Title: Volatility Isn’t The Enemy: Inefficiency Is

In the world of investing, trading, and economics, volatility often gets a bad rap. It is typically portrayed as a perilous beast that threatens to devour returns and upend markets. However, it’s high time we reassess this viewpoint and explore why inefficiency, rather than volatility, should be viewed as the real adversary in the financial landscape.

Understanding Volatility

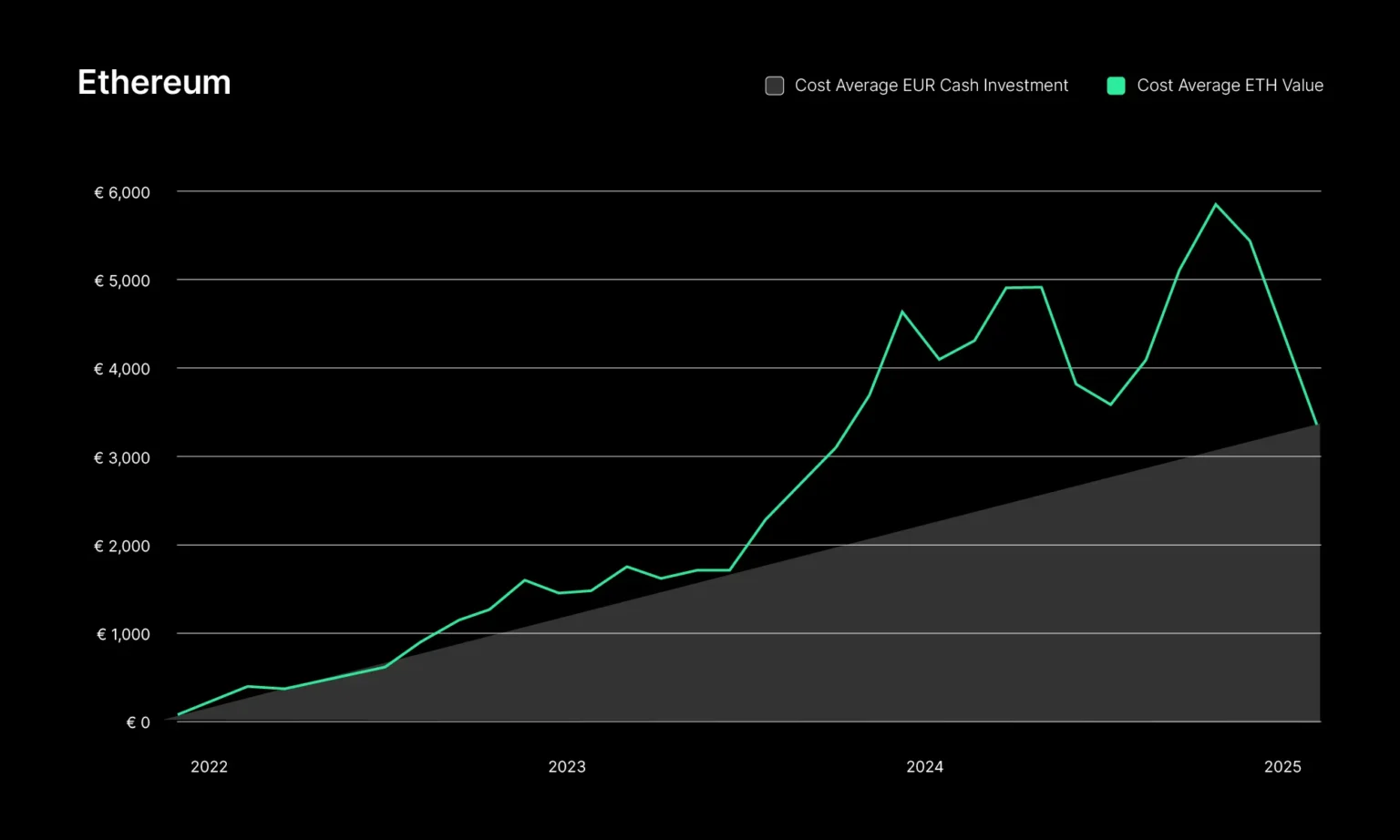

Volatility represents the degree to which the price of a security, asset, or market index fluctuates over a specific period. It is often measured by the standard deviation of returns and serves as a proxy for risk. While high volatility means an asset’s price can change dramatically in a short period in either direction, it isn’t inherently negative. In fact, volatility can benefit investors by offering opportunities for significant gains.

Sharp market movements can create lucrative openings for astute investors who can buy assets at low prices during downturns and sell them during upswings, capitalizing on these fluctuations. Day traders and active managers often seek out volatile markets for this exact reason, as these environments present numerous trading opportunities.

The True Foe: Inefficiency

While volatility presents challenges, it is inefficiency that poses a more insidious threat. Market inefficiency occurs when there is a failure in the dissemination or incorporation of information in prices, leading to asset values that do not reflect their true intrinsic worth. This mispricing can lead to poor allocation of resources, misguided investment decisions, and ultimately, reduced economic growth.

Inefficiencies can arise due to various factors, including regulatory constraints, monopolistic market structures, limited market participation, or informational asymmetries where some market participants have access to information not available to others.

The Perils of Inefficiency

The ramifications of market inefficiency are extensive. Investors who are unable to access or correctly interpret information might make investments that do not align with their risk profiles or expected returns, possibly resulting in substantial losses. Furthermore, inefficiency can stifle competition, deter innovation, and lead to an unfair distribution of economic gains.

The presence of inefficiencies in financial markets often necessitates greater regulatory oversight to protect uninformed investors and ensure fair trading conditions. However, excessive regulation can, paradoxically, exacerbate inefficiencies by creating barriers to entry or distorting price signals, which can hinder market dynamics.

Embracing Volatility

Given that volatility can be managed but inefficiency must be eradicated, how should stakeholders respond? Firstly, embracing volatility as a natural component of market dynamics is crucial. Investors, particularly long-term holders, need to accept that price fluctuations are part of the investment landscape and can be mitigated through diversification, hedging strategies, and a well-calibrated risk tolerance.

Educational initiatives can also equip investors with better tools to understand and leverage volatility, rather than fear it. Improved financial literacy can help demystify the complexities of volatile markets, empowering more individuals to participate confidently in the financial ecosystem.

Tackling Inefficiency

Addressing inefficiency requires a more nuanced approach. Transparency is critical – better access to reliable and timely information can help correct mispricing and lead to more efficient markets. Technological advancements such as blockchain and improved data analytics can play significant roles in enhancing transparency and reducing informational asymmetries.

Regulators must also strive to find the balance between necessary oversight and excessive interference. Smart regulations should aim to prevent market abuses and protect investors while encouraging innovation and competition.

Conclusion

Volatility and inefficiency are often conflated, but they are inherently different forces with distinct impacts on the economic and financial environment. While volatility is a natural market phenomenon that offers both risks and rewards, inefficiency is a distortive element that undermines market functionality and economic welfare. By understanding and addressing the nuances of each, stakeholders can help foster a more robust, dynamic, and equitable financial market.