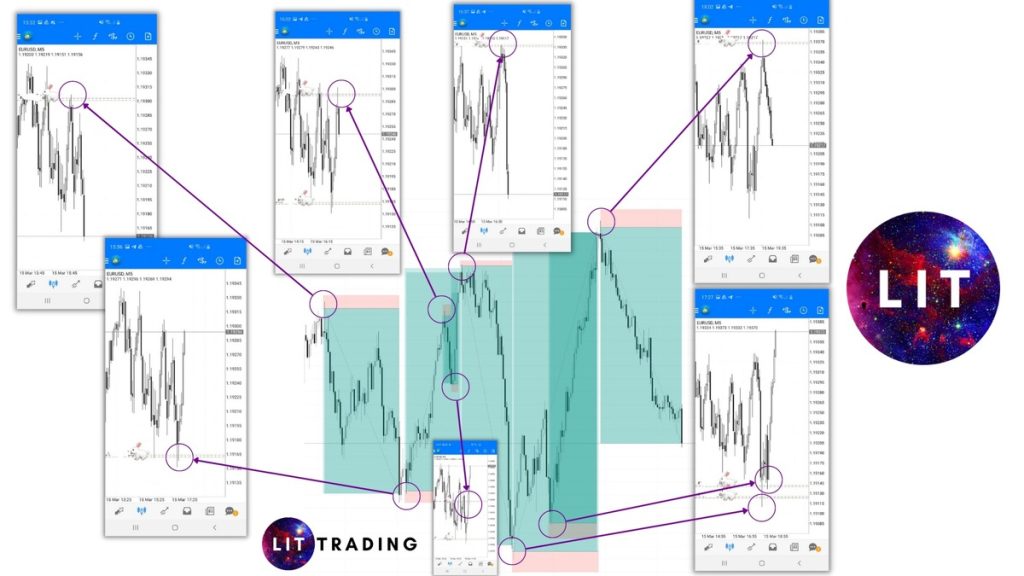

LIT Price Analysis: Factors Driving Recent Growth

The recent increase in LIT’s price can be attributed to several factors, including increasing adoption and demand for LIT across trading platforms like OKX. Analyzing LIT’s price trends reveals critical data points that can inform traders about potential future movements. Understanding the historical price actions helps in forming strategies and positioning oneself ahead of market shifts.

Moreover, examining technical indicators alongside market sentiment can provide a more nuanced view of LIT’s price dynamics. As LIT continues to attract investor interest, ongoing analysis will play a pivotal role in determining its future trajectory and assisting stakeholders in making informed decisions that align with evolving market conditions.

The Significance of LIT Transactions in the Current Market Landscape

Transaction trends involving LIT provide insight into broader market dynamics and investor behaviors. The recent strategic withdrawals and purchases tied to influential figures illustrate how individual actions can ripple through the market, affecting supply and demand. This intertwines with investor psychology, as every major transaction can often lead to immediate market reactions.

Understanding the significance of these transactions is crucial for assessing LIT’s market value. With increasing participation from both retail and institutional investors, the constant evaluation of transaction trends will inform market predictions and investment strategies. As the crypto landscape evolves, staying informed about such dynamics will remain key for traders.

Navigating Crypto Asset Performance in the Context of LIT

Cryptocurrency performance is often a reflection of various internal and external factors, and for LIT, this is particularly relevant as it adapts to shifting market demands. Navigating asset performance involves considering historical data, trading volumes, and emerging patterns. LIT’s recent performance can serve as a benchmark for understanding how crypto assets can recover and gain momentum.

Furthermore, investors must remain vigilant about the overall performance of the crypto sector, looking at how broader economic conditions, market sentiment, and regulatory frameworks can impact their assets. Balancing these factors will be key to success for those invested in LIT and seeking to maximize their returns within the ever-changing market.

Frequently Asked Questions

What factors are contributing to the rise of LIT pre-market contracts above 3 USDT?

The rise of LIT pre-market contracts above 3 USDT is attributed to various factors, including positive market sentiment, strategic buying by key investors, and improved liquidity in the cryptocurrency market. Analysts suggest that developments surrounding USDT cryptocurrency news may also play a crucial role in this price movement.

How do OKX market trends influence LIT pre-market contracts?

OKX market trends significantly influence LIT pre-market contracts by determining the overall trading volume and investor interest. As LIT contracts rise, market data from OKX indicates a shift towards increased demand, driven by the performance of related crypto assets and overall market conditions.

What insights can LIT price analysis provide for traders?

LIT price analysis offers valuable insights for traders by highlighting historical performance patterns and potential future movements. By analyzing support and resistance levels, traders can make informed decisions on whether to invest in LIT pre-market contracts as they rise above critical price points like 3 USDT.

What implications do rising LIT pre-market contracts have on Web3 financial logic?

The rising LIT pre-market contracts above 3 USDT could signify a return to fundamental values in Web3 financial logic, as emphasized by experts. This trend indicates that cryptocurrency markets may be stabilizing and aligning more with traditional economic principles, thus attracting more institutional investments.

What does the recent surge in LIT pre-market contracts indicate about crypto asset performance?

The recent surge in LIT pre-market contracts suggests a positive outlook for crypto asset performance, reflecting increased investor confidence and market participation. Such movements often precede broader upward trends in cryptocurrency markets, making LIT a key asset to watch.

How does news regarding USDT affect LIT pre-market contracts?

News regarding USDT can significantly impact LIT pre-market contracts, as USDT is a widely used stablecoin in trading. Fluctuations in USDT’s value or changes in its market positioning can lead to immediate effects on LIT contracts, influencing trading strategies and investor behavior.

What are the risks involved with trading LIT pre-market contracts?

Trading LIT pre-market contracts involves risks such as market volatility, liquidity issues, and potential price manipulation. Traders must stay informed about OKX market trends and LIT price analysis to navigate these challenges effectively.

Can LIT pre-market contracts impact the broader cryptocurrency market?

Yes, LIT pre-market contracts can impact the broader cryptocurrency market. Significant price movements in LIT can signal changes in trading dynamics and investor sentiment, potentially affecting other crypto assets and overall market trends.

| Date | Event | Details |

|---|---|---|

| 2025-12-30 | LIT Pre-market Contracts Rise | LIT pre-market contracts have surpassed 3 USDT according to OKX market data. |

| 2025-12-30 | Analyst Withdrawal | Analyst Sun Yuchen withdraws 5.2 million USDC to purchase approximately 1.66 million LIT. |

| 2025-12-30 | Short Selling Activity | A particular address has opened 1.11 million LIT short positions, becoming the largest short seller on Hyperliquid. |

| 2025-12-30 | Market Movement | Solana’s DEX trading volume hit 4.13 billion US dollars, the highest in 38 days. |

Summary

LIT pre-market contracts have made significant strides, surpassing the 3 USDT mark as of December 30, 2025. This increase reflects growing interest and activity in the cryptocurrency market. Notably, analyst Sun Yuchen’s recent large-scale purchase of LIT indicates confidence in its potential, despite fluctuations indicated by increased short-selling activities. As the cryptocurrency landscape continues to evolve, the rise of LIT pre-market contracts showcases both the challenges and opportunities inherent in digital asset trading.