In an era where the conventional wisdom of portfolio diversification has prompted many investors to look beyond traditional stocks and bonds, cryptocurrencies have increasingly come under consideration for their potential to enhance portfolio returns. A recent study suggests that allocating a relatively small percentage of an investment portfolio to Solana (SOL), a rapidly growing blockchain platform, could significantly boost its performance.

Diving into the Study’s Findings

The groundbreaking study, conducted by a prominent financial research institute, closely examined the volatility and return profiles of various asset classes over the past decade, including emerging cryptocurrency assets. The researchers focused on Solana due to its unique position in the blockchain ecosystem, highlighting its innovative technology and rapid adoption rate among developers.

According to the research, portfolios containing a 5% allocation to Solana exhibited superior risk-adjusted returns compared to those without any crypto assets. The study attributed this enhancement in performance to Solana’s relatively low correlation with traditional investments like stocks, bonds, and even other cryptocurrencies such as Bitcoin and Ethereum.

Why Solana?

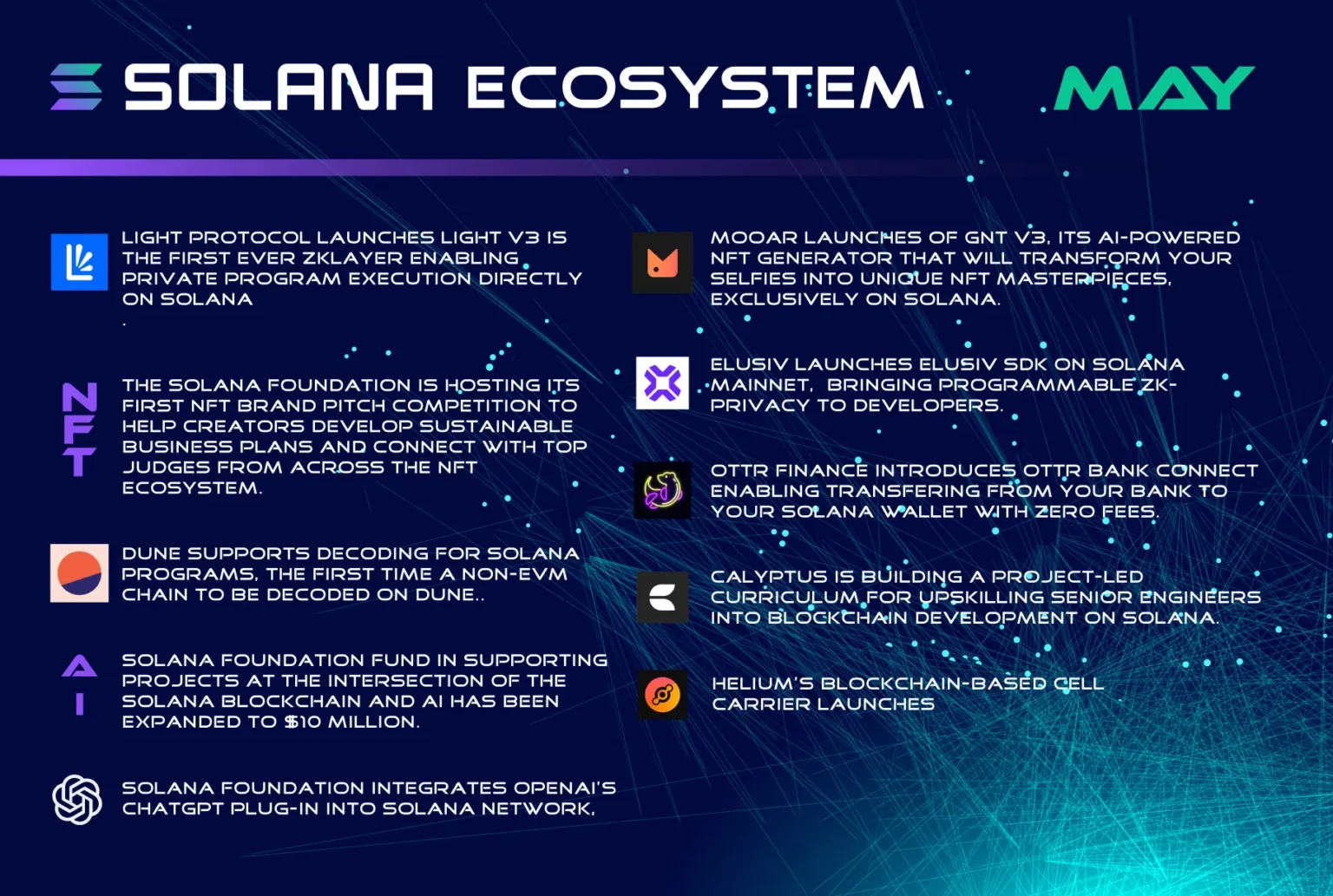

Solana has distinguished itself in the blockchain space due to its high throughput capabilities and significantly lower transaction costs. Founded in 2017 by Anatoly Yakovenko, the platform supports a unique hybrid consensus model combining proof-of-stake and proof-of-history mechanisms, which allows it to process thousands of transactions per second. This technical prowess has made it an attractive option for developers, particularly those involved in decentralized finance (DeFi) and non-fungible tokens (NFTs).

The study highlighted several factors contributing to the positive impact of Solana on diversified investment portfolios:

- Innovation and adoption: Solana’s continued development and the growing ecosystem of applications contribute to its robustness and potential for appreciation.

- Market positioning: Being regarded as a potential ‘Ethereum killer,’ Solana has carved out a significant niche in the market, which could lead to substantial growth as the blockchain sector expands.

- Reduced transaction costs and speed: These factors make Solana appealing both as a development platform and an investment.

Portfolio Allocation Strategies

Based on the research findings, the study advises investors who are looking to integrate cryptocurrencies into their portfolios to consider a limited, strategic exposure to high-potential assets like Solana. A modest allocation of 5% can provide sufficient exposure to the potential upsides of the crypto market while limiting the downside risk associated with the extreme volatility that cryptocurrencies are known for.

Risk Considerations

However, the study also cautions investors about the high-risk nature of cryptocurrencies, including Solana. The crypto market is known for its rapid price swings, and while high volatility can lead to high returns, it can also result in significant losses. Therefore, investors are urged to consider their risk tolerance and investment horizon carefully before adjusting their portfolio allocations.

Conclusion

The inclusion of Solana in an investment portfolio, even in a minimal proportion, can provide diversification benefits and enhance overall returns, according to the recent study. However, like any investment, appropriate risk management strategies are essential to mitigate potential downsides. As the blockchain technology landscape continues to evolve, Solana appears to be a compelling candidate for those looking to tap into the growth potential of cryptocurrencies within a diversified investment framework.