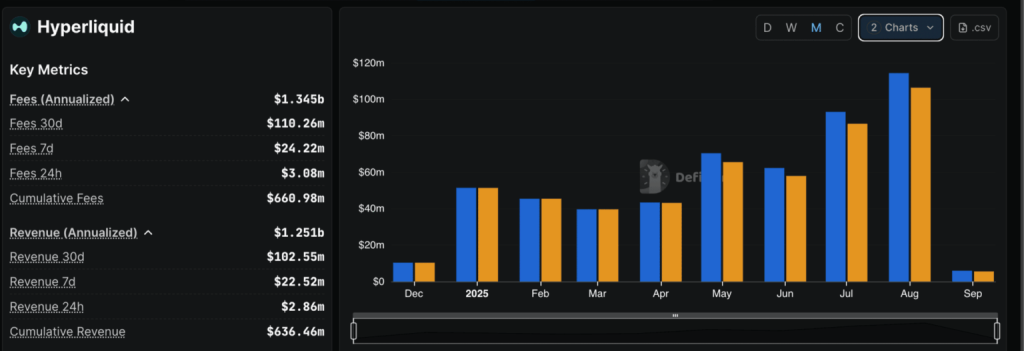

Hyperliquid blockchain fees have recently made headlines by securing the top position in the latest blockchain fee rankings, showcasing its efficiency in the cryptocurrency landscape. According to Artemis data, Hyperliquid outperformed competitors like edgeX and Tron in terms of transaction costs. This surge in performance is critical for traders and investors looking for cost-effective solutions in the ever-evolving digital currency environment. As the demand for efficient cryptocurrency fees rises, Hyperliquid’s prominence highlights its potential to reshape user experiences. Stay tuned for the latest Hyperliquid news, as its rising position continues to attract attention from the crypto community.

The transactional costs associated with cryptocurrencies are a vital aspect of any digital asset exchange, and Hyperliquid is currently at the forefront of this discussion. Recently, Hyperliquid has emerged as a leader in the realm of blockchain fees, easily eclipsing traditional platforms like edgeX and Tron. As users across the globe seek competitive advantages in trading, understanding the nuances of fees becomes essential. Terms like cryptocurrency expenses and digital transaction costs are becoming increasingly relevant in today’s market. Therefore, keeping an eye on Hyperliquid’s developments can provide valuable insights into the future of efficient trading.

Understanding Hyperliquid Blockchain Fees

Hyperliquid has made headlines recently by topping the blockchain fee rankings. This achievement indicates the platform’s efficient transaction mechanisms and growing popularity among cryptocurrency users. As more individuals and businesses flock to Hyperliquid, understanding its blockchain fees becomes critical for users looking to maximize their investments and minimize transaction costs. Analyzing these fees can provide potential investors with insights into not only the current state of the platform but also its future scalability and user experience.

The Hyperliquid platform stands out for its competitive fee structure compared to others in the blockchain ecosystem, such as Tron and edgeX. For instance, while Tron fees often fluctuate, Hyperliquid maintains a transparent and relatively low-cost transaction process. This can be incredibly beneficial for traders who engage in high-volume transactions, as lower fees can lead to significant savings over time. Keeping an eye on blockchain fee rankings ensures that users always choose the most financially prudent platforms.

A Comparative Study of Blockchain Fee Rankings

In the highly competitive cryptocurrency market, fee structures play a crucial role in determining user preference among exchanges. Recent blockchain fee rankings revealed that Hyperliquid, edgeX, and Tron are at the forefront, each catering to different user needs. Hyperliquid’s position as a leader indicates not only its efficacy in cost management but also its ability to attract new users. It is essential to delve deeper into how these platforms manage their fees and what that means for the user experience overall.

Looking at the fee structures from a comparative perspective, we note distinct features across different platforms. For example, edgeX has gained traction for offering straightforward fee transparency, while Tron achieves competitive rates, especially for high-frequency transactions. However, Hyperliquid’s ability to adjust fees dynamically based on network demand places it at an advantage. Understanding these nuances is vital for anyone interested in cryptocurrency, as it impacts potential returns on investment.

The Impact of Cryptocurrency Fees on Trading Strategies

Trading strategies in the cryptocurrency world are often influenced by the fees associated with each platform. As users navigate various exchanges, understanding the impact of transaction costs becomes paramount. Hyperliquid’s standing in the blockchain fee rankings suggests it provides a suitable environment for frequent traders focused on minimizing overhead expenses. Therefore, integrating these fees into one’s trading strategy can enhance profit margins and overall trading efficiency.

On the other hand, a thorough analysis of cryptocurrency fees at edgeX and Tron reveals important considerations for traders. These fees can vary not just in terms of percentage but also in terms of how they are calculated based on transaction size or volume. By assessing these fees critically, traders can choose platforms like Hyperliquid that align best with their trading patterns. This strategy can be particularly beneficial for those engaged in activities such as day trading, where every transaction count towards the overall profitability.

The Role of EdgeX in Blockchain Fee Comparisons

EdgeX has emerged as a significant player in fee comparisons within the blockchain sector. Its fee structure not only competes against platforms like Hyperliquid and Tron but also offers unique features that appeal to certain user demographics. By analyzing how edgeX manages its fees, users can better understand how it fits into their overall trading landscape — especially when considering potential switching costs involved when moving from one platform to another.

The comparative advantage edgeX holds often stems from its trial user programs that enable traders to experience the platform without significant risk. In contrast to Hyperliquid’s rapidly evolving fee model, edgeX offers a more stable fee environment that can be appealing for long-term investors. Ultimately, the decision may depend on whether a trader prioritizes low fees (as with Hyperliquid) or stability and predictability in their transaction costs.

Tron Blockchain Fees: An Overview

Tron has established itself as a significant entity in the blockchain ecosystem, known for its low transaction fees and high throughput capabilities. As one of the three leaders in blockchain fee rankings, it appeals to a wide range of users, from casual traders to high-frequency investors. Users often weigh the benefits of low fees against other factors like transaction speed and reliability.

Comparing Tron’s fees with those of Hyperliquid reveals interesting dynamics in user choice. While both platforms provide competitive pricing, Tron implicitly appeals with its marketing around fee-less transactions for specific operations. However, potential traders should consider not only the fees but also overall platform efficiency and user feedback when deciding which blockchain best fits their needs.

Navigating Cryptocurrency Fees for New Users

For newcomers to the cryptocurrency landscape, navigating transaction fees across different platforms can be daunting. By focusing on blockchain fee rankings, new users can quickly identify the most economically feasible options. Hyperliquid stands out as an ideal starting point, offering low costs and a user-friendly interface for beginners who are still learning about the crypto space.

Additionally, it’s essential for new users to engage actively in learning about each platform’s fee structure to avoid unexpected costs later. Platforms like edgeX and Tron present their unique advantages, and understanding these can make a significant difference in a user’s overall trading experience. By conducting thorough research and utilizing blockchain fee comparisons, users can set realistic expectations, leading to smarter trading and investment choices.

Future Trends in Blockchain Fees and Their Implications

As the cryptocurrency market evolves, so too does the landscape of blockchain fees. Future trends may include increased transparency in fee structures, greater competition among platforms like Hyperliquid, edgeX, and Tron, and potentially lower fees overall. Keeping an eye on these trends is crucial for traders looking to maximize their profits in an increasingly competitive environment.

Moreover, the implications of these changes can significantly impact trading behaviors. Greater transparency may design user trust and foster a more engaged community. Additionally, as platforms work to capture market share, innovations in fee structures could redefine how users approach trading strategies. Adapting to these trends will be key as the cryptocurrency world continues to grow and change.

Hyperliquid News: Keeping Up with Developments

The Hyperliquid platform is continuously evolving, with developments that can impact its users and fee structures. To stay informed, traders should regularly follow Hyperliquid news and updates from reliable sources. This vigilance ensures that users can adjust their strategies in response to changes, such as shifts in fee structures or new features that may influence their trading experience.

Regularly checking for updates allows traders not only to stay informed about changes in Hyperliquid’s fees but also to understand broader market trends that may affect the entire blockchain ecosystem. Staying ahead of the curve is vital for traders aiming to optimize their trading outcomes and maximize their investment in cryptocurrency.

The Importance of Fee Awareness in Cryptocurrency Trading

Awareness of fees is crucial for anyone involved in cryptocurrency trading. Each platform, including the likes of Hyperliquid, edgeX, and Tron, has different structures that can greatly affect trading outcomes. By becoming more fee-aware, users can make better decisions, ultimately leading to improved profitability.

This awareness extends to understanding how fees are applied, whether they are based on transaction volume or specific asset transfers. Being educated on these factors will help traders navigate the complexities of cryptocurrency ecosystems effectively. Tools and resources for fee comparisons should be utilized to make informed decisions that align with a trader’s individual strategy and goals.

Frequently Asked Questions

What are the current Hyperliquid blockchain fees as ranked today?

As of January 8, 2026, Hyperliquid tops the blockchain fee rankings, achieving the lowest fees among competing platforms, particularly in comparison to edgeX and Tron.

How does Hyperliquid compare to edgeX in blockchain fees?

Hyperliquid currently has lower blockchain fees than edgeX, placing it at the top of the fee rankings according to recent reports from Artemis.

Why are Hyperliquid blockchain fees considered favorable?

Hyperliquid’s blockchain fees are considered favorable as it ranked first in recent comparisons, showcasing competitive pricing that benefits users over platforms like edgeX and Tron.

Are Hyperliquid blockchain fees lower than Tron’s fees?

Yes, according to the latest cryptocurrency fees evaluations, Hyperliquid’s blockchain fees are lower than those of Tron, providing a more cost-effective option for users.

Where can I find updates on Hyperliquid news related to blockchain fees?

Updates on Hyperliquid news, especially regarding blockchain fees and fee rankings, can typically be found on cryptocurrency news websites and financial data platforms, including Artemis.

| Ranking | Blockchain | Fees | |

|---|---|---|---|

| 1 | Hyperliquid | Top ranked in fees | |

| 2 | edgeX | Second in fees | |

| 3 | Tron | Third in fees |

Summary

Hyperliquid blockchain fees have been the highest in the rankings for the last 24 hours, indicating a strong position in the market. As detailed in the recent data from Artemis, Hyperliquid leads amidst competitors edgeX and Tron, showing significant growth and user engagement.

Related: More from Market Analysis | Barclays Looks at Blockchain for Payments, Deposits | PayPal USD Powers New PYUSDx App