Kalshi open contracts have emerged as a revolutionary tool in the trading world, demonstrating impressive growth by reaching $410 million in value—a staggering fourfold increase in just six months. This surge reflects a burgeoning interest in diverse contract categories, particularly in the sports sector, where open contracts now account for 50% of total trading volume. Alongside sports contracts, political contracts have maintained a steady presence at 25%, illustrating a balanced market landscape. The rapid expansion and diversification in these contracts underscore Kalshi’s potential as a leading platform for traders looking to capitalize on various events, from sporting outcomes to political developments. As updates roll in, it’s clear that Kalshi is reshaping how we engage with financial predictions and contracts in today’s dynamic economy.

Open trading agreements on Kalshi, a platform paving the way for modern financial contracts, have become a focal point for investors and traders alike. With remarkable advancements in the last half year, these trading instruments have gained notable traction, particularly in the realms of sports and politics. The escalating popularity of cryptocurrency contracts is also noteworthy, as the platform continues to innovate and attract a diverse audience. As the market evolves, the increase in transaction volumes within Kalshi highlights the shifting landscape of trading and the growing demand for versatile contract options. This dynamic environment is effectively transforming how individuals approach trading agreements, making Kalshi a key player in the financial technology sector.

| Key Point | Details |

|---|---|

| Open Contracts Value | $410 million, quadrupled in six months |

| Growth Rate | Fourfold increase in the past six months |

| Sports Category Share | Increased from 25% to 50% of total contracts |

| Political Contracts Share | Remains at 25% |

| Other Categories Share | Accounts for 25% of open contracts |

Summary

Kalshi open contracts have demonstrated remarkable growth, soaring to a value of $410 million in just six months. This significant escalation highlights not only the increasing popularity of various open contracts but also a pronounced shift towards sports contracts, which now represent half of Kalshi’s overall offerings. The durability of political contracts at one-fourth of the total suggests a diversified interest among investors, while other categories maintain a stable presence. Overall, Kalshi is establishing itself as a dynamic platform for trading diverse contracts, reflecting both trends in finance and investor preferences.

Kalshi’s Remarkable Growth: A Look at Open Contracts

Kalshi has recently reported an impressive surge in its open contracts, reaching a remarkable $410 million. This figure reflects a staggering growth rate, with open contracts quadrupling in the last six months alone. Analysts attribute this success to increased consumer interest in prediction markets, making Kalshi a significant player in the financial landscape. As the platform integrates itself deeper into mainstream finance, it sets the stage for further expansion and diversification.

The sustained interest in Kalshi’s offerings has been driven by various factors, including the growing popularity of sports contracts, which have jumped significantly in share. With this category representing 50% of all open contracts now, it’s clear that sports enthusiasts are eager to engage in predictive betting. This shift indicates a burgeoning market for not just sports contracts but also for other categories like political and cryptocurrency contracts, which hold equal weight in the overall portfolio.

The Rise of Sports Contracts on Kalshi

As the sports category on Kalshi has seen a dramatic increase, it exemplifies the platform’s ability to tap into trending recreational interests. Sporting events draw a vast audience, and the ability to predict outcomes has transformed passive viewing into interactive engagement. Fans are now able to leverage their knowledge and insights on their favorite teams and events, which opens up fresh avenues for profit and community interaction within the trading framework.

This trend not only signifies robust consumer participation but also showcases how Kalshi is capitalizing on the sports industry’s vast potential. With sports contracts now comprising 50% of total open contracts, the platform is effectively catering to a passionate demographic. This past growth phase positions Kalshi ideally for future expansion as sports contracts are likely to remain a primary attraction, potentially inspiring the introduction of unique features or betting options that enrich the user experience.

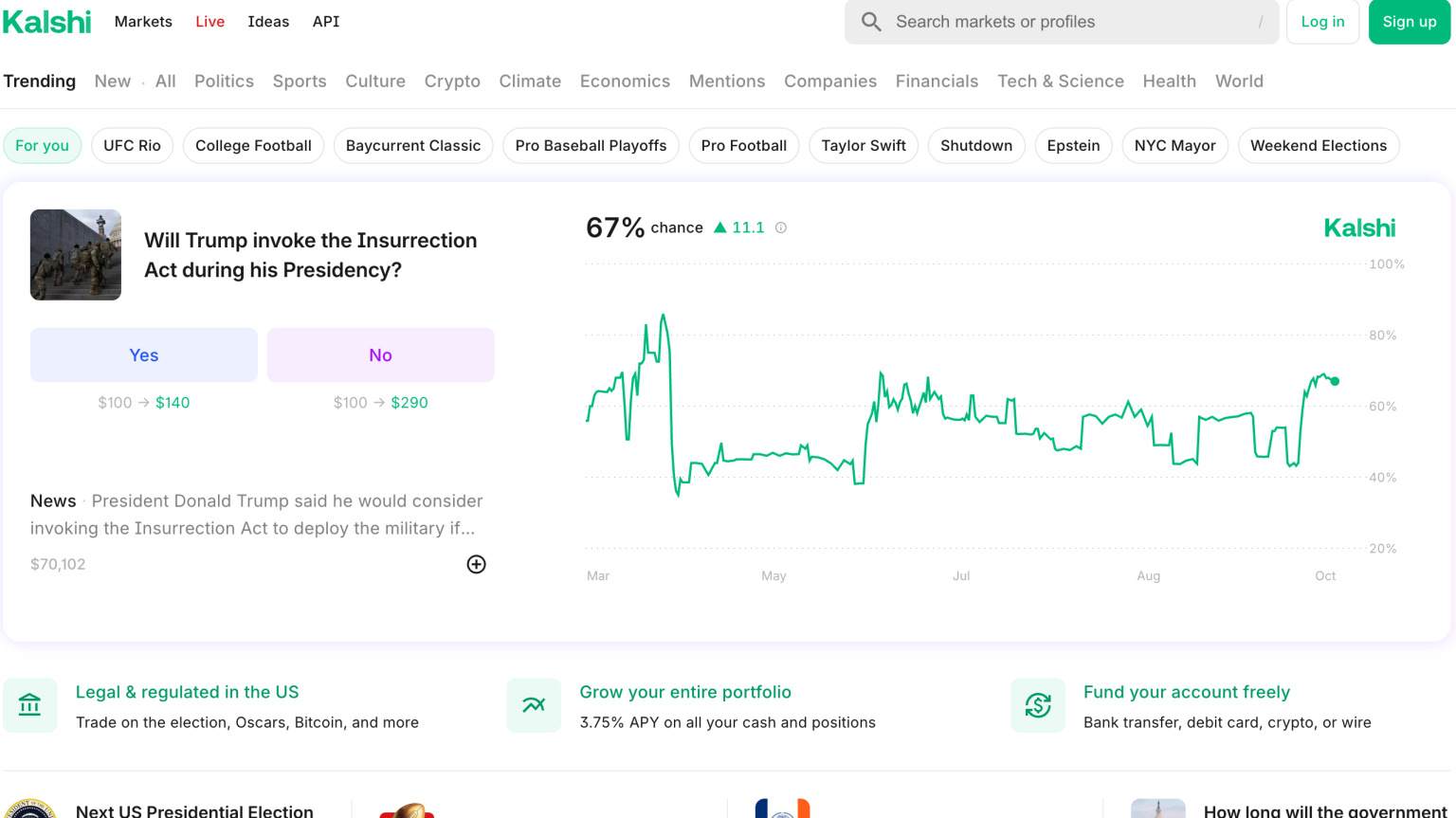

Political Contracts: Stability Amid Rapid Growth in Other Areas

Political contracts, despite their modest share, remain a stable offering on Kalshi. These contracts make up 25% of the total market, illustrating that users are equally interested in predicting political outcomes as they are in sports. As political events influence market conditions, the ability to forecast outcomes based on current affairs provides an intriguing opportunity for those engaged on the platform.

Moreover, the engagement in political contracts hints at users’ interests beyond entertainment; they seek meaningful interactions within crucial societal frameworks. As we move closer to pivotal electoral events, the potential for increased engagement in political contracts is likely to rise, providing Kalshi with a dual-faceted appeal that combines both political insight and market-based prediction.

Future Insights: Kalshi’s Contract Categories

Looking into the future, several categories of contracts are developing their unique market dynamics on Kalshi. The platform’s ability to host a range of categories, including sports and cryptocurrency contracts, suggests an exciting blend of interests and expertise amongst users. As cryptocurrency becomes more mainstream and integrated into financial planning, contracts associated with this sector may unveil substantial room for innovation.

These cryptocurrency contracts not only attract tech-savvy investors but also those curious about the digital currency landscape. Given the volatile nature of the cryptocurrency market, Kalshi’s model could provide a protective mechanism for users looking to hedge their investments through predictive contracts, ultimately democratizing access to complex financial instruments.

Kalshi Updates: Tracking Transformations in Open Contracts

Timely updates from Kalshi are crucial for stakeholders monitoring the transformations within open contracts. Recent statistics indicate that the company has adapted to market demands, responding to the rapid growth and sharing insights on user engagement across different categories. Engaging with users through updates not only builds trust but also cultivates a community of informed participants who are keen on maximizing their predictive betting potential.

Regular updates serve as vital communication channels, allowing users to stay informed about not only the growth metrics but also potential new categories or alterations to existing contracts. Keeping abreast of these changes positions users to take strategic actions that could influence their investment decisions and interaction rates on the platform.

Understanding the Impact of Kalshi’s Growth on Market Dynamics

The growth of Kalshi’s open contracts and the dramatic rise in sports contracts highlight a fundamental shift in market dynamics. This change reflects a larger trend towards interactive investment strategies where participants prefer engaging with assets they are passionate about. The rise in Kalshi’s popularity could lead to increased competition in the space, prompting other platforms to innovate or diversify their offerings to retain users.

Such a competitive environment is likely to benefit consumers, as companies strive to cater to their preferences, leading to better rates, features, and user experiences. Moreover, Kalshi’s success could inspire new participants to explore prediction markets, further influencing overall trading culture and possibly leading to legislative attention as awareness grows.

Kalshi’s Positioning in the Cryptocurrency Market

As Kalshi integrates cryptocurrency contracts into its offerings, its positioning within this burgeoning market is noteworthy. Cryptocurrency has become an investment category in its own right, attracting individuals who seek high-risk, high-reward opportunities. By providing contracts that allow users to predict the trajectory of various cryptocurrencies, Kalshi taps into a lucrative segment that continues to attract attention from both retail and institutional investors.

With the right tools and insights, users can engage with these contracts in ways that mitigate risks and maximize potential returns. Kalshi is set to become a significant venue for those looking to navigate the complexities of cryptocurrency through predictive insights, appealing to both novice users and seasoned investors familiar with the volatile nature of digital assets.

Navigating Political Contracts: Opportunities on Kalshi

The political landscape provides fertile ground for predictive contracts, and Kalshi is well-positioned to leverage this opportunity. Political contracts on Kalshi allow users to wager on electoral outcomes, legislation impacts, and various other political events. This unique offering captures the interest of politically inclined users, transforming speculation and opinion into financial opportunities.

As events unfold within the political realm, these contracts can provide insights and anticipation that are particularly appealing to those passionate about current affairs. The stability of political contracts amidst the rapid growth within the sports and cryptocurrency markets shows Kalshi’s versatility and ability to connect users with a variety of investment motivations.

Expanding Horizons: The Future of Contracts on Kalshi

The future for Kalshi appears bright as it continues evolving its contract offerings and expanding its user base. As user engagement rises, there’s significant potential for the introduction of new categories that could enrich the trading experience. The adaptability of Kalshi in responding to market trends will be fundamental in retaining its competitive edge and attracting diverse participants.

Moreover, embracing innovations such as machine learning algorithms or user-centric features could enhance the overall experience for contract traders. With an eye on future advancements, Kalshi is not only aiming to consolidate its existing user base but also to venture into unexplored territories that could define the next phase of market participation.

Frequently Asked Questions

What are Kalshi open contracts and how do they work?

Kalshi open contracts are financial instruments that allow users to trade on the outcomes of various events, such as sports or political results. Each contract represents a bet on a specific outcome, enabling users to speculate on future events. This innovative platform allows for a transparent and regulated trading experience.

How has Kalshi’s open contracts market grown recently?

Kalshi’s open contracts market has experienced remarkable growth, increasing fourfold to $410 million within the last six months. This significant surge highlights the growing interest in trading on future events through platforms like Kalshi.

What types of contracts are available on Kalshi?

Kalshi offers a variety of contracts, including cryptocurrency contracts, sports contracts, and political contracts. The recent growth in open contracts has seen the sports category double from 25% to 50% of the total trades, reflecting a dynamic interest in sports betting.

Why are Kalshi’s open contracts a good investment option?

Kalshi’s open contracts present a unique investment opportunity, providing a way to trade on tangible outcomes rather than speculative assets. With significant growth in categories like sports contracts, investors can capitalize on their knowledge of specific events.

What is the current trend in Kalshi’s open contracts related to sports?

The trend in Kalshi’s open contracts for sports is particularly promising, with the proportion of these contracts rising from 25% to 50%. This indicates a strong consumer interest in sports betting and a growing market share for Kalshi in this sector.

How can I stay updated on Kalshi’s open contracts and market movements?

To stay updated on Kalshi’s open contracts and market movements, consider following the company’s official channels, subscribing to their newsletter, and engaging with their community on social media platforms, where they share timely updates and insights.

What impact do Kalshi open contracts have on traditional betting markets?

Kalshi’s open contracts offer a regulated alternative to traditional betting markets. By allowing users to trade on a broad range of outcomes, they may challenge traditional betting models and provide more transparency and liquidity in the betting space.

Are Kalshi’s open contracts regulated?

Yes, Kalshi’s open contracts are regulated by the Commodity Futures Trading Commission (CFTC), ensuring that trading practices meet legal standards and protect users, contributing to a safe trading environment.

How have political contracts on Kalshi performed?

Political contracts on Kalshi have maintained a stable share of 25% despite the growth in other categories. This steady performance indicates persistent interest in political outcomes among traders.

What is the significance of the $410 million in open contracts for Kalshi?

The achievement of $410 million in open contracts signifies a strong market presence and user confidence in Kalshi. This milestone reflects the platform’s successful strategies and growing acceptance of trading on event outcomes.