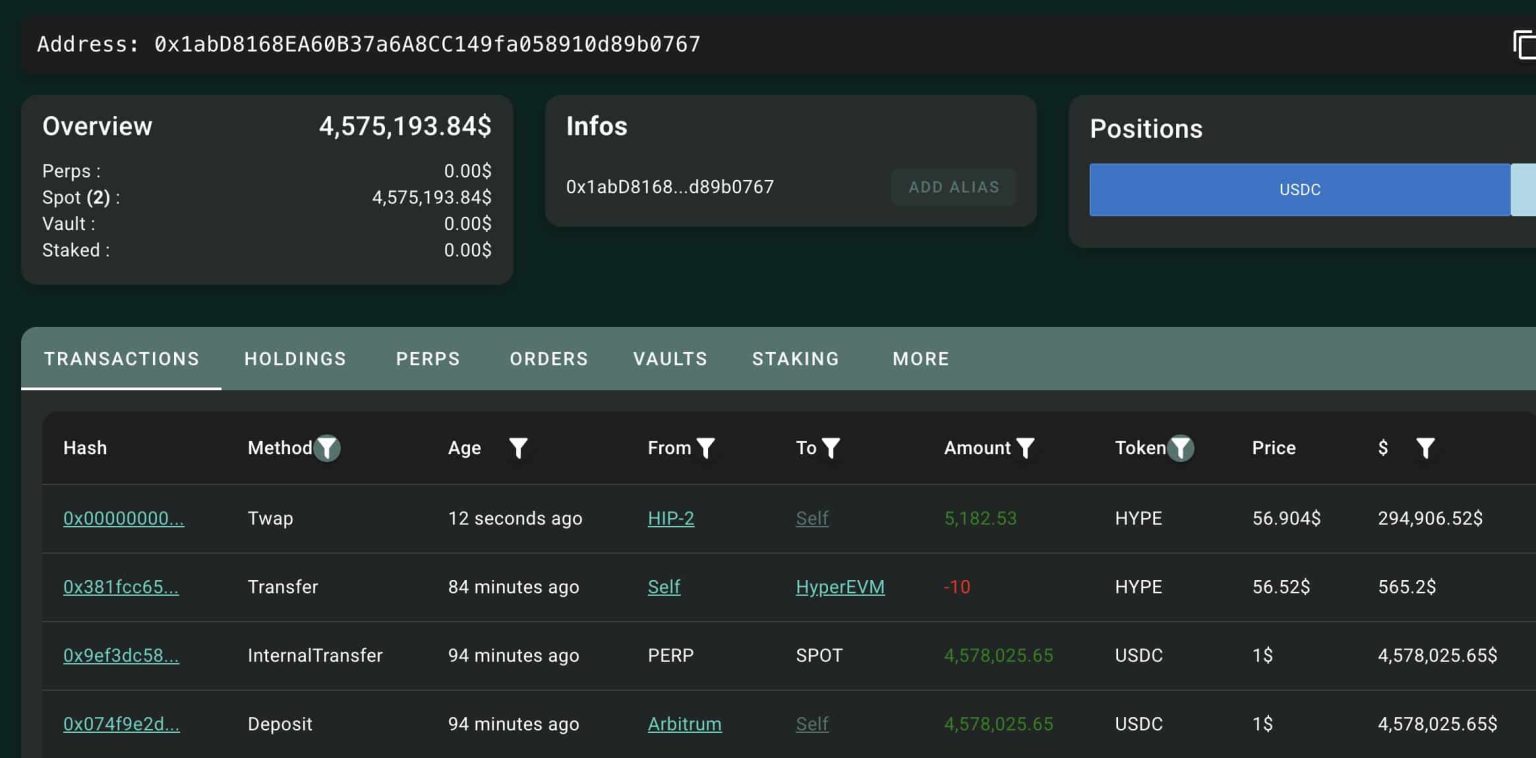

In a bold move within the crypto investment landscape, a prominent whale has recently made waves by spending $1.73 million to acquire 69,975 HYPE tokens. This remarkable HYPE whale purchase showcases the growing interest in innovative trading platforms like HyperLiquid, where whale transactions can significantly influence market dynamics. As crypto market news continues to highlight the importance of strategic investments, the implications of such substantial investments cannot be overlooked. Furthermore, this noteworthy acquisition comes on the heels of a $2.5 million USDC deposit into HyperLiquid, indicating a calculated USDC investment strategy that may set a new precedent in the sector. It’s clear that with the rise of HYPE, the potential for significant returns excites both seasoned and new investors alike.

A recent development in the cryptocurrency arena highlights a significant investment by a high-net-worth individual commonly referred to as a ‘whale.’ After a lengthy hiatus, this whale initiated its latest venture by transferring $2.5 million USDC into HyperLiquid, subsequently making a sizable purchase of HYPE tokens. This transaction hints at a larger trend in the crypto market, where whales are increasingly dominant players influencing price movements through strategic acquisitions. As investors keep a close watch on crypto market developments, the details surrounding this substantial HYPE whale acquisition reveal vital insights into future market behaviors. The executed funding strategy underscores the growing significance of alternative trading avenues and innovative assets like HYPE.

Understanding Whale Transactions in the Crypto Market

Whale transactions are significant movements of cryptocurrency by individuals or entities that hold large amounts of digital assets. These transactions can influence the market by causing price fluctuations, as the buying or selling of large quantities can create bursts of volatility. In the context of the recent HYPE whale purchase, a single transaction involving $1.73 million for 69,975 HYPE has generated considerable attention and analysis. Such activities highlight the importance of monitoring whale behaviors, as they could provide insights into market trends and potential price movements.

Tracking whale transactions is crucial for investors, as they often indicate confidence in a particular asset. In the case of HYPE, the $1.73 million purchase signals a considerable commitment from a large investor, which may inspire confidence in retail investors and traders alike. Additionally, monitoring these transactions can help identify potential entry and exit points in the market, informing strategies for both short-term trading and long-term investments.

Frequently Asked Questions

What is the significance of whale transactions in the HYPE crypto investment landscape?

Whale transactions, like the recent $1.73 million purchase of 69,975 HYPE, play a crucial role in shaping market trends and influencing HYPE’s price in the crypto market. These large purchases indicate strong investor confidence and can drive significant interest from other investors.

How can investors benefit from the latest HYPE whale purchases?

Investors may benefit from whale purchases of HYPE, as they often signal bullish sentiment in the market. Observing whale transactions can help guide investment strategies, particularly in identifying potential price movements and trends within the HYPE crypto investment space.

What does the recent influx of USDC into HyperLiquid mean for HYPE trading?

The recent deposit of $2.5 million USDC into HyperLiquid highlights a growing interest in HYPE trading. This influx not only facilitates whale transactions, like the purchase of 69,975 HYPE for $1.73 million, but it also indicates potential liquidity and trading activity that could positively impact HYPE’s value.

How should investors approach HYPE crypto investment after significant whale activities?

Investors should consider analyzing whale activities, such as the recent $1.73 million HYPE purchase, to formulate their USDC investment strategy. Understanding the motives behind these transactions can provide insights into market trends and assist in making informed investment decisions in the HYPE crypto landscape.

What do whale transactions indicate about the future of HYPE in the crypto market?

Whale transactions, such as the $1.73 million spent on purchasing HYPE, often indicate growing confidence in the asset’s future. As whales accumulate positions, it can signify strong bullish sentiment, which may lead to increased interest and higher prices in the HYPE crypto market as retail investors follow suit.

Why is monitoring crypto market news important for HYPE investors?

Monitoring crypto market news, especially about whale purchases like those involving HYPE, is crucial for investors. This information helps them stay informed about market dynamics, potential price shifts, and overall investor sentiment that can affect HYPE’s performance in the crypto market.

What strategies might be effective for investing in HYPE post-whale transactions?

After significant whale transactions in HYPE, investors could consider diversifying their USDC investment strategy, utilizing dollar-cost averaging, or closely watching market trends to capitalize on potential dips or spikes in HYPE’s price.

What tools can help track whale transactions in HYPE crypto investment?

To effectively track whale transactions in HYPE crypto investments, tools like on-chain analytics platforms and crypto market analysis tools are essential. These resources help investors monitor large transactions and gauge market sentiment around HYPE and other cryptocurrencies.

| Key Point | Details |

|---|---|

| Whale Purchase | A whale spent $1.73 million to buy 69,975 HYPE tokens. |

| Initial Deposit | The whale deposited $2.5 million USDC into HyperLiquid before purchasing. |

| Remaining Funds | The whale has $765,619 USDC left for future purchases. |

| Monitoring Source | The transaction was reported by Onchain Lens monitoring. |

Summary

The HYPE whale purchase marks a significant move within the cryptocurrency market, demonstrating the whale’s confidence in HYPE’s future potential. With an investment of $1.73 million for 69,975 tokens and a remaining balance of $765,619 USDC for future transactions, this strategic buying action underscores the whale’s commitment to accumulating a substantial position in HYPE.

Related: More from Market Analysis | Kaspa KAS Price Forecast: Why $0.03 Crucial for Bulls | Barclays Looks at Blockchain for Payments, Deposits