Understanding the Bitcoin Death Cross and Its Impact on Future Price Movements

Bitcoin, the pioneering cryptocurrency, has always been subject to intense scrutiny and analysis, with investors and traders eagerly dissecting every pattern and trend to predict its next big move. One such pattern that often makes headlines within financial circles is the “Death Cross.” This technical chart pattern has historically been viewed as a harbinger of potential bearish downturns in various markets, including the cryptocurrency market. But what does it actually mean for Bitcoin, and how can it influence the future price trajectory of this volatile digital currency?

What is a Death Cross?

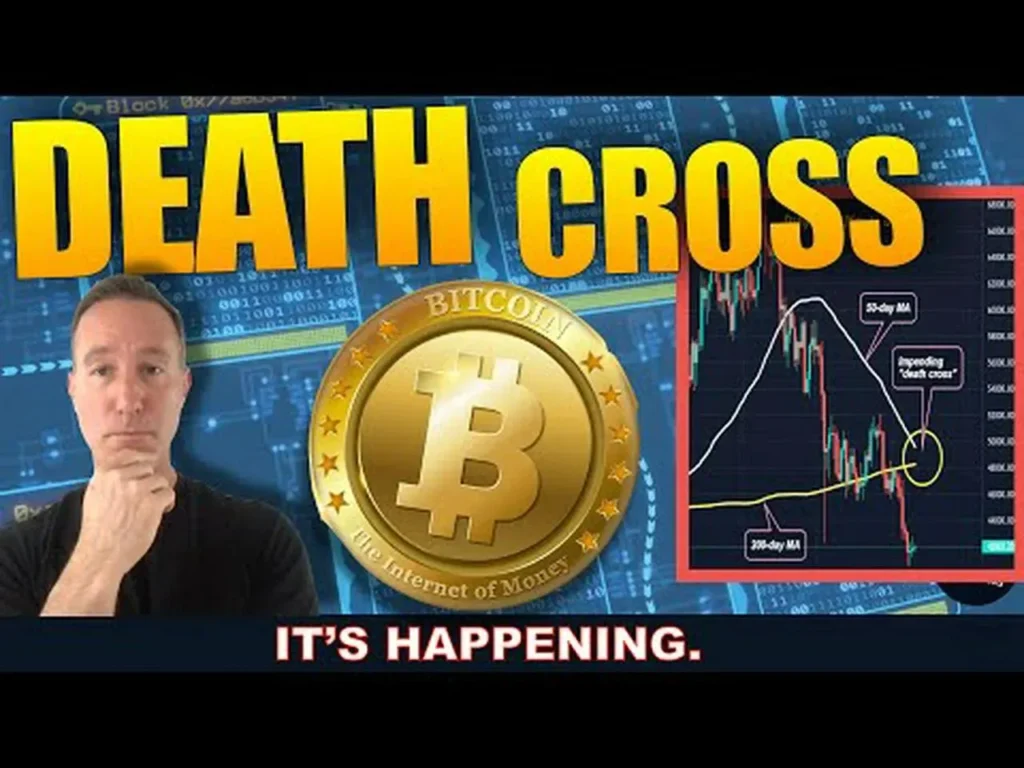

The Death Cross is a technical chart pattern indicating a possible major sell-off. It appears on a chart when a security’s short-term moving average crosses below its long-term moving average. Typically, the most commonly used averages are the 50-day moving average (short-term) and the 200-day moving average (long-term). For Bitcoin, traders watch these moving averages closely as a shift can suggest significant price movement directions.

Historical Context of the Bitcoin Death Cross

Bitcoin has experienced multiple Death Cross events in its relatively short existence. Notable occurrences were seen in 2014 and 2018, both periods where Bitcoin exhibited strong bearish trends following the pattern’s emergence. However, it’s important to note that while the Death Cross can precede plummeting prices, it’s not a foolproof indicator. Crypto markets often react to a plethora of factors including regulatory news, tech innovations, and shifts in investor sentiment, which can all override the predictive power of this chart pattern.

The Dual Nature of the Death Cross

It’s critical for investors to approach the Death Cross with a nuanced understanding:

1. Psychological Impact: The Death Cross can often lead to bearish sentiment among investors, potentially causing panic selling that exacerbates the price decline.

2. Lagging Indicator: The Death Cross is a lagging indicator, meaning it confirms trends that have already begun. By the time a Death Cross is evident, Bitcoin might have already undergone significant price decreases.

The 2023 Perspective

Looking into the recent behavior of Bitcoin’s price and its moving averages, say in 2023, whether an imminent Death Cross could suggest a downward trend might depend heavily on contextual factors surrounding the market at that time. For instance, Bitcoin’s integration into traditional financial systems, or its increasing recognition as a ‘digital gold’ for hedging inflation, might cushion any negative impacts.

Predicting the Next Price Move

When a Death Cross appears, what should Bitcoin investors do? Here’s a simplified strategy:

1. Keep Calm and Analyze: Avoid panic selling based on the Death Cross alone. Analyze other market indicators and consider broader market conditions.

2. Diversification: It’s often wise to diversify one’s investment during uncertain times. If you hold multiple assets, the negative impact of a Bitcoin downturn might be buffered.

3. Set Stop-Loss Orders: To avoid potential losses triggered by a further dip in Bitcoin’s price post-Death Cross, setting stop-loss orders can help manage risk.

Conclusion: A Tool Among Many

The Death Cross should not be viewed in isolation but as part of a broader analytical toolkit. While it can certainly provide valuable insights, its predictive reliability is not absolute. Investors should combine such technical indicators with comprehensive market analysis and their investment strategy to navigate through Bitcoin’s complex price dynamics effectively.

In conclusion, the appearance of a Bitcoin Death Cross might indeed point towards a bear market or at least a substantial price dip. However, the overall impact on the future price action should be weighed in context, taking into account prevailing market sentiments, upcoming technological developments, and macroeconomic factors that could influence cryptocurrency markets. The most successful traders will use the Death Cross as a tool rather than a prophecy, integrating it with other metrics and market signals to make informed decisions.