Injective (INJ) Completes Its First Community-Driven Buyback Worth $32 Million

Injective Protocol has made headlines in the cryptocurrency sector by completing its inaugural community-based buyback, amounting to a substantial $32 million. This significant financial move is not just a display of the protocol’s robust economic health but also a testament to its commitment to fostering community involvement and ensuring the token’s stability and growth potential.

What is Injective Protocol?

Injective Protocol is recognized for its decentralized finance (DeFi) services which offer a fully decentralized exchange platform that is entirely permissionless, allowing users to trade on any derivative market of their choosing with zero gas fees. This innovative approach positions Injective as a pivotal player in the DeFi arena, facilitating an unrestricted financial future.

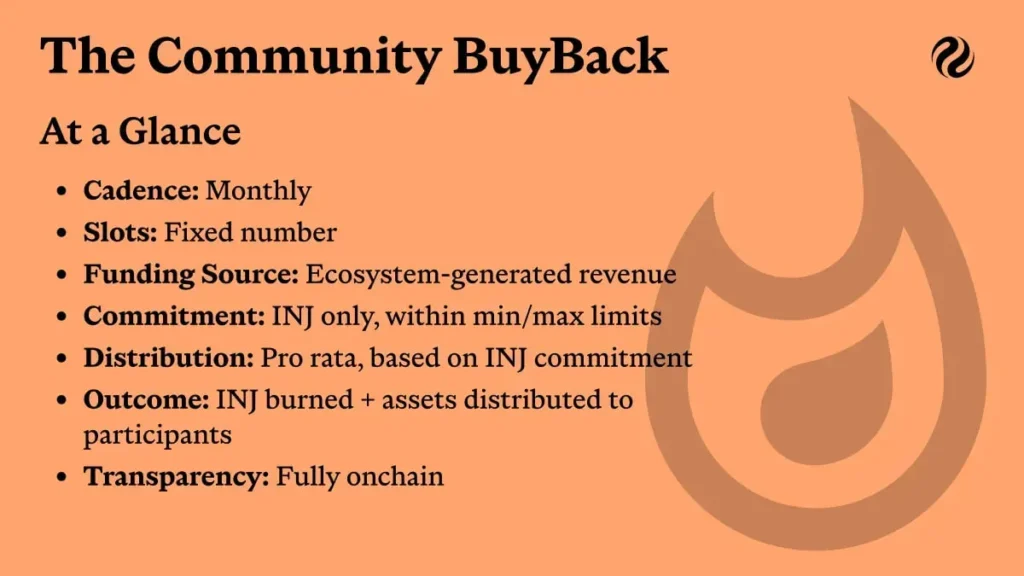

Details of the Buyback

The buyback involved purchasing INJ tokens, the native token of Injective Protocol, from the open market. This strategy was devised following considerable discussions within the community and numerous governance proposals. The decision to buy back tokens worth $32 million reflects a strategic move to reduce the overall supply, potentially leading to an appreciation in token value. Moreover, this approach directly benefits the community, giving them a say in crucial governance decisions, thereby aligning with the decentralized ethos of the protocol.

Significance of the Buyback

This buyback serves multiple strategic objectives. First, it demonstrates Injective Protocol’s solid financial foundation and commitment to reinvesting in its own ecosystem. Second, it actively involves the community in the governance process, empowering token holders and giving them a stake in the decision-making process. This is especially crucial in a landscape like DeFi, where decentralization and user empowerment are key.

Market Reaction

Following the announcement, the market’s reaction was noticeably positive. The value of INJ saw an uptick, reflecting investor confidence in the protocol’s governance and future roadmap. Analysts suggest this could pave the way for further price stability and growth as the protocol continues to expand and innovate.

Future Prospects

Looking forward, Injective Protocol aims to continue enhancing its DeFi offerings, with plans to expand beyond derivatives trading to include new financial instruments in a decentralized manner. The successful completion of this buyback not only strengthens Injective’s market position but also bolsters its reputation within the community and with potential investors.

The protocol’s emphasis on zero gas fees and a fully decentralized trading experience remains a significant draw for users seeking efficient and cost-effective trading solutions. As Injective continues to innovate and build out its features, the ecosystem looks poised for further growth and greater adoption.

Conclusion

The successful completion of their first community-driven buyback marks a significant milestone for Injective Protocol. By actively involving the community in key financial decisions, Injective not only upholds its commitment to decentralization but also reinforces its financial dedication to ensuring the growth and stability of the INJ token. This bold move underscores the protocol’s strong positioning in the DeFi market, ready to face future challenges and seize opportunities as they arise in the dynamic cryptocurrency environment.