Is a Breakout Looming? Analyzing the Emerging Price Pattern in Ethereum

In the ever-evolving landscape of cryptocurrencies, Ethereum has long stood as a giant alongside Bitcoin. However, recent times have seen unprecedented activity around its price patterns that is catching the eyes of investors and traders globally. This article delves into the emerging price pattern in Ethereum, assessing whether a breakout could indeed be on the horizon.

Understanding Ethereum’s Current Stance

Ethereum, known for its smart contract functionality apart from being a cryptocurrency, has been foundational in establishing the decentralized finance (DeFi) and non-fungible token (NFT) sectors. Despite the broader market downturns frequently impacting cryptocurrencies, Ethereum has managed to maintain resilience, showing strong signs of an upcoming price escalation.

The Technical Perspective: Analyzing the Charts

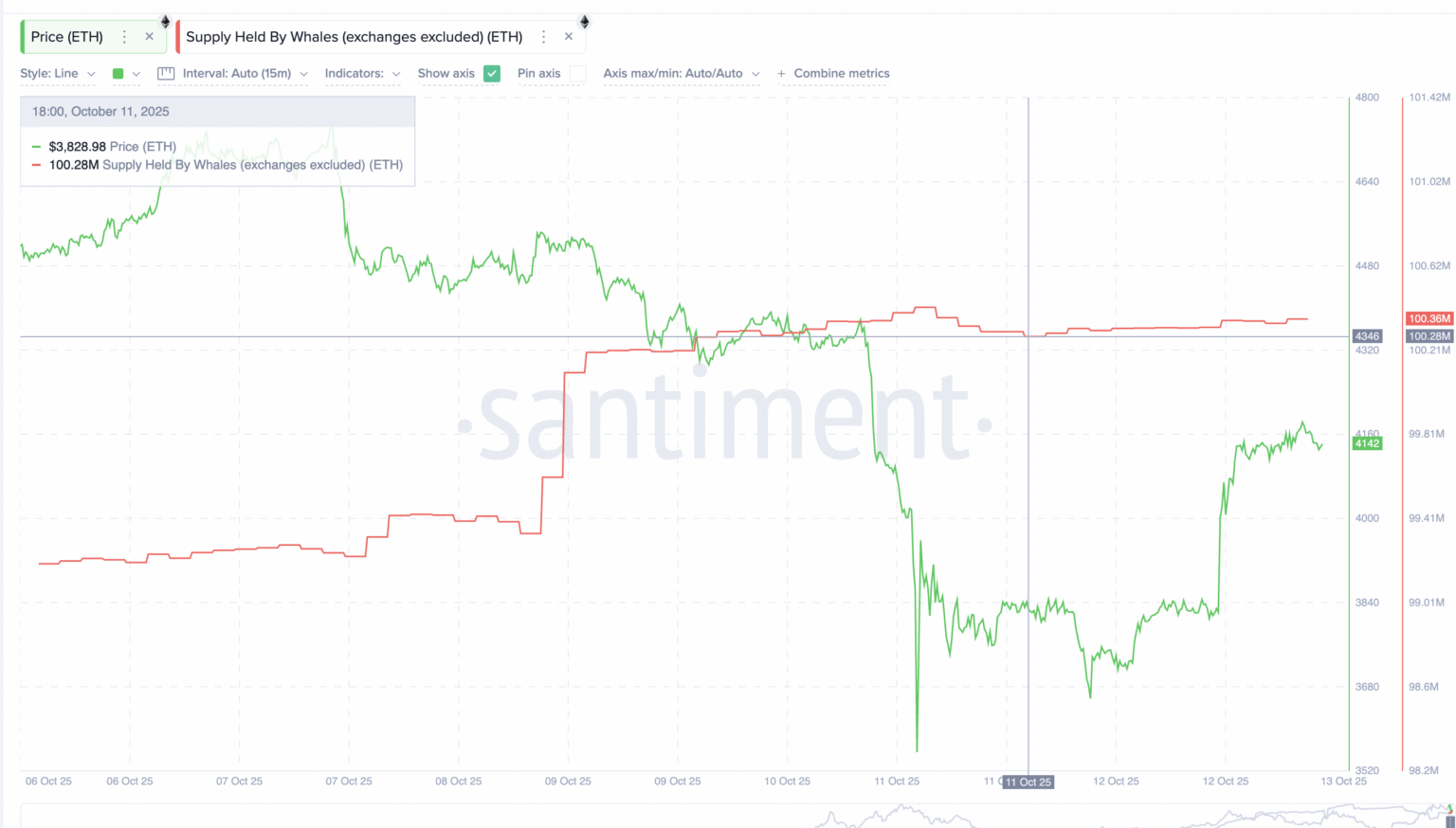

From a technical analysis viewpoint, Ethereum has been forming what appears to be a consolidation pattern, commonly seen as a precursor to significant price moves. The chart has begun to exhibit a classic ‘symmetrical triangle’ pattern, characterized by lower highs and higher lows converging towards a point of equilibrium.

This pattern suggests indecision among traders but is typically followed by a decisive breakout. The direction, bullish or bearish, depends on various external market forces and fundamental indicators but given the current market conditions, inclinations lean towards a bullish outcome.

External Influences and Fundamental Analysis

Fundamental factors also play a critical role in shaping the potential breakout. Important to consider are:

-

Upcoming Ethereum Upgrades: The Ethereum network is undergoing significant changes, including transitioning from proof-of-work to a more energy-efficient proof-of-stake consensus mechanism. These upgrades could significantly increase transaction speeds and reduce fees, thereby potentially boosting Ethereum’s price.

-

Institutional Adoption: Increasing interest and investment from institutional entities often bode well for crypto prices. Ethereum’s growing involvement in various enterprise applications and financial tools presents a strong case for increased demand and, subsequently, price increases.

- Regulatory Environment: The regulatory landscape surrounding cryptocurrencies remains a pivotal factor. Positive developments, such as clear and supportive regulations, could propel Ethereum into new price territories.

Market Sentiment and Investor Behavior

Investor sentiment is another critical aspect influencing Ethereum’s price. With the rise in discussions surrounding its technological upgrades and more institutions leaning towards blockchain for solutions, the general sentiment is gradually shifting from cautious to optimistic.

Monitoring tools like the Fear and Greed Index, social media sentiment analysis, and trading volume can provide insights into investor behavior and sentiment, hinting at whether a breakout is imminent.

Potential Scenarios and Precautions

Investors and traders should brace for multiple scenarios:

- Bullish Breakout: If the price breaks above the triangle’s upper boundary on significant volume, a new uptrend could be initiated.

- Bearish Drop: Alternatively, a breakdown below the triangle could lead to a sell-off, underscoring the essential nature of stop-loss strategies.

Given the volatile nature of cryptocurrencies, it’s advisable for investors to employ risk management strategies, staying aware of both macroeconomic factors and Ethereum-specific developments.

Conclusion

The price pattern forming in Ethereum’s chart indeed suggests that a breakout might be brewing. Whether this results in a bullish rally or a bearish downturn depends on various factors including market sentiment, fundamental developments within the Ethereum network, and overarching economic conditions. Investors should keep a close eye on emerging patterns and be ready to adjust their strategies accordingly, taking into account the inherent unpredictabilities associated with cryptocurrencies. As always, a balanced perspective combining technical analysis with keen market insight is crucial in navigating the complex yet potentially rewarding cryptocurrency market.