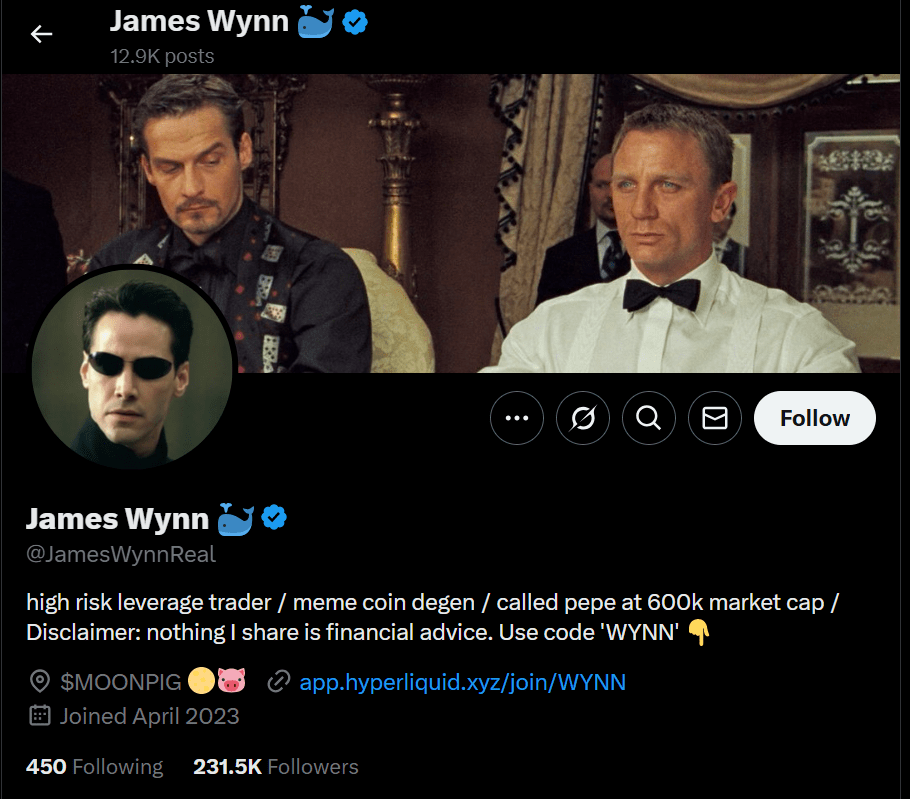

James Wynn has found himself at the center of recent ETH liquidation news, with his long positions in Ethereum, Bitcoin, and even PEPE seeing significant turbulence. In just 24 hours, James has faced liquidation a staggering 12 times, highlighting the volatility of the crypto market downturn. This dramatic turn of events has sparked widespread interest and concern among traders and investors alike, as many look for BTC liquidation updates to gauge the potential impact on their portfolios. The sudden shift in market dynamics has kept the crypto community buzzing, particularly regarding the rise and fall of long positions in this unpredictable landscape. With several factors at play, including global economic pressures and investor sentiment, James Wynn’s situation serves as a cautionary tale in the constantly evolving digital currency ecosystem.

The ongoing turmoil within the cryptocurrency sector has led to a slew of developments regarding long positions and liquidation trends. Recent updates indicate that high-profile traders, such as James Wynn, are experiencing significant challenges as they navigate these turbulent waters. Reports surrounding the liquidation of long positions in Ethereum, Bitcoin, and the meme-inspired PEPE coin paint a vivid picture of a market grappling with a sharp downturn. Investors are anxiously seeking insights into ETH liquidation news and BTC liquidation updates, as the fragile state of the market leaves many questioning their strategies. As traders adapt to the prevailing conditions, discussions on the implications for long positions and market strategy become increasingly critical.

Overview of James Wynn’s Recent Liquidations

In a troubling turn of events, James Wynn has experienced significant challenges in the volatile crypto market, with his long positions in major cryptocurrencies like ETH, BTC, and PEPE being liquidated a staggering 12 times within just one day. This incident reflects a larger trend observed across the cryptocurrency landscape, where traders are facing increasing risks due to ongoing market fluctuations. Liquidation events, particularly for long positions, indicate heightened pressure as traders are unable to maintain their margin requirements amid falling prices.

The repeated liquidation of Wynn’s positions sheds light on the broader implications of the recent crypto market downturn. It serves as a cautionary tale for investors engaging in leveraged trading, particularly in highly speculative assets such as ETH and BTC. As the crypto market grapples with unpredictable volatility, such occurrences pave the way for discussions around risk management strategies for traders looking to navigate these treacherous waters.

Frequently Asked Questions

What happened to James Wynn’s ETH positions recently?

James Wynn’s ETH long positions have been liquidated 12 times in the past 24 hours due to a significant downturn in the crypto market. This trend highlights the risks involved in trading during volatile conditions.

How did the BTC liquidation updates affect James Wynn?

Recent BTC liquidation updates indicate that James Wynn’s long positions in Bitcoin were also negatively impacted, with 12 instances of liquidation reported due to the ongoing market downturn.

What are the implications of the PEPE trading news for James Wynn?

The latest PEPE trading news reveals that James Wynn’s positions have been liquidated multiple times recently. The sell-offs of PEPE assets are part of a larger trend affecting his positions across various cryptocurrencies amid the market’s decline.

Why is the crypto market downturn significant for traders like James Wynn?

The current crypto market downturn poses significant risks for traders like James Wynn, as evidenced by the liquidation of his long positions in ETH, BTC, and PEPE. This downturn has led to increased volatility and liquidations across the market.

How can long positions liquidation affect investors like James Wynn?

Long positions liquidation can severely impact investors like James Wynn by forcing them to sell their holdings when prices drop, leading to potential financial losses and affecting trading strategies, especially during unpredictable market downturns.

| Cryptocurrency | Number of Liquidations | Time Period | Reason for Liquidation |

|---|---|---|---|

| ETH | 12 | Past 24 hours | Market downturn |

| BTC | 12 | Past 24 hours | Market downturn |

| PEPE | 12 | Past 24 hours | Market downturn |

Summary

James Wynn has recently faced significant challenges in the cryptocurrency market, particularly with his investments in ETH, BTC, and PEPE. Over the past 24 hours, these positions have been liquidated 12 times due to a notable market downturn. This highlights the volatility of the crypto assets and serves as a reminder for investors to closely monitor market conditions.