Key Bitcoin Charts to Monitor Following BTC’s Sudden Surge to $103K

On [date of surge], the cryptocurrency market was electrified by Bitcoin’s remarkable surge to $103,000. This unprecedented spike not only shattered previous resistance levels but also reignited investor interest globally. As traders and analysts scramble to decode the implications of this dramatic climb, monitoring key Bitcoin charts and indicators has become crucial. This article will explore essential metrics to keep an eye on in the wake of Bitcoin’s bullish momentum.

1. Price Action Analysis

The most fundamental chart to watch is the price action chart. With Bitcoin’s recent surge, understanding support and resistance levels can provide insights into future movements. The key levels to monitor include:

-

Support Levels: After the surge, the immediate support level can be identified at $95,000. If Bitcoin drops below this point, it may indicate a potential pullback, prompting traders to reconsider their positions.

- Resistance Levels: The next psychological target is the $110,000 mark. Watching how Bitcoin interacts with this level will be vital. Trading volumes at these resistance points can suggest whether the bull run has staying power or whether profit-taking might lead to a potential reversal.

2. Moving Averages

Moving averages are a powerful tool for gauging the strength of a trend. Following the surge, the 50-day and 200-day moving averages are particularly useful:

-

50-Day Moving Average (MA): This short-term trend indicator can signal potential bullishness. If Bitcoin’s price remains above the 50-day MA, it reflects a strong bullish sentiment and could entice more institutional and retail investors.

- 200-Day Moving Average (MA): This long-term trend indicator provides a broader view of Bitcoin’s health. If Bitcoin price sustains above the 200-day MA, it may signify a prolonged bull market, while a downturn below it could indicate a bearish reversal in sentiment.

3. Relative Strength Index (RSI)

The RSI is a momentum oscillator measuring the speed and change of price movements, ranging from 0 to 100. Traditionally, readings above 70 indicate an overbought condition, while readings below 30 indicate oversold conditions.

-

Following Bitcoin’s rise to $103K, checking the RSI will be crucial. If the RSI approaches or exceeds the 70 mark, it raises caution for potential overbought conditions, signaling a possible price correction.

- Conversely, if the RSI remains below 70 but trends upwards, it may suggest that further upside potential exists.

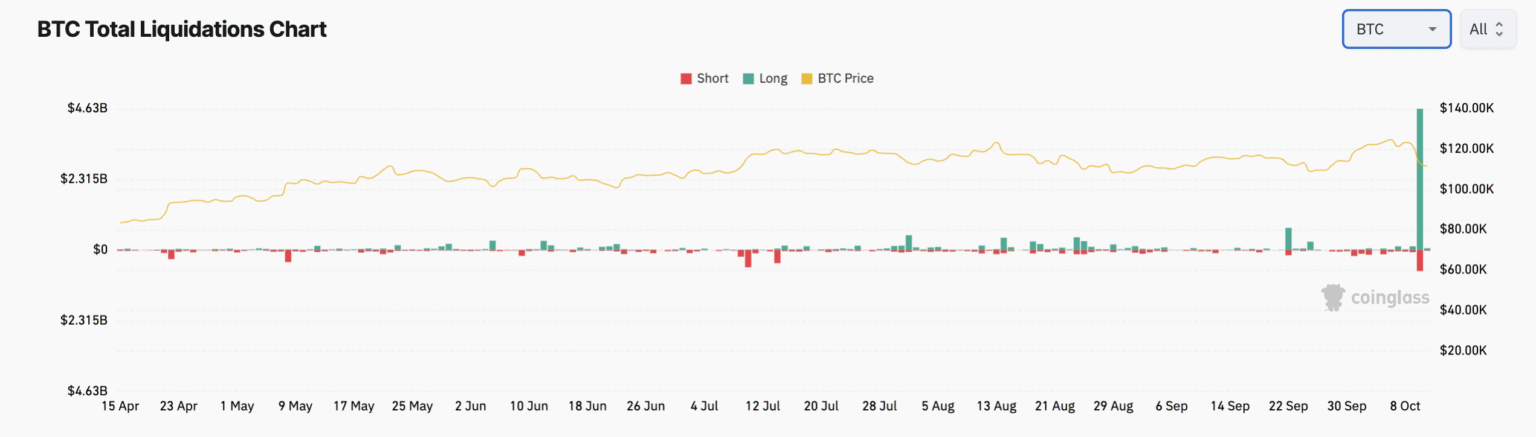

4. Volume Analysis

Volume is an essential indicator that validates trends; a price surge accompanied by high volume signifies strong interest and momentum. As Bitcoin moved past $100K, volumes surged, reflecting increased buying activity.

- Investors should carefully analyze volume trends post-surge. If Bitcoin continues to rise but volume begins to decline, it may point to weakening momentum. Conversely, sustained high volumes can indicate that the price rises are legitimate and may continue.

5. On-Balance Volume (OBV)

OBV is another metric to consider when assessing overall market sentiment. It measures buying and selling pressure as a cumulative total. An increasing OBV alongside rising prices indicates that the bull run may have demand behind it.

- Post-surge, an upward trending OBV suggests that the rally is supported by buyers, while a stagnating or declining OBV could indicate selling pressure is building, leading to potential corrections.

6. Market Sentiment and News

Finally, it’s essential to monitor overall market sentiment influenced by external factors, such as regulatory news, economic indicators, and technological advancements within the blockchain space. News cycles significantly impact trading behavior and can cause rapid price fluctuations.

- Keeping an eye on social sentiment metrics and news headlines will provide broader context to price movements, potentially alerting you to upcoming volatility.

Conclusion

Bitcoin’s surge to $103,000 has captured the attention of traders and investors alike. As the dust settles, monitoring critical charts and indicators becomes essential to navigate the complexities of the market. By keeping an eye on price action, moving averages, RSI, volume, OBV, and market sentiment, investors can make more informed decisions in this volatile yet opportunity-rich environment. Ultimately, understanding these key metrics is vital for anyone looking to capitalize on Bitcoin’s ongoing journey in the cryptocurrency space.