| Key Point | Details |

|---|---|

| HYPE Whale Position | A significant whale is holding a long position on HYPE. |

| Unrealized Loss | The whale’s unrealized loss exceeds $23.3 million. |

| Leverage Used | The long position is leveraged at 5x. |

| Current HYPE Price | HYPE’s price has dropped below $22. |

| Capital Loss | The capital loss stands at $1.25 million. |

| Liquidation Price | The liquidation price is set at $19.32. |

Summary

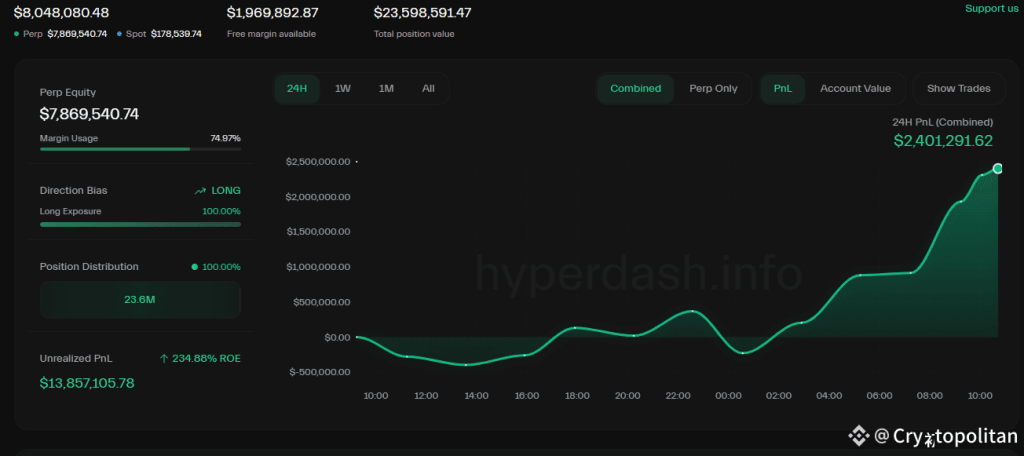

HYPE whale unrealized loss has emerged as a significant concern following recent market events. A prominent whale with a 5x leverage long position on HYPE is currently facing an alarming unrealized loss that exceeds $23.3 million due to the price plummeting below $22. This situation emphasizes the risks associated with leveraged trading, particularly in volatile markets. As the current capital loss stands at $1.25 million and the liquidation price is notably at $19.32, traders should remain vigilant and assess the impacts of price fluctuations on their positions.

In the ever-volatile world of cryptocurrencies, the HYPE whale unrealized loss has become a focal point for traders and investors. Recent reports indicate that a prominent whale, having placed a long position with 5x leverage on HYPE, is now facing staggering unrealized losses surpassing $23.3 million. This dramatic shift comes as HYPE’s price experienced a significant drop below $22, triggering ripple effects throughout the market. With the current HYPE liquidation price set at $19.32, concerns about further trading losses loom large. Such scenarios highlight the precarious nature of long positions in the cryptocurrency landscape, where market fluctuations can lead to substantial capital losses like the one currently faced by this whale.

The recent developments surrounding this notable HYPE investor reveal a critical aspect of whale trading dynamics and their associated risks. With the cryptocurrency’s value witnessing a drastic decline, this investor’s long position has turned into an unrealized loss, presenting challenges commonly faced by large-scale traders. The losses highlight the precarious balance between leveraging investments and the potential for significant financial downturns. Understanding the implications of market movements on such holdings is essential for both novice and seasoned traders alike. This situation encapsulates the risks inherent in cryptocurrency markets, especially when leveraging significantly for long positions.

Understanding the HYPE Whale’s Unrealized Loss

The recent downturn in the HYPE cryptocurrency has left a prominent whale trader facing an astonishing unrealized loss of over $23.3 million. This significant figure underscores the high stakes associated with cryptocurrency trading, especially for those employing leverage. In trading terms, an unrealized loss occurs when the market price of an asset—here, HYPE—drops below the purchase price, but the position has not yet been liquidated. This scenario becomes increasingly precarious for whales who hold large amounts of cryptocurrency, as they risk larger financial impacts compared to average traders.

As the HYPE price dipped below $22, the whale’s long position, which was amplified by 5x leverage, became vulnerable. Such leverage can intensify both gains and losses; in this case, it has led to a substantial unrealized loss in trading. Traders must monitor not only the market price but also their liquidation price, which in this case is set at $19.32. If HYPE continues to fall, reaching this liquidation threshold, the whale could face forced selling of their holdings, potentially exacerbating the market downturn.

Impact of HYPE Price Drop on Whale Trading Strategies

The recent HYPE price drop has significant implications for whale trading strategies. As cryptocurrency prices fluctuate, whales often employ sophisticated tactics to mitigate risks and enhance potential returns. However, with an unrealized loss exceeding $23.3 million, this specific whale’s strategy may need reevaluation. The situation highlights the inherent risks of maintaining long positions in volatile markets, especially when amplified through leverage.

Whales, due to their substantial holdings, can create ripple effects in the market. This HYPE liquidation scenario may not only impact the whale’s portfolio but also influence other traders’ decisions. If the price approaches the liquidation threshold, it could trigger a wave of selling activity, further driving the price down. Understanding these dynamics is crucial for traders who wish to avoid similar pitfalls associated with whale trading losses.

Long position traders must continuously analyze market trends to protect against such drastic downturns. The losses experienced by this whale serve as a warning to others in the cryptocurrency space, emphasizing the importance of establishing robust stop-loss orders and exit strategies.

Assessing the Risks: The HYPE Liquidation Price

The HYPE liquidation price of $19.32 is a critical point for traders holding leveraged long positions. Once the market price approaches or dips below this level, traders must either infuse additional capital to maintain their positions or risk liquidation. This pressure can lead to significant losses not just for individual traders but also for the overall market, as mass liquidations may result in a cascade of price declines.

Understanding the implications of the liquidation price is vital for any cryptocurrency trader. This highlights the necessity for proper risk management strategies, especially for those in leveraged positions. The case of the HYPE whale demonstrates how unforeseen price drops can create severe financial repercussions, making it crucial for traders to stay informed about market conditions and adjust their positions accordingly.

Strategies to Mitigate Unrealized Loss in Trading

Traders can adopt several strategies to mitigate unrealized losses in trading, particularly in the highly volatile cryptocurrency market. Firstly, establishing a clear risk management plan is essential. This can involve setting stop-loss orders, which automatically sell a position when it reaches a predetermined price, helping to protect against drastic losses.

Additionally, diversifying one’s portfolio can spread risk across various assets, reducing the impact of a single asset’s poor performance. For instance, if a trader holds multiple cryptocurrencies, a downturn in HYPE might be offset by gains in others, cushioning the overall financial impact. Active monitoring of market trends and adjusting positions accordingly can also play a crucial role in reducing potential unrealized losses.

Market Reactions: Aftermath of the HYPE Price Drop

The cryptocurrency market often reacts swiftly to significant events, such as the recent HYPE price drop. Following such downward fluctuations, market sentiment can tilt towards fear and uncertainty, leading to increased volatility. Traders may panic-sell to avoid further losses, creating a ripple effect that drives prices down even more. The aftermath of such a price drop can thus be quite pronounced, with implications for traders, investors, and even the broader market.

In light of the whale’s unrealized loss, market observers are closely monitoring trading behavior. It’s crucial for participants in the cryptocurrency ecosystem to remain vigilant, as the actions of whales can influence price dynamics in significant ways. Understanding how psychological factors and market sentiments interplay can help traders devise more effective strategies to navigate this tumultuous environment.

Long Position Challenges in Cryptocurrency Trading

Holding long positions in cryptocurrencies can be particularly challenging due to their inherent volatility. Traders aiming for profit must continually assess their investments against market trends. In the case of the HYPE whale, the inability to counteract the steep price drop has resulted in substantial losses. This underscores the high risks associated with long positions, particularly those utilized with leverage.

Moreover, the emotional toll of such losses can impact a trader’s future decision-making. As seen with the HYPE situation, unrealized losses may deter traders from pursuing further long positions or lead to more cautious trading practices. It’s vital for traders to develop psychological resilience and maintain a disciplined trading approach, irrespective of market fluctuations.

Lessons Learned from HYPE Trading Losses

The extensive unrealized loss experienced by the HYPE whale serves as a collective lesson for traders in the cryptocurrency market. It highlights the necessity of thorough research, understanding market dynamics, and being aware of one’s positions during turbulent times. As the digital asset landscape continues to evolve, learning from both personal and others’ trading experiences is essential for navigating potential pitfalls in the future.

Additionally, this situation champions the importance of education in trading. By enhancing one’s knowledge of market indicators, leverage implications, and risk management strategies, traders can make more informed decisions, potentially steering clear of severe losses like the one the HYPE whale is currently facing.

The Future of HYPE and Cryptocurrency Trading

Looking forward, the future of HYPE and its price trajectory remains uncertain. The volatility that characterizes the cryptocurrency market requires traders to remain agile and make data-driven decisions. The significant unrealized loss of the whale may provoke shifts in market behavior, as traders reassess their positions and strategies in light of the recent price movements.

Advancements in analytics and trading technology can provide traders with better tools for monitoring market trends and managing risks. As the cryptocurrency ecosystem matures, it will likely offer more robust mechanisms to protect against the type of losses experienced by the HYPE whale. The importance of adapting to changing market conditions cannot be overstated, as it is key to long-term success in cryptocurrency trading.

Frequently Asked Questions

What is the current HYPE whale unrealized loss after the price drop?

The current HYPE whale unrealized loss has exceeded $23.3 million due to the significant drop in HYPE price.

How does HYPE price drop affect whale trading losses?

The HYPE price drop below $22 has led to substantial whale trading losses, particularly for those holding long positions, including an unrealized loss of over $23.3 million.

What is the HYPE liquidation price for whales with long positions?

The HYPE liquidation price stands at $19.32, which poses a risk for whales holding leveraged long positions.

What does unrealized loss in trading mean for HYPE whales?

Unrealized loss in trading indicates the difference between the current value of the HYPE holdings and the price at which they were purchased, resulting in a loss that has not yet been realized through a sale.

How much capital loss has the HYPE whale incurred?

The HYPE whale has incurred a capital loss of $1.25 million as a result of the current market conditions and unrealized losses.

What implications does the unrealized loss of $23.3 million have for future HYPE trading?

The unrealized loss of $23.3 million might influence market sentiment and trading strategies, as whales reassess their positions to avoid further losses.

Can the HYPE price recovery help mitigate unrealized losses?

Yes, a recovery in HYPE price above the current levels could help mitigate unrealized losses for whales by increasing the value of their positions.

How does leveraging impact HYPE whale trading losses?

Leveraging, such as the 5x leverage in this case, amplifies both potential gains and losses, meaning that the HYPE whale faces significantly higher risks amid price declines.