Hyperliquid has distinguished itself in the crypto landscape, achieving a remarkable double-digit price surge while many major cryptocurrencies, such as Bitcoin and XRP, struggle amidst a prevailing bear market. The HYPE token, a fundamental part of Hyperliquid’s ecosystem, has soared approximately 71% to reach a peak of $35, marking the highest valuation since last December. This unexpected price movement captures the attention of crypto traders, signaling a bullish sentiment around Hyperliquid’s innovative product offerings and its strategic focus on perpetual contracts. In contrast to the broader trends in the DeFi market, where risk aversion reigns, Hyperliquid’s resilience reflects its unique structural attributes that could drive further demand for HYPE. As the crypto trading environment evolves, understanding the implications of Hyperliquid’s performance on market dynamics is crucial for investors keen on navigating the complexities of the digital asset space.

Hyperliquid showcases a fascinating case study in the cryptocurrency market, especially amid the prevailing bearish trends affecting many digital assets. The recent HYPE token price surge highlights the protocol’s potential to innovate within decentralized finance (DeFi) by harnessing the power of perpetual contracts. As the crypto space grapples with risk aversion, Hyperliquid’s strategies for growth and volatility management present a stark contrast to traditional trading patterns observed in other cryptocurrencies. Notably, with increasing trading activity, the demand for HYPE token serves as a barometer for the evolving sentiments within the digital trading landscape. This exploration into Hyperliquid’s market performance offers valuable insights into current trends and future directions that investors should consider.

| Key Point | Details |

|---|---|

| Hyperliquid’s Price Surge | HYPE surged approximately 71%, reaching a peak of $35, contrary to trends in the broader market. |

| US Investor Influence | The upward movement of HYPE is being primarily driven by US investors. |

| Market Sentiment | While the overall market is experiencing a downturn, especially impacting major tokens, HYPE shows resilience. |

| Revenue Generation | Hyperliquid’s 30-day revenue reached $68.42 million, with an annualized revenue pegged at $834.7 million. |

| Buyback Mechanism | 99% of fees are directed towards buying back HYPE tokens, increasing demand amid trading activity. |

| Expansion Beyond Cryptos | Hyperliquid plans to diversify into Real World Assets (RWAs) and new markets with HIP-3 and HIP-4 upgrades. |

| Next Unlock Concern | A significant HYPE unlock set for February 6 could impact market dynamics depending on holders’ selling behavior. |

Summary

Hyperliquid stands out in the current crypto landscape by achieving significant price increases while the broader market faces downward pressure. This surge, primarily driven by US investor enthusiasm, suggests a promising trajectory for HYPE amidst an otherwise bearish environment for digital assets. As Hyperliquid expands its offerings and enhances its volatility revenue, the potential for further growth is evident. The upcoming token unlock on February 6 presents both an opportunity and a challenge, as market reactions will depend on trading behaviors surrounding this event. Overall, Hyperliquid’s resilient performance and innovative strategies could redefine its standing in the volatile crypto sphere.

Understanding Hyperliquid’s Recent HYPE Token Surge

Hyperliquid’s recent performance showcases an impressive surge in its HYPE token, experiencing a remarkable increase of approximately 71% over the last couple of weeks. While major cryptocurrencies like Bitcoin and XRP are facing significant downward pressure in the bear market, Hyperliquid has diverged from this trend, indicating strong investor sentiment. Notably, this price increase brought HYPE to about $35, the highest since last December, highlighting the potential that traders see in Hyperliquid’s platform for expanding product offerings.

This surge is not merely a market anomaly; it reflects a broader shift where traders are finding refuge in assets that thrive amid volatility, unlike traditional altcoins. Investors are increasingly recognizing Hyperliquid not just as a crypto asset but as a platform that can capitalize on changing market dynamics. The contrast in performance with broader market trends emphasizes the unique position Hyperliquid holds and the strong demand it’s generating from crypto traders looking for alternative trading opportunities.

The Role of Volatility in Hyperliquid’s Growth

In the context of risk aversion plaguing the larger crypto market, Hyperliquid’s unique value proposition lies in its perpetual contracts, which gain traction as market volatility spikes. This volatility drives traders to engage in hedging, asset rotation, and speculation, significantly increasing trading volumes on the platform. As a result, Hyperliquid has reported substantial revenues, reaching 30-day totals of $68.42 million, thus demonstrating how volatility plays a pivotal role in encouraging trading activity that directly impacts HYPE’s demand.

Furthermore, the design of Hyperliquid ensures that increased trading activity translates into direct demand for HYPE tokens. The perpetual futures trading mechanism fosters a self-reinforcing loop where higher volumes generate fees that contribute to buying back HYPE tokens. This intrinsic relationship underlines the platform’s potential to weather market downturns while enhancing its revenue generation structures.

The Impact of Recent Market Dynamics

While the broader crypto market grapples with a pronounced risk-off sentiment, Hyperliquid stands out by demonstrating resilience thanks to its solid fundamentals. Anticipation of buybacks linked to thriving trading volumes has led to increased investor interest in HYPE token. Data indicates that daily buyback rates have surged, reaching nearly $4 million, showcasing how a volatile market can boost the platform’s stability and attractiveness as a trading platform.

In addition, the increased metrics of HYPE’s trading performance signify a tightening demand curve that can safeguard HYPE against the fluctuations typical in a bear market. The rise in buybacks at elevating price points indicates that investors are not only buying HYPE but are reinforcing their belief in its long-term viability amidst broader market challenges.

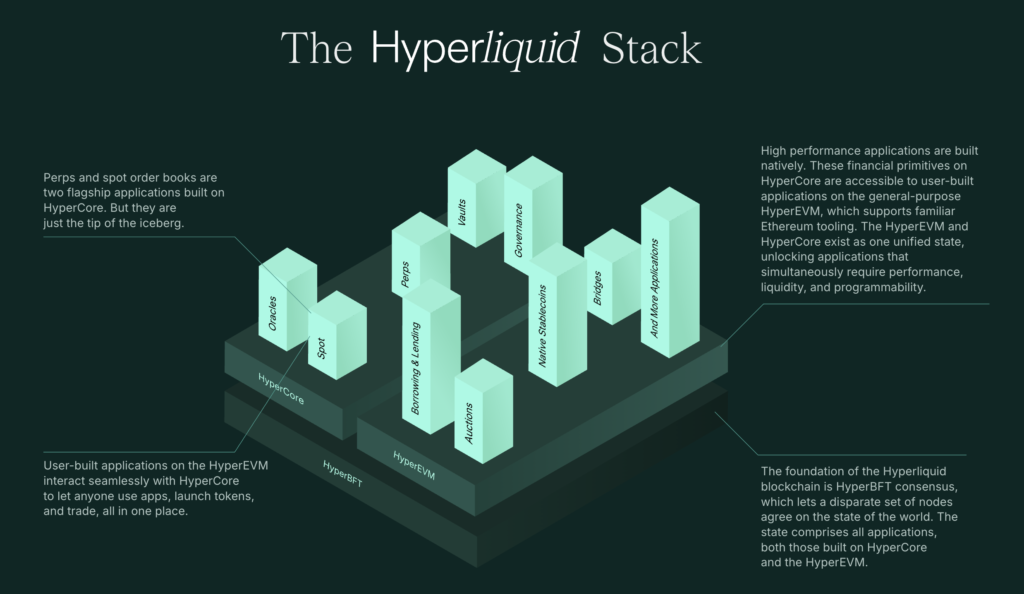

Hyperliquid’s Strategic Product Expansions

Hyperliquid’s forward-looking approach is evident in its recent updates which focus on expanding its ‘volatility surface area’ by diversifying into Real World Assets (RWAs) and permissionless markets. The recent HIP-3 upgrade facilitates this diversification, allowing for the creation of new markets for perpetual contracts. Such strategic initiatives are designed to attract a wider trader base while enhancing liquidity on the platform, ultimately benefiting HYPE token holders.

By introducing innovative products and markets, Hyperliquid aims to provide traders with more opportunities, especially during instability in traditional crypto assets. This diversification not only supports HYPE’s price stability but also positions Hyperliquid as a robust player in the DeFi market, reflecting trends that favor specialized trading platforms over generic ones.

Anticipating the Future: HIP-4 and Its Potential

The upcoming launch of HIP-4, which introduces outcome-style and event-based markets, is poised to enhance Hyperliquid’s market appeal significantly. These new derivatives are tailored to attract traders looking for predictive market instruments and limited-risk structures designed to avoid liquidations. Such innovations are expected to drive substantial trading volumes and interest in HYPE, potentially leading to another price surge.

Market sentiment regarding HIP-4’s rollout remains optimistic, and early indicators point toward a potential influx of trading activity. As traders anticipate these developments, Hyperliquid’s ability to innovate and remain adaptive in a challenging market landscape will be crucial in determining the trajectory of HYPE’s price in the coming months.

Hyperliquid’s Upcoming Core Contributor Unlock Event

As February 6 approaches, the impending release of 9.92 million HYPE tokens to core contributors raises important questions about market dynamics. This unlock event could drastically affect HYPE’s price if contributors decide to sell aggressively. While the automated buyback mechanism is in place, the sheer scale of this unlock represents a substantial value that could challenge the token’s current resilience.

Traders will be closely monitoring how this unlock affects market sentiment. A staggered selling approach could mitigate negative impacts, whereas rapid selling in a low-risk appetite environment may result in a significant dip. The behavior of core contributors in this unlock will be a critical factor in determining HYPE’s immediate future, especially amidst a backdrop of cautious market conditions.

Navigating Market Sentiment in the DeFi Landscape

Overall, Hyperliquid finds itself at a unique intersection of market dynamics, where it must navigate both the structural support of its design and the psychological aspects of trader sentiment. As it capitalizes on volatility and diversifies its offerings, understanding these market sentiments can provide crucial insights into how Hyperliquid and HYPE might fare amid changing conditions and increased scrutiny.

In a landscape where many tokens face challenges, Hyperliquid’s focus on stability and innovation could set it apart. It’s imperative for traders and investors to keep an eye on the broader DeFi market trends while also understanding the behavioral nuances that can impact HYPE’s price action, especially as the market continues to adjust to ongoing uncertainties.

HYPE Token’s Long-term Viability Amid Market Cycles

With the DeFi market eyeing a potential recovery, HYPE’s long-term viability hinges on Hyperliquid’s ability to adapt to market cycles. The mechanisms that connect trading activity with buying pressure signal that, if managed well, HYPE could maintain its upward trajectory in favorable conditions. However, strategic maneuvers will be essential in ensuring that any potential volatility generates sustained interest rather than panic selling.

Moreover, as Hyperliquid broadens its scope by integrating more diverse trading instruments, its relevance within the crypto ecosystem will likely grow. Long-term investments in HYPE will depend on the platform’s capacity to innovate continually, address trader needs, and effectively manage their buyback strategies to foster lasting interest amidst fluctuating market dynamics.

Hyperliquid’s Edge in a Competitive DeFi Market

As the DeFi market becomes increasingly crowded, Hyperliquid maintains a competitive edge through its innovative approach to perpetual contracts and volatility trading. By not relying solely on traditional trading methods or sentiment-based valuations, it positions itself to attract traders seeking opportunities insulated from extensive market fluctuations. Such a strategic foundation is vital for its growth trajectory.

Hyperliquid’s commitment to enhancing user experience through product innovation and market diversification makes it a standout platform in a sea of similar offerings. As more traders recognize the value of using advanced strategies that capitalize on market volatility, HYPE’s role could solidify further in the DeFi landscape, making it a key player to watch moving forward.

Frequently Asked Questions

What is Hyperliquid and how does it relate to the HYPE token?

Hyperliquid is a trading protocol that offers perpetual contracts and aims to capitalize on volatility in the crypto market. The HYPE token is essential within the Hyperliquid ecosystem, as it is used for staking, governance, and benefiting from the platform’s revenue generation, especially during market surges.

How has the Hyperliquid price surged in comparison to Bitcoin and other altcoins?

Recently, Hyperliquid has experienced a notable price surge, with the HYPE token rising approximately 71%, reaching a peak of $35. This performance stands in stark contrast to Bitcoin and traditional altcoins like XRP, which have struggled amid a broader bear market.

What role do perpetual contracts play in Hyperliquid’s trading model?

Perpetual contracts are at the core of Hyperliquid’s trading model, allowing traders to speculate on price movements without an expiration date. Increased volatility often leads to higher trading volumes in these contracts, enhancing Hyperliquid’s revenue and subsequently benefiting the HYPE token through a mechanical loop.

What are the implications of Hyperliquid’s significant trading volumes for the HYPE token?

The rising trading volumes on Hyperliquid result in increased fees that are directed toward purchasing HYPE tokens. This creates a systematic buyback mechanism that supports HYPE’s price, especially during market instability, ultimately driving demand even amid bearish trends.

How is Hyperliquid responding to current DeFi market trends?

Hyperliquid is adapting to the evolving DeFi market trends by expanding its product offerings and surface area to include Real World Assets (RWAs) and new event-based markets, as indicated by its recent upgrades, such as HIP-3 and HIP-4. These innovations aim to attract additional trading volumes and enhance the utility of the HYPE token.

What should investors know about the upcoming unlock of HYPE tokens?

On February 6, a significant unlock of 9.92 million HYPE tokens will take place, affecting approximately $335 million at current valuations. Investors should monitor this event closely, as aggressive selling by unlocked holders could impact HYPE’s price, despite ongoing buybacks and strong market interest.

What factors contribute to the volatility revenue observed in Hyperliquid?

Hyperliquid’s volatility revenue is driven by the active trading environment of perpetual contracts, particularly during market fluctuations. As traders engage in hedging and speculation, the trading volumes and associated fees increase, fostering stronger demand for the HYPE token within the system.

How does Hyperliquid ensure the security of its staking and market participation?

Hyperliquid requires builders to stake 500,000 HYPE tokens for deploying perpetual contracts. This staking mechanism ensures that participants are financially committed to the platform’s integrity, as any malfeasance can result in slashing through validator votes.

What are the expected benefits of Hyperliquid’s HIP-4 upgrade for traders?

HIP-4 will introduce fully collateralized outcome-style contracts, designed to limit risk and avoid margin calls. These new contract types aim to attract traders seeking predictive market instruments, potentially boosting trading volumes and enhancing the HYPE token’s value.

What market conditions could affect the performance of the HYPE token in the future?

The future performance of the HYPE token may be influenced by market volatility levels, trading activity, macroeconomic factors, and the effects of significant token unlocks. Increased volatility can enhance interest in perpetual contracts and stabilize HYPE’s price, but diminished market engagement could lead it to behave like a typical altcoin.