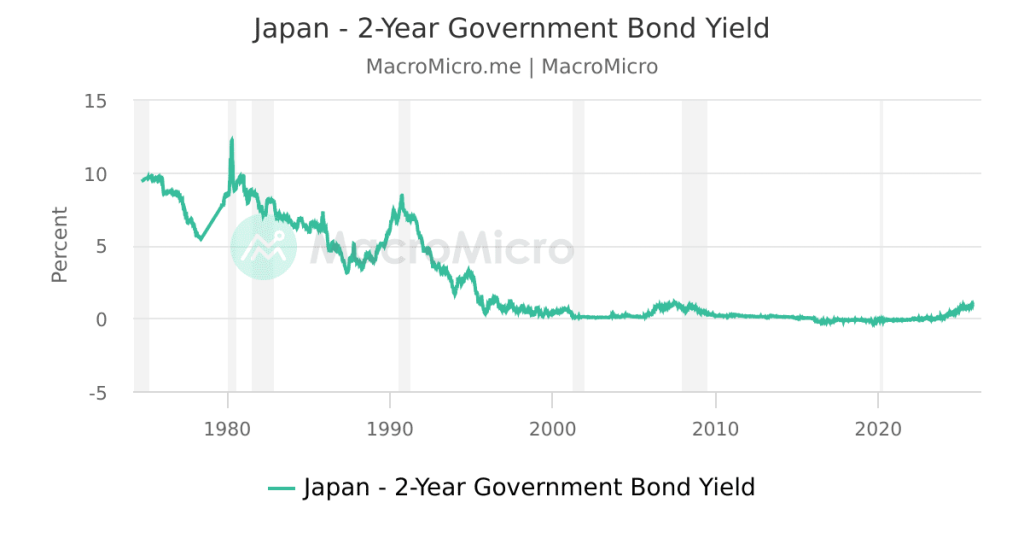

The Japan 2-year government bond yield has surged to an impressive 1.245%, marking its highest point since 1996. This notable rise in bond yields signals a shift in the country’s financial landscape, as investors react to changing economic conditions and fiscal policies. With Japan bond yields gaining attention in the global market, analysts are closely monitoring how these shifts could influence interest rates and investment strategies. As the financial news from Japan continues to evolve, the implications of these alterations in the 2-year bond yield become critical for both domestic and international stakeholders. Understanding the dynamics of government bonds in Japan offers valuable insights into future economic trends and potential investment opportunities.

In recent months, the yield on Japan’s short-term government securities has seen a significant uptick, highlighting the evolving nature of interest rates within the country’s economy. The rise in yield for the two-year notes reflects broader economic shifts and changing market sentiments, making it a focal point for investors and economists alike. As financial analysts delve into the factors driving these changes, the implications of higher yields on investment portfolios and national debt management are becoming increasingly pertinent. Moreover, the interplay between Japan’s fiscal policies and global economic trends is stirring discussions in financial circles, pointing to a new era of government securities in Japan. Keeping abreast of these developments is essential for anyone interested in the intricacies of Japan’s financial system and its impact on the global market.

| Key Points |

|---|

| Japan 2-year government bond yield reached 1.245% |

| Highest level since 1996 |

Summary

Japan 2-year government bond yield has reached a notable milestone, climbing to 1.245%, which is the highest rate observed since 1996. This increase reflects the changing dynamics in the bond market and may impact investor sentiment and borrowing strategies. Investors should pay close attention to these developments as they could signal shifts in economic policy and financing conditions in Japan.

Understanding Japan’s 2-Year Government Bond Yield

The recent surge in Japan’s 2-year government bond yield has been noteworthy, now sitting at 1.245%. This peak marks the highest level for these bonds since 1996, reflecting significant shifts in Japan’s economic environment. Such changes not only affect financial markets but also indicate broader economic trends and investor sentiment. With rising bond yields, there is often speculation about inflation and how it might impact consumer spending and investment strategies within Japan.

Investors closely monitor the yield on government bonds as it serves as a benchmark for various financial instruments. A rise in the Japan 2-year bond yield could signal a shift in monetary policy or expectations of economic growth. Understanding these dynamics is crucial for stakeholders in the Japan financial news landscape, as fluctuations in bond yields can affect stock prices, currency valuation, and overall investment strategies.

The Impact of Rising Bond Yields in Japan

The rise in bond yields, particularly the Japan 2-year government bond yield, has broader implications for the economy. As yields increase, borrowing costs can also rise, potentially slowing down economic growth. This is especially critical for Japan, where low interest rates have been a hallmark of the economic landscape for decades. The governing authority’s response to these rising yields can shape future monetary policy and influence market perceptions.

Furthermore, the implications of increasing bond yields affect both domestic and international investors. A stable increase in Japan bond yields could attract foreign investment, driving inflows into the Japanese economy, yet any abrupt spikes may lead to market volatility. Monitoring Japan’s financial news regarding these bond yield trends is vital for understanding economic policy directions and predicting market movements.

Analyzing the Trends in Japan Bond Yields

Analyzing the current trends in Japan bond yields reveals a complex interplay between domestic economic performance and global market influences. As the Japan 2-year government bond yield rises, it reflects not only local factors like fiscal policy and economic data but also external pressures such as global interest rate movements. Investors must consider these trends as they navigate opportunities and risks in the Japanese bond market.

Moreover, understanding bond yield trends in Japan is essential for policy makers as they respond to inflationary pressures and changing economic conditions. A continued rise in bond yields may necessitate a reevaluation of Japan’s long-term financial strategies, both in terms of debt issuance and economic growth initiatives. Keeping an eye on Japan bond yields provides insight into broader economic health and financial stability.

The Role of Government Bonds in Japan’s Economy

Government bonds play a critical role in Japan’s economic structure, serving as a vehicle for financing public spending and influencing monetary policy. The Japan 2-year government bond yield is particularly popular among investors seeking relative safety amid fluctuating markets. As the yields rise, it highlights the investors’ shifting expectations about the economy and borrowing costs, cementing the position of government bonds as a barometer for economic sentiment.

Additionally, the rise in yields can impact various sectors, from real estate to equity markets. For example, higher yields on government bonds may discourage investment in equities as investors shift their focus to fixed-income securities. This dynamic showcases how vital government bonds are in shaping investment flows and economic decisions within Japan.

Exploring Investor Sentiment and Japan’s Bond Market

Investor sentiment regarding Japan’s bond market is notably influenced by the current rise in bond yields. The increasing Japan 2-year government bond yield signals a shift in sentiment as investors speculate on future economic conditions. This speculation can generate volatility in financial markets, as traders adjust their portfolios in response to changing yields and perceived risks.

Furthermore, monitoring shifts in investor sentiment regarding Japan bond yields can provide insights into market trends. For instance, as bond yields rise, it may indicate a belief that the Bank of Japan will move away from its ultra-loose monetary policy. This anticipation can lead to increased investment in bonds as traders position themselves for potential market adjustments.

Government Policy and its Effects on Bond Yields

Government policy significantly impacts Japan’s bond yields, particularly through changes in interest rates and fiscal policies. The rise in the Japan 2-year government bond yield implies that market participants are adapting to these policy shifts. These adaptations signal expectations for the future trajectory of economic performance and monetary measures.

Furthermore, any signals from the Bank of Japan regarding potential tightening of monetary policy in light of rising yields can send ripples through the market. Policymakers must carefully consider how their decisions will affect government bond yields and, by extension, investor behavior and economic stability.

Forecasting Future Trends in Japan’s Bond Market

Forecasting the future of Japan’s bond market requires a comprehensive understanding of the factors currently driving the rise in bond yields. Analysts are focusing on the Japan 2-year government bond yield as a key indicator. If the trend of rising yields continues, it may lead to a reassessment of risk among investors and impact the broader financial landscape.

In addition, the anticipation of changes in fiscal policy and inflation expectations will play a crucial role in shaping future bond market dynamics. As both domestic and international economic conditions evolve, stakeholders must be vigilant in monitoring how changes in Japan bond yields correlate with overall economic growth.

Rising Japan Bond Yields and Global Economic Impact

The rise in Japan’s bond yields does not exist in isolation; it has implications for global economic markets as well. The 1.245% yield on the Japan 2-year government bond can influence foreign investment flows and currency markets. As bond yields rise, investors may seek higher returns elsewhere, potentially triggering shifts in capital movements across borders.

Furthermore, Japan’s position as one of the largest economies in the world means that its bond yield fluctuations can ripple through global markets. As the yields on Japan government bonds rise, countries with similar economic structures may respond, leading to a realignment of global interest rates and investment strategies.

Strategies for Investing in Japan’s Rising Bond Market

In light of rising Japan bond yields, investors must reevaluate their strategies for entering the bond market. The 2-year government bond yield has reached a significant threshold, offering both new opportunities and risks. Diversifying portfolios by including government bonds could be prudent, particularly if yields are expected to continue their upward trend.

Additionally, understanding the broader economic context is essential for making informed investment decisions in Japan’s bond market. Keeping up with the latest Japan financial news and market analyses can help investors navigate the complexities of changing yields and make strategic decisions that align with their financial goals.

Frequently Asked Questions

What factors are influencing the rise in Japan’s 2-year government bond yield?

The rise in Japan’s 2-year government bond yield can be attributed to global economic trends, inflation expectations, and the Bank of Japan’s monetary policy adjustments. As investors anticipate changes, yields on Japan bond yields, including the 2-year bond yield, tend to reflect these market dynamics.

How does the 2-year bond yield in Japan impact the overall bond market?

The 2-year bond yield in Japan is a critical indicator of investor sentiment and future interest rates. An increase in this yield can signal rising borrowing costs and affect the pricing of other government bonds Japan, influencing the overall bond market performance.

What does a 1.245% yield on Japan’s 2-year government bonds mean for investors?

A 1.245% yield on Japan’s 2-year government bonds indicates higher returns compared to previous years, attracting investors looking for safer assets. This rise in bond yields reflects changing economic conditions that impact interest rates, making it vital for investors to adapt their strategies accordingly.

How has Japan’s financial news reflected on the rising 2-year bond yield?

Recent Japan financial news has highlighted the rising 2-year bond yield as a significant economic signal. Analysts frequently discuss the implications of this increase on monetary policy, inflation, and the health of Japan’s economy, making it a key focus for investors.

What historical trends are associated with Japan’s 2-year government bond yield?

Historically, Japan’s 2-year government bond yield has been low, particularly during periods of economic stagnation. However, the recent rise to 1.245% marks the highest level since 1996, prompting discussions about potential shifts in Japan’s economic landscape and interest rate policy.